Real estate remains a preferred asset class for investors seeking stable income, diversification, and inflation hedging. Global transaction volumes are recovering, with direct deals in early 2025 reaching nearly $185 billion. It is representing a year-over-year increase of more than 30%. Yet activity is still below historic highs, making valuation accuracy, financing risks, and market liquidity key concerns. In this climate, due diligence in real estate is no longer a compliance formality but a critical safeguard. It covers financial validation of rent rolls and expenses, compliance with valuation standards, and environmental checks. They include Phase I assessments and new resilience frameworks.

Sustainability pressures are also reshaping investment outcomes. Poor energy performance increasingly leads to “brown discounts,” pushing some assets toward stranded risk without retrofit plans. At the same time, technology is transforming diligence. AI speeds document reviews, IoT enables real-time monitoring, and digital twins allow predictive modeling of building performance. Looking ahead, due diligence will expand to cover climate resilience, embodied carbon, and long-term obsolescence. While automation compresses review timelines. For investors, rigorous and tech-enabled diligence will define competitive advantage in the next phase of real estate markets.

Why Due Diligence in Real Estate Is Essential in 2025

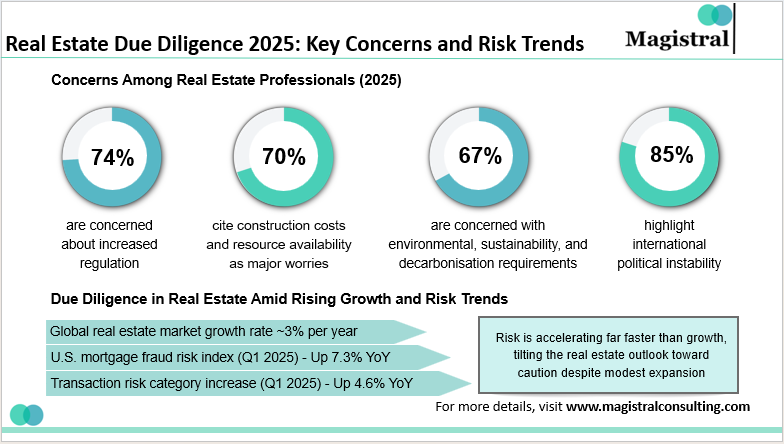

The global real estate market was valued at $4.2 trillion in 2024 and is projected to grow at 5.8% annually through 2030. This expansion is being fueled by urbanization, large-scale infrastructure projects, and growing institutional participation. However, it also brings heightened complexity. Rising interest rates, stricter ESG mandates, and increasing cross-border transactions mean property deals. They now carry greater regulatory, financial, and reputational risks.

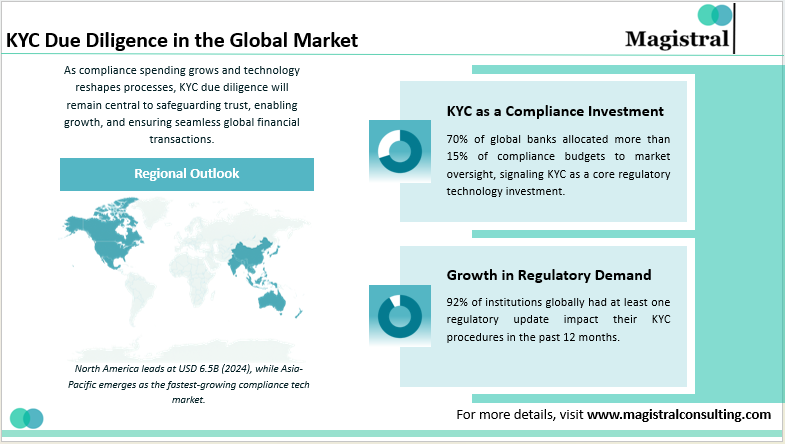

Real Estate Due Diligence 2025: Key Concerns and Risk Trends

According to Deloitte, 25% of real estate deals collapse post-closing due to inadequate due diligence. It often results in financial loss or litigation. In contrast, transactions supported by rigorous diligence report 40% higher investor confidence and up to 20% stronger returns. It serves as underscoring its role as a strategic differentiator.

In 2025, due diligence in real estate must evolve from a reactive checklist to a forward-looking framework. Investors who integrate robust financial scrutiny, regulatory compliance, and ESG evaluation will not only minimize hidden liabilities but also position themselves for sustained outperformance. Technology is further reshaping the process, with AI and blockchain reducing verification timelines and improving accuracy. Meanwhile, scenario-based risk modeling helps investors navigate volatility in interest rates and climate risks. Ultimately, due diligence is no longer just about protecting capital, it is about securing competitive advantage. It is also about building resilient portfolios, and driving alpha in a rapidly changing market.

Cross-Border Deals: Multiplying Complexity

Global real estate markets are being reshaped by policy shifts and regulatory reforms, making location-specific due diligence in real estate more critical than ever. In the U.S., the 2025 “One Big Beautiful Bill” extends tax benefits for pass-throughs and Opportunity Zones, directly influencing yield calculations. The U.K. is debating a new national property levy to replace stamp duty and council tax, injecting uncertainty into high-value transactions.

In Europe, Germany’s stringent tenant protections keep rental yields tight, while loopholes in furnished short-lets distort market dynamics. Australia has imposed a foreign-buyer ban on existing homes from April 2025. It is alongside AI-driven approvals and modular construction incentives to boost housing supply. In the UAE, freehold ownership rules, municipal fees, and repatriation frameworks remain central to investor strategies. These evolving shifts highlight why a one-size-fits-all approach to real estate due diligence in real estate no longer suffices.

The challenge for global funds is not only to identify these differences but to integrate them into valuation models and exit plans. A surface-level check of financials and titles rarely suffices when returns depend on regulatory agility and market-specific knowledge. Cross-border due diligence in real estate demands a layered approach, combining local expertise with global investor expectations.

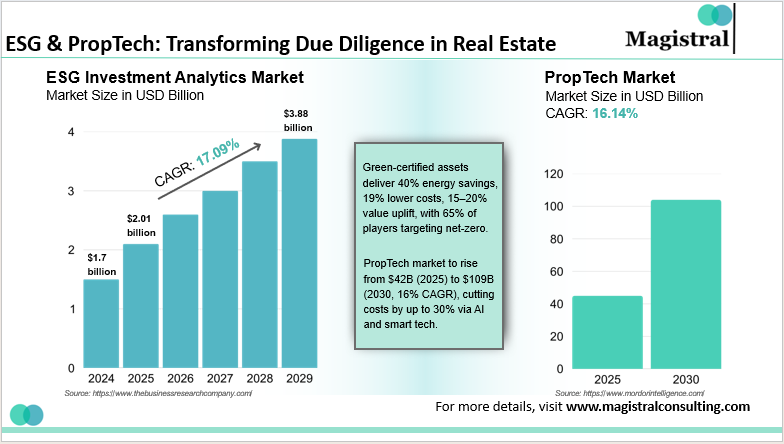

Distressed and Special Situations: Where Diligence Creates Alpha

In today’s market, due diligence in real estate is no longer a procedural step—it is both a risk shield and a value driver. On the compliance front, mounting regulatory scrutiny and ESG expectations are reshaping investment standards. Real estate disputes rose 27% globally in 2024, while 68% of investors now demand end-to-end diligence covering legal, financial, and climate exposure. Robust assessments help prevent costly errors such as unpaid taxes, zoning violations, or overvaluation, missteps that can erode annual IRRs by 2–4%. Deals supported by comprehensive diligence also experience 33% fewer post-closing disputes. This makes it a clear competitive edge in safeguarding capital and reputation.

At the same time, diligence has emerged as a source of alpha, particularly in distressed and special situations. With global distressed real estate projected to surpass $200 billion by 2026, the opportunity set is expanding rapidly. But these are precisely the assets most vulnerable to hidden liabilities- ranging from litigation to environmental non-compliance. In this context, diligence becomes a negotiation lever. In 2024, U.S. buyers of defaulted loans achieved 30–35% discounts once ESG and technical deficiencies were uncovered. By systematically surfacing such risks, investors can reprice transactions, and also secure deeper discounts. They ultimately transform compliance discipline into return generation.

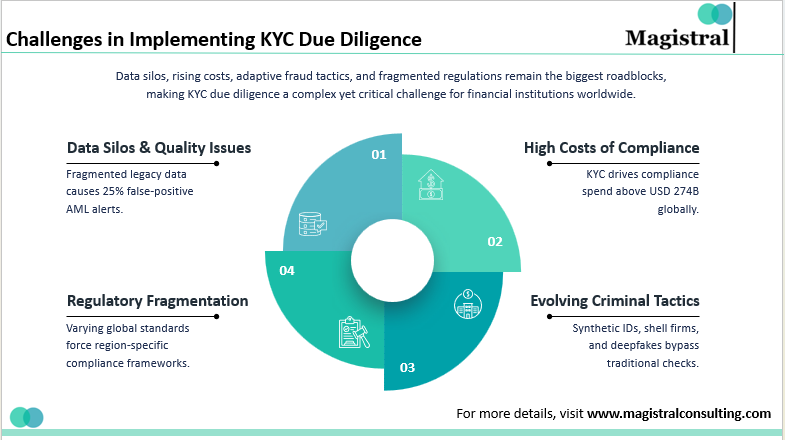

ESG and PropTech: Redefining Due Diligence in Real Estate

Another structural shift is that diligence is no longer confined to financials, legalities, and engineering reports. Sustainability and technology are now integral. JLL reports that green-certified buildings command a 10–15% rental premium in developed markets. Conversely, assets that fail environmental compliance tests face declining liquidity. Climate risk assessments, from flood modeling for coastal assets to energy efficiency audits for commercial towers, are becoming part of standard diligence packages.

ESG & PropTech: Transforming Due Diligence in Real Estate

At the same time, PropTech tools are revolutionizing how due diligence in real estate is performed. AI-driven platforms can now analyse tenant sentiment, energy usage, and even construction quality data drawn from digital blueprints. These insights help investors move beyond static documents to dynamic, real-time assessments of asset quality and tenant health. Ignoring these tools risks holding stranded assets in a market increasingly tilted toward transparency and sustainability.

The Global Market Outlook for Due Diligence Services

With global real estate expected to surpass USD 5 trillion by 2030, the importance of due diligence in real estate has never been greater. What was once a procedural step is now a strategic requirement. It is critical for accurate pricing, regulatory compliance, and ESG alignment. Investors who integrate rigorous diligence into their decision-making not only avoid costly pitfalls but also strengthen resilience and reputation in an increasingly regulated market.

The due diligence services market itself is projected to grow at an 8% CAGR through 2030. It is driven by digitalization and shifting investor priorities. AI and blockchain are streamlining verification processes, while ESG factors now influence nearly 90% of institutional asset allocation. At the same time, advanced risk-adjusted valuation models are becoming mainstream. This helps investors navigate volatility in rates, climate risks, and macroeconomic shocks. Deloitte reports that portfolios applying these techniques outperformed peers by 18% in IRR over five years. It is proof that future-ready diligence is not just about compliance, but about capturing alpha in a complex global market.

Real Estate Due Diligence Services by Magistral Consulting

Magistral Consulting offers end-to-end due diligence in real estate solutions designed to support smarter, risk-mitigated investment decisions. Their services include legal and title verification, financial modeling, valuation benchmarking, and thorough ESG and environmental audits. They also conduct market feasibility studies using predictive analytics and provide deal structuring support through secure virtual data rooms. Magistral’s tech-enabled approach ensures faster turnaround, enhanced data accuracy, and compliance with evolving global standards. With a strong focus on risk-adjusted returns and sustainability, Magistral empowers institutional investors, developers, and private equity firms to make confident, data-backed real estate investment decisions across markets.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

Akansha is a Stanford Seed alum with an MBA (Finance & Operations) and B.Com (Hons). She delivers business and financial research for PE/VC and investment banking clients. Experience spans fundraising, M&A support, deal sourcing, consolidation accounting, supply chain analysis, and CRM-led outreach. Known for meticulous detail and fast learning, she turns analysis into investor-ready decisions.

FAQs

Why is real estate due diligence more important in 2025 than before?

What are the most critical components of real estate due diligence?

How is technology improving real estate due diligence?

How do ESG factors influence property investment decisions?