Mergers and acquisitions consulting has evolved significantly and is now recognized as a key strategic advantage. One of the reasons is the drastic changes in capital markets, which, along with interest-rate fluctuations and geopolitical tensions, prompted the need for tighter financial discipline and a broader operational perspective to scrutinize deals. The top consulting firms are now leveraging numerous sectoral insights, AI-powered analytics, and an extensive global research network. It enables clients to achieve the highest level of accuracy in underwriting transactions. The 2024 report of PwC suggests that the upswing of deal activity is confined to the buyers who take advantage of the two pillars of Mergers and Acquisitions consulting. This includes advanced diligence frameworks and data-backed valuation models.

The Growing Importance of Mergers and Acquisitions Consulting in a Volatile Market

Mergers and acquisitions consulting has become a necessity for dealmakers who are facing timelines that are shorter than before, and the additional stress that comes with the valuation process. The role of consultants has evolved into that of partners with the ability to structure intelligence in such a way as to bear all the necessary economic signs, macro, sector, and financial into one big agreement or a whole deal thesis.

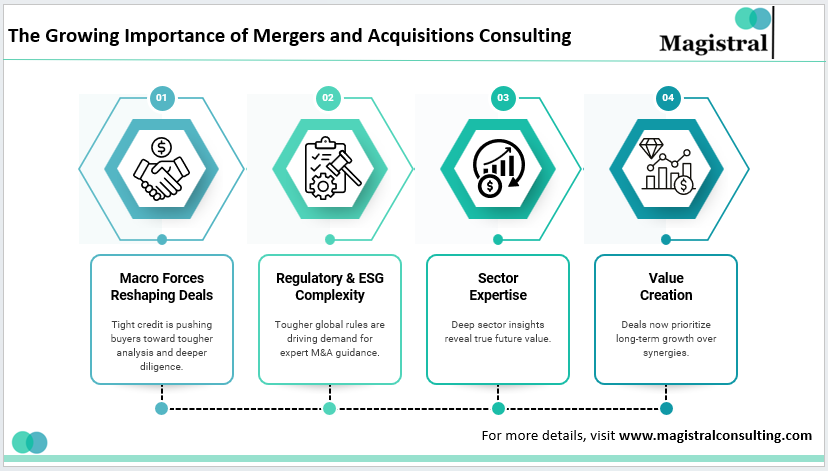

The Growing Importance of Mergers and Acquisitions Consulting

Macro Forces Reshaping Dealmaking

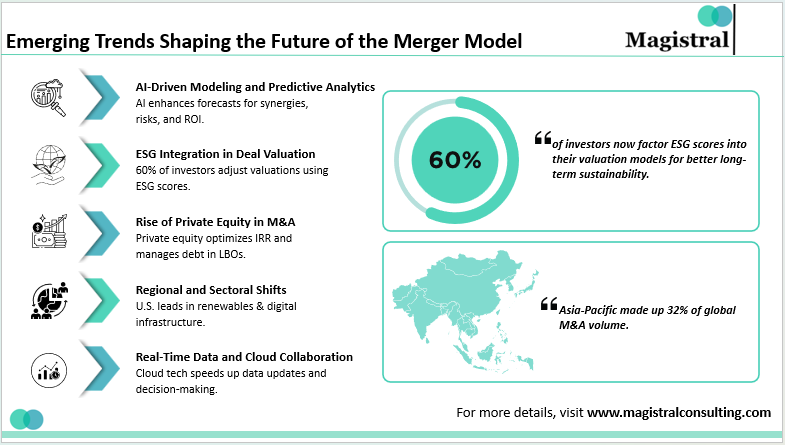

In a scenario with credit being tight and money lending being very selective, buyers would have no option but to make the case for acquisitions by putting them through a very rigorous process of scenario analysis. Deloitte’s M&A Trends shows that more than 60% of corporates consider strategic acquisitions necessary for maintaining their competitive edge. The condition of the market is also leading investment funds to employ extensive diligence frameworks to justify the price they offer.

Regulatory and ESG Complexity Driving Advisory Demand

The regulatory agencies in the US, EU, and APAC have started monitoring closely the areas of antitrust, data governance of companies, and ESG disclosures. The firms that specialize in Mergers and acquisitions consulting provide support to companies in trying to manage the expectations of the regulators, calculate the exposures, and come up with mitigation strategies. These strategies will minimize the potential of the companies being impacted by delays in the granting of approvals and the resulting adjustments in valuations.

Sector Expertise as a Differentiator

Top-notch experts analyse extremely niche indicators such as the pharmaceutical development pipeline, risk during transition to cleaner energy, vulnerability of the supply chain, and digital readiness that have an impact on the value of the enterprise. This know-how empowers the buyers to go beyond the numbers and grasp the future strength of an economic model.

Value Creation Extends Beyond Synergies

The new rules of the game when it comes to deals have no longer focused on synergies but on the sustainable value creation that is modern and is to be done with the help of consultants. They are the ones who guide the buyers to articulate the growth-oriented strategies, etc.

Core Components of High-Quality Mergers and Acquisitions Consulting

An elaborate Mergers and Acquisitions Consulting method combines financial correctness, operational review, strategic vision, and progressive analytics. This will eliminate uncertainty transversely through the whole transaction process.

Target Screening and Deal Origination Intelligence

The consultants in Mergers and Acquisitions Consulting are utilizing steady frameworks to analyse the trends of sector consolidation, competitive dynamics, and the emergence of new disruptors. The teams are increasingly using AI-powered deal origination tools. This allow them to spot targets way before they come into conventional projects. The early information gives acquirers better positions in terms of price and the benefits of secrecy.

Multidimensional Due Diligence

The best diligence practice now incorporates financial, operational, commercial, ESG, human capital, and digital factors. One common operational due-diligence technique tests the target under different market conditions. This approach supports more accurate downside pricing.

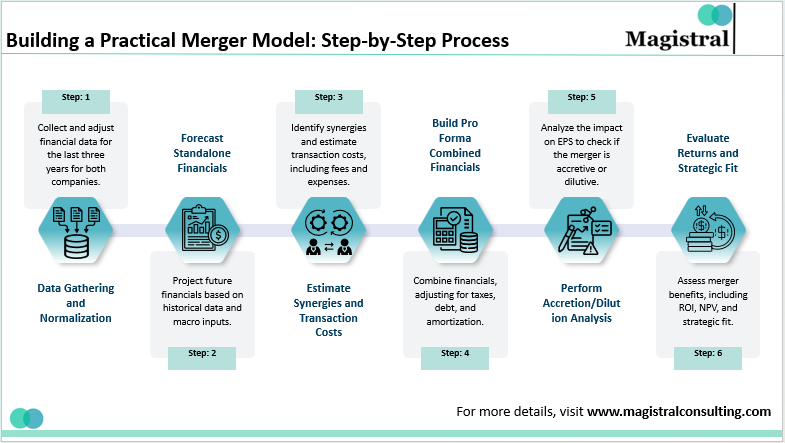

Financial Modeling and Valuation Precision

The consulting firms that specialise in Mergers and Acquisitions consulting make connected models. These models consider market flexibility, cost structure sensitivity, revenue seasonality, and changes in capital intensity. Often, these models use DCF methods combined with industry standards. By applying valuation principles, consultants help clients assess both short-term fluctuations and long-term value drivers. This approach helps clients avoid the risk of overpaying in changing deal environments.

Term Sheet Structuring and Negotiation Strategy

Advisors support negotiation by conducting detailed synergy quantification, earn-out simulation, and risk allocation analysis. Their contribution helps to make certain that the deal is designed for a balance of interests before and during the integration phase.

Post-Merger Integration (PMI) Execution

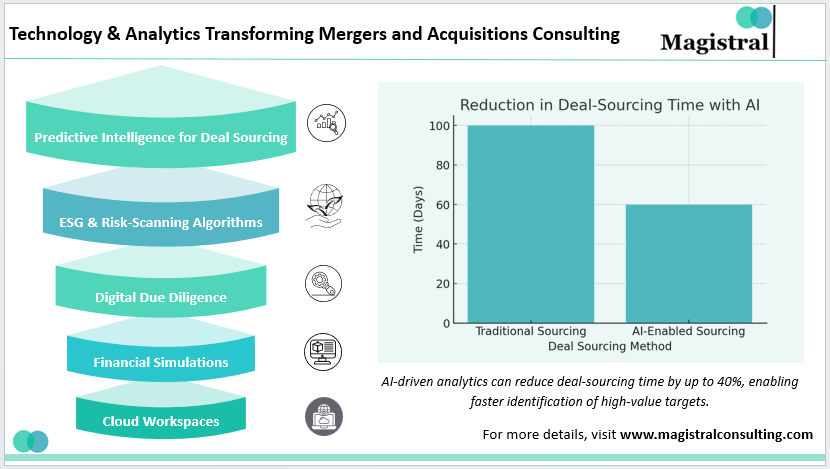

Technology and Analytics Transforming Mergers and Acquisitions Consulting

Predictive Intelligence for Deal Sourcing

The early acquisition signals, such as industry growth, hiring, product launch, and regulatory filing, can be recognized by a certain data-driven methodology. This will allow the experienced consultants to see the next big target earlier than others. AI-supported sourcing has been stated by McKinsey to potentially cut the sourcing times by 40%.

Advanced Financial Simulations

The platforms powered by AI conduct the testing of multiple financial scenarios at the same time in an integrated manner with the real-time market input. Such synchronization results in more accurate valuations and better capital-allocation decisions.

ESG and Risk-Scanning Algorithms

With ESG becoming a major factor in determining valuations, consultants resort to technological means. This is to dig out data regarding carbon emissions, ethical standards in supply chains, resource dependency, and how sustainability practices would be in future settlements. Such information is becoming more decisive in favour of the lenders and in gaining regulatory approvals.

Digital Due Diligence and Cyber Audits

M&A transactions can take significant advantage of the digital diligence tools. These will be able to carry out penetration-testing simulations, identify IP risks, and assess the digital maturity. All these aspects now have an impact on the determination of the deal value and, consequently, the deal pricing.

Integrated Cloud Workspaces

The consulting and client collaboration through integrated cloud platforms make deal execution easier, as they centralize documentation, workflow tracking, and risk logs.

How Magistral Consulting Enables Stronger Mergers and Acquisitions Outcomes

Magistral Consulting is a partner of extended intelligence with an objective to support the entire M&A lifecycle by means of scalable teams, advanced analytics, and research capabilities aligned with the sector.

Comprehensive Deal Origination Support

The analysts keep an eye on global happenings to identify companies with high potential. This makes pipeline creation for corporates and investors of a better quality.

High-Fidelity Financial Modeling

The company develops interconnected valuation structures by using strong forecasting logic, sensitivity testing, and scenario modeling. The investment banking research enhance the accuracy of pricing decisions across mid-market and large-scale transactions.

Diligence Frameworks Anchored in Sector Reality

The diligence methodology of Magistral evaluates the commercial viability, cost structures, operational bottlenecks, and future scalability.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

Prabhash Choudhary is the CEO of Magistral Consulting. He is a Stanford Seed alumnus and mechanical engineer with 20 + years’ leadership at Fortune 500 firms- Accenture Strategy, Deloitte, News Corp, and S&P Global. At Magistral Consulting, he directs global operations and has delivered over $3.5 billion in client impact across finance, research, analytics, and outsourcing. His expertise spans management consulting, investment and strategic research, and operational excellence for 1,200 + clients worldwide

FAQs

What is the primary role of mergers and acquisitions consulting?

Why do companies rely on consultants during complex transactions?

How does technology enhance M&A advisory quality?

What makes Magistral Consulting a strong partner for M&A?