Fundraising is a significant component of private equity (PE) and venture capital (VC) firms. It actually goes into investing in promising start-ups, scale-ups, or established businesses. The process is the most competitive. It requires a combination of strategic foresight, strong relationships with investors as well as great execution. This article will discuss issues related to capital raising for PE and VC firms, important steps, market dynamics, and trends.

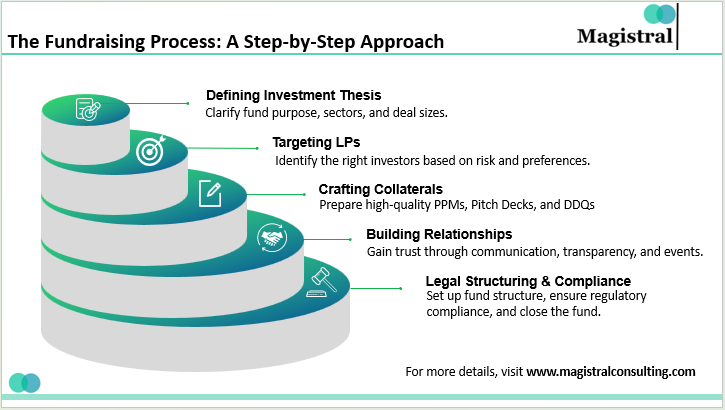

The Fundraising Process: A Step-by-Step Approach

Fundraisers master the art of fundraising by taking a structured and strategic approach. They design every step to attract the right investors, align goals, and secure commitments effectively.

The Fundraising Process: A Step-by-Step Approach

Defining the Fund’s Investment Thesis

A clear and concise investment thesis backs every successful fundraising effort. The PE or VC firm must clearly state why it is creating the investment fund and for what purpose. It should specify the targeted industry sectors and geographical areas for deal sourcing, as well as the minimum and maximum sizes of acceptable investment deals. Not only is this for marketing purposes but also to ensure serious alignment with any prospective Limited Partner (LP).

Market Research and Targeting LPs

Identifying the right LPs is essential for capital raising. Institutional investors, family offices, sovereign wealth funds, high-net-worth individuals, and endowments represent the typical LP base. Market research is a way to classify potential investors using different dimensions like risk appetite, industry preference, and geographical exposure.

Crafting Fundraising Collaterals

High-quality documentation in capital raising is critical to securing commitments. This includes Private Placement Memorandums (PPM), outlining fund details, strategy, risks, and governance, Pitch Decks and Teasers. They act as visual summaries for initial outreach, and Due Diligence Questionnaires (DDQs). It is to answer detailed LP queries on track record, compliance, and fund structure.

Building Relationships with Investors

Typical private equity (PE) and venture capital (VC) firms would have relied on existing relationships within the firm to secure initial commitments. Rather, general partners (GPs) have to earn that trust through a combination of communication, transparency, and evidence that they are able to deliver returns. Events, one-on-one meetings, and roadshows are equally important in this process of relationship-building.

Legal Structuring and Compliance and Closing the Fund

A proper legal framework plays a crucial role in ensuring smooth operations and compliance with regulatory requirements. Most funds typically operate as limited partnerships, where general partners manage the fund and limited partners contribute capital. Different jurisdictions enforce specific regulations—such as the SEC in the U.S. and AIFMD in Europe—which firms must follow. Once the firm secures target commitments, it closes the fund by executing Limited Partnership Agreements (LPAs) and initiating capital calls for deployment. Timing becomes essential because delays could also erode the trust of investors.

Challenges in the Current Fundraising Landscape

Because of the uncertainties in the macroeconomy and the increasing interest rates becoming more pronounced, the environment of raising capital has since changed. There is a rigidity in LPs’ demands as they want to see track records of past performance and a clear commitment to Environmental, Social, and Governance (ESG).

>As more and more funds have been launched, increasing differentiation and competition are becoming more and more crucial in capital raising. Trends in LP preferences have shifted toward institutions supporting focused and specialized strategies, accompanied by a rise in the anticipation of transparency and compliance requirements which adds complexities to the fundraising process contributing to regulatory constraints.

Role of Technology in Fundraising

Technology has significantly changed the way fundraising works for PE and VC firms. It also allows the use of digital platforms and tools that make their processes smoother, improve LP targeting, and enhance investor engagement.

Investor Relationship Management Software (IRMS)

These solutions, such as Affinity and Salesforce, can be used to track interactions, manage pipelines, and analyze LP preference for the GPs.

Data-Driven Targeting

From PitchBook to Preqin, these platforms provide snapshots of LP activity that help firms tailor their approach.

Webinars

GPs can pitch to a global audience using all these online platforms such as Zoom, Skype, Google Hangouts, and Cisco Webex, since geography is no longer an issue.

AI and Analytics

AI and analytics-driven predictive models now optimize outreach strategies by assessing the likelihood of LP commitments.

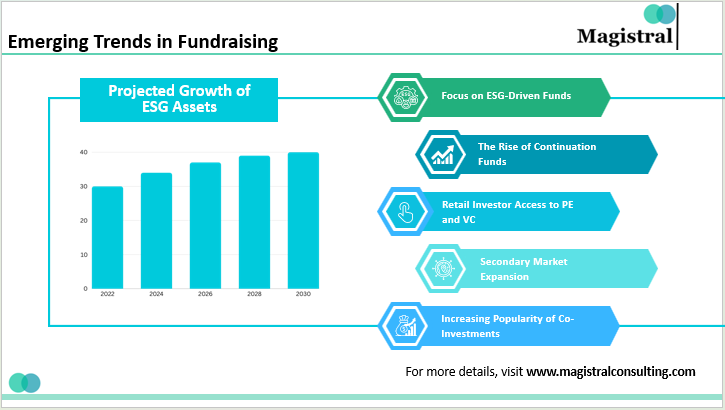

Emerging Trends in PE and VC Fundraising

Capital raising for private equity (PE) and venture capital (VC) firms is undergoing significant changes. These shifts are primarily driven by evolving market dynamics, changing investor expectations, and rapid advancements in technology. Following are the emerging trends in fundraising:

Emerging Trends in PE and VC Fundraising

Focus on ESG

ESG considerations have become crucial in capital raising. LPs now want the GPs to align their strategies with sustainable and ethical practices.

Increased LP Demand

Reports project that ESG assets under management will exceed $40 trillion by 2030, clearly indicating strong momentum toward sustainable investing.

Reporting Standards

General Partners (GPs) must disclose ESG metrics and reports, including details such as carbon footprint, diversity initiatives, and more.

The Rise of Continuation Funds

Since continuation funds act as a mechanism for increasing the lifetime of high-quality assets, especially in situations where GPs see potential for further growth or value creation.

Investor Appeal

These funds offer liquidity options for existing LPs while allowing new investors to participate in well-established investments.

Market Growth

Continuation prestige funds will also be part of the record highest activity GP-led secondary transactions of recent years. In 2022, GP-led transactions would be worth around $50 billion globally, making it the second most active year ever recorded. In this category, single-asset continuation funds accounted for another $20 billion or 42 percent of all GP-led transactions and 19% of the overall secondary market.

Retail Investor Access to PE and VC

In the past, only institutional investors were expected to access investments in PE or VC however with this democratization, the scenario is taking a U-turn completely.

Accredited Platforms

Platforms such as Moonfare and iCapital help provide accredited investors access to private equity and venture capital funds, usually with lower minimum investment thresholds.

Regulatory Adjustments

Jurisdictions are reviewing regulations to make the participation of the retail investor easy without compromising on investor protection.

Secondary Market Expansion

The secondary market which entails the buying and selling of already existing fund stakes is growing at a fast pace as LPs look for liquidity options.

Surge in Transactions

The secondary market accounted for over $100 billion in transactions in the year 2022, and their volume is promising to show growth over the next two or three years.

Innovative Solutions

Structured secondary deals and fund recapitalizations allow LPs to get some flexibility in their exits as GPs begin to use secondaries.

Increasing Popularity of Co-Investments

A rise can be seen in the adoption of co-investment opportunities whereby LPs are directly involved in making investments alongside the fund in specific deals in capital raising.

Attractive for LPs

Co-investments allow LPs to invest in deals with very low fees and most direct exposure to the best deals.

Operational Complexity

GPs need some infrastructure built and communication channels opened to manage the sources of co-investment effectively.

Best Practices for Successful Fundraising

Using established strategies and practices is highly likely to improve the outcomes of fundraising efforts, fostering long-term trust and a diversified, loyal investor base.

Make use of a Strong Track Record

LP confidence may be built by showing successful exits, high IRRs, and high MOICs. Emerging managers must team up with established GPs or convey operational excellence as a way to bridge credibility gaps.

Maintain Transparent Communication

There should be some regular information about the market environment or fund performance, and other follow-ups to cultivate confidence among the investors, thus increasing the likelihood of further investments from the investors.

Diversify the Investor Base

There is risk present in receiving funds from a handful of LPs and it can instead be minimized by widening geographically and investor-type focus.

Incorporate Flexibility

Additional flexibility in terms can be allowed by using co-investment opportunities or targeted fees in making the funds more attractive to LPs.

Magistral’s Services for Fundraising

Magistral Consulting provides complete capital raising solutions to Private Equity and Venture Capital firms. It is done in an effective manner along the entire capital-raising process in a most impactful way. This enables the PE and VC firms to spend more time on running their strategic initiatives. They can yield better results with fundraising. Our fundraising services include:

Creating Private Placement Memorandums (PPMs), Pitch Decks, and Teasers

We draft all kinds of investor documents around the fund’s vision, strategy, and future performance, these include PPMs, pitch decks, teasers, and more. Every one of these deliverables is geared toward impacting the potential investors and fitting them perfectly into the market.

Email Campaigns and Investor Reach-out

Our team composes and executes focused email campaigns aimed at establishing an effective liaison between the potential LPs and other important stakeholders. Additionally, we specialize in investor profiling and creating outreach strategies to engage the right audience and expand your network.

Design and Data Support

We make sure that all material-from presentation aesthetics to data-driven insights is visually compelling and analytically sound. It is so that firms can clearly communicate their value proposition.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is Authored by the Marketing Department of Magistral Consulting. For any business inquiries, you could reach out to prabhash.choudhary@magistralconsulting.com

Who are the typical Limited Partners (LPs) in PE and VC fundraising?

Typical LPs include institutional investors (pension funds, insurance companies), family offices, sovereign wealth funds, endowments, and high-net-worth individuals.

What role does a Private Placement Memorandum (PPM) play in fundraising?

A PPM is a comprehensive document detailing the fund's strategy, governance, risk factors, and financial structure. It serves as a key tool for securing investor commitments and ensuring transparency.

What is the impact of ESG on PE and VC fundraising?

ESG considerations are increasingly critical. LPs demand funds align with sustainable and ethical practices, provide detailed ESG metrics, and adhere to global reporting standards. ESG-focused funds also enjoy greater differentiation and appeal.