The mortgage industry is quite multifaceted and has high operational costs and, in recent years, it is undergoing a significant modification. With mounting pressure to become more efficient, to lessen costs, and keep in line with changing regulations, many lenders are now embracing consumer mortgage outsourcing as the only way out. The mortgage sector outsourcing uses third-party providers to help carry out core processes like origination, underwriting, processing, and servicing for a loan. This practice is gaining momentum as companies operating in the mortgage space start realizing the various operational efficiency benefits that outsourcing gives along with customer satisfaction boosts.

>This article explores the growing opportunities and trends in consumer mortgage outsourcing, supported by the latest data, trends, and future projections. We will also delve deeper into the opportunities that this market presents and how it can help both established lenders and new entrants thrive in an increasingly competitive landscape.

Fastest Growth in Consumer Mortgage Outsourcing

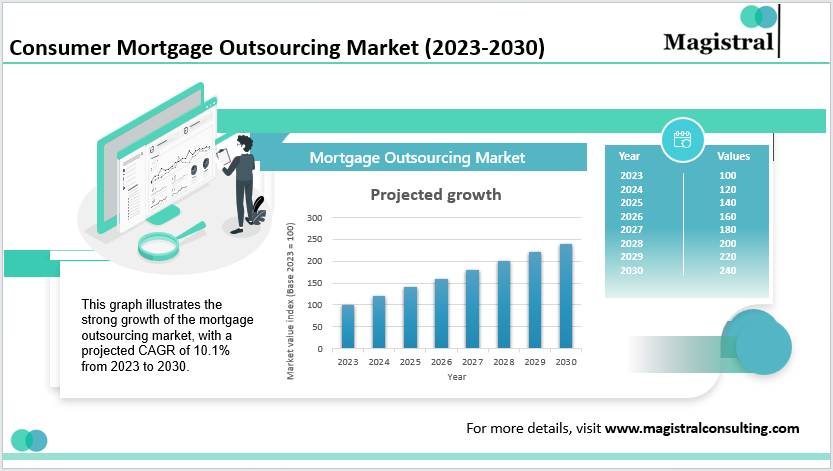

Consumer mortgage outsourcing is growing rapidly with estimations indicating further growth over the next few years. The Grand View Research report claims that the global Consumer mortgage outsourcing market is going to grow at 10.1% CAGR between the years 2023 to 2030. The increasing demand, the rising complexity with mortgage processes, and the growing pressure on both efficiency and cost consolidation are all factors contributing to this trend. Contribution varies, given different factors.

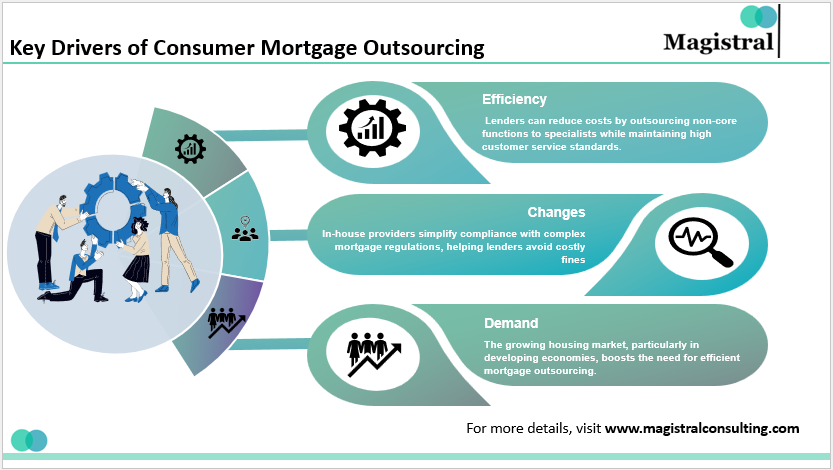

Key Growth Drivers in Mortgage Outsourcing

Following are the key growth drivers that help in making the task more effective and efficient.

Key Drivers of Consumer Mortgage Outsourcing

The Increasing Requirement for Mortgage Outsourcing

The housing market is presently in a great boom, and especially in developing economies, where economic development is rapidly occurring. This activity surge is further causing an increased requirement for an efficient consumer mortgage outsourcing processing system that will handle the influx of applications.

Regulations

The mortgage industry functions in an environment where there are heavy regulations, which compound the efforts of companies to comply with the regulations. Such task generates huge volumes of work and investment by the company in accordance with the different rules and regulations on both domestic and global levels. In-house service providers understand how to adapt with various regulatory demands. Thus, they can lead lenders better through the complex and puzzling world of regulations with much ease than others. Therefore, there is a significant reduction of maybe costly fines imposed by authority for non-compliance.

Cost effectiveness

Lenders are putting so much stress on reduced costs, but they must have customer service standards either at par or even much higher than ever. In this regard, the company can transfer the entire non-core functions to the respective area specialist service provider.

Emerging Trends in Consumer Mortgage Outsourcing

There are several critical trends that are driving the outsourcing business development process in the mortgage industry. Such trends are shaping up lenders’ and third-party service providers’ collaboration and flexibility regarding shifting market conditions.

Technology enabling Functions in Consumer Mortgage Outsourcing

The new advances in technology are increasingly making an impact on the mortgage industry. New technology such as AI, RPA, Analytics, or Big Data has been used by outsourced providers to optimize processes and therefore create space for more efficient operations.

As a result, the technology became the part and parcel for these types of innovations in the life of people with these development advancements in all sections of life. There has been competition in developing this technology that now every aspect of living is made easier.

Regulatory Compliance and Risk Management

The mortgage industry is being regulated under the various laws and, therefore, non-compliance will lead to severe penalties. Outsourcing providers are offering special services that would help the lender in navigating their complex regulatory landscape.

Compliance Technology (RegTech)

Such RegTech solutions automate the compliance management process for mortgage lenders conforming to local and cross-regulatory standards, thus minimizing the risk of fines and providing business continuity.

Information Security and Data Protection

With ever escalating apprehensions over data privacy, outsourcing solution providers have initiated the application of cutting-edge cybersecurity solutions for consumer data protection. Such technologies include but are not limited to encryption, multi-factor authentication, and secure storage of data, which are used to comply with regulations such as GDPR and CCPA.

An Approach that Centers on the Customer

The mortgage industry, however, seeks to enhance customer experience. This is realized through the outsourcers whose added value would basically provide better service experience in terms of quality and speed.

Omnichannel Customer Support

These service outsourcing companies provide 24 hours customer service via multiple touch points: phone calls, e-mail, chatbots, and social networks. Customers will find it very easy to access help at any moment.

Personalized Mortgage Products

Through data analytics, outsourcing firms aid lenders in designing personalized mortgage products for each individual customer to enhance their satisfaction.

Opportunities in Consumer Mortgage Outsourcing

It indeed brings both lenders and service providers closer as possibilities from outsourcing. Hence, companies would be enabled to construct streamlined operations at lows while enhancing the service delivery through economics by having specialized skills along with advanced technology.

Consumer Mortgage Outsourcing Market (2023-2030)

Newcomers in Developing Markets

The developed world Consumer mortgage outsourcing market is a mature one; however, the emerging markets have great growth potential. In increasing homeownership per capita in countries like India, Brazil, as well as Southeast Asia, the market is increasing demand for the services involved in mortgages, thus giving much room for potential outsourcing providers.

Cost-Effective

Consumer Mortgage Outsourcing service to countries with low labor costs gives lenders big savings with operational costs while ensuring the quality of service provided. For instance, India and the Philippines are countries with a multitude of experienced professionals who would be able to process and service mortgages for peanuts in comparison to what it would otherwise cost.

Growing Demand for Consumer Mortgages Outsourcing

The developing economies are demonstrating a fast growth of demand for home loans as a result of rapid urbanization and economic advancement. This expanding market is thus a promising opportunity for outsourcing providers to lenders managing increasingly huge volumes of mortgage applications.

Outsourced Niche Service and Expertise

In an ever-evolving mortgage industry, lenders are more inclined to partner with an outsourcer that specializes in niche services, such as FHA, or VA-backed loans, reverse mortgage services, or green mortgages.

Government-Backed and Reverse Mortgages

Outsourcing firms would have this type of expertise in niche areas to reengineer processes and compliance hot spots in helping lenders, so that they could tap into those markets that remain underserved.

Sustainable Mortgages

Demand for Green mortgages, financing energy-efficient homes, is catching up. So, it is really possible for the lenders to listen to the outsourced companies that had come in contact with lenders in the field of partnership to provide outstanding solutions, fulfilling the modern demand of market needs for sustainable housing.

Collaborations / Partnership with Fintech and Digital Solutions Providers

The rise of Fintech has revolutionized the mortgage sector by offering innovative solutions that simplify the application and approval processes. Progressively, the typical lenders are collaborating with all those tech-driven companies to develop their mortgage activities by introducing digital solutions.

Digital Mortgage Platforms

Through consumer mortgage outsourcing the design and management of digital mortgage platforms, lenders can offer services via quick, easy channels to their customers.

Blockchain in Mortgages

The possibilities of blockchain technology in mortgage transactions used are such that it is made simple and secure for one to process loans. Companies that offer solutions of outsourcing with a value-added service of integration of blockchain will differentiate lenders in a race to establish themselves as secure and convenient mortgage providers.

Magistral’s Services for Consumer Mortgage Outsourcing

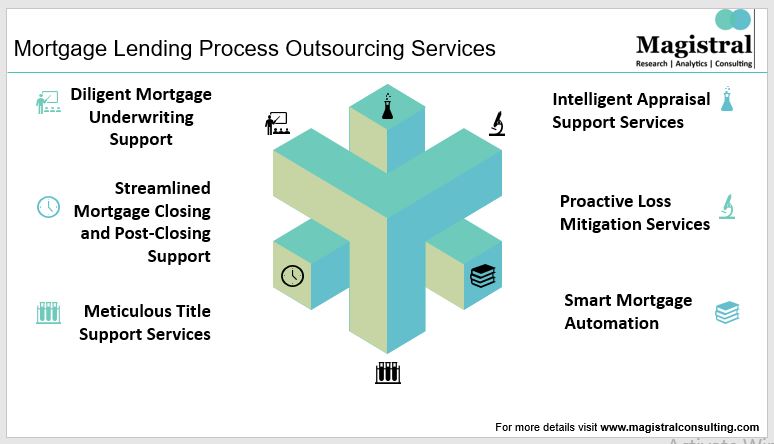

Magistral Consulting offers comprehensive outsourcing services for consumer mortgage processes, including:

Loan Origination Support

Assisting in lead generation, credit processing, rate quoting, and document indexing.

Processing and Underwriting

This includes underwriting support, clearing loan conditions, conducting quality checks, and auditing the files for fraud.

Closing and Funding

Preparing closing documents, ensuring proper quality checks, and conducting file audits.

Servicing

Loan boarding, auditing new loans, processing pay-offs, and conducting customer research and resolutions.

In this way, services streamline the entire mortgage world, speeding up turnaround times, and giving the institutions room to focus on core competitiveness.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

How does technology contribute to the mortgage outsourcing business for consumers?

Emergent technologies such as AI, robotic process automation, and analytics lend themselves to mortgage processing in terms of cost reduction, performance enhancement, and bringing in new innovations.

What emerging opportunities are there to mortgage outsourcing in the marketplace?

The rise in urbanization coupled with booming economies has brought the much-needed demand for mortgages and has given all the reason to believe that the future is quite bright for outsourcing providers.

What changes brought by fintech towards mortgage outsourcing in collaboration?

Digital mortgage platforms enabled with blockchain technology are working with fintech companies to help lenders in the provision of modern, efficient, and affordable mortgage offers.