The evolution of technology is changing the way commercial loans are made. This, in turn, raises the expectations on the part of financial institutions to ensure the rational, expandable, and legally compliant implementation of lending activity. More and more, banks, credit unions, and other financial institutions are turning towards commercial lending outsourcing as a means of improving their lending operations, cutting down expenses, and simplifying processes.

The Need for Commercial Lending Outsourcing

Commercial lending is intricate and involves a lot of resources and effort such as in-depth underwriting, evaluation of risks, understanding and abiding by the regulations in place, and finally, managing the client. Due to the increasing regulatory demands competition, and fluctuating interest rates, many institutions come to realize that keeping the services within the institution becomes a resource and budget strain. As an alternative, financial institutions can engage in commercial lending outsourcing to cut down on costs, improve effectiveness, and access skills and technology that may be difficult to build internally.

Technology and the Commercial Lending Process

Advancements in information technology have revolutionized commercial lending outsourcing, ushering in a new era of speed, efficiency, and accuracy courtesy of digital platforms and analytics, artificial intelligence, etc.

AI in Credit Assessment

With real-time-based credit modeling, the use of AI and deep learning in commercial lending outsourcing overcomes the limitations of static scoring models and techniques in evaluating credit risk.

Automated Underwriting

Automated systems based on artificial intelligence provide a rapid assessment of underwriting, conveying undifferentiated outcomes of borrowers to the lenders.

Predictive Analytics for Portfolio Management

Prediction tools in commercial lending outsourcing make it easier for lenders evaluate the possible risks in advance so that they can take preventive action before any changes occur in the loan portfolio. They also enable the proper control of the loans.

Fraud Detection

AI tech savvy, algorithms are used to detect when a transaction is not consistent with the previous ones, thereby assisting in fighting fraud with little manual effort and supporting commercial lending outsourcing.

Personalized Borrower Experience

Chatbots and virtual assistants provide interactive assistance in resolving issues related to loans and other stages of the process in commercial lending outsourcing.

Risk Factors and Considerations

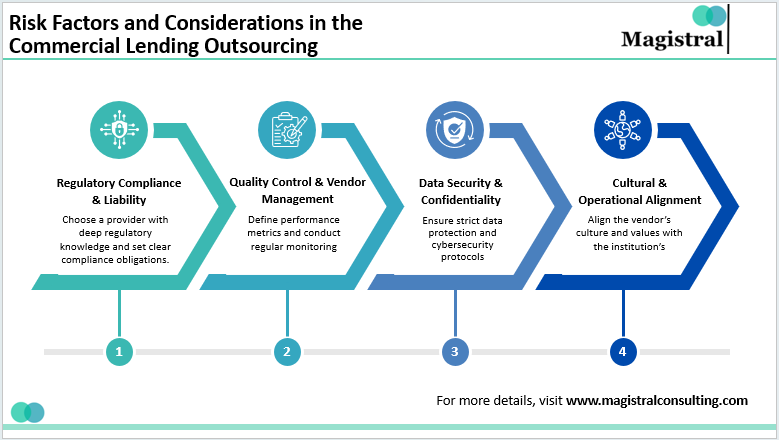

Outsourcing has numerous benefits; however, financial institutions need to be cognizant of certain risks and factors before embracing commercial lending outsourcing.

Risk Factors and Considerations in Commercial Lending Outsourcing

Data Security and Confidentiality

Data protection becomes paramount in view of the fact that the nature of commercial lending outsourcing involves a lot of customer details. Institutions should ensure that the third parties they engage adhere to stringent data protection measures and have efficient cybersecurity systems.

Quality Control and Vendor Management

Maintaining consistent service quality can be challenging when tasks are outsourced. Financial institutions should establish clear performance metrics and regularly monitor the commercial lending outsourcing provider’s performance to ensure alignment with internal standards and regulatory requirements.

Regulatory Compliance and Liability

It is quite difficult to manage consistent service delivery, especially with respect to outsourcing jobs. In such cases, banks should undertake definition and communication of performance benchmarks and provide constant supervision on the commercial loan outsourcing service provider, to ensure compliance with internal and regulatory standards.

Cultural and Operational Alignment

Effective commercial lending outsourcing requires the vendor’s culture, values, and operations to align with that of the financial institution. To make this possible, there must be an active engagement, regular updates, and a clear definition of the objectives of the partnership.

Key Drivers Shaping the Future of Commercial Lending in 2024

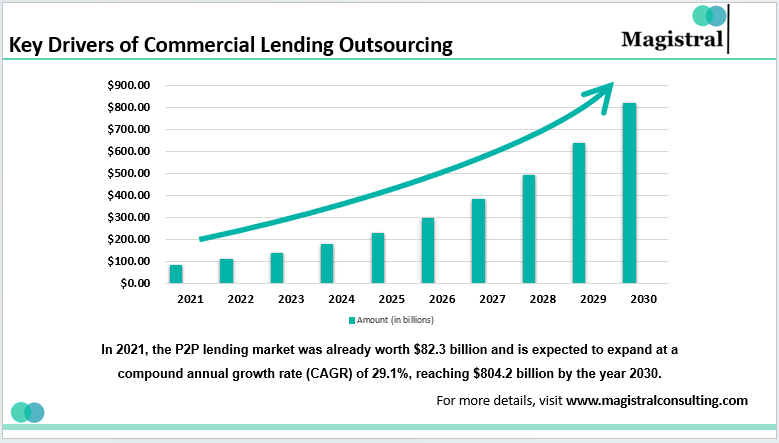

After the pandemic hit, the sector of commercial loans has been undergoing a lot of changes, some of them expected while others not. There is a growing appetite for business credit in the market, with average amounts standing at close to $663,000 per business (FED), yet there are periods when the volume of applications for business loans from the banks seamlessly falls.

On the other hand, the traditional lending spectrum is shifting. A combination of modern banking technologies and peer-to-peer networks is gaining traction. In 2021, the P2P lending market was already worth $82.3 billion and is expected to expand at a compound annual growth rate (CAGR) of 29.1%, reaching $804.2 billion by the year 2030.

Aside from hard data, there are several important facets or directions, which undeniably, if not significantly, are driving these trends and changes: The geopolitics of the world, plus social, technological advancements, and other market concerns, in themselves cause the following trends:

Key Drivers of Commercial Lending Outsourcing

Geopolitical Factors

As globalization continues to grow, and with individuals becoming more mobile, businesses expand their needs for lenders that are more internationally oriented. Furthermore, as the global economy barely gets into its feet and starts operating new markets, the business intrusions are further complicated by regulatory regimes that require better KYC and AML compliance standards in commercial lending outsourcing.

Sociological Changes

Traditionally in commercial lending outsourcing, business owners have been reliant on financial institutions’ standby credit. Today, however, they are shunning such loans for smarter, flexible funding sources such as P2P systems and others. A lot of them are also active in seeking out funding that is ethical and environmentally sustainable but of this, they rarely find in the market.

Evolution of Technology

The banks are now embracing artificial intelligence and machine learning which, in turn, has changed the dynamics of lending processes in a great way. Such technologies are the catalysts causing change in innovation and the processes of coming up with the commercial lending solutions.

Tide for Small Businesses

Furthermore, small-scale enterprises make for 99.9% of all the businesses in the U.S. and hence, they play a very critical role in the economy. To exacerbate this situation, 59% of those businesses struggle with access to capital due to one or more financial constraints, however, many of them were rated in the Federal Reserve Small Business Credit Survey as being “poor” or “fair”. This makes it evident that traditional credit measures do not work for them.

Regional Variations

In commercial lending outsourcing, most of these factors are likely to impact global tendencies, but their effects will differ depending on the specific regional economic and regulatory environment – leading to both challenges and benefits in particular regions.

These trends are interrelated and therefore lend themselves to the need for the lenders to fit in the changing environment, with the help of technology and other alternative lending strategies and other approaches in order to compete with the rest.

Magistral’s Services for Commercial Lending Process

Magistral Consulting assists lenders in commercial lending outsourcing helps them control risks, and boost productivity and borrower satisfaction. Credit risk assessment, collateral evaluation, automated underwriting, fraud detection, and the like, allow lenders to manage the process of borrowing and its attendant risks even more effectively:

Credit Risk Assessment Support

When it comes to assessing the credit risk of a borrower, which is often the outsourced process of commercial lending, we assist our clients i.e. lenders in the analysis of the various financial indicators like financial statements and debt-to-equity ratio, cash flow ratios, as well as numerous other ratios and their respective metrics. AI and data modeling make it viable to undertake an improved debt risk assessment for a borrower.

Collateral Evaluation

The last spin of our specialists includes the assessment of collateral aimed at determining appropriate loan-to-value LTV ratios as well as availing the lender’s information on the more appropriate securities to adopt to minimize loss from defaults.

Portfolio Monitoring and Predictive Analytics

We provide lenders with loan performance analytics, forecasting, and vigilance of the fluctuations of loan performance. The assistance of our analytical solutions is helpful in minimizing the risks as the terms are adjusted towards the institution even prior to the deterioration in the situation.

Customized Borrower Experience

Magistral assists its clients in using artificial intelligence devices such as chatbots and virtual assistants so as to enhance interactivity with customers, provide answers to the borrowers’ queries in the quickest possible time, and offer products fitting the profile of the borrower.

Regulatory Compliance and Reporting

In compliance, our services encompass management reporting and regulatory audits, assisting the lenders to which we provide services to maintain outstanding performance and adapt to the evolving laws and regulations.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is Authored by the Marketing Department of Magistral Consulting. For any business inquiries, you could reach out to prabhash.choudhary@magistralconsulting.com

How does technology play a role in commercial lending outsourcing?

Technology, including AI, digital lending platforms, predictive analytics, and open banking APIs, enhances the efficiency and accuracy of the lending process. These tools streamline applications, improve risk assessment, and provide a more personalized borrower experience.

What risks are associated with commercial lending outsourcing?

Potential risks include data security issues, quality control challenges, and regulatory compliance concerns. Financial institutions should conduct thorough due diligence on outsourcing partners and establish clear service-level agreements to mitigate these risks.

What trends are shaping the future of commercial lending outsourcing?

Emerging trends include the rise of digital transformation, stricter underwriting standards, increased focus on ESG compliance, API integration for open banking, and enhanced risk management through advanced analytics. Outsourcing firms are adapting to meet these demands, providing specialized support in areas like sustainable finance and regulatory compliance.