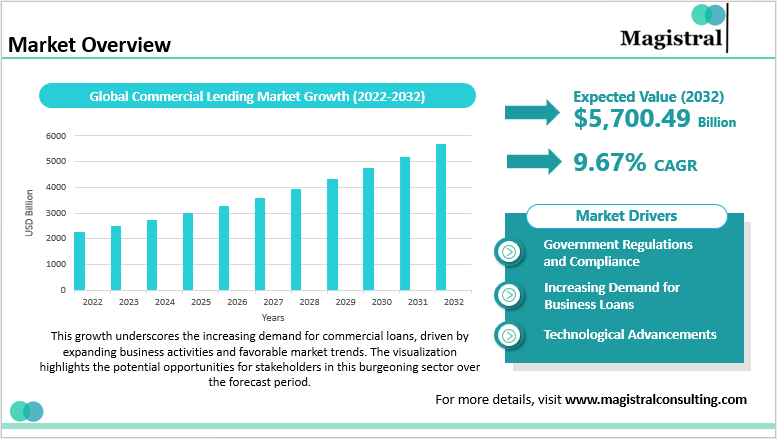

For the past few years, corporate lending has experienced a revolution. Lending businesses face multiple challenges like changing regulatory requirements. So lending experts seek efficient and trustworthy means of securing financing, stimulating banking businesses to streamline their processes and enhance customer experiences. As the rapid transformation is taking place in the industry, commercial lending software is experiencing significant advancements supported by multiple technological transformations worldwide. A notable number of collaborations and partnerships have taken place between the AI-driven commercial lending platforms and GoDocs.

Global Loan Software Services Market

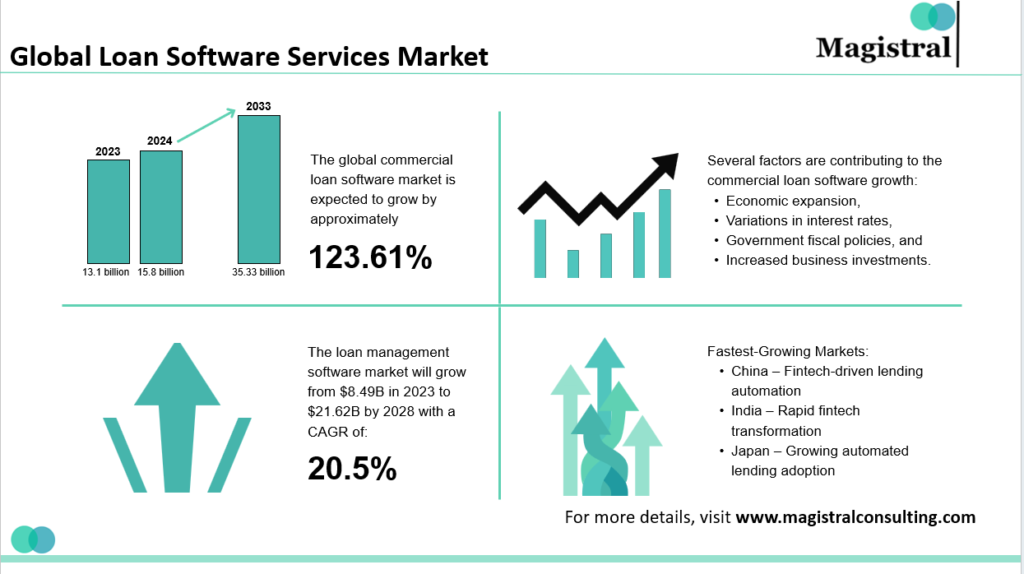

In accordance with the market projections, the growth of commercial lending software is substantial. With a current value of USD 15.8 billion in 2024, the software market is expected to grow by an 8% CAGR between 2024 and 2032. The expected growth is a testament to the increasing demand for software support in the commercial lending market, partnering with the latest and updated versions of available technologies.

Modern Lending Solution: The Role of Automation

The responsible factors for fueling the growth of commercial lending software involve increasing demand for automation and a shift to a digital transformation in the field of financial services to minimize and eliminate manual errors in the process. Financial services firms are prioritizing more efficiency, compliance, and better risk management for driving the adoption of advanced lending platforms. With a mission to deliver a more agile and innovative product, these firms take advantage of advanced techniques like the incorporation of real-time data analysis for decision-making, digitalizing the documentation process, and automating the workflow to accelerate the loan approval process and enhance the overall experience of the borrower.

AI Platform Lending Market Growth Forecast

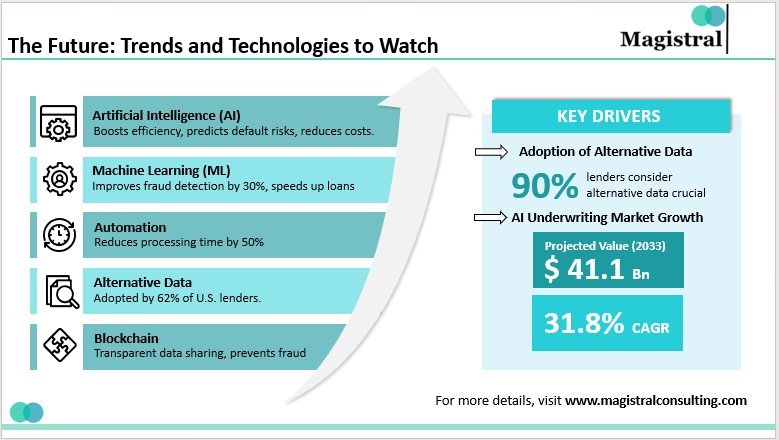

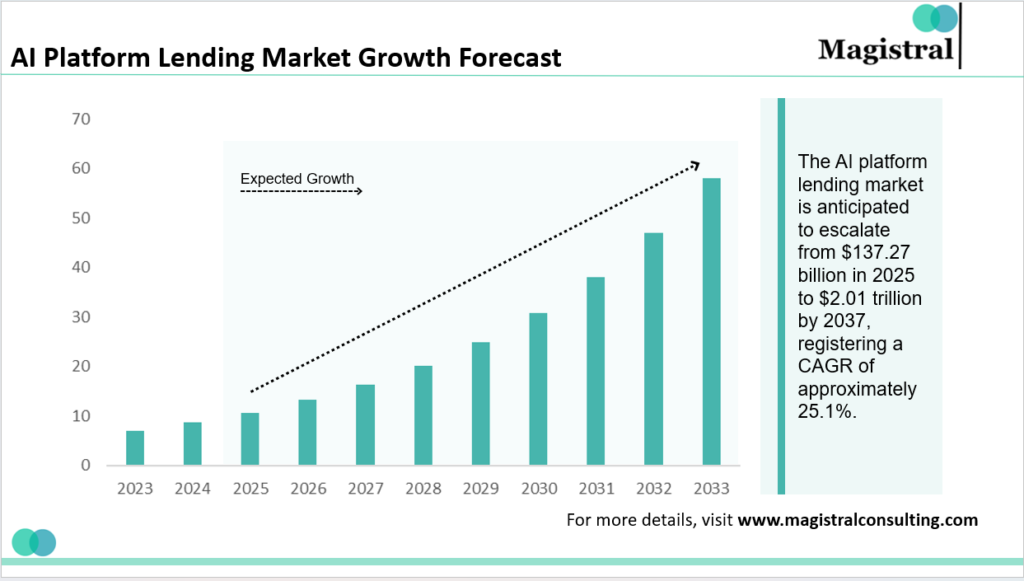

With enhanced cybersecurity measures accompanied by strict regulatory compliances, the integration of high-tech is responsible for a transformative decision-making process and also enables predictive analysis, automates the underwriting process, and detects any fraudulent conduct involved in the process. Additionally, concepts like cloud-based solutions offer a better and more integrated system to the lenders allowing them a seamless management process.

Changing landscape of modern commercial banking

The continuous evolution in the modern commercial lending market has recently experienced an efficient means of securing financing activities. Corporate banks are efficiently using the updated technologies to streamline the corporate loan process from the initial application to the disbursement and ongoing services. Following are some major features that are helping the commercial banks to automate their process:

Automation of the Workflow

Looking into the current scenario, automation goes hand in hand with all the workings of a lending business. The tedious task of maintaining paperwork requires high manpower which further increases the cost. Apart from reducing the turnaround times and cost the commercial lending software also reduces the manual errors saving any efforts for maintenance. As soon as the loan application is submitted the automated workflow immediately captures and records all the details. The reduced administrative overhead ultimately improves the experience of borrowers. Because timing and accuracy are the two most important aspects of a lending business. In addition, automation facilitates easy integration with third-party financial institutions. It includes credit bureaus and regulatory agencies, to provide real-time verification of customer information. This minimizes the risk of fraud and maximizes compliance while accelerating loan approval procedures. Automated reminders and alerts also enhance communication between borrowers and banks. This facilitates timely repayment and minimizing default rates.

High-end experience with cloud-based Saas

The cloud-based saas offers a user-friendly experience by eliminating the requirement for on-premises maintenance costs. Such advanced support allows users to access remote services across different locations globally. The algorithm ensures access to all the latest features and security updates without any risk of manual error, along with an in-built recovery and data backup feature immunizing the data to all possible failures and losses. The technology allows commercial banks to align with increasing modern corporate needs and wants. In addition, cloud-based SaaS improves scalability, enabling banks to scale their services effortlessly without infrastructure constraints. Its integration with AI and big data analytics maximizes decision-making, fraud prevention, and customer personalization, making the banking system more efficient and secure.

Compliance with the management

Using the advanced support of commercial lending software, banking companies can easily comply with the regulatory and legal aspects of lending. Compliance management is a must-ask feature for every corporate lending software, as it helps the business to comply with all the related legalities and adhere to the relevant regulations and standards in the market. To mitigate the risks of penalties and build the trust of the stakeholders, this software associates the penalties through automated checks and real-time monitoring, providing clear visibility of audit trials and enhancing transparency and accountability among the final users. Besides, the software is also updated automatically to incorporate the newest regulatory developments, thus keeping banks in compliance without intervention. Its documentation and reporting functions make regulatory filings and audits easier, easing administration. Through the integration of risk assessment tools and automated compliance processes, financial institutions are able to anticipate problems beforehand, improve decision-making, and promote a culture of responsibility and trust among stakeholders.

Customization of features for a better and unique experience

To understand and align with the everchanging customer needs and convenience, the software designs personalized dashboards with multiple widgets and data view options. It helps and allows the users to adjust the layout preferences and themes and adjust the interface settings. Using such approaches saves manual energy and time and allows for a better and effortless process. Incorporating such robust customizable features into commercial lending software cements its alignment with the other parts of the business, the final users’ preferences, and supporting strategic goals. With all the possible flexibilities, the software provides a more user-friendly experience. In addition, cutting-edge APIs and integration features allow for effortless connection with third-party applications, maximizing functionality and flexibility. Workflows can be automated, custom alerts can be established, and role-based access controls can be configured to enhance security and productivity. Such high customization ensures that financial institutions can make the software suit their specific business operations. This enables them to maximize productivity while providing a more intuitive and personalized user experience.

Data-driven decision-making with AI integration

The feature that makes the commercial lending software stand is its ability to leverage advanced analytics for structured data-driven decision-making. The advancement allows lenders to access real-time analysis of data. It enables gaining deeper insights into borrowers’ behavior, market trends, and creditworthiness all at once. Following these insights, lenders can gain more accuracy in assessing the risk. It results in fastening the loan approval process in accordance with the requirements of the borrower. Apart from this, the software gives a predictive analysis to identify any potential issue in the process. This allows lenders to chart out their future strategies accordingly. With such an approach commercial banks can stay competitive in the market and make more informed and precise lending decisions. In addition, AI-based automation is improving efficiency through reduced manual intervention in fraud detection, risk assessment, and document verification. Machine learning algorithms keep improving lending models from historic data, and accuracy improves over time.

With the development of commercial banking, technology-driven and automation-based solutions are increasingly becoming integral to optimizing efficiency. It also helps in cutting costs, and delivering better customer experiences. Ranging from optimizing processes to facilitating compliance and capitalizing on AI-driven intelligence, lending is being reshaped by financial institutions. With emerging technologies like blockchain, they are assuring better security and transparency. Fintech partnerships and open banking projects are facilitating innovation and personalization in banking.

Those banks that focus on technological innovations using commercial lending software will be more apt to satisfy increasing borrowers’ demands. This will allow them to remain competitive in a quickly evolving market. By adopting automation, security, and compliance, commercial banks are able to deliver sustainable growth. There is also a long-term profitability in a highly digitalized financial environment.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

How does Magistral handle data migration and integration with client systems?

Magistral ensures seamless data migration and integration through secure APIs, automation, and customizable solutions, ensuring compatibility with client systems while maintaining data integrity and security.

How does Magistral ensure transparency in outsourced operations?

Magistral ensures transparency through real-time reporting, automated tracking, audit trails, and clear communication, providing clients with full visibility into outsourced operations.

What pricing models does Magistral offer?

Magistral offers flexible pricing models: FTE Model for dedicated full-time support, Retainer Model for predictable monthly costs, and Ad-hoc Model for on-demand services, ensuring scalability and cost efficiency.