In a sea of ever-increasing and complicated CPA compliance in 2025, CPAs who are nimble and informed will keep pace. The changes within the regulation of beneficial ownership, licensure, an increased focus on ESG, a focus on cyber security, increased enforcement by the IRS, and the rapid advancement of technology, namely artificial intelligence, have set the stage for a changing regulatory regime in many new ways. This article reviews the relevant regulatory updates that will impact CPAs this year and offers helpful tips to handle the changes abruptly and efficiently, including the use of artificial intelligence overall.

CPA Compliance Regulatory Landscape: Key Updates and Strategies

As we move through 2025, CPA compliance is facing a changing regulatory environment. It is important to stay current and vigilant to ensure CPA compliance and competitiveness. Here are the important changes and our recommendations:

Beneficial Ownership Information (BOI) Reporting Enhancements

The Financial Crimes Enforcement Network (FinCEN) is increasing its scrutiny regarding transparency under the Corporate Transparency Act, which requires certain entities to identify their beneficial owners for the purpose of fighting illegal financial activity. CPAs should:

Develop reliable data gathering procedures: Create procedures for collecting and validating beneficial ownership information.

Remain current: Follow FinCEN’s guidance to avoid late filings and ensure accurate and timely reporting.

Emphasis on ESG Reporting and Assurance

Environmental, Social, and Governance (ESG) are increasing components of financial reporting:

Regulatory Developments: Expect both climate risks and sustainability metrics to be subject to increased disclosures.

CPA Role Expansion: CPAs will be asked to provide assurance services concerning ESG reports. CPAs and firms will also need to become familiar with the overlapping standards and requirements.

Adapting to IRS Enforcement Intensification

The Internal Revenue Service (IRS) has announced a more aggressive stance on enforcement now:

Be Audit Ready: Make sure you maintain proper documentation and comply with tax laws.

Client Advisory: Inform clients about recordkeeping and audit flags.

AI in CPA Compliance

AI utilization in the CPA compliance and accounting space is growing rapidly as finance leaders start automating aspects of accounting functions like reconciliations, fraud detection, and forecasting, among others. This process involves utilizing historical data combined with machine learning and predictive intelligence to help accountants make better decisions. By going beyond standard manual accounting activities, accountants will be able to focus on advising the organization on the insights associated with historical data. The real integration of AI tools will influence the nature and types of interactions financial professionals have with data. The preliminary rewards for those who populate their processes with AI tools will include efficiency, speed of acceptable options, and accuracy. Companies adopting the implementation and consideration of AI are developing a connected ecosystem that may augment their ability to manage the firm, develop analytics-savvy leaders, and positively influence their professional career opportunities.

AI in CPA Compliance

AI’s Growing Impact on Accounting

Artificial Intelligence is starting to disrupt the accounting profession, and all indications are that this influence is only going to grow. The AI in the accounting market is projected to have a compound annual growth rate of circa 42% CAGR to an estimated USD 37.66 billion by 2030 from USD 6.58 billion in 2025.

Segment Analysis

In the AI in accounting market, the software segment leads with approximately 85% market share as of 2024. This dominance is fuelled by the widespread adoption of AI-powered tools that streamline tax preparation, automate routine tasks like data entry, and enhance customer interactions through intelligent Q&A and virtual assistants. The demand for cloud-based, AI-enabled accounting solutions providing more visibility and insight than traditional methods is stimulating the growth of this segment. In contrast, the services segment is the fastest-growing segment and is expected to grow at a CAGR of approximately 48% between 2024 and 2029. This is due to increased reliance on AI services for setup, integration, maintenance, fraud detection, and digital assistance. Growth is further driven by more data, industry moves toward flexible cloud platforms, regulatory shifts, and immense government spending to support AI adoption in all sectors.

Market Geography Segment Analysis

North America tops the AI in accounting market with a global share of 43% (2024) due to large technology firms, growing independent technology entrepreneurs, and the high adoption of cloud-based product solutions. The U.S. plays a critical role in leveraging AI for automation, CPA compliance, and advanced analytics. Further, strict regulations and substantial research and development are contributing to AI growth in accounting.

Europe continues to show significant momentum and is growing at a rate of 42% from 2019-2024. Germany, the UK, and France are on this advanced adoption path of AI in accounting, with diverse digital innovation hubs, data protection laws, and SMEs of all shapes and sizes seeking more automation and analytics in their operations.

Asia-Pacific is the fastest-growing region, with a projected 44% CAGR (2024–2029). Rapid digital transformation, government-backed innovation in countries like China, Japan, and Singapore, and rising SME adoption are driving AI integration in financial processes and accounting tasks.

The rest of the World (Latin America, the Middle East, and Africa) is showing steady growth, supported by fintech development, digital transformation agendas (notably in the UAE and Saudi Arabia), and increasing demand for automation, cloud solutions, and compliance-driven accounting tools.

This rapid global adoption of AI in accounting has direct ramifications for CPA compliance. The regulatory requirements become increasingly complex and region dependent. AI-enabled solutions help CPAs to keep up with the evolving compliance landscape. They automate compliance workflows, identify anomalies, and generate on-time regulatory reports.

CPA Compliance: The Future Outlook

For future-proofing your business and preserving a client’s confidence in your services, it is important to manage CPA compliance with great care. AI continues to emerge as a positive disruptor in the compliance space as it boosts accuracy and optimizes efficiency. It also lessens your risk exposure. It is unsurprising that the Global AI Compliance Monitoring Market is expected to grow from a valuation of USD 1.8 billion in 2024 to USD 5.2 billion in 2030 at a compound annual growth rate (CAGR) of 19.4%.

CPA Compliance: The Future Outlook

Staying Ahead of Regulatory Changes

Tax codes and CPA compliance laws are always changing, which makes tracking the updates a full-time job if done manually. It adds a time drain and potential costly mistakes. AI solves this problem by streamlining the regulatory surveillance process. These intelligent systems scour large amounts of data live for legislative updates that are relevant in real time! Recent studies suggest that AI-enabled tools can reduce the effort involved in the task of document analysis. They also help in anomaly detection, and information gathering by upwards of 70%. In our opinion, they make a firm’s compliance workload much more manageable.

Smarter Data Handling and Fewer Errors

The success of the accounting profession relies on precise data. In addition to being burdensome, manual data entry and analysis also provide an opportunity for human error. AI technology changes this by streamlining data collection, verification, and interpretation. Processes that took an accountant hours to match records together or verify entries can now be fully automated, allowing for fewer mistakes. There is also the opportunity for accountants to shift their focus to bigger picture strategic decisions and compliance evaluation.

Proactive Fraud Prevention

Financial fraud continues to be a significant compliance risk. Traditional means can take time to pick up on early warning signs of fraud or simply miss them altogether. AI, through machine learning algorithms, has the advantage of constantly monitoring financial transactions. It also checks for emerging trends and identifying anything that appears to be suspicious. It can help in identifying odd trends and inconsistencies early on. AI also provides an additional layer of protection for firms to satisfy their legal obligations to prevent fraud.

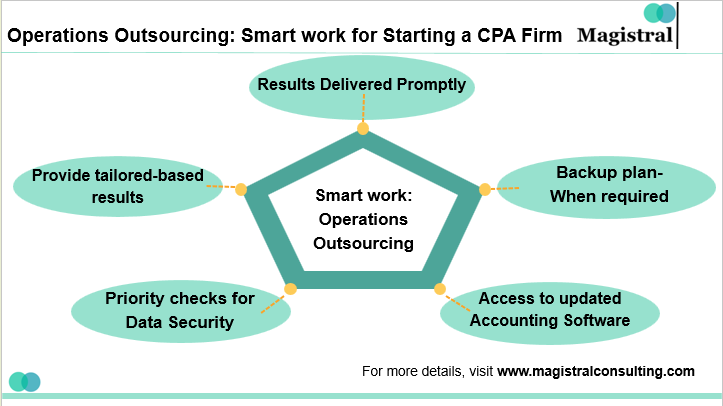

Magistral’s Services for CPA Compliance

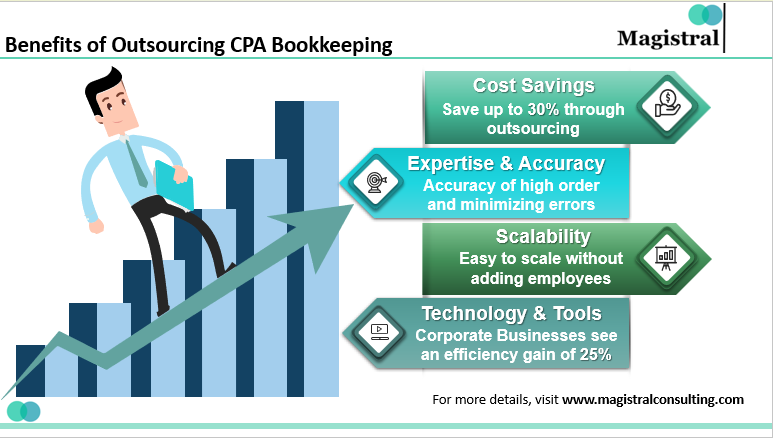

At Magistral Consulting, we offer outsourced services focused on supporting firms in navigating complex regulatory requirements efficiently. Our team of professionals provides transparent, customized services to improve accuracy and keep firms compliant. We also deliver reports consistently while being responsive to evolving standards.

Regulatory Monitoring and Updates

We provide ongoing tracking of the CPA changing regulations and CPA compliance requirements to keep firms informed and ready for audits.

Compliance Documentation and Reporting

We can prepare and review regulatory documentation filings for CPA compliance with regulations and forms, and we make sure they are accurate. Internal

Controls Review

We can evaluate a firm’s processes to maintain compliant procedural practices and reduce regulatory exposure to human error or fraud.

Data Management and Validation

Streamlined service offerings for data collection, reconciliation, and validation for accurate financial reporting.

Audit Support and Preparation Assistance

Assistance with audit preparation and support, including compiling the documentation to provide to the auditors.

Risk and Fraud Detection Analysis

Analytics and AI tools enabled data science to identify a compliance risk or potentially fraudulent activity. It is done early in the investigation process.

Technology Integration Support

Advising and implementation for AI-enabled tools and automation-cloud-based solutions. It is to simplify a company’s compliance workflow and reporting processes.

Ongoing Compliance Advisory

Expertise to support maintaining a compliance posture through rapidly changing regulatory environments and phases of business growth.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

FAQs

What is the Corporate Transparency Act, and how does it affect CPAs?

How has CPA licensure changed in 2025?

What is the role of CPAs in ESG reporting?

Why is cybersecurity important in CPA compliance?