Credit risk monitoring in banks was gaining importance as the financial sector was going through economic volatility and swift digital transformation. The global banking industry fares on rising credit losses in 2025, with global credit losses being projected by S&P Global to stand at $814 billion, a 24% unprecedented growth from the original forecast. This climate calls for banks to enhance their credit risk monitoring systems to protect financial stability and promote sustainable development. With the use of sophisticated analytics, AI, and real-time data, banks can anticipate developing risks, adhere to changing regulations, and sustain sound loan books. In this article, the most current approaches, technologies, and market statistics defining credit risk monitoring for banks are addressed, providing practical advice for financial institutions seeking to remain at the forefront of an ever-changing environment.

Credit Risk Monitoring in Banks: Market Trends and Industry Data

The requirements for prompt oversight and predictive abilities variance have, in the past, seen an evolution in credit risk monitoring in banks. According to a research, the global credit risk management software market is projected to grow from $1.4 billion in 2023 to $2.6 billion by 2028, at a CAGR of 12.7%. There has been more regulatory scrutiny, digital lending, and, therefore, AI-powered buy-side solutions. Banks invest in integrated credit risk monitoring platforms that deliver a single view of borrower risk, including automation of data collection and actionable insights.

Credit Risk Monitoring in Banks: Market Trends and Data

The Shift to Proactive Monitoring

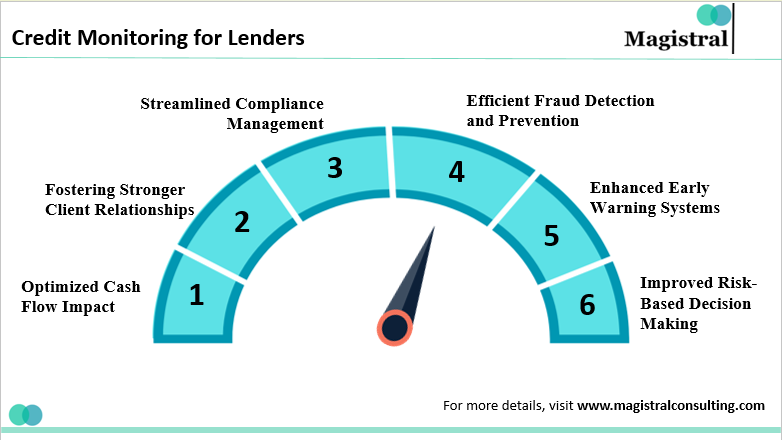

Banks are transitioning from responsive, manual procedures to preventive, automated credit risk surveillance about Pulse Real-time analytics and early warning solutions designed to help banks recognize deteriorating credit conditions before they become a problem in order to reduce non-performing loans and protect profits.

Regulatory Pressures and Compliance

The new RBI guidelines and Basel III have forced banks to incorporate strong credit risk monitoring systems. All the guidelines are about the identification of future risk, scenario analysis, and overall reporting, forcing banks to incorporate high-level monitoring systems.

Technology as a Differentiator

Machine learning and artificial intelligence are changing how banks manage credit risk. They analyze large amounts of data, find hidden patterns, and predict potential defaults with an accuracy rate of 96%. Banks use this technology to make quicker and smarter lending decisions. They also customize their risk strategies for each borrower.

Market Growth and Regional Insights

Key regions for credit risk monitoring adoption are North America, followed by Europe and Asia Pacific, where digital lending and fintech partnerships are driving demand. The size of the credit risk assessment market in value terms is forecast to be $23.97 billion in 2032 by Future Market Insights, making it the most critical component of the risk management infrastructure as businesses become more data focused.

Credit Risk Monitoring in Banks: Core Components and Best Practices

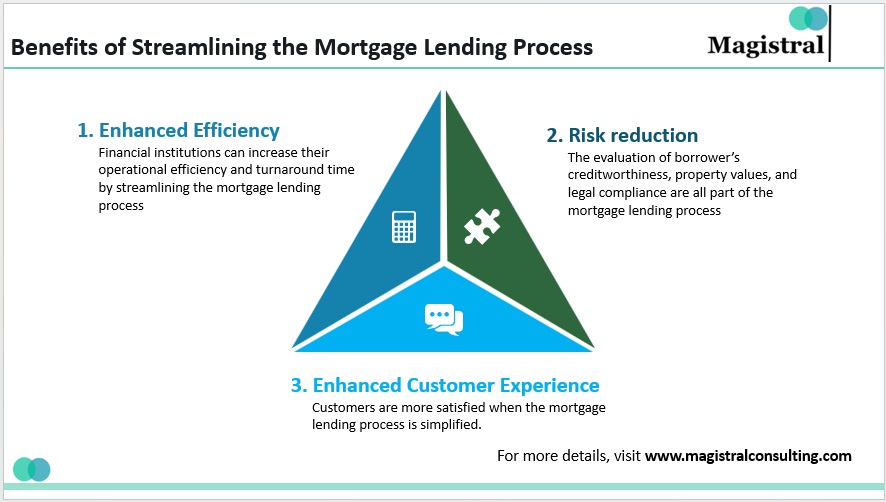

Real-time integration of data, predictive analytics, and strong governance are linchpins of effective credit risk monitoring at banks. Banks that exhibit strong performance in these areas consistently outperform peers in loan performance, capitalization, and regulatory compliance.

Real-Time Data Integration

Today’s credit risk monitoring systems combine data from numerous channels—previous transactions, payment behaviors, external credit bureaus, and even alternative sources such as social media points. This full approach allows banks to keep current borrower profiles and act quickly in response to changing lending risks.

Early Warning Systems

Banks globally use early warning systems to monitor critical risk metrics — such as missed repayments, falling sales, or industry or sector stress — in their lending portfolios. They alert risk managers to step in before loans end up as non-performing.

Predictive Analytics and AI

Credit scoring improves and improves as machine learning models improve, learning from past defaults and macroeconomic patterns. Banks that implement AI in credit risk management report a reduction in default rates of 20% and a reduction in operating expenses by 15%.

Internal Controls and Governance

Sound governance frameworks ensure consistency, transparency, and auditability in monitoring credit risk in banks. Model validation periodically, independent review of credit, and transparent escalation mechanisms are essential in ensuring risk discipline.

Credit Risk Management in Banks: Regulatory Compliance and Capital Management

Credit risk monitoring has a close connection with regulatory compliance and capital adequacy. As regulators turn up the heat, banks are forced to provide proof of sound supervision, risk grading, and timely reporting.

Basel III and RBI Guidelines

As per Basel III, banks are required to maintain a minimum capital ratio and to be subjected to regular stress tests. The RBI Guidelines of 2024 require Indian banks to incorporate macroeconomic data, scenario analysis, and expected credit loss models while conducting credit risk monitoring.

Stress Testing and Scenario Analysis

Banks perform stress tests to predict the effects of unfavorable economic conditions on loan books. Stress tests enable banks to discover weaknesses, modify capital cushions, and increase risk appetites.

Documentation and Reporting

Regulators mandate banks to maintain complete records of credit risk models, methods, and validation results. Automated systems of monitoring credit risk enable proper reporting and compliance with evolving standards.

Credit Risk Monitoring in Banks: Technology Use and Outsourcing

Technology adoption is now central to credit risk monitoring evolution in banks. Many look to outsourcing partners to get specific skills, cut down costs, and fast-track their digital transformation.

Credit Risk Monitoring in Banks: Technology and Best Practices

AI-Powered Platforms

Credit risk monitoring platforms based on Artificial Intelligence (AI) permit real-time risk scoring, fraud detection, and portfolio analytics. Also, these solutions can be adapted to bank-specific risk appetite and regulatory requirements.

Outsourcing for Agility

More and more banks are relying on consulting and technology firms to monitor their credit risks. The outsourcing of credit risk management opens access to best-in-class tools, analytics, and domain expertise. Thus, it enables banks to focus on their core activities.

Market Data and ROI

The May study by Deloitte indicated that banks investing in advanced credit risk monitoring see notable benefits. With support from predictive analytics firms, they enhance credit decision processes. As a result, they experience a 30% improvement in risk detection and a 25% decline in compliance costs.

Credit Risk Monitoring in Banks: Looking to the Future and Strategic Focus

The next decade shall be defined by sustained and digital innovation, with even closer regulatory scrutiny and consideration of ESG (Environmental, Social, Governance) as part of the credit assessment.

ESG Integration

Banks are starting to integrate ESG metrics into credit risk monitoring and early analysis of borrowers’ environmental and social risks against their financial metrics. This change is consistent with sustainable finance and follows the trend of the world in regulation.

Cloud and API-First Solutions

Cloud-based credit risk monitoring tools can scale, morph, and integrate easily with third-party data sources. API-first architecture allows the banks to hook onto their legacy systems and exploit data better in decision-making.

Continuous Improvement

Leading banks set up feedback loops to optimize credit models and track new risks and market changes. Such periodical reviews permit the credit risk monitoring frameworks to hold strong and perform well.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

Prabhash Choudhary is the CEO of Magistral Consulting. He is a Stanford Seed alumnus and mechanical engineer with 20 + years’ leadership at Fortune 500 firms- Accenture Strategy, Deloitte, News Corp, and S&P Global. At Magistral Consulting, he directs global operations and has delivered over $3.5 billion in client impact across finance, research, analytics, and outsourcing. His expertise spans management consulting, investment and strategic research, and operational excellence for 1,200 + clients worldwide

FAQs

How does credit risk monitoring in banks reduce non-performing loans?

What technologies are transforming credit risk monitoring in banks?

Why is regulatory compliance important in credit risk monitoring for banks?

How does outsourcing support credit risk monitoring in banks?

What role does ESG play in credit risk monitoring in banks?