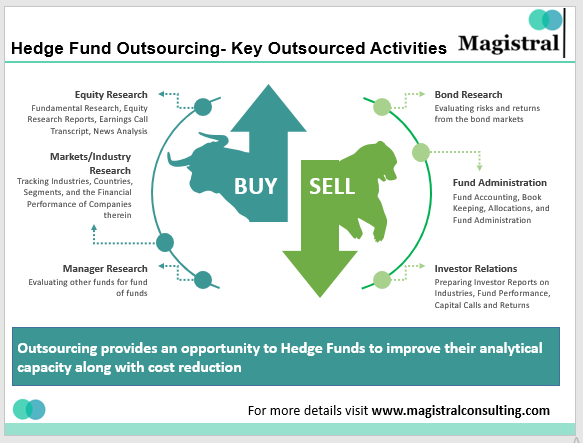

Hedge Funds are known for their high-risk investment strategies and the role of the back office has started gaining more attention. A lot of operational work goes into running these funds and this operational work also known as “back office” includes a variety of tasks like management of risk, reporting, compliance with the laws, trade settlement, etc. Due to the complexities of these tasks, many hedge funds are now increasingly opting for hedge fund back office outsourcing. This helps them to focus on better core activities increasing the efficiency and effectiveness of their work.

In this article, we will discuss about hedge funds back-office operations, outsourcing the back-office functions, trends and considerations.

Understanding Hedge Fund Back Office Operations

The back office in a hedge fund plays a very important role in making sure that compliance requirements are being met, financial reports are being generated, and that the trades are being processed accurately. Some functions of the hedge fund back-office include:

Hedge Fund Back-Office Functions

Trade Settlement Processing

After trade execution, the back office reconfirms and settles trades made by the front office. This involves ensuring that each transaction detail matches those of other parties engaged in it. The process of settlement includes transferring securities & funds confirming that both parties’ obligations have been met as per agreement. The importance of hedge fund back office outsourcing cannot be overemphasized because it helps to mitigate risks related to settlements and guarantee timely completion of trades.

Management of Risk

In order to uphold the stability of the fund it is vital to observe and supervise the financial risks such as market, liquidity and operational risks linked with it. This entails measuring exposure, exploring potential losses, and implementing plans that contribute towards reducing risks. Furthermore, the stipulations as well as the investment strategy of the fund.

Regulatory Reporting and Compliance

Hedge funds operate in a complex regulatory environment and must comply with various laws and regulations. Hedge fund back office outsourcing helps ensure the fund follows all relevant rules, including those set by the SEC, CFTC, or other regulatory bodies. Outsourcing partners prepare and submit regular reports such as Form PF, Form ADV, or AIFMD, depending on the jurisdiction. Compliance can also mean keeping proper records, implementing anti-money laundering procedures as well as ensuring that all activities of the fund are open and above board.

Financial Reporting and Accounting

Precise financial reporting as well as accounting is vital for operations of hedge funds. One of their responsibilities includes maintaining detailed records about fund’s financial activities, like income, expenses, and performance metrics. All transactions have to be accurately recorded in books belonging to these funds. Timely & accurate financial reports become really important if investors want their funds’ performance disclosed for them based on clear information hence, they will make better choices & meet various requirements put forth by regulators.

Investor Reporting and Communication

Essentially, the back office serves as a link between investors and organizations through meeting their desires by giving them updated reports especially reports that talk about performance, capital account statements, and documents related to tax like K-1 or 1099 forms among other things. Timeliness is crucial because it establishes good rapport between the two parties involved. Without proper communication channels, clients may lose confidence in their investment trades leading to dismal results for them all.

Perks of Outsourcing Back Office Functions

Expert Knowledge

Having professionals with knowledge and expertise in Hedge Fund Back Office Outsourcing or operations can improve the efficiency and effectiveness of tasks.

Scalability

It is often seen that with the growth of hedge funds handling their operations becomes quite tedious and difficult, however, Hedge Fund Back Office Outsourcing can provide practical scalable solutions according to the required needs of the fund. This is usually not possible with an in-house team.

Prioritization of Core Activities

With the help of external companies that will be performing back-office tasks, hedge funds will be able to focus more on key investment strategies and make rational decisions. Further, Hedge Fund Back Office Outsourcing will also enhance fund performance regarding investment thereby leading to better growth.

Management of Costs

Hedge fund back-office outsourcing has the potential to optimize operational costs significantly. To avoid or keep away these expenses, outsourcing these functions to professionals would create an opportunity for companies not to incur various costs such as wages, staff training, and overheads.

Mitigation of Risks

Experts and outsourcing partners are often quite knowledgeable about risk management and ensuring that all regulatory requirements are met. Hedge funds back-office outsourcing can avoid regulatory breach risks, errors, and frauds.

Trends in Hedge Fund Back Office Outsourcing

Trends in Hedge Fund Back-Office Outsourcing

Regulations

With the development of various regulatory requirements, hedge funds are depending more on outsourcing partners to help maneuver complicated compliance landscapes. And Hedge Fund Back Office Outsourcing firms are adjusting to these changes by giving tailored services and expertise.

Management of Risks

Hedge funds are utilising outsourcing to improve their risk management abilities. This involves using risk analytics and reporting tools that are advanced and are offered by the Hedge Fund Back Office Outsourcing partners.

Tailored Services

Hedge Fund Back Office Outsourcing providers offer more customized solutions to adjust to the required needs of hedge funds. Tailoring these services can help hedge funds in focusing on specific operational challenges and achieve better results.

Technology

With advanced technologies like AI and blockchain back-office operations have seen a tremendous transformation. These technologies can help in upgrading the level of efficiency, accuracy, and transparency in processes such as trade settlement and management of risks.

Globalization

Hedge Fund Back Office Outsourcing partners customize services to manage international transactions, handle various currencies, and ensure compliance with international laws.

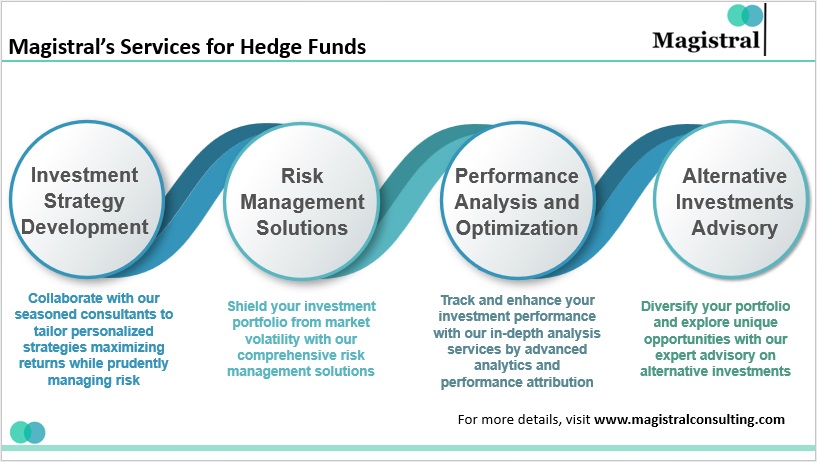

Magistral Consulting’s Services for Hedge Funds

For successful and fruitful operations in Hedge Fund Back Office Outsourcing, we provide total back-office support services. These revolve around both the efficiency-enhancing services as well as those assisting strategic choices while ensuring compliance with regulations and laws. These services include:

Fundamental and Technical Research

In our pursuit to provide hedge funds with thorough insights into their investments’ true values, we analyze companies’ specific aspects, industries, and trends of the economy in general. Additionally, we analyze price changes over time, and trading patterns among others in a bid to improve entry or exit timing for hedge fund managers (investment timing).

Industry and Sector Reports

We prepare reports that would help hedge funds evaluate risks pertaining to particular sectors and identify possible sources of growth within them. Aiding hedge fund clients to understand high-growth industries with strategic relevance is possible through our industry reports as they detail outlooks, opportunities, and threats.

Balance Sheet Analysis and Recommendations

A comprehensive assessment of a company’s balance sheet allows us to know its financial standing. The assets-liabilities-equity structures provide valuable insights into making sound investment decisions by hedge funds.

Profiles

Our experts offer in-depth company profiles for potential targets. Giving a complete view in terms of financial performance, quality of management, and strategic positioning which helps hedge funds in evaluating the longevity of their investments.

DCF Modeling and Valuations

With our DCF modeling and valuation services we give accurate estimates of a company’s worth relying on future cash flows. This assists hedge funds in carrying out valuating procedures as well as making investment decisions accurately.

Reports’ Preparation

Among other documents, we offer assistance in the preparation of various types of reports like presentations for shareholders and financial statements. Coherent and accurate as well as industry-driven; our reports aim at promoting good relationships with stakeholders through effective communication.

Stock Price Analysis Reports

The study also encompasses an analysis of stock price behaviors. Like, historical price movements, stock volatility patterns and market sentiment fluctuations. Such documents are key tools for money managers who want to know what moves the market while creating their own trading plans.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

Why are hedge funds increasingly opting for back-office outsourcing?

Hedge funds are increasingly outsourcing their back-office functions to focus on core investment strategies, enhance operational efficiency, and manage costs. Outsourcing provides access to expert knowledge, scalability, and advanced technology, allowing hedge funds to optimize their operations and mitigate risks.

What are the key benefits of outsourcing hedge fund back-office functions?

The key benefits of outsourcing back-office functions include access to expert knowledge, scalability, cost management, risk mitigation, and the ability to prioritize core activities. Outsourcing enables hedge funds to enhance performance, reduce operational risks, and achieve greater efficiency.

What considerations should hedge funds keep in mind when outsourcing back-office functions?

Hedge funds should evaluate potential outsourcing vendors based on their expertise, ability to meet specific needs, and security measures to protect financial data. Other important considerations include regulatory compliance, effective integration, communication, and maintaining high-quality standards to ensure smooth operations.