Introduction

An Industry Report is a detailed analysis of a specific industry that includes a wealth of data, facts, and figures. There are two types of industry reports: private and public. The customers buy the prepared Industry reports, while some can be downloaded for free. The financial services industry is a large industry that caters to both individual and corporate financial requirements. The industry is made up of both large corporations and small businesses. The financial sector is an essential component of various Industrialized economies around the world, and it is critical to global economic development. The financial services sector will be worth $26.5 trillion by 2023, accounting for one-fourth of global GDP—the financial services industry profits from larger investments. When the business cycle is on the rise. When the economy improves, new capital projects and personal investments are likely to follow.

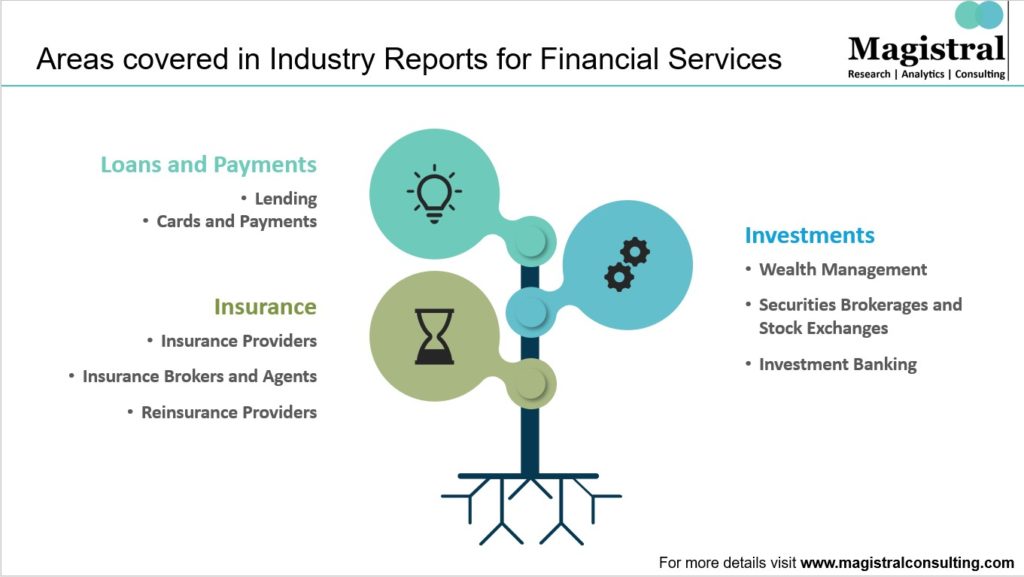

The financial services sector forms companies that sell financial services such as loans, investment management, insurance, brokerages, payments, and transferring money. The financial services industry is divided based on the companies’ business models that make up the industry. Most businesses fall into multiple categories.

Areas covered in Industry Reports for Financial Services

Areas covered in Industry Reports for Financial Services

Loans and Payments

Organizations that sell lending and payment services, such as loans, payments, and money transfer services, are included in the loans and payments market. Banks and other financial service providers accept deposits and reimbursable payments as well as make loans. Providers compensate those who provide them with funds, which they then lend or invest to profit on the differences between what they give depositors and what they earn from borrowers. Providers enable payments to be transferred from payers to recipients and ease transactions and account settlement, using credit and debit cards, bank drafts such as checks, and electronic funds transfer.

Insurance

-Insurance Providers-Direct insurers aggregate payments from individuals looking to cover risk and payout to those involved in covered personal or business-related catastrophes, such as a car accident or a shipwreck.

-Reinsurance Providers-They can be companies or wealthy individuals who offer to cover some of the risks that a direct insurer assumes in exchange for a fee.

-Insurance Brokers and Agents- Insurance intermediaries, including agencies and brokers, connect those who want to pay to cover risk with people prepared to take it on for a fee.

Investments

Wealth Management-

Wealth management is an investment advising service that integrates other financial services and meets high-net-worth individuals’ demands. The advisor obtains information about the client’s aspirations and personal situation through a consultative approach, then produces a tailored strategy that integrates a range of financial products and services. An integrated strategy is often used in wealth management. Numerous services might well be supplied to meet a client’s specific demands. While total wealth management service charges vary, they are often decided by the amount of money customer has with them.

Securities Brokerages and Stock Exchanges-

Individuals can use investing services to gain access to financial markets such as stocks and bonds. Brokers, who are either human or self-directed internet services, enable the buying and selling securities for a fee. Financial advisers may charge an annual fee depending on assets under management (AUM) and supervise various trades to build and manage a well-diversified portfolio. Robo-advisors are the latest financial advice and portfolio management iteration with automated algorithmic portfolio allocations and trade executions.

Investment Banking

Dealmakers and high-net-worth individuals (HNWIs) are often the only people who work with an investment bank—not the public. These institutions underwrite transactions, provide access to capital markets, provide wealth management and tax advice, aid corporations with mergers and acquisitions (M&A), and make stock and bond trading easier. This market also includes financial counselors and cheap brokerages.

Major Components in Industry Reports for Financial Services

The following are usually found in industry reports for financial services:

-Industry definition

-Major industry players

-Market share

-Historical and current trends

-Employment statistics

-SWOT analysis

-Achievements

-Outlook

Latest trends found in Industry Reports for Financial services

Aside from the obvious concerns, there are a few financial services industry trends to keep an eye on. Consumer behavior is shifting, and financial services companies must adapt, or risk being left behind.

Latest trends in Industry Reports for Financial Services

Digital Transformation

The financial sector, which always relied on paper documents, has changed in recent years. The way firms work is dramatically altering because of digital transformation. As a result, investors can now use their cellphones to track the success of their portfolios in real-time and buy shares with a single tap. Because digitization has become the new normal, businesses can no longer be profitable if they keep the current quo. Instead, they will have to put money into a digital transformation plan.

Explosion of Fintech

The rapid growth of fintech startups has helped customers significantly while forcing proven financial institutions to rethink their business models. Companies have revolutionized the way individuals pay for goods and services. Apps that use AI to improve earnings while streamlining the corporate loan process are being used. Customers may manage their money, trade cryptocurrency, send money to friends, and donate to influential social organizations using a digital bank with a powerful app. The traditional financial institutions will have to figure out how to provide similar benefits to their customers as new fintech companies develop.

Democratization of Investing

When it comes to investing, several apps have lowered the bar. Individuals can now buy whole or partial shares in their favorite companies for a low or no fee. Setting up automated stock that buys any time people visit their favorite stores and for a Robo-investor to invest in firms and mutual funds depending on the risk tolerance has been made possible now. Due to this, traditional investing firms have faced considerable challenges while also from mass communication sites like Reddit and Discord. Financial advisors and investment businesses must differentiate themselves and prove their worth to succeed.

Utilizing Big Data

Financial organizations generate massive volumes of data, but the data is useless without a robust engine to organize it. Fintech software enables businesses to get actionable insights from big data. More organizations are expected to mine their data to improve customer service while increasing earnings.

More Open Banking Apps

Open banking is an API approach that allows financial institutions to securely exchange client data with other businesses. In recent years, many apps have sprung up that use open banking to provide unique services to clients. An app that scans transactions to watch subscriptions and bills while automatically saving a specific amount each month and a conversational chat app that uses artificial intelligence to help manage the budget is also being used.

Magistral’s Industry Reports for Financial Services

Magistral’s Industry reports for financial services typically include graphs, charts, tables, and written commentary. Even non-professionals can gain an understanding of the sector because of this. The financial services sector is the engine that propels a country’s economy forward. It allows capital and liquidity to flow freely in the market. The economy expands when the sector is robust, and businesses in this area are better prepared to manage risk. The financial services sector’s strength is also vital for the prosperity of the country’s population. Consumers earn more when the industry and economy are robust, increasing their self-assurance and buying power.

About Magistral consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates and Portfolio companies. Its functional expertise is in Deal origination, Deal Execution, Due Diligence, Financial Modeling, Portfolio Management , and Equity Research.

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is Authored by Marketing Department of Magistral Consulting. For any business inquiries, you could reach out to prabhash.choudhary@magistralconsulting.com