Introduction

An Initial Public Offering, simply referred to as an IPO, is a major phenomenon for any firm. In an IPO, the corporation raises funds by first issuing shares to the public. Preparation work, strict observance of regulatory regimes, and documentation are involved. Companies hire investment banks to market, determine demand set the price, and date, among other things.

An IPO can be an exit option for the founders and initial investors of the company since it realizes the full profit from their private investment. Privatization to a public company could be quite an important moment when private investors can realize total gains from their investment. It usually encompasses a share premium for existing private investors. On the other hand, it also allows public investors to participate in the offering.

Going public is a strictly regulated process by the Securities and Exchange Commission. It governs the process in the United States. This article would therefore examine the IPO documentation required in the US by considering the general major steps and requirements involved.

The Regulatory Environment

SEC is an administrative body that regulates IPO documentation filings in the United States of America. All securities have to be presented for public offering through a registration statement. Such a statement is a full disclosure document regarding the financial health of a business model and the prospects for the company’s future from the point of view of potential investors.

Documentation Requirements

IPO documentation in the US is extensive and encompasses various legal, financial, and operational aspects of the company. The following are key features of the IPO documentation process and disclosure s that companies must prepare and submit as part of the IPO:

Registration Statement (Form S-1)

A Form S-1 is a two-part document by:

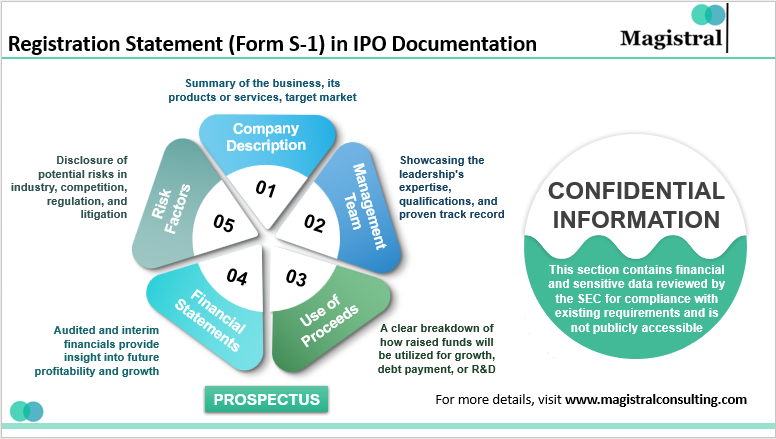

Registration Statement (Form S-1) in IPO Documentation

Prospectus

This is a little like the IPO marketing flyer. You’re going to be informed about the business activities of the company, financial results, management team, and the most crucial risk factors associated with the company. A prospectus is supposed to attract a potential investor and persuade the reader that this is an investment-worthy company. Here’s how some of the key areas of a prospectus break down:

Company Description

The description is therefore brief and straightforward, as it defines the summary of the company’s business, its products or services, its target market, and generally the competitive landscape.

Management Team

It then states that the prospectus contains a general overview of how the best expertise and experience are brought to the leadership of the company concerning their qualifications and track record.

Use of Proceeds

The firm includes the use of raised capital so that there is an adequate indication of the way such money shall be directed when funds are issued in the process of fund raising by the IPO. It may further show funds for carrying out the extension, payment of debts, or research and development investment.

Financial Statements

This includes audited financial statements for the last two-three years and unaudited interim financial statements. The statement provided to the investors further helps them get clear statements about their probable future financial health, profitability, and growth.

Risk Factors

The offer should also make room for an honest and transparent declaration stating the risks associated with investing in the company. Risks may be industry, competition, regulatory, and threats of litigation

Confidential Information

This section is not open to the public but has financial information and other sensitive information that has been analyzed by the SEC to ensure that they comply with the existing requirements.

Legal and Corporate Documents

Companies must provide various legal and corporate documents as part of the IPO documentation process, including:

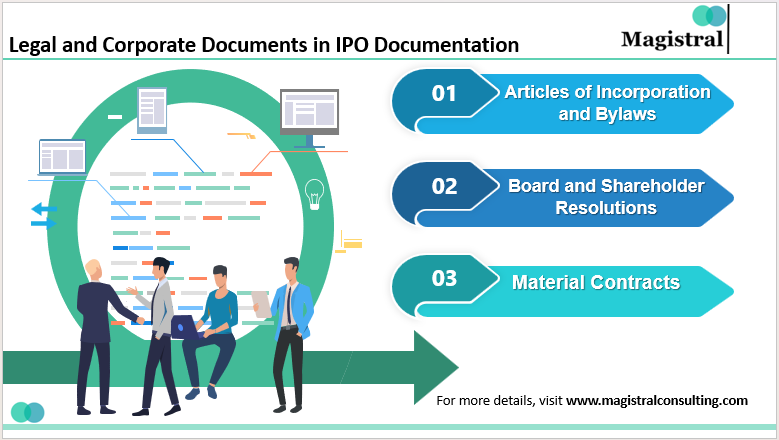

Legal and Corporate Documents in IPO Documentation

Articles of Incorporation and Bylaws

These documents outline the company’s corporate structure, governance framework, and operating procedures.

Board and Shareholder Resolutions

Companies must obtain board and shareholder approvals for the IPO and related transactions. Resolutions documenting these approvals must be provided to the SEC.

Material Contracts

Companies must disclose significant contracts, agreements, and arrangements that could impact their business operations or financial performance.

Due Diligence Materials

Companies must conduct thorough due diligence to ensure the accuracy and completeness of the information disclosed in the registration statement. This includes reviewing and validating financial records, corporate documents, contracts, and other relevant information. Due diligence materials assure investors and regulatory authorities that the company has conducted a comprehensive review of its operations and financial affairs.

Underwriting Agreement

The underwriting agreement is a contract between the company and the underwriters managing the IPO documentation. It outlines the terms and conditions of the offering, including the number of shares to be issued, the offering price, underwriting fees, and the allocation of shares. The underwriting agreement also sets forth the rights and obligations of the company and the underwriters throughout the IPO documentation process.

Legal Opinions and Auditor’s Consents

These documents are typically attached to the registration statement, providing third-party verification of the company’s financial statements and legal standing.

Blue Sky Memorandum

A Blue-Sky Memorandum is a document prepared by counsel for issuers of securities as a presentation to underwriters and broker-dealers of the applicability of and compliance by the issuer with registration and qualification requirements in each state in which securities are to be offered, or the availability of an exemption in each of those states. In the Blue-Sky Memorandum, the requirements of each state in which the offering will be made are addressed, and the status of the issuer’s compliance is detailed. This is a form of Blue-Sky Memorandum for an offering of common stock with a concurrent rights offering.

Stock Exchange Listing Application

As part of the IPO documentation process, the company must apply to list its shares on a stock exchange, like the New York Stock Exchange (NYSE) or NASDAQ, meeting specific listing requirements. This includes providing research and documentation demonstrating compliance with the exchange’s standards and entering into a listing agreement covering terms such as fees and reporting obligations. Listing on a stock exchange is crucial for accessing public capital markets and enhancing visibility among investors.

Final Prospectus

Issued upon approval of the registration statement, this includes final details about the pricing of the shares, the number of shares being offered, and other finalized terms of the IPO.

SEC Comment Letters and Responses

Throughout the review process, the SEC provides comment letters outlining questions and concerns about the registration statement. The company must respond to these letters, often resulting in multiple rounds of revisions to the registration statement.

FINRA Filing

The company must file certain documents with the Financial Industry Regulatory Authority (FINRA) to ensure that the underwriting arrangements comply with FINRA rules and regulations. This includes details of the underwriting compensation and any conflicts of interest.

Magistral Consulting’s Services in IPO Documentation

At Magistral Consulting, we provide you with complete support in the IPO documentation process so that your company is well-prepared for public offerings. We make the complex requirements before you simplified, especially in documenting with accuracy and legality in mind. Here’s where we can help in your journey.

Financial Due Diligence

It involves doing all kinds of checks on your financial records, validating statements and internal controls with ascertained accuracy and regulatory compliance.

Business and Market Analysis

Our team conducts in-depth research into the market position, the competitive landscape, and every detail of the business strategy behind it to create an attractive prospectus that can appeal to investors.

Documentation Support

We prepare all the significant aspects that you have to write in your IPO documentation filings, namely MD&A, risk factors, and use of funds. We make sure all these pieces are clear and informative.

Internal Readiness

This is advising the governance, internal controls, and compliance overall so that your company prepares the gears for not only staying but also moving within a smooth operation after going public.

Our customized approach helps us in making the IPO documentation process less complicated for you, and then the expertise we extend to you and guide you through a successful launch.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

What documents are required for a U.S. IPO?

A U.S. IPO requires several key documents, including the Registration Statement (Form S-1), which consists of the prospectus, financial statements, and disclosures of risk factors and use of proceeds. Other documents include corporate governance materials, due diligence reports, underwriting agreements, legal opinions, and a final prospectus issued after SEC approval.

What does the IPO prospectus include?

The prospectus is a key document that outlines critical details about the company, including its business model, financial performance, management team, and the risks associated with investing. It also provides information on how the raised capital will be used, and aims to convince potential investors that the company is a sound investment opportunity.

Why is due diligence important in the IPO process?

Due diligence ensures that all the information provided in the IPO documents is accurate and complete. It involves a thorough review of the company's financial records, contracts, and operations. This step is vital to build trust with investors and to comply with regulatory requirements, as it demonstrates the company’s commitment to transparency and integrity.

How can Magistral Consulting assist in the IPO process?

Magistral Consulting provides expert support throughout the IPO journey. We assist with financial due diligence, business and market analysis, preparing key IPO documents (such as the MD&A and risk factors), and ensuring internal readiness for public company operations. Our tailored approach simplifies the IPO process, helping companies navigate regulatory requirements and prepare for a successful market debut.