Crafting a compelling investor narrative is increasingly complex, requiring clear storytelling, credible numbers, and market-backed logic. Pitch deck outsourcing has evolved from a tactical design choice to a strategic decision that impacts fundraising success. In tighter capital markets with limited investor attention, professionally built decks help businesses stand out and save leadership time. Investors spend only a few minutes on pitch decks, making concise storytelling, clear financial logic, and structured narratives essential. This approach is gaining traction across startups, funds, and advisory firms globally.

Pitch Deck Outsourcing and the Growing Demand for Investor-Ready Narratives

The rising complexity of fundraising explains why pitch deck outsourcing has become integral to capital markets communication. Investors no longer review decks casually. They analyze them as condensed business cases supported by data, valuation logic, and growth realism.

Pitch Deck Outsourcing & Growing Demand for Investor-Ready Narratives

Why pitch deck outsourcing aligns with modern investor expectations

Investor conversations today are shorter yet deeper. Investor deal flow has intensified, while time spent evaluating individual opportunities has remained limited. Average time spent per deck has remained near historical lows, increasing pressure on founders and fund managers to communicate clarity early in the process. Outsourcing it ensures that narratives are structured clearly, assumptions are defensible, and visuals guide attention to value drivers rather than distractions. Teams focusing on product or deal sourcing often lack the bandwidth to refine these elements internally.

The link between outsourced decks and faster capital raising

Well-structured decks directly influence capital raising efficiency. When founders or fund teams integrate outsourced pitch decks with broader capital raising strategies, investor meetings progress faster, and follow-up questions decline. This often complements advisory support linked to private equity and venture capital mandates, where clarity and precision influence early screening decisions.

Financial accuracy as a driver of credibility

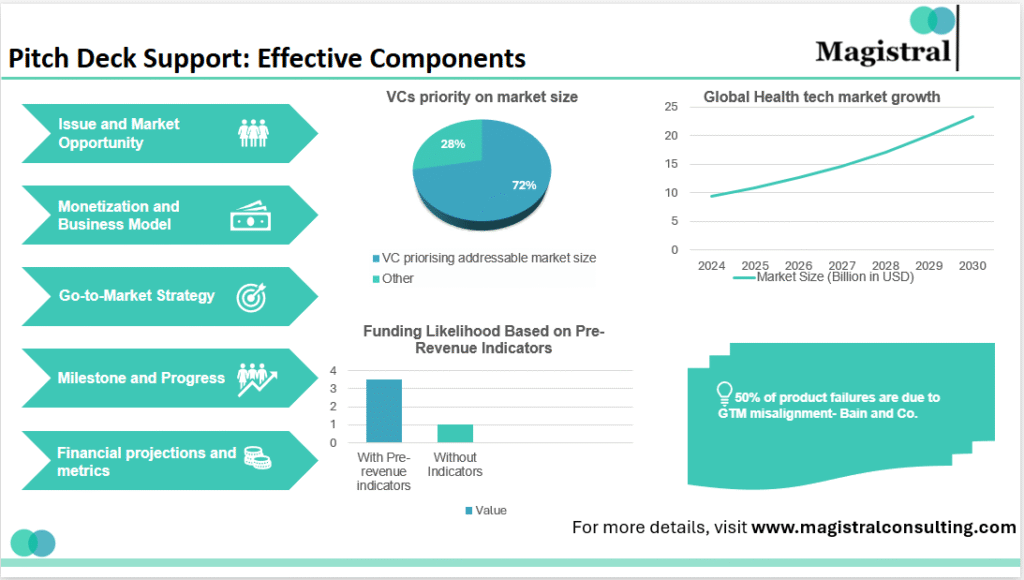

Outsourced specialists typically combine storytelling with robust modeling inputs such as market sizing, scenario analysis, and valuation logic. This approach mirrors institutional standards used across funds, helping early-stage or mid-market firms present information in formats investors already trust. Standardized and well-structured presentations help investors assess opportunities more efficiently. Investors focus disproportionately on a small number of slides, making consistency, comparability, and narrative flow essential for reducing friction during early screening.

Design is not just aesthetics anymore

Visual consistency supports comprehension. Pitch deck outsourcing integrates design with data flow so that numbers reinforce the story instead of overwhelming it. This is particularly important when decks incorporate insights from real estate financial modeling or sector-specific investment theses, where charts, assumptions, and timelines must align logically.

Pitch Deck Outsourcing as a Cost-Efficient Alternative to In-House Teams

Building an internal pitch team appears attractive until costs and timelines are examined. Pitch deck outsourcing often delivers better economics with higher output quality.

Comparing internal effort versus outsourced expertise

An internal team requires hiring analysts, designers, and strategists, which increases fixed costs. Outsourced models convert these costs into variable engagement based on fundraising cycles. Large consulting firms continue to highlight outsourcing as a flexible operating model that allows organizations to scale specialized capabilities without expanding fixed costs. Deloitte’s global sourcing research shows that a growing share of executives are increasing budgets for managed and outsourced services to improve efficiency and speed during peak demand cycles.

Scalability during peak fundraising cycles

Fundraising rarely follows a linear schedule. Teams experience sudden bursts of activity when investor interest peaks. An outsourcing pitch deck allows firms to scale output quickly without diverting internal resources from core operations such as product development or deal execution.

Supporting funds and investm ent professionals

For investment firms managing multiple funds, outsourced decks bring consistency across strategies and vintages. This is particularly valuable for funds presenting to limited partners who expect standardized disclosures and comparable performance narratives across portfolios.

Reducing opportunity cost for leadership

Time spent refining slides is time not spent meeting investors or closing deals. By outsourcing pitch decks, founders and partners focus on conversations while specialists handle structure and polish. This approach aligns well with advisory models used across investment banking support functions, where execution speed is critical.

Pitch Deck Outsourcing and Its Role in Data-Driven Storytelling

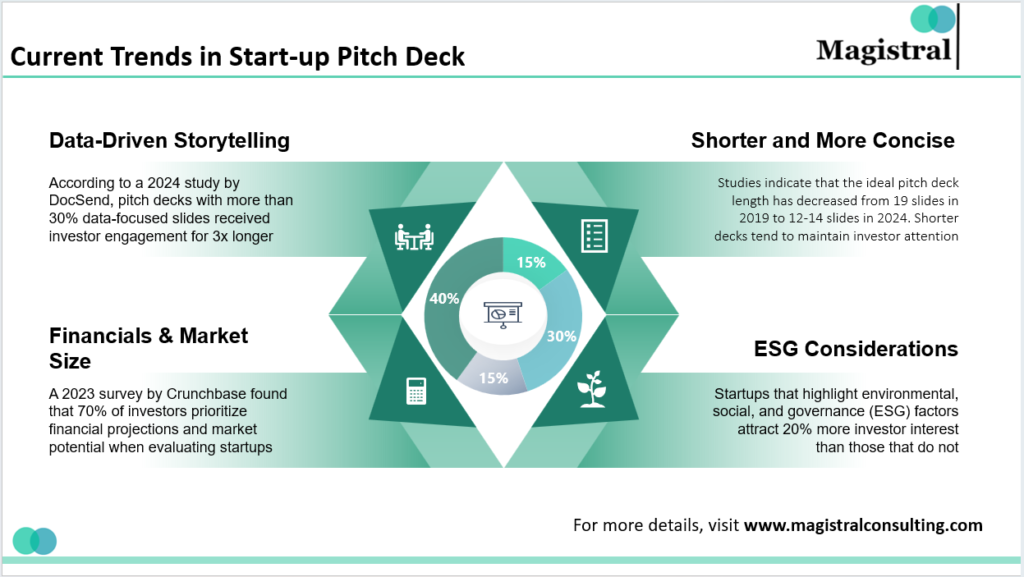

Modern pitch decks are analytical tools disguised as stories. Pitch deck outsourcing strengthens this balance by grounding narratives in credible data.

Integrating market data and benchmarks

According to market forecasts, the global IT and business process outsourcing market is projected to grow at approximately 9% CAGR over the second half of the decade, underscoring continued demand for specialized external capabilities.

Financial modeling and valuation alignment

Investors look for coherence between assumptions and outcomes. Pitch deck outsourcing often works alongside valuation frameworks such as discounted cash flow logic or comparable analysis. When decks align with disciplined valuation thinking, credibility increases, and follow-up diligence becomes smoother.

Customizing decks for different investor profiles

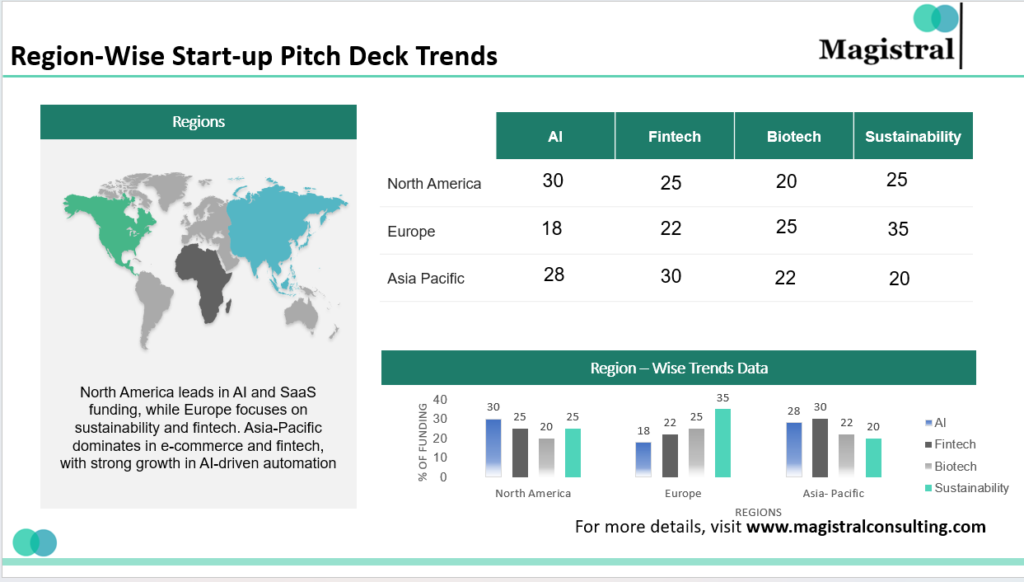

A single pitch rarely fits all audiences. Institutional investors, strategic partners, and family offices focus on different risk metrics. Outsourced teams adapt decks accordingly, adjusting emphasis on growth, cash flow, or downside protection without rebuilding the core narrative from scratch.

Technology and analytics are enhancing presentation quality

AI-driven analytics increasingly support outsourced pitch development by identifying weak assumptions or narrative gaps. Organizations using analytics-driven content development reported higher stakeholder confidence during investment discussions.

Pitch Deck Outsourcing Across Industries and Deal Types

The application of these spans industries, each with unique storytelling demands.

Pitch Deck Outsourcing Across Industries and Deal Types

Startups and early-stage ventures

For startups, outsourced decks often bridge the credibility gap. They help founders articulate a vision while backing it with structured market logic. This complements broader startup fundraising efforts where clarity often outweighs scale in early discussions.

Private equity and growth investments

In private equity contexts, decks focus on value creation plans, operational improvements, and exit logic. Outsourcing ensures that complex operational narratives remain concise while aligning with investor expectations around governance and returns.

Real estate and asset-backed strategies

Real estate-focused decks rely heavily on cash flow projections, sensitivity analysis, and market comparisons. Outsourced specialists experienced in asset-level modeling help translate granular data into investor-friendly visuals without diluting analytical depth.

Cross-border and emerging market deals

When pitching international opportunities, clarity becomes even more critical. Outsourced decks standardize messaging, reduce ambiguity, and address risk considerations that global investors prioritize, such as currency exposure or regulatory stability.

How Magistral Consulting Supports Pitch Deck Outsourcing Engagements

Effective pitch deck outsourcing requires more than slide creation. It demands financial insight, strategic context, and execution discipline.

Strategic narrative development

Magistral Consulting approaches pitch decks as investment stories rather than presentations. Teams focus on aligning business fundamentals with investor expectations while maintaining logical flow across sections.

Financial rigor and market context

Support extends beyond visuals into underlying analysis. By combining market surveys, financial modeling, and sector benchmarks, decks remain grounded while highlighting upside potential.

Integration with broader advisory services

Pitch deck outsourcing often works best when aligned with complementary services such as deal support and ongoing finance transformation initiatives. This integrated approach ensures consistency across investor communications and operational planning.

Delivering confidence at critical moments

Ultimately, the goal is confidence. When leaders walk into investor meetings knowing their materials reflect best practices, conversations shift from clarification to conviction. It becomes not just a service but a strategic enabler that supports long-term capital strategy and investor relationships.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

Dhanita is a BD and Marketing professional with 6+ years’ experience in sales strategy, growth execution, and client acquisition; credentials include Stanford Seed (Stanford GSB), an MBA from USMS–GGSIPU, and a B.Com (Hons) from the University of Delhi. Expertise spans market research and opportunity mapping, sales strategy, CRM, brand positioning, integrated campaigns, content development, lead generation, and analytics; currently oversees business development calls and end-to-end marketing operations

FAQs

Who benefits most from pitch deck outsourcing?

Does outsourcing reduce control over messaging?

How does pitch deck outsourcing impact fundraising timelines?

Is pitch deck outsourcing suitable for repeat fundraises?

How do companies measure the ROI of pitch deck outsourcing?