Since it serves to enable the movement of money, strategic transactions, and financial restructuring possibilities, investment bank has been front and foremost in the sphere of global finance from the start.

As we go toward 2025, the industry is undergoing transforming changes. These developments are the outcome of technological innovations, government policy adjustment, and changing market dynamics.

Global Investment Bank Market Synopsis

By enabling capital raising, mergers’ advice, and large-scale investment management, investment bank is essential in the global financial system.

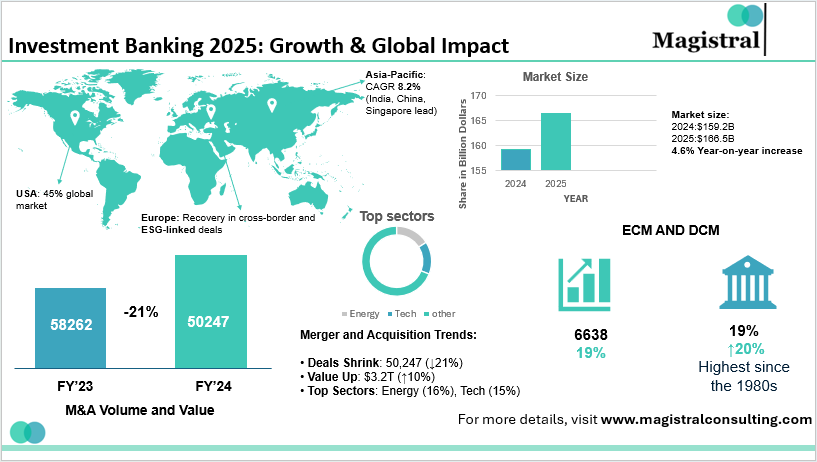

Market Scope and Development

Rising M&A activity, debt refinancing, and the emergence of private capital across Asia and the Middle East are driving the projected $5 billion global investment market of banking from $159.2 billion in 2024 reflecting a year-over-year growth of 4.6%.

Regional Contributions

The United States keeps leading the industry, accounting for over 45% of all worldwide.

With nations like India, China, and Singapore driving fresh deal-making activity, the Asia-Pacific region is expected to grow at a CAGR of 8.2% between 2023 and 2028.

Europe, recovering from regulatory tightening and economic slowdown, is showing indications of modest revival in cross-border deals and ESG-linked transactions.

Mergers and acquisitions (M&A) Trends in Investment Bank Services

With strategic consolidation and cross-border agreements gathering steam in 2025, M&A activity remains a fundamental driver of banking income.

Deal Volume and Their Value

By contrast, the worldwide value of announced merger and acquisitions (M&A) agreements dropped by 21% to reach 50,247 in FY’24, from the previous FY’23 level of 58,262.

Conversely, the whole transaction value grew by 10% to almost USD 3.2 trillion, so the fiscal year 24 was the most successful one for deal-making since 2022.

Sectoral Highlights

With 16% and 15% respectively of the total transaction value, the sectors of energy and technology were the most successful.

Capital Markets performance of the Investment Bank Sector

As businesses investigate various fundraising possibilities within changing macroeconomic circumstances, equity and debt capital markets are witnessing strong activity.

Growth and Global Impact in 2025 for Investment Bank

Equity Capital Markets (ECM)

With global ECM activity reaching USD 638 billion in the fiscal year 24 (FY’24), year-over-year increase was 19%. For worldwide ECM for the last three years, this made this the most successful annual performance.

Debt Capital Markets (DCM)

A 20% rise from FY’23, the worldwide DCM activity in FY’24 came to USD 10.7 trillion. This makes DCM activity recorded since 1980 the best year period ever.

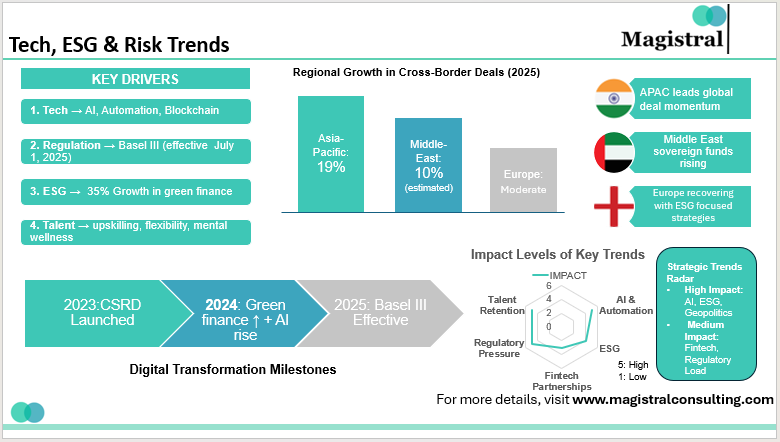

ESG integration in Investment Bank Ecosystem

Environmental, Social, and Governance (ESG) elements are now fundamental to deal structure and capital allocation, thus redefining banking objectives.

Sustainable finance Growth

Eco-friendly money Growing by 35% in 2023, the number of green and sustainable finance contracts reflects the industry’s efforts toward ESG (Environmental, Social, and Governance) targets.

Regulatory developments

The European Union started the Corporate Sustainability Reporting Directive (CSRD) in 2023, impacting 50,000 EU companies—including 10,000 companies outside the EU but engaged in Europe—among other 50,000 companies worldwide.

Digital Transformation and Technological Advancement in Investment Bank Operations

By improving efficiency, customer service, and data-driven decision-making across operations technology is transforming banking.

Artificial Intelligence and automation

Wall Street banks are deploying generative artificial intelligence across a range of processes, including trading and payments, marketing, and internal operations, more and more.

Blockchain and Fintech partnership

Developments in digital banking and alliances between fintech businesses are driving growth; so, it is projected that the market size of the worldwide investment banking sector will rise by 4.7% in the year 2024.

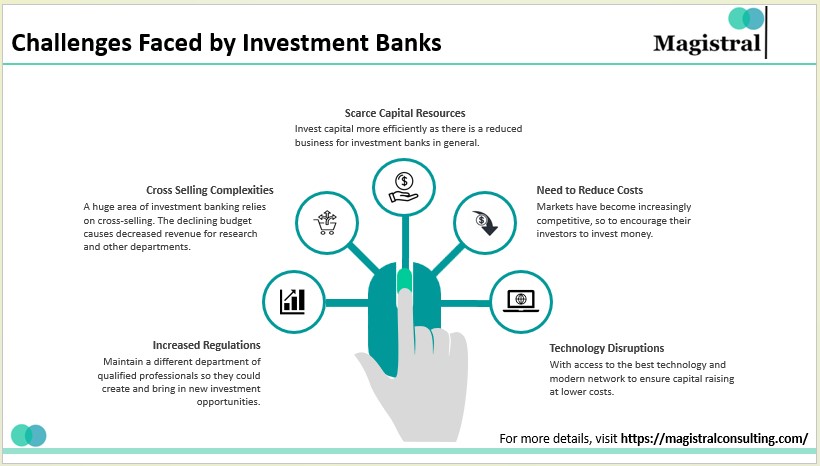

Risk Management and Regulatory Landscape in Investment Bank Activities

Stricter compliance rules and geopolitical concerns will be changing how investment banks handle risk, governance, and openness in 2025.

Regulatory changes

Designed to increase the resilience and risk sensitivity of the current approach by modifying criteria for credit risk, operational risk, and leverage ratios, the Basel III changes—which are scheduled to take effect on July 1, 2025—seek to These changes are expected to take effect until July 1, 2025.

Geopolitical Risk Management

JPMorgan Chase has created the Center for Geopolitics to help clients negotiate the always growing complexity of the political and economic environments that are spreading around the globe.

Talent Acquisition and Organizational Evolution in an Investment Bank

Companies looking for tech-savvy workers able to negotiate both finance and innovation are driving the struggle for talent forward.

Skill Development

Banks are developing consulting alliances to close a capability gap and are focusing on internal analytics and environmental, social, and governance (ESG) upskilling.

Cultural Shifts

Mental health and flexible working circumstances are becoming more and more important in order to retain gifted people under very competitive environments.

Global Corporate Transactions and Emerging Markets in Investment Bank Growth

Cross-border deals and portfolio diversification in emerging markets are driven by globalization and economic development in rising economies.

Global Corporate Transactions and Emerging Markets in Investment Bank Growth

Regional Growth

Asia-Pacific had a 19% increase in cross-border transactions, with middle east sovereign fund activities driving most of this rise.

Bank roles

Managing money and jurisdictional risks, banks negotiate local legal systems, arrange international transactions to seize chances in developing markets.

Services Provided by Magistral Consulting for an Investment Bank

In order to enhance operations and give better value to customers, Magistral Consulting offers a full array of services. These services combine domain knowledge with excellence in execution.

Deal Origination Support

Magistral helps in identifying potential acquisition or investment targets through deep market mapping and profiling.

This accelerates the pipeline building process and ensures higher-quality lead generation.

Mergers & Acquisitions (M&A) Support

They assist with pitchbooks, information memoranda, synergy assessments, and target screening.

This enables deal teams to focus on strategy while outsourcing research-heavy support tasks.

Equity and Debt Capital Markets Support

Magistral supports capital market activities by preparing company profiles, term sheets, and investor decks.

Their assistance boosts transaction readiness and enhances client presentations.

Financial Modelling

The firm develops robust DCF, LBO, merger, and comparable company financial models tailored to client needs.

These models offer high accuracy and are customizable for valuation and scenario analysis.

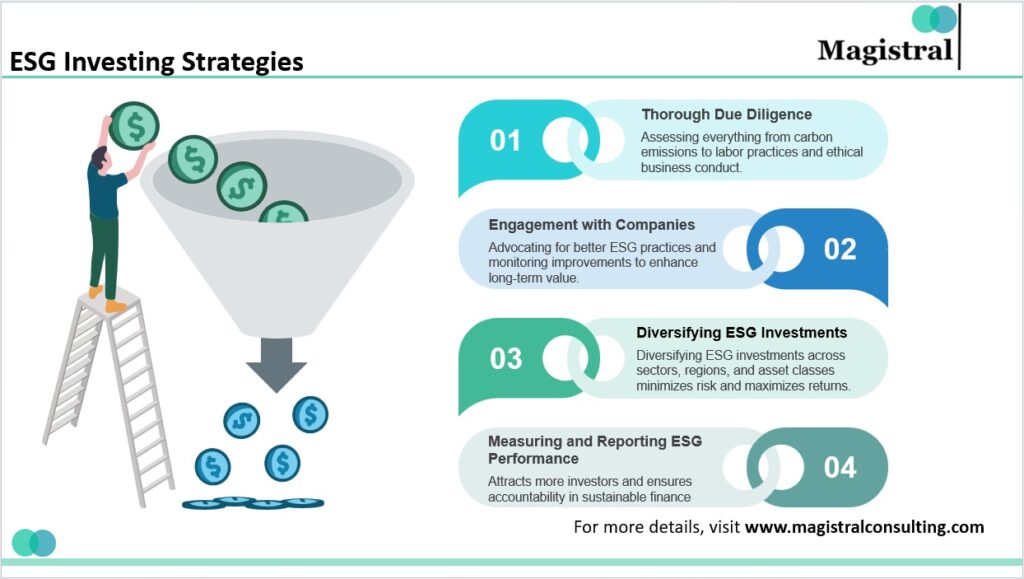

Due Diligence

Magistral conducts commercial, financial, and operational due diligence with risk flagging and benchmarking.

Their due diligence insights help reduce investment risk and speed up decision-making.

Industry and Market Research

They deliver customized sector reports, competitive analysis, and market entry strategies.

ESG and Impact Investing Support

ESG screening and scoring services are provided based on regulatory frameworks and investor preferences.

It supports clients in aligning investment decisions with sustainability goals.

Investor Relations and Fundraising Material

Magistral creates impactful pitchbooks, teasers, investor updates, and roadshow materials.

These enhance communication with current and potential investors, supporting capital raising.

Valuation Services

The team conducts valuations using trading comps, transaction comps, and intrinsic valuation models.

This ensures accurate and defensible pricing for deals and investment decisions.

Private Placement and CIM Preparation

They prepare high-quality Confidential Information Memorandums (CIMs) and marketing documents.

This reduces turnaround time and increases the effectiveness of fundraising and deal execution.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

How are investment banks incorporating ESG (Environmental, Social, and Governance) principles?

Investment banks are embedding ESG into deal structures and capital allocation. The sector witnessed a 35% increase in sustainable finance contracts in 2023. Regulatory initiatives like the EU’s Corporate Sustainability Reporting Directive (CSRD) are also influencing global ESG compliance.

What role does technology play in modern investment bank?

Technology is revolutionizing investment banking through AI-driven automation, blockchain adoption, and fintech collaborations. These innovations are enhancing trading, payment processes, marketing, and operational efficiency.

What trends are shaping Mergers & Acquisitions (M&A) activity in 2025?

Despite a decline in deal volume, total M&A transaction value grew by 10% to USD 3.2 trillion in FY’24. Cross-border consolidation and sectoral strength in energy and technology (16% and 15% of value, respectively) are key trends.