With buildings contributing nearly 40% of global carbon emissions, sustainability is no longer optional but a business imperative. Making the thinking forward for real estate firms’ compliance is no more a regulatory obligation but a strategic advantage. Carbon credits allow the real estate firms to compensate for their greenhouse gas emissions. It is by investing in projects that reduce or eliminate an equal amount of carbon production. The shifting framework of the ESG structure is now observing a shift from a cost center to a growth driver for the real estate industry. Utilizing the major shift, integrating ESG frameworks, and leveraging carbon credits. They are projected to reach $50 million by 2030 (McKinsey), developers, along with asset managers, are turning regulatory pressure into financial upside.

How Real Estate Firms Are Acting

Real estate companies are shifting from ESG promises to real action by integrating sustainability into construction, operations, and financing, They are also addressing scaling gaps. Coping up utilizing embodied carbon by using low-carbon materials like green concrete and recycled steel. And this is also by retrofitting mature assets with energy-efficient HVAC, lighting, and insulation systems to lower energy consumption. To reduce the scalability of emissions, developers and REITs are becoming buyers of more high-quality carbon credits. They are backed by record transactions like JPMorgan’s 450,000-metric-ton CO₂ offset deal, highlighting the pace. Circular construction methods, including recycling demolition waste in new construction. They are gaining momentum to reduce resource intensity.

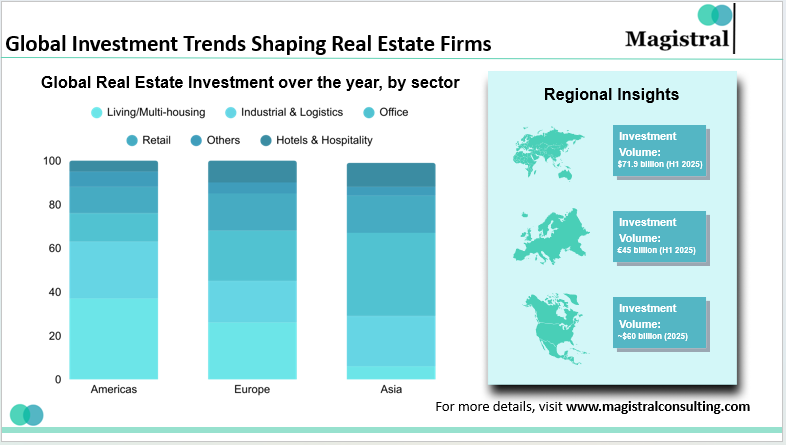

Global Investment Trends Shaping Real Estate Firms

Meanwhile, leading players are joining net-zero tracks under the Paris Agreement, raising their attractiveness to investors. Around 57% of whom currently are making ESG-driven decision-making. The emphasis is coupled with reducing regulatory risk, fueling returns, and achieving green-certified buildings. They receive premium rents of 6–11% and up to 18% sales premiums. This illustrates that ESG adoption in real estate firms is also a driver of long-term market competitiveness.

Green Building Certifications

Green building certifications, including LEED, IGBC, and GRIHA, are quickly transforming the real estate arena by awarding credits to buildings for sustainable design, construction, and operation. More than 180 countries across the world have adopted LEED, covering over 100,000 projects that span 29 billion square feet, while India recorded 370 LEED-certified projects in 2024 across 8.5 million square meters.

IGBC-rated buildings in India number over 600, spanning 185 million square feet, achieving energy savings of 40–50% and water savings of 30–35%, with construction premiums cut down to just 2–3% and payback periods as low as 18 months. Aside from environmental advantages, green-certified buildings provide lower operating expenses, greater tenant satisfaction, and greater property values, which render them a regulatory or moral option but also a strategic benefit for real estate companies looking to prove their portfolios and attract investors and environmentally sensitive buyers alike.

Retrofitting Legacy Assets

Real estate firms are increasingly adopting retrofitting old buildings as a strategic means to make them more sustainable, energy-efficient, and lower their operating expenses. Through improved building systems, insulation, lighting, and HVAC systems, companies can increase the lifespan of their properties while achieving ESG targets.

Energy use can be cut by 30–40% via well-designed retrofits

Payback periods tend to be as low as 2–3 years

Retrofitted buildings make substantial utility savings

Tenant satisfaction and occupant comfort are significantly enhanced

High-profile instances demonstrate the effect: the Empire State Building cut energy consumption by 38%, saving more than $4 million a year, and other city buildings have cut up to 46% of their energy consumption. For real estate companies, retrofitting existing assets is not just an environmental commitment but also a smart investment that adds value to the property, reduces risk, and puts them at the forefront of green development.

Smart Infrastructure & PropTech

Real estate firms are translating ESG commitments into action in construction, operations, and finance. On the construction side, they are reducing embodied carbon through the deployment of low-carbon concrete, recycled steel, and sustainable wood. Some are embracing circular practices, like recycling demolition waste for use in new developments, to minimize material intensity.

On the operations side, ageing assets are being retrofitted with efficient HVAC, lighting, and insulation systems. This enhances energy efficiency and reduces emissions throughout property portfolios. To offset unavoidable emissions, developers are investing in carbon credits. For instance, JPMorgan bought offsets of 450,000 metric tons of CO₂, illustrating how carbon markets are becoming an integral part of real estate firms planning. On the funding front, companies are joining net-zero trajectories and ESG reporting norms to win over institutional investors.

Over 57% of investors around the world screen portfolios for ESG performance. The business case is powerful—green-certified buildings fetch 6–11% higher rents and up to 18% sales premiums. This establishes the fact that ESG in real estate is no longer compliant but a way to grow and a competitive edge.

ESG-Linked Financing

ESG-linked finance is growing fast in real estate firms as companies draw on green bonds, sustainability-linked bonds, and ESG-bound loans to finance climate-resilient and energy-efficient projects. Green, social, and sustainability bond issuance around the world reached $1.1 trillion in 2024, up 5% from 2023. Green bonds alone are still expected to hit $1.55 trillion by 2033.

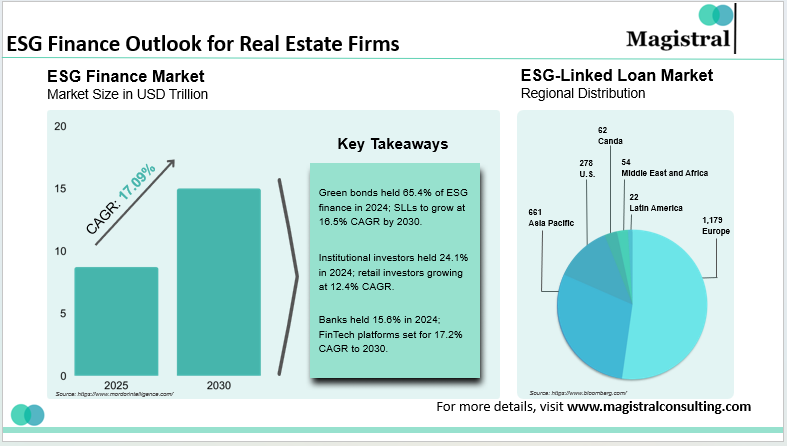

ESG Finance Outlook for Real Estate Firms

In emerging economies, green bond issuance amounted to $137 billion cumulatively as of 2016 and accounts for 16% of the total labeled sustainable bond issuance. In Africa, ESG-linked property finance has expanded at an average annual rate of 41% since 2018. It is to reach a cumulative amount of $4.2 billion by mid-year 2024, with $1.3 billion emitted during the first half of 2024 alone. REITs in the U.S. have registered an increase in green bonds. While in India, Mindspace REIT collected more than ₹1,200 crore from two sustainability-linked bond offerings. One of which was a ₹550 crore transaction in 2025 under SEBI’s new ESG regime.

These tools benefit real estate firms not only by reducing the cost of capital but also by enhancing investor attraction, as capital markets are increasingly rewarding tangible progress towards sustainability targets.

Future-Proofing Real Estate Firms with ESG Integration

The subsequent stage of competitiveness among real estate companies will be characterized not by place or size. It would be by how integrated ESG is into strategy. Green buildings are already providing 10–21% value premiums and more resilient rental yields. They are also retrofitting mature assets can reduce energy consumption by up to 40% with paybacks in as little as two years. In India alone, more than 300 million square feet of aging inventory is a retrofitting opportunity of almost USD 4.5 billion.

On the other hand, non-conforming assets risk value loss of 20–30% as funding becomes expensive. Tenants seek out greener buildings. By embedding ESG into development, operations, and funding, real estate companies can turn compliance into resilience. There are also future-proofing portfolios while locking in long-term investor trust.

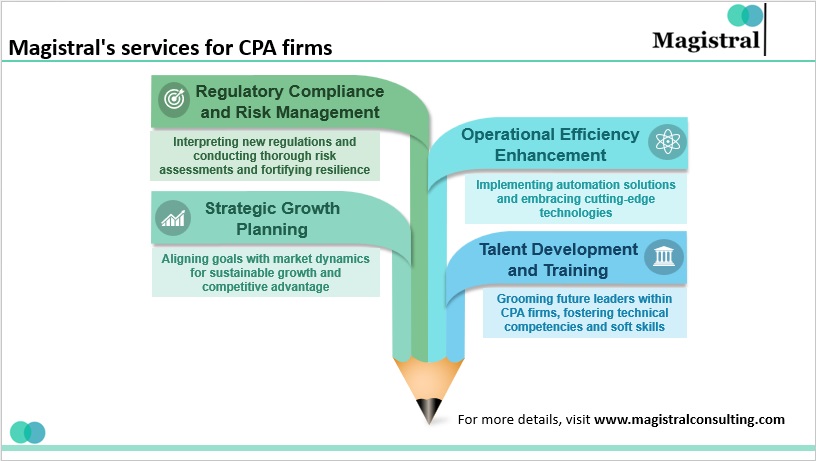

Magistral’s Services for Real Estate Firms

Magistral collaborates with real estate companies to enhance decision-making, maximize operations, and release investor confidence with the help of tailored research and analytics capabilities. Our solutions cater to the complete range of ESG, investment, and operational needs, defining the industry today:

ESG Research & Reporting

Creating frameworks for sustainability, designing ESG disclosures, and comparing performance with peers.

Financial Modeling & Valuation

Creating elaborate financial models for assets, portfolios, and REITs to aid in fundraising and investment choices.

Market & Investor Research

Monitoring trends in real estate markets, investor attitudes, and regulatory changes by geography.

Presentation & Deal Support

Creating investor-friendly pitch books, transaction materials, and deal analysis to drive capital raising faster.

Operational Outsourcing

Aiding operations like procurement analytics, portfolio tracking, and performance measurement for efficiency improvement.

Through the integration of deep domain knowledge with scalable implementation, Magistral assists real estate companies. It is in adapting to global sustainability agendas and remaining competitive in rapidly evolving markets.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

Nitin is a Partner and Co-Founder at Magistral Consulting. He is a Stanford Seed MBA (Marketing) and electronics engineer with 19 + years at S&P Global and Evalueserve, leading research, analytics, and inside‑sales teams. An investment‑ and financial‑research specialist, he has delivered due‑diligence, fund‑administration, and market‑entry projects for clients worldwide. He now shapes Magistral Consulting’s strategic direction, oversees global operations, and drives business‑development support.

FAQs

How does Magistral Consulting support real estate firms with ESG integration?

How does Magistral enhance market research for real estate firms?

Where is Magistral Consulting located, and does it serve global clients?

Can Magistral assist in financial modeling for real estate investments?