From 2019 to 2024, Family Office Service Providers have grown and changed a lot. They have become advanced organizations focused on managing and safeguarding the wealth of very rich families. This article looks at their fast growth, their investment plans, and which industries and areas have shaped their impact investments during this period.

Overview of Growth of Family Offices: 2019-2024

The count of single-family offices around the world has undergone a sustained increase from about 6,130 in 2019 to an estimated count of 8,030 in 2024, indicating approximately a 31% growth. Such a trajectory probably would go forward by a further 12% increase to 9,030 in 2025 and a rise of 33% to 10,720 in 2030. Such an expansion indicates a 75% growth over the decade.

The most up-to-date picture of family office distribution shows North America at the front, with 3,180 entities, followed by Asia with 2,290, Europe with 2,020, the Middle East with 290, South America with 190, and Africa with 60 family offices in 2024.

Starting at USD 3.3 trillion in 2019, it reached USD 5.5 trillion by 2024-a compound increase of some 67 percent.

It is projected that the figure will be around USD 6.9 trillion by the year 2025 AD, as well as about USD 9.5 trillion by 2030 AD. This would actually make for a stupendous increase of 189 percent between 2019 and 2030.

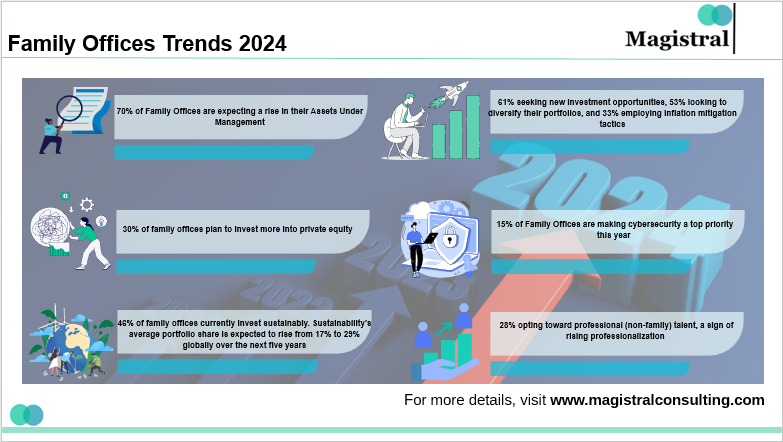

Investment Strategies and Trends

Among direct investment approaches, Family Office Service Providers have increasingly preferred business services, industrials, and software as the most lucrative sectors. This direct investment shift allows for more control and/or potential higher returns.

Impact investing is hitting the news and has secured the top slot for the Family Office Service Providers in recent times as a large share of their portfolios is being invested in sectors aimed at producing positive social and environmental outcomes. Between June 2022 and June 2024, education and renewable energy dominated the areas of interest, making up 29% and 24% of total impact investments.

More Attention on the Private Equity Sector

Many family offices are allocating larger portions of their portfolios to private equity than before. It is done with both direct investments and typical managed funds. The target allocations of family offices to private equity are expected to be around 25%-30% by 2024, though these qualities might change over time.

The Rise of Co-Investments

Large numbers of family offices are participating in Co-investment opportunities with private equity firms and another institutional investor. It will enable to larger deal flow with lower fees while nurturing partnership and distribution of information between the co-investors.

Philanthropy and ESG

Many Family Office Service Providers blend philanthropic objectives with strategies for impact investing, thereby introducing ESG aspects into their portfolios. By that logic, the mission will thereby be commenting on wider global challenges while achieving a financial return.

Venture Capital Investments

Venture capital has become a popular investment class for Family Office Service Providers, especially in the fields of technology and AI. Startups in such domains have enormous growth potential, while family offices use branded portfolios of flexible capital to facilitate the disruptive innovations they promote.

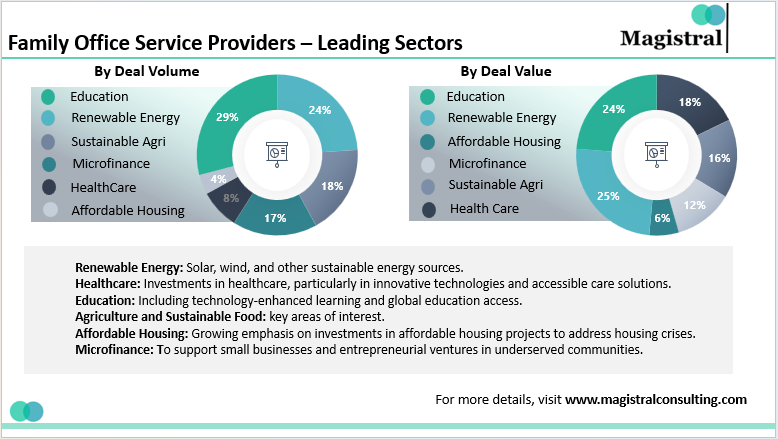

Leading/Dominating Sectors Global Family Office Impact Investments

In 2023-2024, the sectors dominating global Family Office Service Providers impact investments include:

Family Office Service Providers – Leading Sectors

Impact of family offices in Renewable Energy

Solar, wind, and other sustainable energy sources are some of the energy projects in which family offices started investing.

Family Office Healthcare Impact

Currently, a lot of energy goes into innovation technologies and care solutions within Family Office Service Providers focus on health.

Family Office Impact on Education

It promotes education-related activities, including e-learning programs and utmost access to education.

Food and Agriculture

Producing food sustainably and the AgriTech sector constitute the foremost significance.

Affordable Housing

Increasing investment into schemes of affordable housing is slowly beginning to receive attention, as it can somewhat alleviate housing crises.

Microfinance

Investments in a microfinance curriculum aim to improve small businesses and foster entrepreneurship in poorer communities.

These sectors have gained a foothold because they tend to create substantial positive social and environmental impacts along with financial returns.

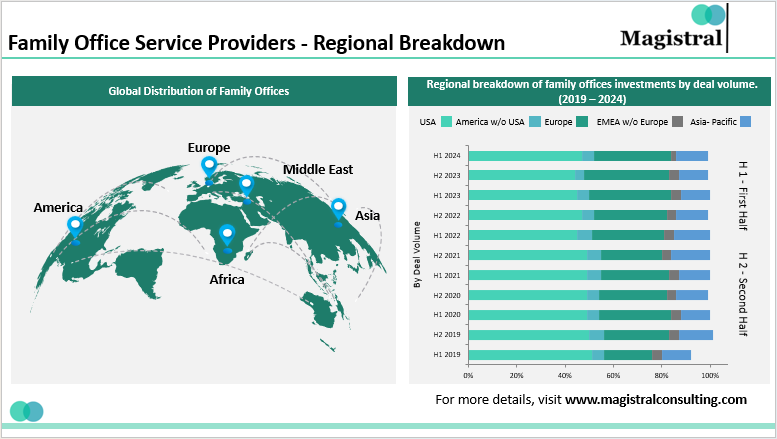

Regional Breakdown of Family Office Investments by Deal Volume (2019-2024)

From 2019 until 2024, the regional distribution of family office investments was influenced either favorably or negatively by economic developments, market opportunities, and geopolitical issues.

Family Office Service Providers – Regional Breakdown

North America

In terms of Family Office Service Providers concentration, the Americas are very active in investment. The steady economic climate and resilient financial market environment in the region act favorably to attract family office investment.

Asia Pacific

The Asia Pacific region has experienced significant growth in family office investments. It is driven by the rapid economic expansion of countries like China and India.

Europe

Europe remains an important area for too many family office investments, particularly in tech, health, and sustainability. The region’s various economies and a strong commitment to innovation open many avenues for family offices working to diversify their portfolios.

Middle East and Africa

Although their share of family office investments is small in global terms, interest continues to grow in Middle East countries and Africa, mainly in real estate, infrastructure, and energy. The wealth created by natural resources in these regions has led to the establishment of new family offices and increased investment activity.

Family Office Investment Opportunities

The opportunities in family office investments are as follows

Advanced Technology

The use of modern technology-driven investment management in recent years has improved the data analysis, risk assessment, and portfolio management knowledge available to family offices.

Sustainable Investments

The increasing focus on environmental, social, and governance (ESG) standards gives family offices the opportunity to invest in projects that coincide with their values and yield competitive returns. Sectors such as renewable energy, sustainable agriculture, and innovative green technologies are catching the attention of family office investors.

Emerging Markets

Due to rapid economic growth and development, emerging markets offer the possibility of great returns. Family Office Service Providers are increasingly on the lookout for opportunities in Southeast Asia, Latin America and Africa for purposes of diversification and to monetize the unique dynamics behind these emerging markets.

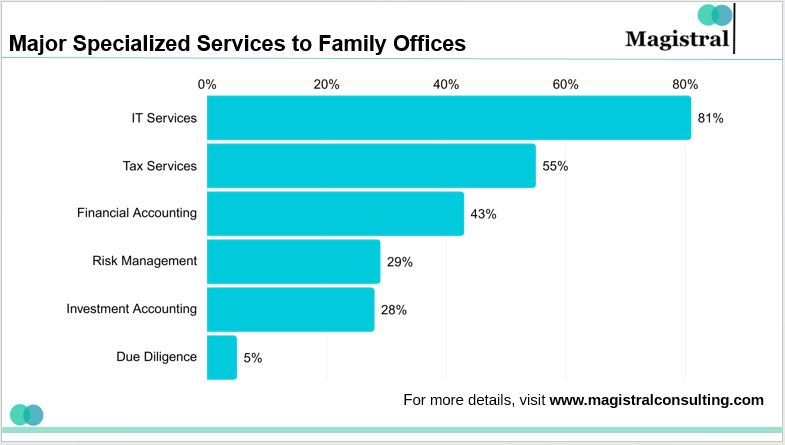

Magistral Services for Family Office Service Providers

Services from Magistral aim to improve the efficiency and effectiveness of the service provided

Investment Research and Advisory

Magistral carries out deal sourcing to identify opportunities across asset classes and offers market research, trend analysis, and portfolio performance evaluation, which include private equity, venture capital, and real estate.

Planning and Reporting

Magistral Consulting assists in establishing the budgets, forecasts, and cash flow management and preparation of consolidated financial statements for efficient management.

Real Estate Advisory

Magistral conducts property market analysis, feasibility studies, and valuation reports to help maximize investment returns for family offices.

Support to PE/VC Firms

In all of its operations, such as deal-sourcing, valuation, benchmarking, and portfolio management, Magistral Consulting acts in support of PE/VC firms, ensuring they get the finest information for their investment decisions.

Estate Planning/Documentation

To aid the smooth transition of the estate, Magistral puts together family business succession planning, trust creation, and estate documentation.

Back-Office Support

They perform document processing, manage compliance, handle data, and optimize customer relationship management. All of which enable family offices to pursue their strategic objectives.

Technology and Digital Transformation

Magistral helps automate various work processes in managing family offices while providing family-office-oriented cybersecurity solutions.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

Which region has the highest number of family offices?

North America is number one with a total of 3180 family offices, with Asia next at 2290, Europe at 2020, the Middle East at 290, South America at 190, and Africa at 60.

Describe the role of private equity in family office investments.

It is estimated that private investments in family offices will represent between 25 and 30 percent of their portfolios by 2024.

Which healthcare innovations attract family office investments?

The family offices are indeed investing in med-tech, biotech, and healthcare infrastructure.

What future investment opportunities are most discussed?

Technology of the future, sustainable investments, and emerging markets have high growth potential.