Introduction

In today’s fast-moving business world, mergers and acquisitions (M&A) are key strategies for growth, consolidation, and diversification. However, these transactions involve complex processes that require expert guidance. Accounting firms play a crucial role by providing insights and expertise at every stage. This article explores how these firms contribute to successful M&A deals.

Due Diligence: The Foundation of Informed Decision-Making

Due diligence is essential for making informed business decisions. Whether for mergers, acquisitions, or partnerships, it involves detailed investigations and careful analysis. This process ensures businesses understand risks and opportunities before proceeding, ultimately reducing uncertainties and enhancing strategic planning.

Comprehensive Financial Analysis

CPA Firms thoroughly review financial records, including balance sheets, income statements, and cash flow reports. This deep analysis helps acquirers assess financial health, performance trends, and potential red flags. Consequently, they gain a clearer understanding of the target company’s value and sustainability.

Risk Assessment and Mitigation

Beyond financial analysis, CPA firms identify risks such as legal liabilities, regulatory issues, and operational challenges. By evaluating these risks, they help acquirers develop mitigation strategies. As a result, businesses can safeguard their investments and ensure smoother post-acquisition integration.

Valuation Expertise and Fair Value Determination

Using financial modeling, CPA firms determine a target company’s fair value. Through discounted cash flow analysis and market comparisons, they ensure acquirers negotiate fair terms. This expertise prevents overpayment and aligns pricing with the company’s actual worth, facilitating well-informed investment decisions.

Regulatory Compliance: Navigating Legal and Regulatory Frameworks

Businesses must comply with regulations to operate legally and ethically. CPA firms help acquirers navigate complex legal frameworks, ensuring adherence to financial reporting standards and industry regulations. Their involvement reduces compliance risks and promotes transparency in transactions.

Adherence to CPA Standards and Regulations

CPA Firms guide businesses through standards such as GAAP and IFRS. They meticulously review financial statements and reporting practices to ensure compliance. This approach not only enhances transparency but also builds trust with stakeholders, investors, and regulatory bodies.

Tax Optimization Strategies

M&A transactions have significant tax implications. CPA firms design tax-efficient structures to minimize liabilities and optimize post-merger value. Their expertise in tax laws and incentives helps businesses maximize financial efficiency and long-term profitability.

Regulatory Due Diligence and Compliance Audits

Accounting firms conduct thorough reviews of legal documents, compliance filings, and regulatory requirements. By identifying gaps, they enable acquirers to proactively address compliance issues. This reduces the risk of regulatory penalties and legal disputes, ensuring smooth transitions.

Financial Integration: Harmonizing Operations and Systems

Successful mergers require seamless financial integration. CPA firms play a key role in aligning financial systems, policies, and reporting structures. Their expertise helps businesses streamline operations, enhance reporting accuracy, and reduce post-merger disruptions.

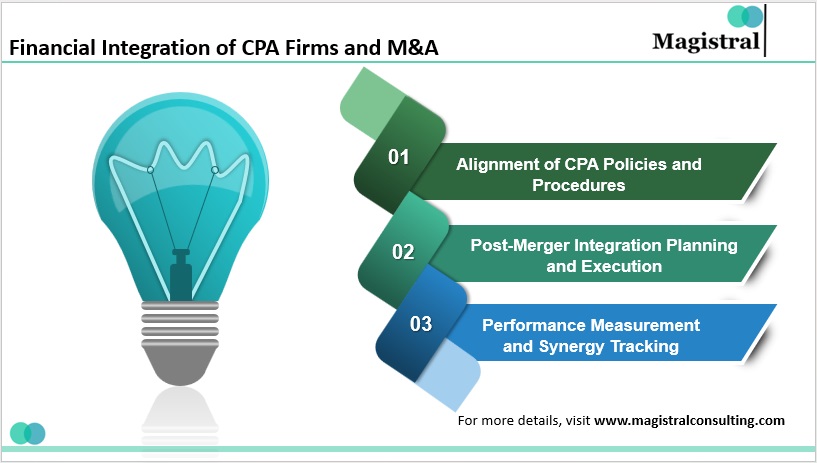

Financial Integration of CPA Firms and M&A

Alignment of CPA Policies and Procedures

After an acquisition, firms work closely with management to standardize financial policies. This alignment ensures consistency across financial reporting systems. As a result, companies can produce accurate financial statements and maintain regulatory compliance.

Post-Merger Integration Planning and Execution

CPA Firms develop integration plans with clear milestones and responsibilities. They assist in aligning organizational structures, IT systems, and financial workflows. By doing so, they minimize disruptions and enhance operational efficiency during the transition.

Performance Measurement and Synergy Tracking

By setting key performance indicators (KPIs), CPA firms track integration progress. They assess whether expected synergies are achieved, helping businesses identify areas for improvement. This structured approach ensures that post-merger goals align with strategic expectations.

Risk Management: Mitigating Operational and Financial Risks

Uncertainty is a constant in business. Effective risk management is essential to safeguard operations and investments. CPA firms help companies identify, evaluate, and mitigate risks that could threaten financial stability and long-term success.

Identification of Operational Risks and Control Weaknesses

CPA Firms assess internal controls, risk management frameworks, and operational processes. By identifying weaknesses, they help businesses strengthen control mechanisms. This reduces the likelihood of financial misstatements, fraud, or operational inefficiencies.

Implementation of Robust Internal Control Frameworks

Based on risk assessments, CPA Firms establish control frameworks tailored to business needs. These include access controls, duty segregation, and fraud prevention strategies. By enhancing accountability, they create a more secure financial environment.

Contingency Planning and Risk Mitigation Strategies

Anticipating potential challenges and contingencies, these firms collaborate with management teams to develop comprehensive contingency plans and risk mitigation strategies. By identifying alternative courses of action and preemptively addressing potential risks, they help acquirers navigate uncertainties and safeguard their investment against adverse events.

Empowering CPA Firms: Magistral Consulting’s Tailored Solutions

Magistral Consulting helps CPA firms enhance performance and competitiveness. Through customized strategies, it enables firms to achieve growth, efficiency, and long-term success. Its expertise covers various aspects of financial consulting and operational excellence.

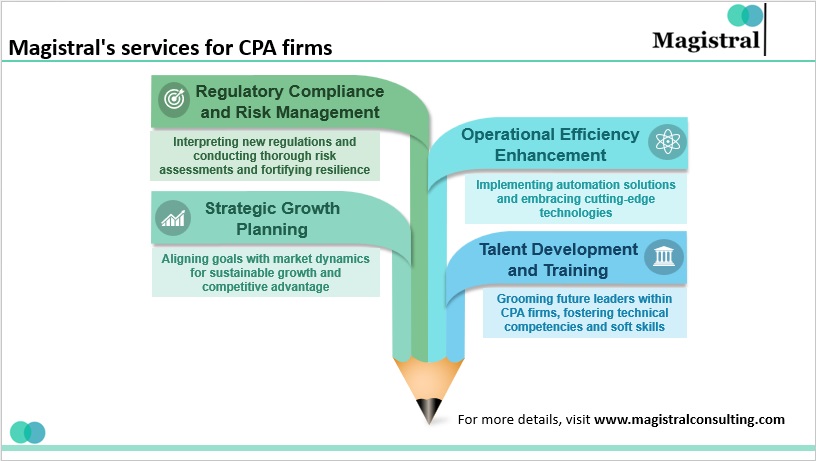

Magistral’s services for CPA firms

Strategic Growth Planning

Magistral Consulting works closely with CPA Firms to craft clear strategic visions aligned with long-term goals and market dynamics. Through in-depth analyses of internal strengths and external opportunities, Magistral Consulting assists them in formulating actionable strategies for sustainable growth and competitive advantage. Leveraging market insights, Magistral Consulting identifies growth opportunities and expansion paths. Whether entering new markets, diversifying services, or targeting specific clientele, Magistral Consulting tailors’ strategies to enhance market presence and revenue streams.

Operational Efficiency Enhancement

Magistral Consulting assesses operational workflows within these firms to pinpoint inefficiencies and streamline processes. By implementing automation solutions and streamlining workflows, Magistral Consulting boosts productivity and reduces operational costs. Magistral Consulting supports firms in adopting state-of-the-art technologies such as cloud-based accounting software and data analytics tools. Embracing technology enables them to enhance efficiency and elevate client service delivery.

Talent Development and Training

Magistral Consulting offers tailored training initiatives covering technical competencies, soft skills, and leadership development tailored to the specific needs of these firms. Collaborating with them, Magistral Consulting facilitates the development of succession plans to groom future leaders and ensure seamless transitions.

Regulatory Compliance and Risk Management

Magistral Consulting provides expert advice on regulatory compliance, assisting CPA firms in interpreting new regulations and implementing compliance measures effectively. Magistral Consulting conducts thorough risk assessments and devises proactive strategies to mitigate vulnerabilities and strengthen resilience, ensuring they are well-prepared to navigate regulatory challenges and operational risks.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

Why are CPA firms considered pivotal in mergers and acquisitions (M&A) processes?

CPA firms bring essential financial expertise to M&A transactions, conducting thorough due diligence, risk assessments, and financial analyses that are crucial for informed decision-making.

How do CPA firms assist in regulatory compliance during M&A transactions?

CPA firms guide acquirers through complex regulatory landscapes, ensuring adherence to accounting standards, tax laws, and industry-specific regulations to mitigate legal risks.

What role do CPA firms play in post-merger integration?

CPA firms collaborate with management teams to harmonize accounting policies, financial reporting practices, and operational workflows across acquiring and target entities, facilitating seamless integration.

How do CPA firms contribute to risk management in M&A transactions?

CPA firms conduct comprehensive risk assessments, identify operational vulnerabilities, and develop proactive strategies to mitigate risks, safeguarding the interests of acquirers and preserving shareholder value.

Can CPA firms assist in talent development and training for CPA firms involved in M&A activities?

Yes, CPA firms offer tailored training programs covering technical competencies, soft skills, and leadership development to enhance the capabilities of these firms engaged in M&A transactions, ensuring they are well-equipped to navigate the complexities of the process.