Introduction

In this fast-moving world of financial services, CPA bookkeeping is the backbone of financial integrity and business success. CPAs would face the great importance of accurate bookkeeping in pursuit of gaining the trust of their clients, regulatory compliance, and offering insightful financial advice. This article explains in detail how CPAs bookkeep, the benefits associated with the outsourcing of such services, and how Magistral Consulting offers comprehensive solutions to raise your practice to the next level.

CPA Bookkeeping services will include the following.

Recording Transactions

All the daily transactions, such as sales, purchases, payments, and receipts, are recorded in their respective accounts. This is fundamental work meant to ensure that everything about financial activity is noted and put in the right class. For example, 2020 saw more than $500 billion worth of purchases and expenses from small businesses alone in the U.S. that require accurate bookkeeping.

Reconciling Accounts

The records should agree with the bank statements and other financial documents. Reconciliation helps to discover and correct errors; hence, it protects the integrity of the financial information. A study by Robert Half reported that 29% of finance professionals said they spent a minimum of 5 hours per month on bank reconciliation.

Generating Financial Statements

Preparing key reports like the income statement, balance sheet, and statement of cash flow. Accounts are meant to take snapshots of the financial health of a company; therefore, this will help in making decisions and strategic plans.

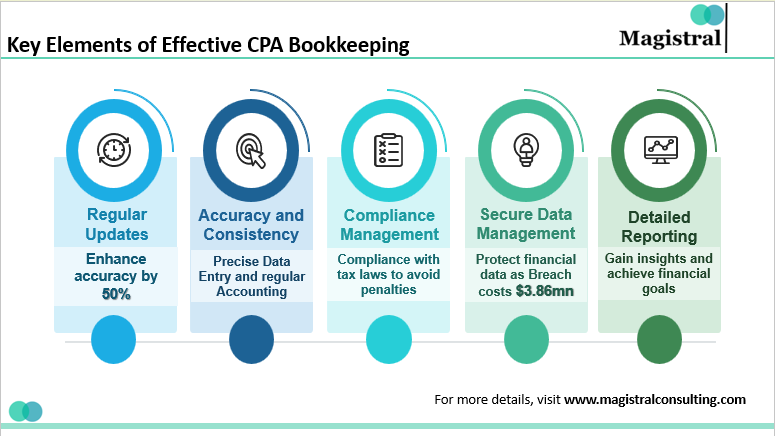

Key Elements of Effective CPA Bookkeeping

CPA Bookkeeping, to be anything worthwhile, must have the following key ingredients so that the management of one’s finances is complete.

Key Elements of Effective CPA Bookkeeping

Regular Updates

The keeping of regular updates is very central to any CPA bookkeeping. This means a business has to keep its books in such a way that every new transaction or change will promptly show. This prevents the rush at the end of the month and ensures timely and proper financial reporting. In fact, according to QuickBooks, every business with a regular update of its bookkeeping is likely to have accurate financial reporting and fewer discrepancies at month-end by 50%.

Accuracy and Consistency

Development of accuracy and consistency is an associated part of bookkeeping by the CPA. Proper data entry and regular accountancy prevent small mistakes from snowballing into massive financial discrepancies. As per the estimation of the Association of Chartered Certified Accountants, the margin of errors in inadequate CPA bookkeeping can be averaged to be 25% of total financial loss resulting from misreported data and correction costs involved. That is why the inclusion of high accuracy and consistency are to be upheld to avoid such pricey mistakes.

Compliance Management

Compliance risk management is an aspect that pertains severely to effective CPA bookkeeping. CPAs must update themselves with all tax laws and financial regulations; since non-compliance may cause the most serious legal consequences and cost the public image of the CPA, non-compliance of individual or corporate tax laws alone caused penalties of over $10 billion to businesses in 2020. Given this fact, compliance management is not only imperative for the sake of the law but also part of running a reputable CPA practice.

Secure Data Management

This goes without mentioning that proper data management is very secure in CPA bookkeeping right from the view of financial data protection from breaches. Strong security measures against unauthorized access are quite essential in a bid to prevent possible financial losses and reputational damage. According to a report filed by IBM Security, the average cost for a breach is about $3.86 million, thus requiring CPAs to have secure management of their clients’ data. CPAs should use the newest cybersecurity practices to protect the risky financial information of their clients. Detailed reporting is another primary service category under assurance services.

Detailed Reporting

Effective CPA bookkeeping is pegged on detailed financial reporting. Comprehensive financial reporting helps to provide insight into financial performance and aids in decision-making. They help identify trends, project future performances, and give support for key strategic business decisions. According to PwC, businesses that have detailed financial reporting are 60% sure to meet their financial goals. Such detailed reporting will help the CPA to give meaningful and useful financial insights with strategies for growth to their clients.

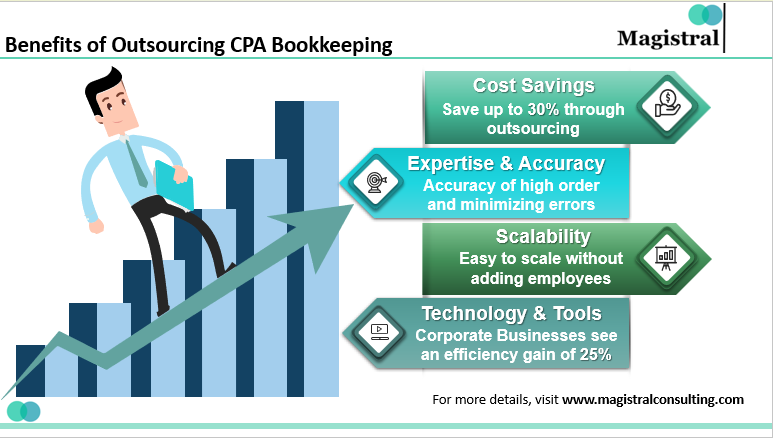

Benefits of Outsourcing CPA Bookkeeping

Outsourcing CPA bookkeeping to specialized firms can have many benefits that will help a CPA practice to be more efficient and profitable. These include:

Benefits of Outsourcing CPA Bookkeeping

Cost Savings

Outsourcing reduces the headache of in-house book-keeping staff, reducing overhead costs. According to a study by Deloitte, companies can save up to 30% through financial services and CPA Bookkeeping outsourcing.

Expertise and Accuracy

Professional firms are staffed with experts who ensure the accuracy of high order, following the latest regulations quite precisely. These firms keep themselves updated with the changing standards of the industry to minimize errors in their work.

Scalability

Outsourced services can be easy to scale with your business by accommodating that growth without adding employees. This scalability is particularly helpful for seasonal businesses or those that have an unusual growth spurt.

Technology and Tools

Outsourcing firms make use of state-of-the-art software and tools. In turn, this regard books of accounts need outsourced companies to avail state-of-the-art solutions. According to Gartner, corporate businesses that adopt state-of-the-art financial tools see an efficiency gain of 25%.

Magistral Consulting’s Services in CPA Bookkeeping

Magistral Consulting specializes in providing top-notch bookkeeping services tailored for CPAs. Our comprehensive service offerings ensure that your financial records are accurate, compliant, and insightful. Here are some of the key services we provide:

Transaction Recording

All monetary transactions are recorded accurately. This is a zero-tolerance error service and, in reality, forms the very basis of any financial analysis. We have the competencies to deal with complex transactions that are quite common within the Private Equity and Venture Capital environment to ensure that capital calls, distributions, and management fees are all correctly recorded.

Account Reconciliation

We regularly reconcile your books with bank statements and other books of accounts from time to time. When reconciled in due time, it goes a long way toward preventing fraudulent transactions and, more so, in better service provisioning for the integrity of financial statements. We effectively reconcile complex accounts for investment banking and hedge funds, given the huge volumes and complexities of the transactions involved.

Financial Statement Preparation

Magistral Consulting specializes in making detailed financial statements, covering income statements, balance sheets, and cash flow statements, thus giving you an overview of your financial health. These statements are very important for management and other concerned parties. We also prepare specialized reporting for Investment Banking clients in line with the requirements of their industry and those of regulators.

Ledger Maintenance

We have properly maintained and detailed ledgers for all accounts payable, accounts receivable, and general ledgers to give a record of the financial activity. This will aid any entity in having proper financial reporting and analysis. We focus on ledgers for Hedge Funds that involve detailed investment allocations to investors, performance fees, and other important relevant components.

Compliance and Reporting

Our team ensures that financial records comply with the latest regulations and prepares reports for tax filing and audit purposes. Services follow strict financial industry compliance, including adherence to regulations issued by the financial authorities.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

What Makes a Good CPA Bookkeeping?

Some of the key features placed in effective CPA bookkeeping include frequent updating to always keep accurate financial records up to date, accurate or consistent entry of data, management of compliance based on tax laws and regulations guiding finance, safe management of data from breaches, and a detailed report based upon financial performance that creates insight into decision-making.

What do people achieve from outsourced CPA bookkeeping?

These could include cost savings due to reduced needs of in-house staff, access to high accuracy, and brought-on-board expertise of professional firms. Other benefits could be scalability to match the speed and employment of advanced technology or tools to make sure that the bookkeeping is highly efficient. This would allow CPAs to begin to focus on core activities such as tax planning and client advisory services.

How is technology modernizing CPA bookkeeping?

Technology drives innovation within the practice of a CPA bookkeeper. Some of the most important technological developments are cloud accounting for on-demand access to and collaboration in data, AI to drive tools for automated entry and reconciliation, blockchain technology for secure, transparent recording of transactions, and business data analytics to interpret insights into financial performance.

What are Magistral Consulting's services in respect of CPA bookkeeping?

Magistral Consulting offers CPAs the following special bookkeeping-related services: drafting of all transactions, account reconciliations and statements, financial statement preparation, ledger maintenance, compliance, and reporting. Such services will enable CPAs to ensure the accuracy, compliance, and insightful nature of the financial records of their clients so that they may be better placed in managing the finances of their clients.