A merger model is a financial construct that assesses if a merger or acquisition generates value for shareholders. The model projects how the financial performance of two companies comes together to assess the merger or acquisition’s impact on earnings, valuation, and capital structure. Referring to the global strength of M&A, “an anticipated 12% year-over-year recovery in 2024 based on underlying technology, healthcare, and infrastructure trends,” in PwC’s 2024 M&A Outlook, the model is a crucial tool for decision-makers. It serves as a bridge from strategic intent to quantitative validation, helping firms quantify synergy potential and financial viability before signing the deal.

The Strategic Significance of the Merger Model in Modern M&A

The model plays a central role in today’s data-centric M&A environment. It provides not only a feasibility analysis on the deal but also quantifies value creation, synergy realization, and capital efficiency.

It takes both companies’ income statements, balance sheets, and statement of cash flows and consolidates these documents from the transaction perspective to project future performance after the merger or acquisition. This exercise allows the executives to understand if the merger and acquisition is accretive or dilutive, as well as identify how to balance leverage and growth in a capital structure.

Accretion and Dilution Analysis

Pro forma accretion/dilution tests are the bedrock of any merger model. An accretive merger meaningfully increases EPS, which means the deal was structured economically, to the benefit of the acquiror.

Synergy Evaluation

The synergy realizations of cost savings, cross-selling opportunities, and tax benefits are the most compelling arguments for merging. According to Deloitte’s 2025 M&A Value Report, the average expectation of realizing synergies is 10-15% of deal value, resulting in an enormously persuasive argument for pursuing mergers. An astounding 45% of firms do not realize these synergies primarily due to poor integration planning.

Scenario and Sensitivity Testing

The merger model will have value as a tool to aid in estimating financial performance under varying interest rate environments, currency rates, and tax realities. As the model can stress test assumptions, management can surface earlier in the process financial sensitivities and vulnerabilities earlier to prepare contingency plans for scenario testing in case a variable requires adjustment.

Connection to Valuation Models

A DCF model calculates the value of a firm on a standalone basis; the merger model helps identify value to the firm adjacent, including any synergies, contingencies, and capital and operating costs (see DCF reference). Combined, these models will help ensure that the valuation work complies with the purpose of a transaction.

Emerging Trends Shaping the Future of the Merger Model (2023–2025)

As global dealmaking evolves, the merger model is transforming from a spreadsheet-based analysis into a dynamic, technology-enabled forecasting system.

Emerging Trends Shaping the Future of the Merger Model

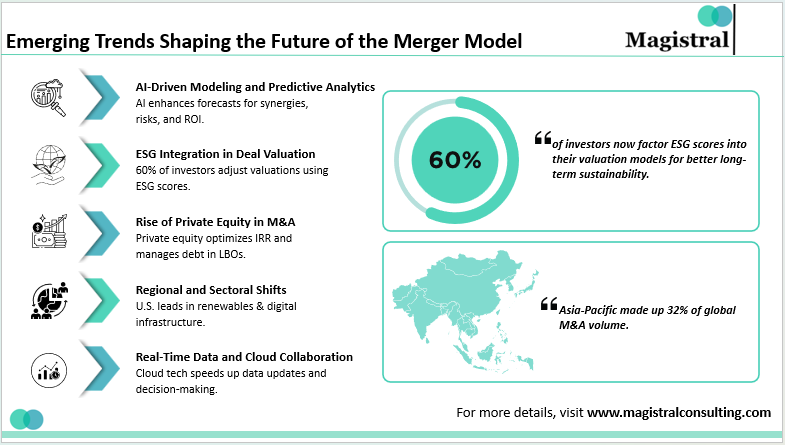

AI-Driven Modeling and Predictive Analytics

AI and machine learning are now enhancing forecasts for synergy capture, risk exposure, and return on investment. In equity research, AI is helping to more accurately model outcomes by analysing thousands of historical transactions to benchmark realistic options.

ESG Integration in Deal Valuation

As sustainability becomes impossible to ignore in mergers, the MSCI 2024 ESG Outlook suggests that 60% of institutional investors are adjusting valuations based on ESG scores. A more full-proof model includes environmental and social risk assessment as part of transaction valuation, emphasizing the importance of long-term sustainability.

Rise of Private Equity in M&A

Private equity firms are increasingly using enhanced merger models to assess the value of portfolio-scale consolidation and exits. Their models tend to play a significant role in leveraged buyout (LBO) scenarios, optimizing the internal rate of return (IRR) while monitoring debt exposure.

Regional and Sectoral Shifts

Based on CBRE’s Capital Markets Report, Asia-Pacific made up 32% of global M&A volume, whereas megadeals in renewable energy and digital infrastructure represented larger overall value creation from U.S. entities. Recognizing shifts and regions is essential when calibrating global merger model assumptions.

Real-Time Data and Cloud Collaboration

Today’s financial teams can leverage cloud-based technologies that allow for instantaneous updates to the model. This supports pulling data faster to accelerate cycles of decision-making and work more effectively across finance, legal, and strategy teams.

Building a Practical Merger Model: Step-by-Step Process

A merger model is an extremely complicated and sophisticated financial tool, which must be designed step-by-step with the integration of financial logic, integration planning, and valuation insight all together.

Building a Practical Merger Model: Step-by-Step Process

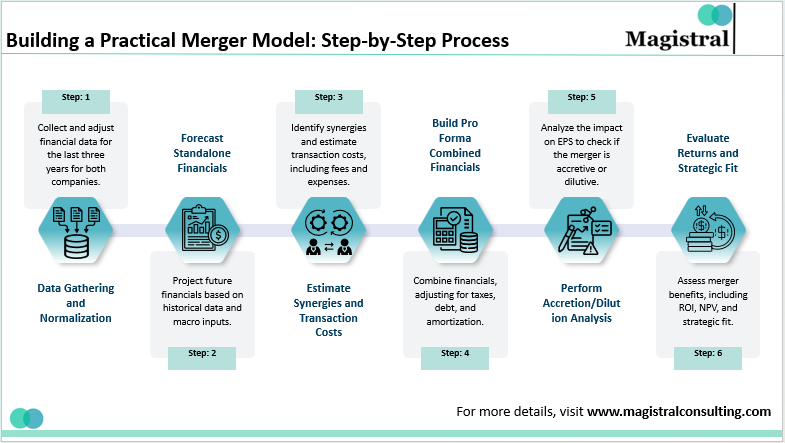

Step 1: Data Gathering and Normalization

Prepare financial documents for the last three years for both companies. Make the necessary adjustments to items not part of regular operations, modify the accounting methods, and verify the accuracy of the data.

Step 2: Forecast Standalone Financials

The base-case projections for the companies are determined using the macroeconomic inputs from Deloitte and the IMF as a springboard. The revenue, cost, and capital expenditure forecasts are extended to a period of 5-10 years.

Step 3: Estimate Synergies and Transaction Costs

Cost synergies (SG&A savings, facility optimization) are to be identified alongside revenue synergies (cross-selling, new markets). Advisory and legal fees, amongst others, are to be mentioned as transaction costs.

Step 4: Build Pro Forma Combined Financials

It will be necessary to combine the two statements and take into consideration the financing structure, taxes, and amortization. The debt or equity issuance needs to be reflected by adjusting the capital structure.

Step 5: Perform Accretion/Dilution Analysis

Calculate pre- and post-merger EPS and determine if the operation is accretive by computing the sensitivity testing on synergy assumptions, interest rates, and currency exposure.

Step 6: Evaluate Returns and Strategic Fit

The evaluation of the qualitative rationale- market expansion, diversification, or technological advantage goes together with the quantitative validation by measuring criteria such as ROI, NPV of synergies, and payback period.

How Magistral Consulting Supports Merger Model Excellence

Magistral Consulting carries out the entire M&A process from the strategy through valuation to the post-merger integration. The company’s know-how changes complicated financial modeling into usable information.

Financial Modeling and Deal Support

The deal support team at Magistral designs comprehensive models tailored to various industries and transaction types. All features, such as synergy monitoring, tax optimization, and capital structuring, are integrated into the models for realistic forecasting.

Due Diligence and Risk Validation

Using detailed financial and operational due diligence, Magistral uncovers secret risks and confirms merger assumptions before giving a final go-ahead.

Post-Merger Integration and Synergy Tracking

Not only before-deal analytics, but also after-deal, the company helps the clients to carry out the integration. Its well-defined synergy realization method delivers the expected results within the specified period.

AI and Analytics-Driven Forecasting

With the use of its proprietary Artificial Intelligence tools, the company predicts several merger outcomes with much greater precision. Its insights on operations and data modeling help to cut down the decision-making time of the acquirers.

Strategic Advisory for Institutional Investors

Magistral works closely with venture capital and funds to make merger models compatible with the strategies of the broader portfolio. This all-embracing advisory approach turns transactional analysis into strategic foresight.

To summarize, the merging model acts simultaneously as a financial compass and a strategic dashboard. In the age of uncertainty, data-driven modeling allows firms to pursue ambitious yet accountable deals.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

Utkarsh is a finance professional with expertise in investment research, M&A, and financial modeling. He has built and applied models including DCF, LBO, and comparable analysis, supporting investment banks, private equity, and venture capital firms across diverse sectors. Utkarsh holds an MBA in International Business & Finance from Symbiosis International University, a B.Com (Hons) from Delhi University, and has completed the Stanford Seed program at Stanford Graduate School of Business.

FAQs

What is the primary purpose of a merger model?

How does a merger model differ from a DCF model?

What are the main inputs of a merger model?

Why is synergy estimation important in a merger model?