In the current data-driven financial environment, the Investment Manager Database has developed into far more than a list of contacts. It is to begin to act and function as a site for strategic intelligence development. Private equity and hedge funds have been relying more heavily on data points to drive allocation decisions. Now data bases have started to incorporate AI, ESG metrics, and predictive analytics. More than 70% of asset managers expect to invest in updating their data infrastructure to help them more effectively target investors. It also helps improve deal sourcing capabilities. This move supports process efficiencies, better workflows, and competitive advantages for managers. The ability to identify emerging funds, improve allocations, and deepen their relationships with investor clients.

The Evolving Role of Investment Manager Database in Modern Fund Management

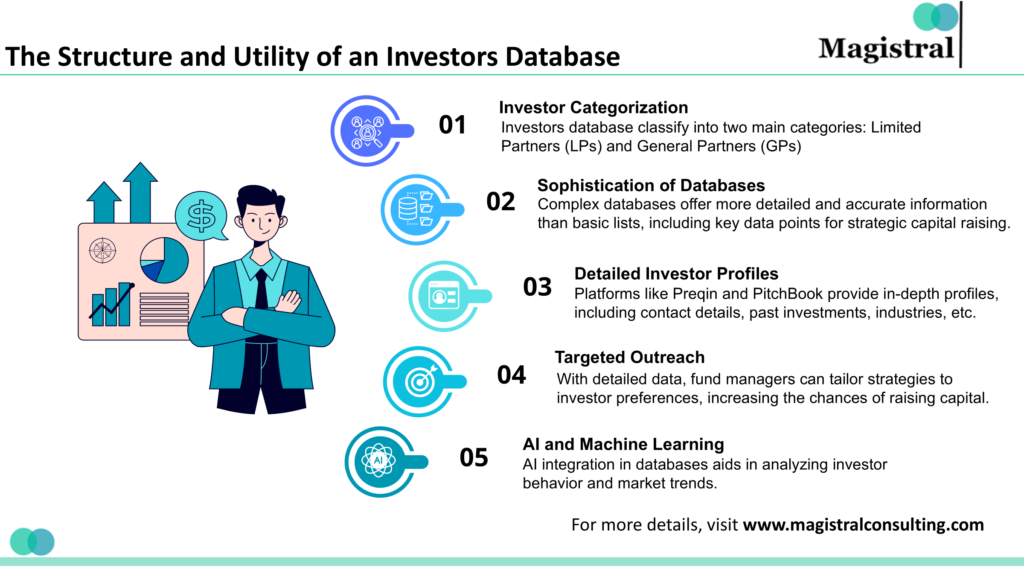

An Investment Manager Database has become essential to connect allocators, fund managers, and service providers through the full investment process. It is the focal point of knowledge about fund strategies, performance benchmarks, and personnel information- an essential tool for institutional investors who are operating in a segmented environment.

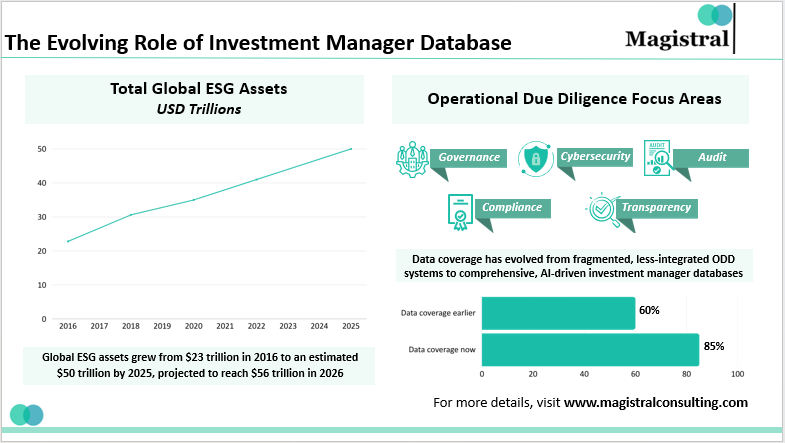

The Evolving Role of Investment Manager Database

Shifting from Static Lists to Dynamic Intelligence

In the past, databases tended to be viewed as static lists. Today, they reflect some entry of AI and real-order analytics. Vehicles like Preqin and PitchBook use algorithmic recommendations to assist clients in identifying top performing managers based on actual alpha generation and risk-adjusted returns.

Combined Use with ESG and Regulatory Information

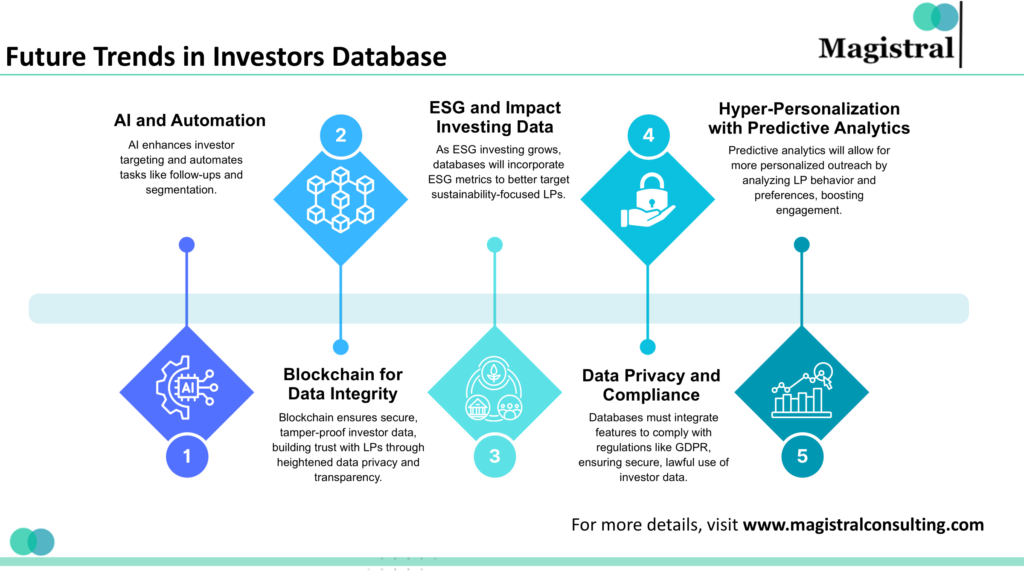

Environmental, Social, and Governance (ESG) investing is projected to surpass $50 trillion worldwide by 2025, and as a result, the Investment Manager Database is slowly beginning to assimilate sustainability scores and compliance markers. This enables allocators to filter the managers to match their organization’s ESG principles, which is particularly crucial for sovereign wealth funds and pension funds.

Advancing Deal Origination

Investment teams can now raise capital alongside manager relationships, aided by predictive search methods. For example, utilizing emerging AI-powered deal origination technologies, databases can point to GPs raising funds with recent vintages or data regarding niche asset exposure. This synergy between databases and private equity workflow has drastically reduced due diligence timelines.

Integrating Data with Operational Due Diligence

Insights into operations that are integrated within databases enable investors to assess fund governance, audit trail, and cybersecurity policies, consistent with operational due diligence.

Market Developments Fueling the Investment Manager Database Transformation

The Investment Manager Database sector is advancing rapidly as asset owners demand more transparency and automation.

Increased Demand from Alternative Asset Managers

Precedence Research (2025) stated that the global alternative investment data market was over $14.16 billion, driven by data streams required by hedge funds and venture capitalists. Database and CRM integration now allows for seamless management of fund pipelines.

Technology Evolution: Excel to AI Models

Many asset allocators are moving away from using spreadsheets to track investments and integrating cloud-hosted and AI-based systems. Around 65% of institutional investors use real-time analytical data in their manager selections moving from passive to active allocation strategy.

The Growth of Customizable Dashboards

Modern platforms provide dynamic benchmarking across asset types, comparing REITs, venture portfolios, and hedge funds through visualization tools, improving transparency, and allowing managers to identify undersized strategies.

Data Monetization Opportunities

Some firms will monetize data from the Investment Manager Database in anonymized form, as a means for trend information for investment banks and advisors.

Establishing and Keeping an Investment Manager Database that Works

Building an Investment Manager Database requires the interplay of technology architecture, data governance, and real-time validation.

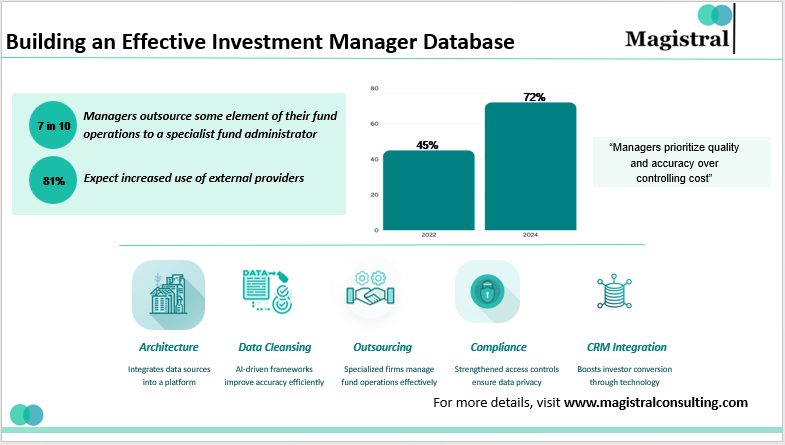

Building an Effective Investment Manager Database

Base Architecture and Data Sources

Most databases have multiple data sources, including public fund disclosures (e.g., Form ADV, SEC filings (regulatory filings)), Subscription data from data providers (e.g., Morningstar), and Internal CRM and pipeline analytics. Cross-checking data supporting the truth and eliminating duplicative analysis is significant.

Data Cleansing and Trouble Shooting

Poor data quality continues to be a major challenge for asset managers, often resulting in inefficiencies, misaligned capital allocation, and additional time spent on reporting and validation processes. A strong ETL (Extract, Transformation, Load) framework, along with AI tagging, can now validate the source.

Using Outsourced Operations

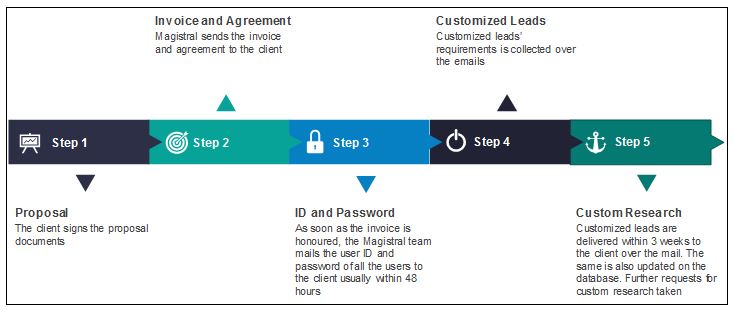

Numerous GPs currently partner with outsourced consultancies like Magistral Consulting for their fund operations to keep their data clean, and investors & operations-ready dashboards.

Compliance and Data Privacy

Lastly, with the increase of data privacy laws, such as GDPR, and SEC guidelines on cybersecurity, compliance is now obligatory. If firms must employ automated access controls and encryption technology to safeguard manager communications.

Integration with Investor Relations Technology Stack

Finally, when integrated with a CRM or marketing automation technology stack – investor relations and data grow exponentially, managers can now utilise previous engagement data towards some type of investors’ outreach strategy.

Strategic Application of Investment Manager Database

The Investment Manager Database offers both a sector-wide application from sourcing funds to benchmarking performance.

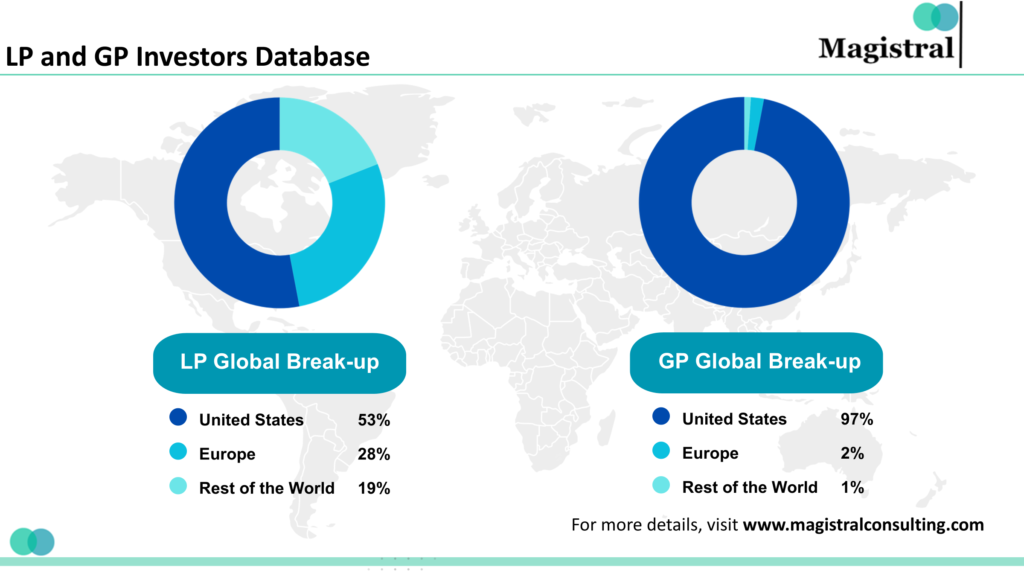

Private equity and venture capital

Private equity and venture capital firms find value in the database to review co-investment partners and limited partners (LPs). Predictive analytics rank LPs on how frequently they invest and their ticket size in recent funds. It helps in providing fund managers the ability to shorten the time it takes to fundraise capital.

Hedge funds

Artificial intelligence-driven hedge fund managers augment their traditional risk factor analytics. They also incorporate investor sentiment scores to improve their alpha generation forecasts. Data-driven managers outperform their peers by 1.8 percent on an annualized basis. They can position their portfolios more quickly to capture alpha.

Real estate funds and active infrastructure funds

Within real estate financial modeling, an investment manager database will provide managers the ability to track metrics at the asset level (e.g. NOI, IRR, cap rates) which enables managers to benchmark returns on a geographically indexed basis.

Institutional allocators and family offices

Institutional allocators rely on the investment manager database as the operating methodology for oversight on multi-manager investments by providing investors with automatic dashboards to measure exposures across assets and flagging managers with poor performance.

Use Case: AI-Driven Fund Matching Process

Suppose a pension fund is looking to match by investing in a fund that would provide green infrastructure exposure. The investment manager database will filter for fund managers who have built portfolios that align with ESG frameworks, have investment performance history we can rely on, and have been audited by a reputable third-party. This process can reduce their fund selection from days (if not weeks) to a matter of hours.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

Tanya is an investment-research specialist with 6 + years advising venture-capital, private-equity and lending clients worldwide. A Stanford Seed alumnus with an MBA and an Economics (Hons) degree, she heads project teams at Magistral Consulting, delivering financial modelling, due-diligence and deal support on 3,000 + mandates. Her blend of rigorous analytics, sharp project management and clear client communication turns complex data into actionable investment insight.