Real Estate Financial Modeling & The Buy/No-Buy Quandary

In real estate investing, deciding whether to buy property or not is important. Real estate financial modeling will help investors ensure the property’s profitability. Real estate financial modeling is a crucial tool in this managerial process. It gives investors the perceptions they need to tackle the complicated parts of property investments. It involves the assessment of diverse factors. By looking carefully at different financial aspects, Real Estate Financial Modeling helps discover risks and returns, eventually determining if a property is worth buying.

Real Estate Financial Modeling

Real estate financial modeling is an important tool. It is about inspecting property investments from equity and debt viewpoints. It comprises various financial aspects such as income, expenses, Business expenditures, Marginal Cost of Capital, Price plan, Probable returns, and Distribution mechanisms to see how profitable an investment could be and the risk associated with the project. The main goal is to deliver investors & stakeholders with a clear picture of whether an economic project makes sense.

Real Estate Investments – Types

Residential

In a residential investment Real estate financial modeling focuses on rental income projection.

Commercial

In this type of real estate, real estate financial modeling focuses on detailed analyses of rental income from leases, tenant turnover rates, and operating expenses.

Industrial

This type of real estate, model evaluates factors such as warehousing or manufacturing space requirements, lease structures, and logistics costs.

Retail

In retail Real estate it considers factors like foot traffic, sales performance, and tenant mix.

Development Projects

It involves detailed cost estimates for construction, project timelines, and potential revenue from sales or leases.

Building a Real Estate Financial Model

- Collection of Data: Collecting accurate data about the property and related market trends. The collection of data includes various components like Historical performance data, Market research, and Financial Statements.

- Spreadsheet Setup: Financial models are generally built by using Microsoft Excel or Google Sheets. Organising by adding clear sections of input assumptions, Calculations, and outputs.

- Develop Assumptions: Assumptions based on rental income, expense growth rates, and financial terms.

- Perform Sensitivity Analysis: Analysis to identify the impact of the changes made, this helps to verify which variables have the most significant effect on profitability risk.

- Review: Update the model based on new information or changes in market trends.

- Presentation: Presentation to show an understandable picture of the calculations made while doing research and analysis by using graphs, chats, and tables to highlight key metrics and insights.

Assessment & Management of Risk

One of the important considerations in real estate financial modeling is evaluating risk through inspecting different factors. Examining old and current data allows investors to spot different risks associated with property.

Financial Modeling – Assessment & Management of Risk

Below are the mentioned risks associated with the property investments:

Building Risk: These problems arise during the construction phase, like cost overruns or delays.

Interest Rate Risk: Increasing interest rates might affect the financing costs and returns on investment thus affecting profitability.

Market Risk: This can impact the rental revenue and property value because of the fluctuations in market dynamics such as changes in economic circumstances and resident real estate trends.

Credit Risk: This risk includes the potential for defaults on loans or financing contracts, which could threaten the financial constancy of the investment.

By cautiously considering these risks, investors can develop strategic methods to lessen possible problems and risks. This proactive risk management allows them to navigate uncertainties more effectually and make well-versed conclusions, boosting their capability to convalesce from setbacks and accomplish long-term achievement.

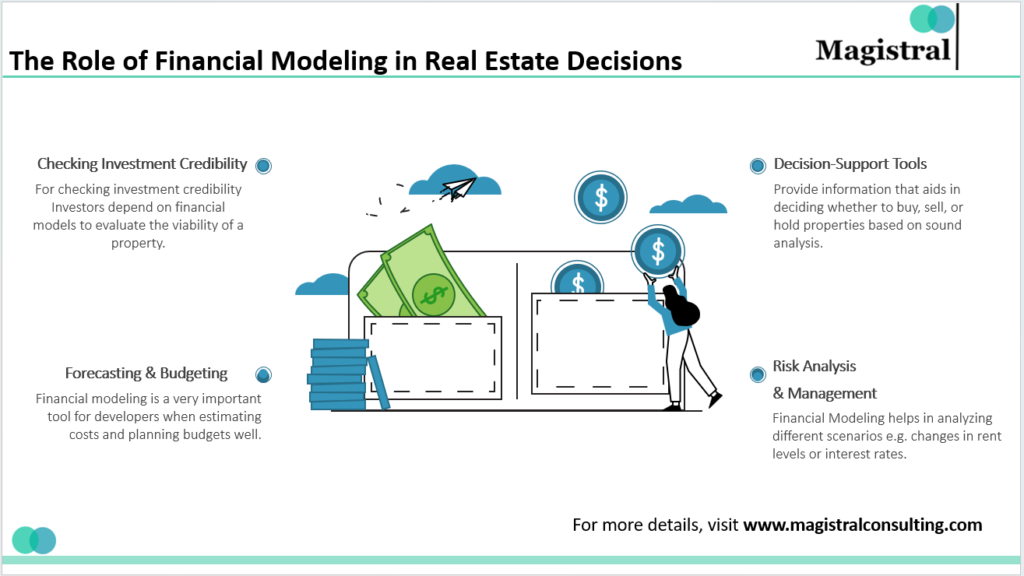

Financial Modeling – Role in Real Estate Decisions

The Role of Financial Modeling in Real Estate Decisions

- Reliability of Investment: For checking investment reliability Investors depend on financial models to estimate the feasibility of a property. Through future income and running expenses, they can establish whether it meets their purposes.

- Better Decision Making: Decision-making becomes easier with financial models. They provide information that aids in deciding whether to buy, sell, or hold properties based on sound analysis. This analytical approach not only illuminates the financial possibility of a property but also supports well-versed decision-making, ultimately determining if a property is a sound investment.

- Prognostication and Budgeting: Real Estate Financial modeling is a very important tool for developers when assessing costs and planning budgets well. For example, this model helps developers estimate operational expenses as well as possible rental charges. Proper planning results in optimum management. This will help make effective plans and strategies to bring more accurate results.

- Analysis & Management: Real Estate Financial Modeling helps in analyzing different scenarios e.g. changes in rent levels or interest rates. Such helps investors minimize risks by appreciating how different variables can affect their finances.

Purpose of a Real Estate Financial Modeling

By looking at several metrics that can optimize returns, Real Estate Financial Modeling helps in determining potential profits for investors through evaluating various factors.

Additionally, Real estate financial modeling is very helpful in navigating investment risks. They show investors where pitfalls could lie and how they might impact on performance thus enabling them to make better choices.

Moreover, they allow easy comparison. Thus, one can compare different investment alternatives and select the best one to make a decision.

Also, Real Estate Financial Modeling establishes whether or not a project makes economic sense—thereby indicating if it can be pursued as an investment.

Lastly, sound Real Estate financial modeling is often necessary to finance your real estate dreams! This is because lenders need detailed projections to determine if a project will be feasible & profitable.

Magistral’s Services for Real Estate Sector

Magistral Consulting offers an inclusive suite of services designed to elevate your real estate ventures at every single stage:

Fundraising

Our fundraising services involve connecting with investors, analyzing funding environments, researching macroeconomic trends, develop fund tactics, and polish pitch decks to secure the capital necessary for real estate projects.

Pre-Deal Support

Summarize investment memorandums, generate financial models, and profile properties.

Deal Structuring

Develop real estate models and prepare investor committee memorandums.

Portfolio Management and Exit

Offer portfolio reporting and craft exit strategies.

Operations Outsourcing

Manage operational functions to streamline your investments. Operations outsourcing comprises delegating the management of several operational tasks to specialized external service providers.

About Magistral Consulting

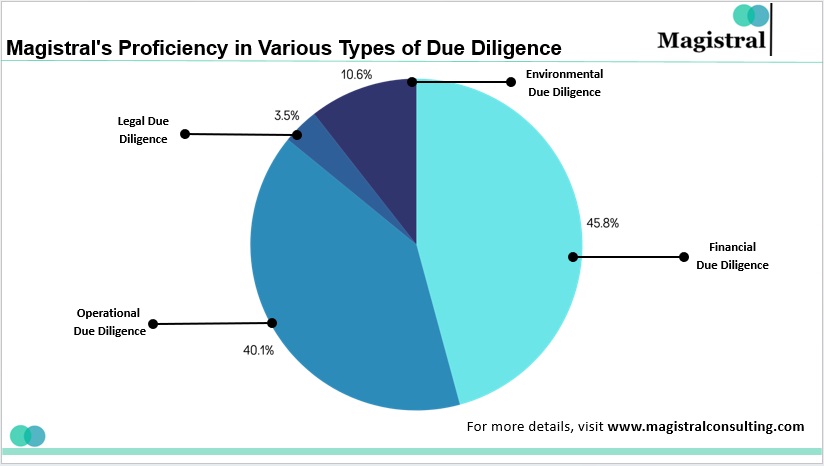

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

How does real estate financial modeling impact long-term investment success?

It provides a chance for investors to model cash flows, returns, and other long and diverse lists of financial scenarios that would determine the most lucrative opportunities in the process of investing. It also points out the probable risk factors for investors through market ups and downs, interest rate changes, and property management expenses.

What factors are considered when estimating probable returns in a financial model?

One is the income that it is deriving from rent on a net basis, as it is this rental income that directly reflects upon cash flow and profitability.

A second consideration is operating expenses: property management, property repair, insurance, property taxes, and utilities all directly impact an NOI number for a project.

The other variables are Financing Costs and Appreciation in Property Value

Explain the significance of a property’s Net Operating Income (NOI) in valuation.

It is the total sum that a property will raise through operation and rents, less the operating expenses, before the deduction of principal repayment, interest, and taxes.

An investor or any appraiser using the NOI gets a clear look into the profitability of an asset and will understand whether to buy, sell, or lend cash flow from the real estate. NOI.