The real estate industry has proved to be very turbulent over the last few years, an aspect mostly presented by technological advancements, globalization, and changing client expectations. The most effective strategy that has been witnessed in recent times is that of real estate outsourcing. The article aims to broaden this concept of real estate outsourcing, the various benefits it brings along, and the compelling data illustrating its importance in the sector.

Understanding Real Estate Outsourcing

Real estate outsourcing is delegating specific business functions or processes wherein an organisation entrusts specific tasks or activities with other external service providers. They include property management, marketing, financial analysis, legal services, and IT support. Outsourcing helps to hold back some complexities in a wide range of real estate tasks, leading to streamlined operations, cost-cutting, and leverage of specialized expertise.

Current Trends in Real Estate Outsourcing

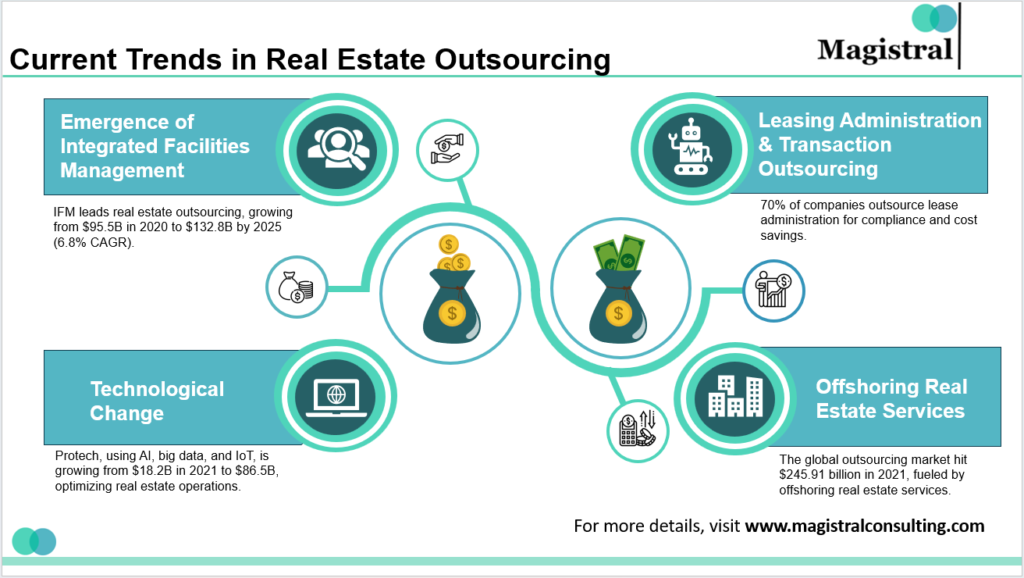

Emergence of Integrated Facilities Management

IFM is the current leader in the graph of real estate outsourcing. This is where organizations are increasingly looking for a single provider in building operations, maintenance, and security. It was estimated that the global IFM market was $95.5 billion in 2020 and would be at $132.8 billion in 2025, with a CAGR of 6.8%. Business cases would form the demand for higher operational efficiency with streamlined facility service provision.

Leasing Administration and Transaction Outsourcing

The urge to handle the complications of leasing and, with it, the ever-increasing requirement of multi-large companies to outsource the administration and management of a lease transaction is driving this process. According to a Deloitte report, 70% of the companies have outsourced at least a portion of their lease administration in the last few years. Third-party vendors increasingly take on lease auditing, rent payment processing, and lease abstraction to guarantee compliance, minimize error and cut costs.

Technological Change

Protech refers to AI, big data, and IoT. They are inducting these at a tremendous speed to increase the outsourcing ability in real estate. The global Protech market was valued at $18.2 billion in 2021; it is going to surge above $86.5 billion at a CAGR of 16.8% in between. Among those integrated into the outsourced services are the technologies aimed at optimizing real estate operations. These, in turn, help property managers collect and analyse data in order to better improve performance in buildings, reduce energy consumption, and predict future needs for maintenance.

Offshoring Real Estate Services

There have been documented growing trends in offshoring real estate services to countries such as India, the Philippines, and Eastern Europe. The global outsourcing market as an overall market is now worth $245.91 billion as of 2021 and continues to rise steadily. Companies involved in real estate are offering back-office support services in the following: property accounting, contract administration, and legal support using skilled people located in lower-cost areas.

Key Statistics and Figures

The real estate outsourcing market globally is expected to have growth of 5.2% CAGR throughout 2025, according to the estimates by Statista.

Cost Savings: Organizations have reported that outsourcing has resulted in tremendous cost savings. Real estate outsourcing can help deliver 20%-30% savings of facility and operational expenditures, states Deloitte.

Sustainability Initiatives, GRESB, or Global Real Estate Sustainability Benchmark, has identified that 90% of real estate companies outsource specific services related to sustainability and energy management to specialized providers.

Real Estate Outsourcing into the Future

Future of Real Estate Outsourcing

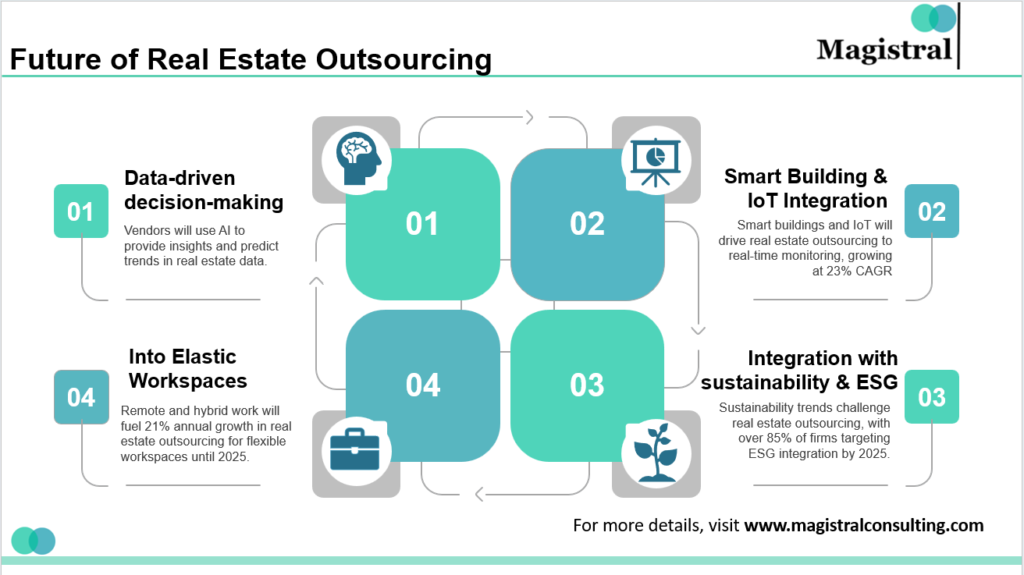

Data-driven decision-making

With the continued flow of mass data by real estate companies, outsourced vendors will assume an even more crucial role in analytics and decision-making. Not so long from now, however, services that the outsourcing companies will be used for will no longer only encompass property management but also interpret data from buildings into actionable insights. AI and machine learning tools will be able to predict trends, identify inefficiencies, and then make decisions on behalf of the owners of the properties.

Smart Building and IoT Integration

Smart buildings and IoT growth will make real estate sector outsourcing firms focus more on real-time building monitoring and predictive maintenance. The smart building IoT market size was about $67.60 billion in 2021. For the next five years, it is likely to grow at a CAGR of 23%. These systems are going to be used by outsourcing companies to take care of all the aspects that can improve efficiency while reducing costs and keeping up with increasing sustainability standards.

Into Elastic Workspaces: Main driver

The rise in adoption of remote and hybrid work models combined with the pressure on the real estate outsourcing industry to open services related to the management of flexible workspaces are expected to be the primary growth drivers. Flexible office spaces, according to the report by JLL, are set to grow at a pace of 21% annually up to 2025. Most of them outsource the design, management, and optimization of the office space as companies shift from traditional leases.

Integration with sustainability and ESG

As for the long term, there is a trend for sustainability and ESG in which opportunities and challenges are presented before outsourced providers of real estate on how sustainable practices can be integrated with the property management service. More than 85% of the real estate firms report EY in integrating ESG strategies into their functions by 2025, and it mainly helps their outsourcing partners achieve that aim. In addition to the experiences above, outsourcing companies will also face pressure in terms of experience on matters related to green building certifications.

Magistral’s Services for Real Estate Outsourcing

Fund-Raising

We provide full-service investor outreach support from analysis of the funding environment to conducting all macroeconomic research to producing sharp, polished pitch decks that help get your strategy across.

Pre-Deal Support

We provide summarize investment memorandums, and create detailed models of financial modeling, and property profiling, thus providing an overall understanding of each potential investment.

Deals Structuring

This involved structuring deals with advanced real estate modeling as well as preparing investor committee memorandums to ensure that every transaction would be well-planned and documented.

Portfolio Management and Exits

We provide portfolio reporting and design thoughtful exit strategies, thus optimizing returns while ensuring a smooth transition in the liquidation of the portfolio.

Operations Outsourcing

We offer operational outsourcing services and provide smooth, back-end processes for real estate management, which ensures that you can truly focus on growing.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

What is the projected growth of the real estate outsourcing market?

According to a recent study, the global market for real estate outsourcing was to grow at a 5.2% CAGR during 2025 with the growing demand for specialized services.

How does real estate outsourcing help lead to a core focus?

By outsourcing non-core functions, organizations can concentrate on property acquisition, property development, and client relationship building, thereby focusing more on their overall productivity.

Will outsourcing enable real estate firms to embrace better technology?

Yes, through the outsourcing of IT services, real estate companies can present the possibility of automation solutions without such huge capital investment.

What is Integrated Facilities Management (IFM)?

IFM is outsourcing building operations, maintenance, and security to a single provider to boost operational efficiency.