AI adoption has rapidly accelerated in financial services, becoming integral to forecasting, risk analysis, compliance, and investment research. According to Gartner’s 2025 survey, 59% of finance leaders report actively using AI, while a report by AllAboutAI indicates that 60% of banks deploy AI. It is across four to six major functions, including fraud detection, lending, and regulatory compliance. Adoption of generative AI is also growing, with nearly half of US banks using it internally for insight derivation. Despite such advances, however, most AI deployments still remain siloed, generating fragmented outputs that analysts must manually reconcile.

The Business Case for Model Merging in Finance

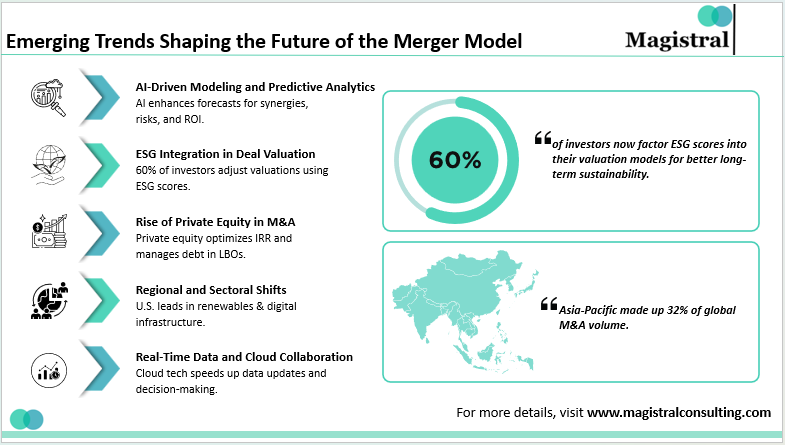

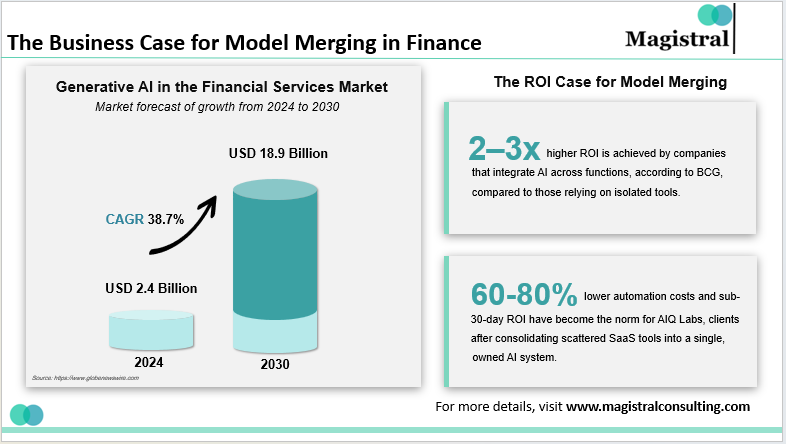

This fragmented landscape brings into sharp focus the strategic importance of model merging. It creates a unified intelligence layer via the integration of specialist models. This includes sentiment analysis engines, quant forecasts, ESG scoring platforms, and risk simulations. This process can help financial institutions cut redundancy, clarify conflicting signals, and quicken the pace toward decisions. Merging allows firms to leverage past AI investments, improve insight quality, and unlock higher operational and financial returns. It is as the base for a more connected, multi-dimensional approach to financial research.

How Model Merging Is Quietly Redefining Financial Research

Financial institutions are operating in an environment where the volume of data has multiplied, uncertainty has intensified, and investor expectations have risen sharply. Despite meaningful spending on analytics and automation, most research teams continue to grapple with a familiar problem. It is that different models give different answers. Sentiment engines interpret earnings calls, quant models forecast price movements, ESG platforms score disclosures, and risk engines evaluate downside scenarios-yet each operates independently. Such fragmentation delays insight and often forces analysts to manually reconcile conflicting signals.

A shift is underway as firms explore model merging, a method that brings these disparate engines together into a single, composite intelligence layer. Rather than constructing one giant model, institutions are merging several specialized ones. It includes building a unified system that processes the financial world like a seasoned analyst: multidimensionally, contextually, and with greater sensitivity to regime shifts.

The Forces Pushing the Industry Toward Composite Intelligence

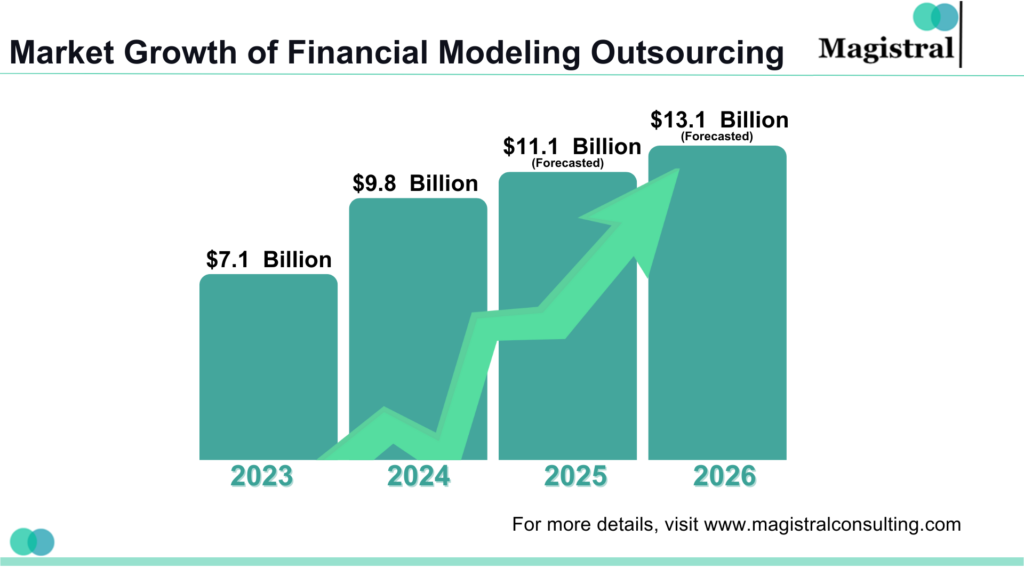

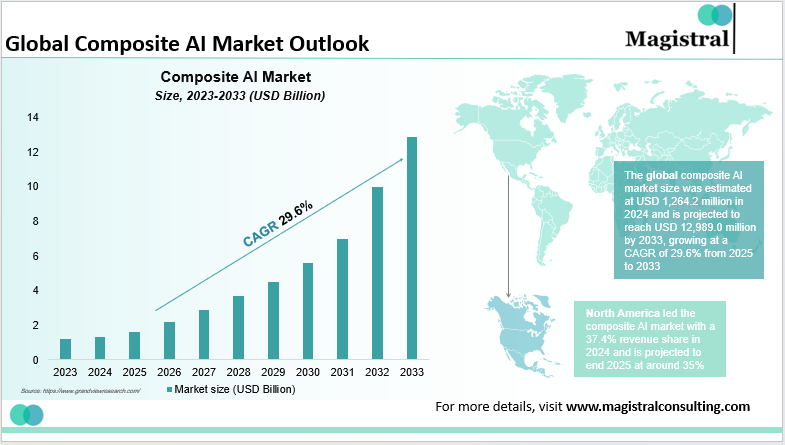

There is nothing accidental about the momentum in this shift. Global investment in AI for financial services is growing at a rapid pace: from an estimated US$38 billion in 2024 to nearly US$190 billion by 2030. Much of this spend is directed toward unstructured data-earnings transcripts, alternative datasets, macro commentary, and regulatory updates, which have grown at a pace no single model can comfortably handle alone.

Global Composite AI Market Outlook

Market conditions also pressurize research workflows. Over the past four years alone, institutions have been called to navigate inflation surges, interest-rate tightening, geopolitical shocks, liquidity shifts, and record earnings volatility. Traditional AI systems, often trained for static regimes, struggle with these dynamics. Indeed, recent OECD research has pointed to rising “AI herding risks” as firms increasingly fall back on similar single-model approaches that may then amplify systemic vulnerabilities.

Model merging responds to these pressures by allowing institutions to combine various forms of intelligence in one system: numerical, linguistic, behavioral, and macroeconomic.

How Merged Intelligence Changes the Way Insights Are Generated

When multiple models are combined, the research workflow doesn’t just get faster; it becomes qualitatively different. A single system can read through the quarterly results of a company, assess the financials, comprehend the tone of management commentary. They find patterns in hiring or customer traffic, and incorporate peer behaviour in one pass. Analysts receive outputs that feel closer to a complete research narrative than to raw model signals.

This is a shift of equal importance both in credit and in risk domains. Early-warning indicators become much stronger once the models of default probability are combined with the macro-sensitive LLMs and anomaly-detection systems. A subtle change in the language of a management call, put together with deteriorating sector liquidity or weakening alternative data trends, can surface as an actionable alert sooner than conventional models would allow.

Quant teams can benefit, too. By combining factor models with narrative intelligence, model merging architectures enable the strategies to adapt more seamlessly to macro regimes around the inflection points where so many purely statistical models tend to become rigid.

The Strategic Value of Merging Models Instead of Replacing Them

Unlike building a large, monolithic AI system, model merging enables firms to maintain and improve the tools they already trust. Most financial institutions have developed models over years of domain-specific development. These represent intellectual property, tuning, and historical familiarity. It is neither feasible nor desirable to replace those with one generic LLM.

Merged architectures deliver a more strategic alternative. They let institutions integrate their existing models, enrich them with generative capabilities, and create a proprietary intelligence layer. It reflects the firm’s unique philosophy and datasets. Every organization merges its models differently, which turns the resulting intelligence into a competitive moat that peers using similar datasets can’t easily replicate.

There is also a clear operational advantage. Maintaining half a dozen independent pipelines is expensive and cumbersome. Model merging system simplifies governance, reduces duplication, and centralizes retraining and monitoring. This improves both cost efficiency and model reliability.

Building Trustworthy, Explainable Merged Models

Like any AI system that informs financial decisions, merged models have to be explainable and auditable. One of the strong positives of model merging is that institutions are able to trace which component contributed to a particular output. If a credit alert triggers, the firm can trace whether macro patterns, sentiment shifts, or financial metrics predominantly drove it. It’s this layered interpretability that gives risk, compliance, and audit teams confidence to scale.

Rigorous backtesting remains paramount. Merged models should be checked against stress periods, such as the 2008 crisis, COVID-19 shocks, inflation periods, and geopolitical disruptions. It is to confirm that the combined intelligence performs well across regimes.

Future Outlook

Model merging is still emerging, but the trajectory is unmistakable. As financial institutions move toward composite intelligence architectures, firms relying on isolated models will continue to face delays, blind spots, and higher costs. Those who adopt merged systems early will operate with deeper context, faster synthesis, and more resilient decision-making.

For research-driven organizations planning their AI roadmap for 2025, model merging is no longer a niche experiment- it is becoming essential infrastructure for competitive financial insight.

How Magistral Consulting Supports This Transition

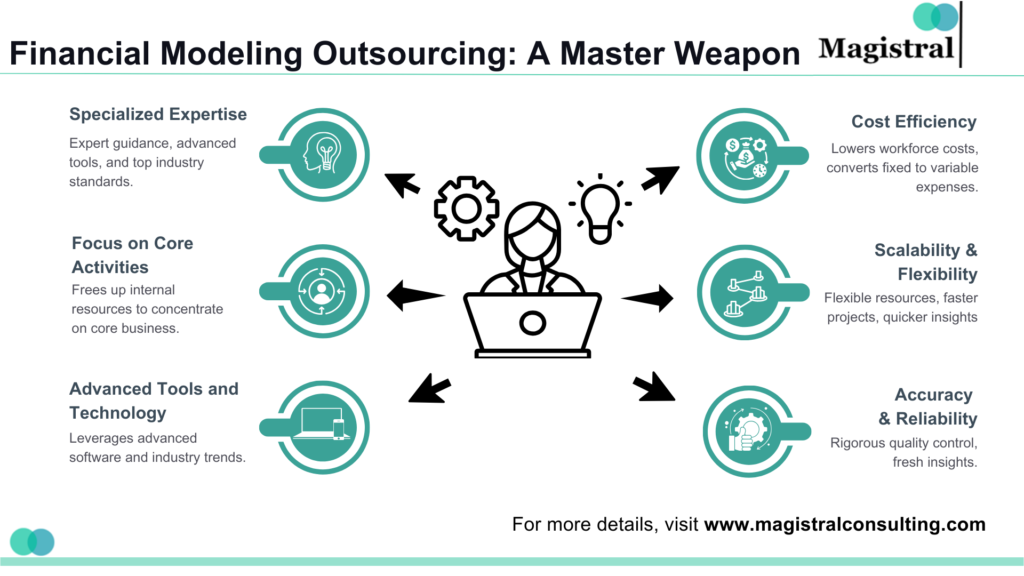

Magistral Consulting supports the rationalization and enhancement of financial institutions’ research processes. It is by facilitating the better integration of insights derived from different analytical models, be it related to markets, sectors, deals, or risk insights. While we do not build or deploy AI models, our teams definitely play a critical role in helping clients operationalize intelligence. Magistral consolidates scattered data inputs, standardizes research outputs, and creates cohesive analytical pipelines. It is for decision-makers who can then work with unified, high-quality insights. This enhances the way firms consume model-driven information and strengthens consistency, clarity, and speed in the research processes.

Relevant Magistral services supporting model merging are:

Investment Research Support

Translates multiple model-generated signals (market, sector, sentiment, and risk) into cohesive research deliverables. This is via structured analyses, earnings tracking, and cross-model benchmarking.

Buy-Side & Sell-Side Support

Synthesizes insights from varied quant and fundamental perspectives into consolidated portfolios, thematic notes, investment screens, and fund intelligence that support merged-model decision workflows.

Investment Banking & Deal Support

Develop and integrate disparate datasets of market, financial, operational, and alternative data. It is then into key CIM/IM content, valuations, comps, and industry research in a consistent manner. This is done across model-assisted analytics.

Data & Insights Standardization

It cleans, aligns, and structures data flowing from multiple analytical engines. It enables clients to create unified dashboards, research repositories, and insight streams, mirroring the logic of model merging.

Custom Research & Analytics

Provides deep-dive reports, ESG datasets, and customized analytics that advance the interpretability and usability of merged-model intelligence within decision-support systems.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

Utkarsh is a finance professional with expertise in investment research, M&A, and financial modeling. He has built and applied models including DCF, LBO, and comparable analysis, supporting investment banks, private equity, and venture capital firms across diverse sectors. Utkarsh holds an MBA in International Business & Finance from Symbiosis International University, a B.Com (Hons) from Delhi University, and has completed the Stanford Seed program at Stanford Graduate School of Business.

FAQs

Can Magistral Consulting provide on-demand or project-based support?

How does Magistral Consulting ensure data confidentiality and quality?

Does Magistral provide real-time or ongoing market tracking?

How is Magistral’s market research aligned with digital transformation trends?