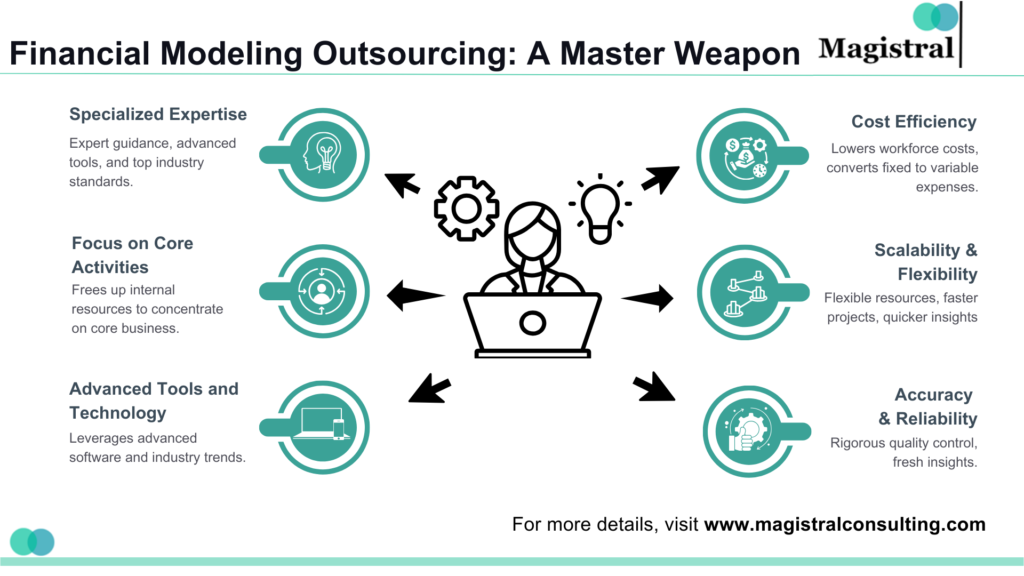

With the growing trends, organizations look forward to improving efficiency, decreasing costs, and optimizing strengths. A good approach is the financial modeling outsourcing tasks to third-party service providers. This approach gives the companies an opportunity to leverage the services of experts who can analyze and interpret data for them with limited capital investment.

Financial Modeling Outsourcing: A Master Weapon

Financial Modeling is essential in the formulation of strategies, investment decisions, and assessing the performance of an organization which is costly and time-consuming and depends on the expertise and resources available. Thus, the application of outsourcing allows obtaining high-quality models and professional services, while the models and other service-providing personnel adhere to modern methodologies and requirements.

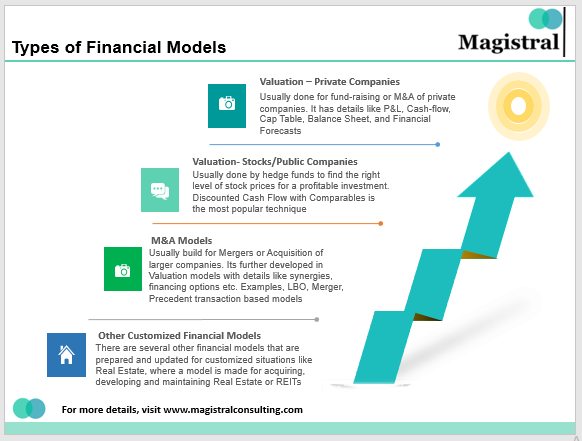

Types of Financial Models

Financial modeling is one of the crucial parts of research for valuing and analyzing the business. Outsourcing helps the internal team of buy-side and sell-side firms to build and update the financial models that will save their time, effort, and cost. Different financial models serve various purposes, but the following types are especially popular in financial modeling outsourcing:

Discounted Cashflow Model (DCF)

Professionals commonly use the DCF model to value businesses, particularly in real estate or industries where they can reliably predict future cash flows. Its versatility makes it a preferred choice for a wide range of valuation scenarios. The major requirements to build a DCF model are:

Unlevered free cash flow

Also known as free cash flows to the firm, brings consistency in the model’s result as it does not depend on the capital structure of the company. Different companies require different modifications while calculating these cash flows, in some cases working capital is not a major value driver but for some, this can be a critical factor.

Discounting rate

After the projection a percentage is required to discount these flows to bring the present worth of the cash flows. The percentage represents the weighted average cost of capital which will carry the weightage of all capital sources like equity, debt, and more.

Terminal value

The value is an outcome of the first cash flow of the company and its cash flow growth rate and discount rate in the terminal period.

Leverage Buyout (LBO) Model

These models are among the most complex financial structures used to evaluate potential LBO deals. They extensively analyze various financial components, especially:

Acquisition Structure

This section analyzes key elements such as the amount of debt raised, the acquisition’s purchase price, and the equity contribution from the investor group or acquiring company.

Key Financial Metrics

Apart from IRR the financial model outsourcing also reveals and studies various other financial metrics such as debt service coverage ratio and cash-on-cash multiple to determine the viability of the transaction for the acquisition.

Sensitivity Analysis

To identify and analyze the potential risks associated with the investment.

Exit Strategy

Different strategies like initial public offering or sale out to another buyer and more are considered in the model.

Consolidation Model

The combination of the parent company’s financial statements with its subsidiary companies gives a 360-degree view of the financial soundness of the business. Two major parts of the process are:

Eliminating intercompany transactions

Based on double-entry logic the process of consolidation eliminates the possible risk of one-sided entries. Intercompany debt, Intercompany revenue and expenses, and Intercompany stock ownership are three intercompany eliminations that are used to reverse the entry to zero effect.

Consolidating financial statements

By integrating and combining all the financial statements of parent and subsidiaries to draft a set of standardized financial statements.

Option Pricing Model

The mathematical structure of this model reveals the theoretical price of the options. Financial teams majorly use this model to value the employee stock options and to manage risk related to currency fluctuations, prices of the commodities, and interest rates. There are three main types of option pricing models:

The Black-Scholes model

The model is used for European options by assuming volatility and risk-free rate constant.

Monte Carlo Simulation

The model is based on random sampling and is used for pricing options that are exotic or complex in nature.

The Binomial model

This model uses a tree-like structure to evaluate and analyze the options.

Market Growth and Trends in Financial Modeling Outsourcing

Organizations of all sizes increasingly outsource financial modeling because it effectively presents budget forecasts, identifies funding needs, and supports strategic planning.

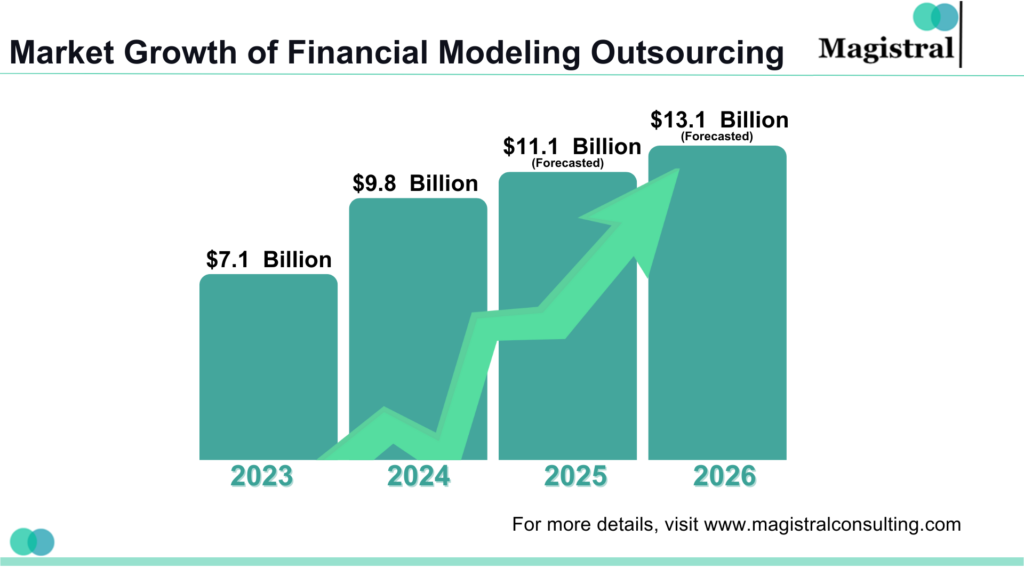

Market Growth of Financial Modeling Outsourcing

Technological Integration

The adoption of AI, ML, and big data analytics is enhancing accuracy and efficiency in financial models. According to the statistics, about 80% of financial organizations are using or planning to use RPA for the automation of routine work in financial fields so that finance specialists can concentrate on value-added work.

Client Satisfaction

According to a 2024 Financial Recovery Technologies survey, 96% of clients are satisfied with outsourced financial modeling services. This satisfaction has led to more business with firms renewing or increasing their contracts.

Market Growth

It is forecasted that the financial modeling outsourcing market will touch $512.4 billion, at the global level by 2030. The IT outsourcing segment is concerned to increase from $460.1 billion in 2023 to $777.7 billion by 2028. The factors that will continue to ‘fuel’ this type of sector include the demand for cheap services and the development of technology.

Widespread Adoption

Various industries such as financial services, healthcare, technology, and real estate are now outsourcing the financial modeling task to capitalize on the expertise and technical tools.

Geographical Diversification

India, Philippines and Eastern Europe outsourcing destinations offer qualified workforce at cheaper rates, which makes this area ideal for financial modeling outsourcing.

Magistral’s Services on Financial Modeling Outsourcing

Magistral Consulting is the top Outsourcing Financial Modeling Company that specializes in providing different services for different clients.

Unparalleled Expertise

Magistral’s competent workforce has adequate knowledge of the current standards, regulations, and trends in financial modeling.

Tailored Solutions

Magistral expert analysts develop the revenue forecast, cost structures, investment and profitability appraisals, and sensitivity analysis based on the client’s strategic objectives.

Cost-Effectiveness and Scalability

It is important to note that organizations that outsource their financial modeling from Magistral recoup much more than if they were to employ and maintain a team of financial modelers, and all this with scalable solutions.

Confidentiality and Data Security

Magistral protects client data by strictly following data protection rules and maintaining confidentiality at every stage.

Quality Control and Assurance

Magistral ensures high quality through rigorous validation checks and alignment with market trends to deliver realistic and credible financial models.

Magistral Consulting offers a cost-efficient yet highly elaborated outsourcing option for financial modeling. We engage our clients in the development of solutions, guarantee data protection and adhere to the highest quality standards. Therefore, our approach gives strategic advantage to business organizations that we deal with.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

Why one should choose Magistral for financial model outsourcing?

Magistral holds talents with years of experience in the field of finance. Our seasoned professionals apply their deep industry knowledge to provide clients with tailored, cutting-edge solutions designed to meet their unique needs.

How does Magistral help in ongoing support for financial models?

With its specialized workforce Magistral provides expert insights and a high-quality support without any additional overhead cost of hiring and training internal staff.

How does Magistral ensure the accuracy in financial modeling?

Magistral follows standardized methodologies to make the financial model clean and consistent based on logical assumptions and validation techniques.