For certain businesses that want to increase capital by attracting investment from the general public, the issuance of shares is likely to be a very lengthy and complicated exercise. However, there is yet another way in which companies intending to raise funds can do so by means of the issuance of a Private Placement Memorandum, which is PPM.

When it comes to private fundraising, the need for a well-written Private Placement Memorandum (PPM) is indispensable for the issuers and their potential investors. A PPM not only discloses key information but also protects against legal issues, supports marketing efforts, and provides detailed insights into the investment being offered.

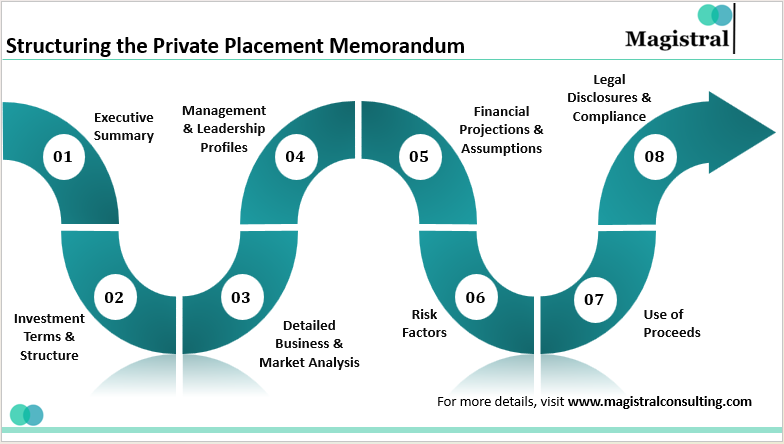

Structuring the Private Placement Memorandum

When drafting the PPM, a great deal of attention goes into ensuring that everything is clear, and to comply with regulations, and make a solid case for investment. Every section and component offer significant information in a constructive manner which offers potential investors a clear picture of the proposition on offer.

Structuring the Private Placement Memorandum

Executive Summary

Despite being a concise section, the Executive Summary demands attention to detail and clarity. It should briefly explain the intent of the investment, the aims, and the strategic benefits without violating regulations. The private placement memorandum should present the value proposition in a way that captures investors’ attention as early as possible.

Investment Terms and Structure

A clearly phrased terms section describes the technical structure of the investment, including minimum investment thresholds, offered securities and their voting powers, dividends and preferences, lockup periods, and how to exit the investment. It should include clarifications on certain contentious terms such as conversion rights, liquidation preferences, etc. so as to address the features of the investment and provide clarity to the investors.

Detailed Business and Market Analysis

An effective business analysis, in PPM, shows the issuer’s business model, how it operates, and a description of its improvement approaches. It should provide an industry outlook based on facts, trends, and drivers of the market study as well as its competitors and disruptions in the market, market data, and forecasts along with other credible sources indicating the growth prospects.

Management and Leadership Profiles

The level of experience of the management team of the issuer has a great potential to change the beliefs of the investors. This part should include the qualifications, experience, and achievements of the key individuals. It is also interesting to know about the governance – how the board and advisors were formed, which enriches the presentation of the issuer’s ability to implement the plan.

Financial Projections and Assumptions

Private placement memorandums typically present financial forecasts as one of their most important elements. Investors expect management to provide realistic, fact-based forecasts over a 3–5-year horizon, covering revenue, EBITDA, capex, and cash flows.

Risk Factors

Due to the need to comply with and manage investor expectations from the outset, it is important to provide a full disclosure of all risks. The types of risk generally covered include risks posed by market fluctuations, levels of regulatory effectiveness, operational control, and competitive factors. Moreover, identifying industry or regional threats can assist in illustrating possible outcomes that are likely to affect profitability.

Use of Proceeds

Investors must understand how their money will be used. A strong ‘Use of Proceeds’ section clearly explains how the funds will be allocated across areas such as research and development, market expansion, operational growth, and debt repayment.

>This section should also exhibit the relationship between capital requirements and timelines with clear purposes that help the investors understand how the growth of the foreign entity will be in relation to their funding.

Legal Disclosures and Compliance

Regulatory compliance is of utmost importance while preparing the private placement memorandum. The legal disclosure’s part shall explain what type of securities laws (including, among others, those exemptions which are entitled under Reg D, in respect of the U.S.–based offerings of any securities) the private placement memorandum is adherent to. Other important disclosures include such issues as conflicts of interest, patents and other intellectual properties, material agreements, and risk of lawsuits.

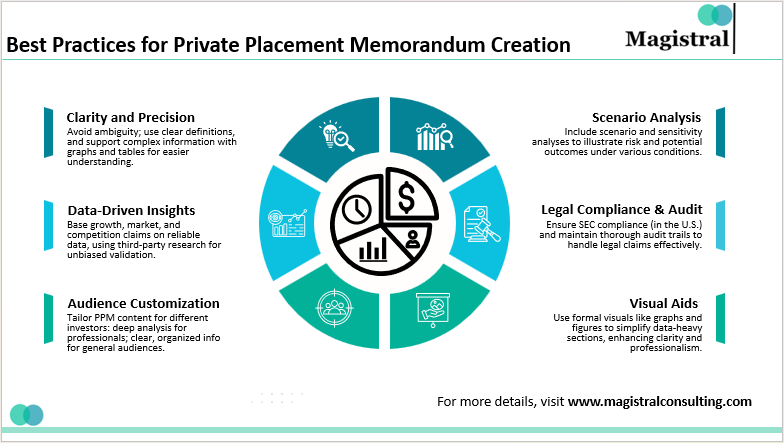

Best Practices for Private Placement Memorandums Creation

An effective PPM should be simple, precise, and able to speak to the intended audience ensuring investors’ confidence and compliance.

Best Practices for Private Placement Memorandum Creation

Clarity and Precision

A private placement memorandum should be free from any vagueness and aspire to straightforwardness that will instill the trust of investors. Although technical jargon is sometimes unavoidable, writers must prioritize clarity and clearly define any ambiguous terms.

In other instances, it is advisable to employ graphs and tables that help to convey complex information better.

Data-Driven Insights

Substantiate any assertions on growth, market size, or competition with solid data, including third-party research, market assessments, or industry reports. This gives an impartial basis for forecasts and puts into perspective the issuer’s circumstances.

Customization for Target Audience

Modifying the content structure of the PPM depending on the type of investors will yield better results. Detailed analysis, comprehensive financial information, and emphasis on competitive advantages are imperative for professional and institutional investors. On the other hand, more general public audiences might be better served with straightforward and organized explanations.

Integrate Scenario Analysis

Incorporating sensitivity analyses or more financial scenarios adds a positive twist in approaching risk management. It raises the level of sophistication in decision-making. Scenario analysis aims to enhance the investors’ understanding of the range and variability of potential outcomes. It also judges the stability of such outcomes under changing conditions.

Legal Compliance and Audit Trail

A private placement memorandum is subject to both political and legal consequences and therefore, the issuers should abide by the SEC requirements, if any, within the United States and seek a lawyer well-versed in securities law. Compliance teams manage noncompliance causes and issues through reviews and documented audit trails, which help address any claims from investors.

Graphic and Visual Aid Integration

Employing illustrations, graphs, and figures is useful especially, in parts with extensive data analysis like financial forecasts and comparisons of industries. However, such components must be the formal ones to enhance the image and illustrate the message properly.

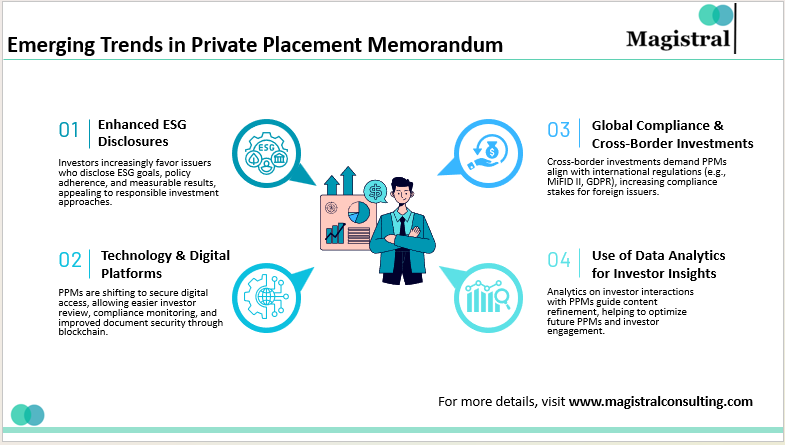

Emerging Trends in Private Placement Memorandums

With the development of PPMs, new trends that benefit investor interests and ease operations have started to be incorporated more into PPMs.

Emerging Trends in Private Placement Memorandum

Enhanced ESG Disclosures

As Environmental, Social, and Governance (ESG) factors become more prominent. There is a growing preference among investors for issuers to inform them regarding the various ESG initiatives. There is also the debate as to how they create sustainable value over time. ESG-related aims, adherence to policy, and quantifying results can be beneficial in attracting more investors. It is good for especially those who have responsible investment approaches.

Integration of Technology and Digital Platforms

Technology is driving a major transformation in how private placement memorandums are distributed and accessed. Secured private placement memorandum Digital Access is very instrumental in the investor review process and provides means to monitor compliance with ease. As such, organizations are exploring the potential of blockchain technology to improve document security and transparency.

Focus on Global Compliance and Cross-Border Investments

With the growth of cross-border fundraising, there’s a need for PPM to include the issues of compliance with different territories. Regulations such as the EU MiFID II and GDPR directly influence how organizations share information and process data, thereby increasing the stakes for foreign issuers.

Use of Data Analytics for Investor Insights

Organizations on the other hand do not stop at designing the private placement memorandum but rather utilize the analytics to understand the investors’ behaviors. This helps to fine-tune the PPM, enhances the subsequent investor roundups, and most importantly, the contents of the PPM. Analytics identifies the most-read sections, helping teams recompose the private placement memorandum for optimal results.

Magistral Consulting Services for Private Placement Memorandums

Private placements can be very difficult to navigate but having a trusted advisor can make all the difference. Magistral Consulting offers extensive support for Private Placement Memorandums (PPMs). Our services include:

Crafting PPM

Our team develops PPM that is detailed and compliant with the laws. Magistral Consulting works closely with you to understand your business, goals, and regulatory requirements. We craft a PPM with all the required elements.

Compliance with the law

We make sure that your private placement memorandum adheres to all the relevant laws and regulations. We also offer guidance on compliance issues, helping you avoid any legal pitfalls.

Financial Reports

We also draft detailed financial statements that clearly present your company’s financial health. It also ensures your data supports better investment decisions.

Assessing Risks

It is very important to understand and disclose any possible associated risks to build investor trust. Our experts recognize and evaluate the associated risks with your investment offering, offering comprehensive risk disclosures in the PPM.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

What are the key elements included in a PPM?

There are several essential sections: overview or summary, company description, team overview, market analysis, risk concerns, allocation of funds, financial reports, terms and conditions, agreement, and details about the legal and tax implications.

How does Regulation D relate to Private Placements?

It offers a legal framework for companies to raise funds through private placements without going through a comprehensive registration process. This regulation sets the requirements and exemptions that companies should follow, ensuring that investors receive enough information to assess the risks of the investment.

What are the major advantages and disadvantages of a PPM?

Private Placements are a quicker and more flexible way to raise capital for companies, and they offer the potential for increased returns for investors with reduced ownership dilution than public offerings. But the disadvantages include limited liquidity of securities, higher risk due to lack of regulatory oversight, and the potential challenges associated with investing in early-stage companies.