Certain worldwide occurrences, like the pandemic or the ongoing conflict in Ukraine, have led to a recession in certain economies. According to World Bank predictions, global growth is expected to decline from 5.7% in 2021 to 3.1% in 2024.

Corporate Lending Market Forecast to 2030

In this regard, credit is necessary for economies all over the world to maintain, particularly during periods of severe inflation and money scarcity. It is crucial to support and encourage people to do so in order to guarantee that they feel financially secure and included in development despite adversity. However, banks and traditional lenders frequently lack the technology necessary to efficiently and rapidly onboard new clients, leaving many individuals behind when they most need it.

Lending operations form the foundation of any financial institution, especially credit intermediaries. These activities directly influence the lender profitability, risk profile, and overall market reputation.

Lending Operations Lifecycle

Lending Operations Life Cycle

Credit Appraisal

At this initial phase in lending operations, a borrower’s creditworthiness is thoroughly evaluated. In order to assess a borrower’s ability, willingness, and character to repay a loan, lenders use a variety of techniques, such as credit scoring, financial ratio analysis, and collateral evaluation.

Loan Structuring

Once they determine the borrower’s creditworthiness, lenders structure the loan by defining key details such as the amount, interest rate, repayment plan, and collateral requirements. The arrangement should fit both the lender’s tolerance for risk and the particular requirements of the borrower.

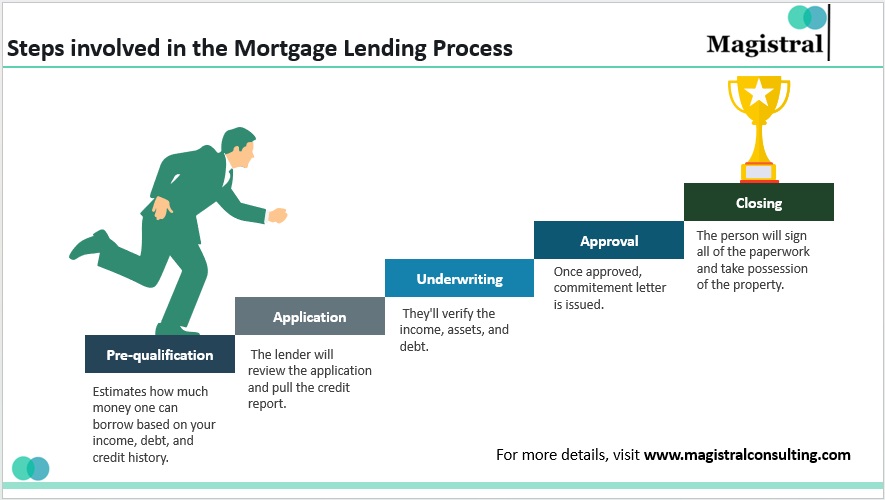

Loan Origination

The formalization of the loan arrangement takes place at this phase. After the necessary paperwork is ready, the borrower receives the loan. The process of starting and handling loan applications is known as loan origination. This covers communicating with customers, gathering data, preparing paperwork, and submitting it for underwriting. Optimizing client experience and operational efficiency requires efficient loan origination processes.

Loan Servicing

This continuous procedure entails overseeing the loan account, getting payments in, and responding to borrower questions. Reducing default rates and preserving client satisfaction depends heavily on effective loan servicing. The continuing administration of loan accounts following disbursement is referred to as loan servicing. It covers tasks including handling payments, keeping track of accounts, responding to client questions, and collecting. Reducing default rates and preserving client satisfaction depends on efficient loan servicing.

Loan Monitoring and Recovery

Lenders regularly monitor loan performance to identify potential defaults early. They implement effective recovery methods to minimize losses in case of defaults.

Loan Portfolio Management

The supervision and modification of a lending institution’s loan portfolio are part of loan portfolio management. It entails keeping an eye on credit quality, controlling loan concentrations, and putting risk-return-balancing measures into practice.

Operational Difficulties in Loaning

Credit Risk

It is important to evaluate and control credit risk. Credit risk is influenced by industry cycles, borrower-specific circumstances, and economic downturns.

Operational Risk

Fraud, ineffective loan processing, and system malfunctions can all result in operational losses.

Regulatory Compliance

There are strict regulations governing the lending sector. Compliance with intricate regulations is essential to prevent fines and harm to one’s reputation.

Competition

A highly competitive environment demands the creation of novel products, effective workflows, and first-rate customer support.

Economic Cycles

Shifts in the economy have an effect on both borrower repayment capacity and lending demand.

Lending Operation’s Strategic Imperatives

Risk Management

It’s imperative to have a strong foundation for managing risks. This entails putting early warning systems, stress testing, and sophisticated credit scoring models into practice.

Adoption of Technology

Using technology can improve customer satisfaction, expedite processes, and reduce hazards. Key technical enablers include data analytics, artificial intelligence, and digital lending platforms.

Customer Centricity

It’s critical to comprehend the wants and demands of your customers. Customer happiness depends on digital platforms, personalized products, and effective service delivery.

Product Innovation

Lenders can gain market share and increase profitability by creating cutting-edge lending products tailored to specific clientele.

Operational Efficiency

Costs can be decreased and operational efficiency increased through outsourcing, automation, and continuous process improvement.

New Developments in Lending Practices

Artificial Intelligence and Machine Learning (AI and ML)

ML and AI are being used more and more in customer relationship management, fraud detection, and credit underwriting.

Open Banking and Data Sharing

By encouraging data sharing and cooperation amongst financial institutions, open banking programs are opening the door to creative financing services and products.

Digital Lending

As digital lending platforms proliferate, the consumer experience is being revolutionized, and credit availability is being increased.

Regulatory Technology (RegTech)

By providing RegTech solutions, lending institutions can effectively and economically comply with regulatory regulations.

Cybersecurity

In order to safeguard sensitive consumer data, lending institutions need to bolster their cybersecurity defenses as cyber threats change.

Particularized Business Lending Operations

Trade Finance

A specific subset of commercial lending that facilitates global trade is known as trade finance. It includes a variety of financial services and products intended to lessen the risks involved with international trade.

Important tools used in trade finance are:

Letters of credit – A bank guarantee provided to a seller by the buyer’s bank, guaranteeing payment under specific terms. In international trade, this gives both parties security.

Export finance – Loans, insurance, and guarantees given to exporters to help with exporting, shipping, and production.

Import finance – Pre- and post-shipment financing are two types of financing available to importers in order to purchase goods from overseas.

Forfeiting – Exporters can sell their export receivables to forfeiture at a discount using this non-recourse financing strategy.

Project Funding

Project finance is a sophisticated lending method used to finance major infrastructure projects, including telecommunications networks, power plants, and roadways. Lenders usually structure the financing based on the project’s cash flows and use the project assets as security.

The following are important aspects of project financing:

Limited recourse or non-recourse – Lenders mostly depend on the project’s cash flows for repayment, not the project sponsor’s overall creditworthiness.

Intricate financial arrangements – Including a number of lenders, stock investors, and frequent government guarantees.

Risk mitigation – Lenders manage project risks by conducting thorough due diligence, performing risk assessments, and implementing risk-sharing procedures.

Syndicated Loans

Several lenders offer a sizable syndicated loan, often coordinated by a lead bank. Large-scale business transactions including leveraged buyouts, mergers and acquisitions, and project financing are all financed by it.

Among syndicated loans’ salient characteristics are:

Risk sharing – Lenders can spread their exposure to a single borrower by taking part in a syndicate.

Huge loan amounts – Syndication makes it possible to finance substantial projects that would be hard for a single lender to approve.

Complex structuring – To handle the interests of numerous lenders, syndicated loans can entail intricate financial and legal arrangements.

Magistral Consulting’s Services for Lenders

Lenders’ operating procedures must be flexible and failsafe when it comes to compliance and due diligence. Our services for lenders increase the confidence in lending decisions made, in addition to the speed of execution.

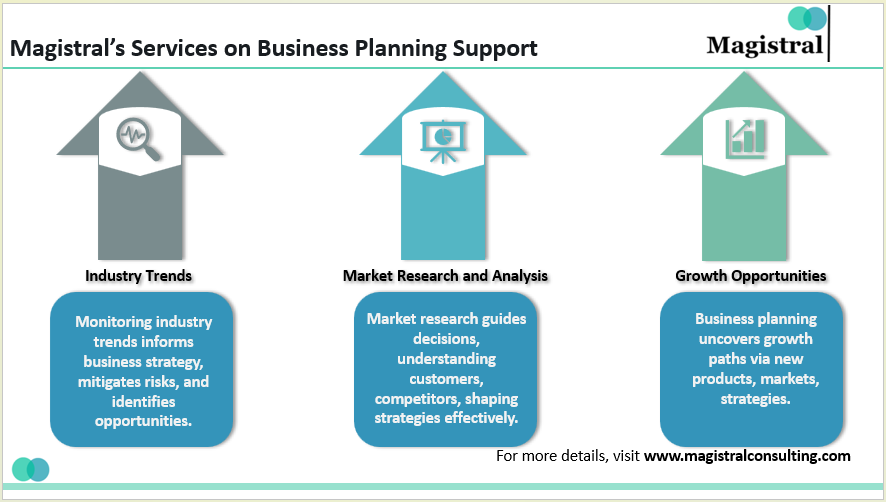

Commercial Real Estate Lending

Magistral’s innovative services disrupt the traditional commercial real estate (CRE) lending market and expedite the loan application process. By doing away with manual processes like pre-qualifying borrowers and expediting property evaluations, data analytics can speed up loan approvals.

Leveraged Lending

Magistral serves borrowers looking for growth capital by providing a simplified leveraged lending procedure. They focus on alternative data sources outside of traditional financial statements and use proprietary technology to speed up credit analysis and due diligence.

Retail Lending

Magistral evaluates the creditworthiness and risk profiles of borrowers by utilizing sophisticated data analytics. Personalized loan offers and instant pre-approvals are given to borrowers.

About Magistral Consulting

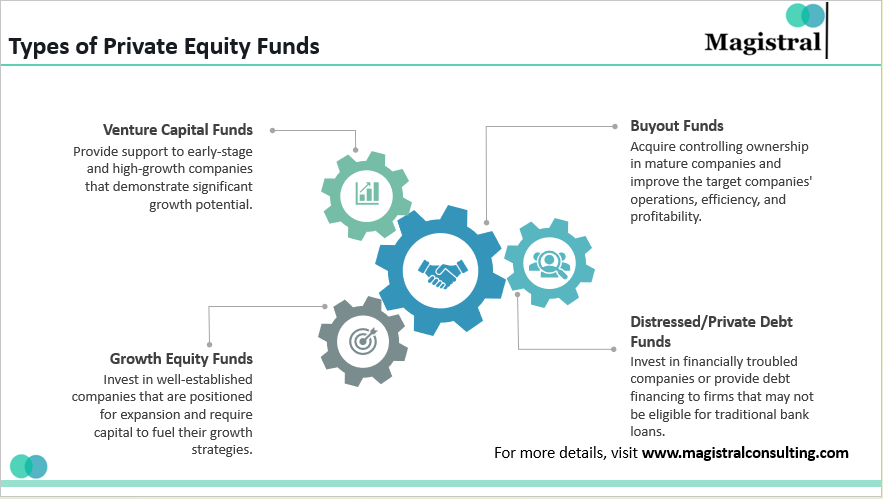

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

How can you reduce lending operations outsourcing costs with Magistral?

Magistral can help reduce lending operations outsourcing costs through analyst expertise and optimized workflows.

What are some specialized lending operations practices offered by Magistral?

Magistral offers services such as Retail financing, Leveraged Lending, and Commercial Real Estate Lending that go beyond typical financing. accelerated loan approvals via property appraisal and data-driven pre-qualification. quicker credit analysis for borrowers looking for growth funding through the use of various data sources. sophisticated data analytics to evaluate the risk profiles of borrowers and present customized lending solutions.

How do you choose the right outsourcing partner for your lending operation’s needs?

The best way to choose an outsourcing partner is to check their scalability, expertise, cost-effectiveness, and experience. Magistral has all four attributes to be the best lending operations outsourcing partner for you.