Picture a hedge fund that deals with very dynamic markets, unceasing regulatory pressure, and an influx of alternative data. In this scenario, the outsourced hedge fund analytics has become one of the most tactical moves for the enhancement of speed, precision, and investment confidence. This change is encouraged by the growing cost pressures and the desire for more quantitative insight. While the managers encounter thinner spreads and heavy scrutiny, outsourcing enables them to concentrate their internal skills on high-value areas. At the same time, leverage specialized models, alternative datasets, and scalable analytical power that organizations usually invest heavily in for internal use.

With the use of more advanced models similar to those used in real estate financial modeling, hedge funds have started to outsource as a way of acquiring specific modeling expertise in the sector without the long hiring cycles. This results in smoother deal screenings and quicker portfolio decisions.

Outsourced Hedge Fund Analytics: Market Overview

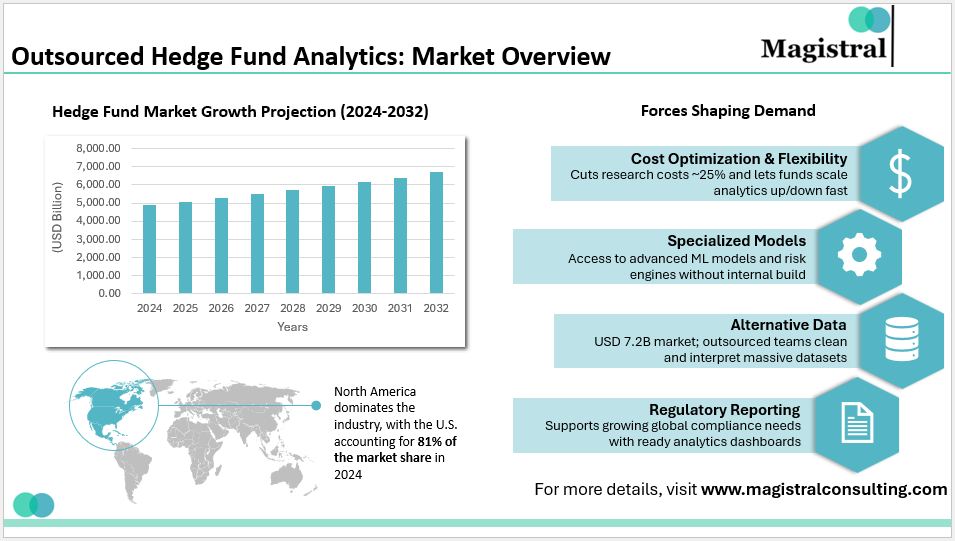

The global hedge fund industry is large and growing. The hedge fund market was valued at USD 4,879.6 billion in 2024. It is projected to grow to USD 6,396.4 billion by 2032, at a compound annual growth rate (CAGR) of ~4.0%. Geographically, North America dominates the industry, with the U.S. accounting for 81% of the market share in 2024. By investor type, institutional investors (such as pensions, endowments, and insurers) are the largest segment, followed by high-net-worth individuals, family offices, funds of funds, and retail investors. This concentration reflects how allocators continue to lean on hedge funds for diversification, risk-adjusted returns, and alternative strategies. The demand for outsourced hedge fund analytics is accelerating because asset managers need to operate leaner while analyzing more data exponentially.

Outsourced Hedge Fund Analytics: Market Overview

This section explores the forces shaping demand, including cost optimization, alternative data growth, and regulatory expectations.

Cost Optimization and Operational Flexibility

Hedge funds are under pressure to deliver alpha while keeping management fees competitive. Outsourced hedge fund analytics reduces fixed costs by converting analytics functions into variable expenses. A recent PwC operational benchmarking study noted that funds using external analytics partners experience up to twenty-five percent lower research-related cost burdens. The flexibility to scale up or scale down quickly is especially valuable in volatile markets, allowing funds to avoid large internal teams during quieter macro cycles.

Access to Specialized Analytical Models

External analytics teams bring niche capabilities that many funds cannot build internally. These include machine-learning-based factor modeling, risk decomposition engines, and automated screening systems. Many hedge funds now rely on outsourced quantitative modeling similar in structure to what private equity teams use for portfolio analytics. The result is a stronger ability to evaluate new asset classes, back-test ideas, and deploy capital faster.

Surge of Alternative Data

The market for alternative data was valued at USD 7.20 billion in 2023. It is projected to continue its rapid expansion at a compound annual growth rate (CAGR) of 50.6% through 2030. Hedge funds now integrate credit card data, satellite imagery, social sentiment, and supply chain feeds. Outsourcing accelerates ingestion, cleaning, and interpretation of these huge datasets. External partners frequently operate with advanced data engineering stacks, which hedge funds utilize to derive signals with higher precision. The raw data stream has rendered contracted personnel particularly crucial in tasks like venture capital market research. It is characterized by a mixture of structured and unstructured datasets used in predictive modeling.

Regulatory Pressures Driving Better Reporting

How Outsourced Hedge Fund Analytics Enhances Investment Decision-Making

Outsourced hedge fund analytics is an innovation that dramatically transforms investment workflows by making signal generation, risk management, portfolio attribution, and decision-making faster and easier.

Sharper Alpha Generation through Quant-Led Research

Outsourced modelers help create factor screens, produce hypothesis-driven datasets, and signal comparisons across different regions. Multi-factor strategies now account for more than one-third of global equity flows managed by quants, indicating that there is a demand for more in-depth analytical foundations.

Faster Idea Validation and Back-Testing

External analytics teams cut down the time required for the validation of ideas. Rather than waiting for internal quant teams to conduct comprehensive back-tests, outsourced professionals can provide model simulations in just one overnight session. This speed-up in the cycle makes the market more competitive, where execution gaps of milliseconds influence the results.

Risk Decomposition and Exposure Management

The application of sophisticated risk modeling remains the most significant reason for outsourcing. Funds use partners to quantify factor-based exposures, track systematic and idiosyncratic risks, and understand sectoral bifurcations. The capability of performing fast scenario analysis is yet another point attracting investors in capital raising conversations. Because the demand for risk transparency is getting deeper.

Portfolio Attribution and Performance Diagnostics

Attribution analytics is how managers get to know the actual sources of alpha. Outsourced teams can analyze daily P&L contributions, factor premiums, and execution analytics. This is to make a small adjustment to the strategy, thereby creating a stronger alignment between the investment vision and performance.

Automation and AI-Driven Efficiency

Automated insights cut down on manual spreadsheet work and boost the reliability of results. This trend coincides with the progress made in DCF valuation and financial modeling.

Operational Advantages of Outsourced Hedge Fund Analytics

Outsourced hedge fund analytics not only enhance the performance of investments but also the very foundation of hedge funds, consisting of operations.

Scalable Analytics Without Long Hiring Cycles

Hiring senior quants, data engineers, or econometricians is expensive and slow. Outsourced analytics teams provide instant access to talent without compromising work quality.

Higher Accuracy and Reduced Human Error

Utilization of a structured analytic pipeline brings about the elimination of human error and inaccuracies in reports. External recruiting firms enforce consistent practices for their auditing and thereby enhance accuracy for the entire research, risk, and valuation process.

Faster Turnaround for Research and Reporting

Hedge fund analytics teams that are hired from outside often work in different time zones. This means that hedge funds can have a workflow that is almost continuous. This leads to quicker reporting, faster and desk-ready model creations, and improved execution strategies.

Improved Business Continuity and Redundancy

Analytics production might be held up because of disturbances like fluctuating markets, changes in staff, and regulations. However, outsourcing partners through their globally spread teams add redundancy to the process, thus ensuring an uninterrupted and continuous flow of analytics and reporting cycles.

Outsourced Hedge Fund Analytics: Future Outlook

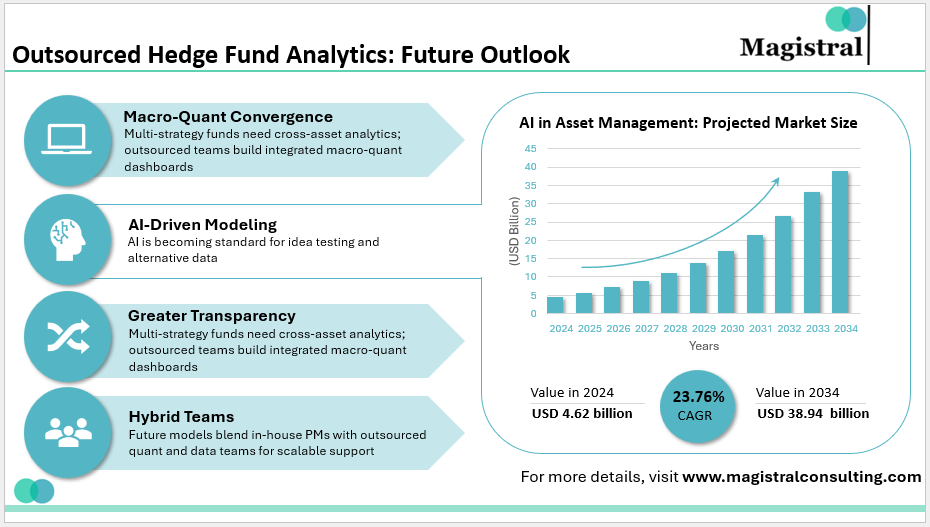

This section elucidates the future projection of outsourced hedge fund analytics concerning large datasets, cross-asset strategies, and advanced AI models.

Outsourced Hedge Fund Analytics: Future Outlook

AI-Driven Modeling Will Become Standard

Generative AI is changing the scenario of hedge funds for the better by providing them with new ways of thinking, analyzing alternative data, and drawing conclusions. By 2028, AI-supported research is expected to be standard across most asset managers. Analysts value the AI in asset management market at USD 4.62 billion in 2024 and predict it will reach USD 38.94 billion by 2034, growing at 23.76% annually.

Multi-Asset and Macro-Quant Convergence

As multi-strategy funds expand into commodities, credit, and macro, outsourced analytics teams will support cross-asset research by building integrated macro-quant dashboards. AI has also started changing the way of doing investment banking analytics because of the removal of partners who are excellent at working with capital-intensive modeling.

Increasing Institutional Demand for Transparency

The generation of investors is expecting nothing less than full disclosure and ESG metrics along with real-time reporting. Analytics done by the outsourced groups make this possible since they create pipelines for reporting that are standardized across the globe, thus enabling real-time reporting.

Hybrid Teams as the New Normal

Outsourcing will not replace internal analysts but will create hybrid working models where external quant teams will be directly collaborating with portfolio managers and risk officers.

How Magistral Consulting Supports Outsourced Hedge Fund Analytics

Magistral provides a wide range of outsourced hedge fund analytics services. It includes support for risk modeling, compliance reporting, and operational scalability. Its cross-functional teams of quants, analysts, research specialists, and data engineers handle everything from screening and back-testing to factor modeling and portfolio diagnostics.

>Magistral’s outsourced hedge fund analytics services align with industry needs by offering standardized research frameworks, customized quant models, and alternative data processing capabilities. The firm assists hedge funds in adopting AI-enabled analytics so they can enhance trading signals and portfolio intelligence. Using the same disciplined approach found in its investor intelligence solutions, Magistral ensures that hedge funds receive predictive models, automated dashboards, and actionable scenario analyses. The company’s expertise includes AI-assisted deal analysis and portfolio surveillance systems, thereby solidifying its position as a strategic ally for funds that need large-scale analytical support.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

Nitin is a Partner and Co-Founder at Magistral Consulting. He is a Stanford Seed MBA (Marketing) and electronics engineer with 19 + years at S&P Global and Evalueserve, leading research, analytics, and inside‑sales teams. An investment‑ and financial‑research specialist, he has delivered due‑diligence, fund‑administration, and market‑entry projects for clients worldwide. He now shapes Magistral Consulting’s strategic direction, oversees global operations, and drives business‑development support.

FAQs

What tasks can be outsourced in hedge fund analytics?

Is outsourcing analytics secure for hedge funds?

How does outsourcing improve investment decisions?

Why is alternative data central to outsourced analytics?

Are outsourced analytics suitable for small hedge funds?