Global investment research plays a critical role in shaping financial strategies and decisions across the world’s capital markets. As global markets continue to grow and the economies of the world become more interconnected it has come to be that quite advanced and sophisticated global investment research techniques are needed by institutional investors, asset managers and hedge funds especially. Such investors rely on using developing techniques that involve macroeconomic analysis, sector knowledge as well as security-specific analysis in making investment decisions in very uncertain and dynamic markets.

Macroeconomic Dynamics and Geopolitical Influences

External environment and the risk factors can chiefly influence investment decisions.

COVID-19 Influence on Inflationary Trends

The COVID–19 outbreak significantly contributed to rising inflation all over the world and by the year 2020 inflation stood at 8.8% the highest in a couple of years. As a result of the inflationary pressures, the central banks resorted to very forceful monetary policies, with that of the US entering as high as 5.25%-5.50% rate in the year 2023.

For Emerging Markets

Rising inflation and the changes in policies led to a great deal of capital flight from emerging markets. This situation has resulted in depreciating currencies, recession, and low growth rates in the respective areas.

Disruption in Trade Activities

Lockdowns imposed on the outbreak of the pandemic disrupted trade activities greatly, revealing the extent of global business operations. Close to these trade wars are causes like the one between America and China which also affect investment decisions among other issues in sectors like technology, energy, and agriculture that face tariffs that threaten business.

Rationale of Continuous Tracking

The members of the global investment research teams should also ensure that they monitor current economic developments, as well as changes in the relevant policy environment towards the future. It is necessary to know how geo-political factors impact in order to devise investment plans that would succeed.

Sector-Specific Research Identifying Trends and Opportunities

There are various trends in opportunities with regards to the different sectors. Some of them are:

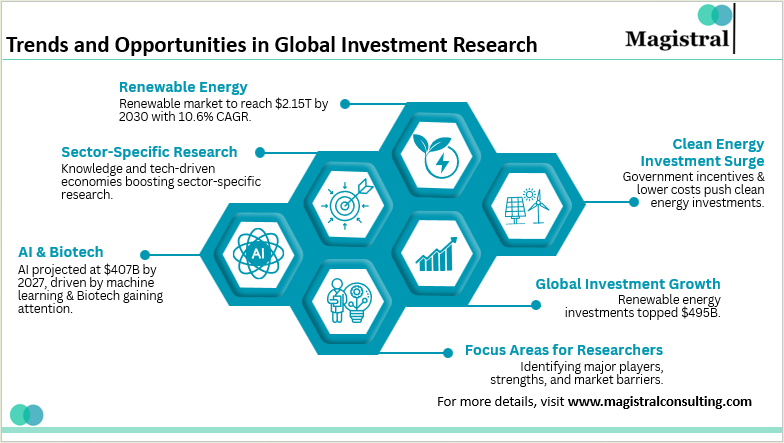

Trends and Opportunities in Global Investment Research

Renewable Energy

In addition to the above, the renewable energy market is forecasted to grow in value to 2.15 trillion dollars by the year 2030 with the compound annual growth rate (CAGR) being 10.6%. This area has thus become a principal area of focus for a study on the trends of investments due to the changes towards the use of energy in a more sustainable manner.

Emerging Sectors AI & Biotech

Artificial Intelligence and Biotechnology are making their way towards convergence owing to the technology in these fields. The value of the AI industry can reach $407 billion by 2017, given the advances in machine learning and intelligence of various systems.

Investment In Clean Energy on The Rise

In reaction to these changes in perspectives, several nations have been providing crucial government returns on investment and the corresponding infrastructure costs for solar and wind, which has led to the clean energy drive seeing huge funding. In the year 2022 alone, the amount of money spent on clean energy projects out of all investments reached over 495 billion dollars, which indicates that investors have very positive expectations concerning this business.

Global Investment Growth

Increased investments in renewable energy, artificial intelligence, and biotechnology, among other levels, further affirm the global growth in investments. There has been a trend whereby technology and sustainability are driving most of the growth in such sectors.

Areas of Focus for Researchers

In the case of growing industries, global investment research teams are looking at the emerging industries, looking for the key players, their power and the barriers in the respective markets. This in turn puts most equities on an attractive investment climate for those who are concerned.

Quantitative Models and Advanced Data Analytics

Today quantitative analysis and applied big data science in global investment research are essential components of any investment research. In this respect, financial institutions have greatly utilized market models to assess future market performance. The global alternative data trends market in the financial services industry is expected to grow at a CAGR of 50.6% between 2024 and 2030. This is because of technological breakthroughs in machine learning and artificial intelligence.

Hedge funds have always been at the cutting edge as far as the development of sophisticated algorithms to engage in systematic trading optimally and more recently in high-frequency trading (HFT) which takes advantage of arbitrage opportunities. These funds apply sophisticated models to analyze huge amounts of data. This includes but not limited to historical prices of stocks, earnings data, and even social network sentiment. Studies on the subject have found that firms employing AI-based trading strategies outperform traditional strategies by about 25%.

The Role of Alternative Data in Decision-Making

Global investment research has experienced a shift with the incorporation of alternative data within its pyramid structure. Information obtained from various sources including satellite, web browsing, and geographical information gives current updates. This enables better decision-making for global investment research. The worldwide market for alternative data is predicted to expand at a CAGR of 52.1% between 2023 and 2030. This is because these insights assist investors in developing strategies.

For example, satellite images have enabled the modeling of dicot yield in regions. Thus, giving an alert when potential threats to food security arise. It can also extend to analyzing the social media sentiment towards the target brands or sectors to explain investor confidence.

The Future of Global Investment Research

Technological Advancements Shaping Research

AI will transform capabilities in research, especially in the speed of making resultant decisions. Advanced Data Analytics tools will go beyond and widen the research undertaken enhancing the precision and insight obtained.

Introduction of ESG and Other Data

Environmental, Social and Governance (ESG) factors will increasingly influence the investment decision-making process. The use of alternative data will be part of the analysis process to enhance the existing traditional methods.

Market Development and Projection

The Market is forecasted to Reach In the year 2024. The size of the global investment research market is estimated to be worth $19.4 billion. Estimation of Future Business Performance Forecasted to have a Compound Annual Growth Rate (CAGR) of 6.2% in the proceeding five years.

Factors for the Successful Future of Investment Management Companies

Agencies which successfully employ sophisticated technologies with updated tools and methods, will be in a position to tackle the challenges of the world. In an information industry where information is time it is hard to survive for firms that remain in stagnation.

Magistral’s Services for Global Investment Research

Magistral Consulting provides a complete range of global investment research services intended to facilitate value-added investment decision-making throughout the investment process. Our research capabilities are ranked by sectors, markets, and geography so that those investment firms that count on us will always have the right insights for their investment strategies. Below you can find some of our services for global investment research

Industry Research

Magistral’s thorough Industry Research supports global investment research. We enable firms to gain deep insights into industry movements, market features, and competitive environments. We evaluate the drivers of growth, regulatory changes, new technologies, and general economies to deliver market-ready solutions. Be it finding the right market or going into the depths of the sector. Our industry research surfacing threats and opportunities for investments allows providing all with statistics-centered choices in foresight of practice.

Company Profiling and Competitive Landscaping

Our Company Profiling and Competitive Landscaping services include an in-depth understanding of a company and its place in a given industry. Magistral, for instance, assesses the financial status of target companies, their operational effectiveness, market presence, and strategic movements in comparison with other participants.

Preparing Investment Memos

For global investment research, we also assist in preparing investment memos. More specifically in composing Memos where relevant information is compiled, analyzed, and presented clearly and concisely. Such documents include industry analysis, company business and financial plans, investment risk levels, and other more relevant information. This gives investors an awareness of the opportunities in the investment.

Research Incoming Pipeline

Magistral also assists investment firms in enhancing their deal flow through the Research Incoming Pipeline. We examine and screen potential investment opportunities according to a set of criteria such as business financial strength, market share, growth capacity, risks, and others, by our professional team.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

What is alternative data, and how does it impact investment decisions?

Alternative data refers to non-traditional data sources like satellite imagery, social media sentiment, and web analytics. This data provides real-time insights that traditional data may not capture, allowing investors to better assess consumer behavior, supply chain risks, and environmental factors, leading to more informed investment decisions.

How do regulatory environments affect global investment research?

Regulatory frameworks, such as MiFID II in the EU, have changed how investment research is consumed and paid for. Additionally, regulations in emerging markets like China and India are continually evolving, affecting capital flows, taxation, and corporate governance. Research teams must stay updated on regulatory changes to ensure compliance and mitigate risks.

What is the future of global investment research?

The future of investment research lies in the growing integration of artificial intelligence, big data analytics, ESG considerations, and alternative data sources. Investment firms that adopt these technologies and approaches will be better positioned to manage the increasing complexities of global markets and stay competitive.