As global markets push for more differentiated risk management strategies and data-supported validation, the requirements of due diligence questionnaires continue to grow. Not only have regulations tightened, but there are also mounting crises around the world. Changes in technology are accelerating, and the number of business types is also growing and becoming more complex. The scope and sophistication of each questionnaire directly impact business outcomes and vary on existing complexity. It is also linked to technological growth/development. Stakeholders envision a world where use of analytics and automation provides the speed, cost, time savings, and real-time risk management. It enhances the questionnaires by 2025. Organizations that have redefined their approach to questionnaire design and execution are moving proactively to surface potential hazards and create value opportunities.

Understanding the Due Diligence Questionnaire

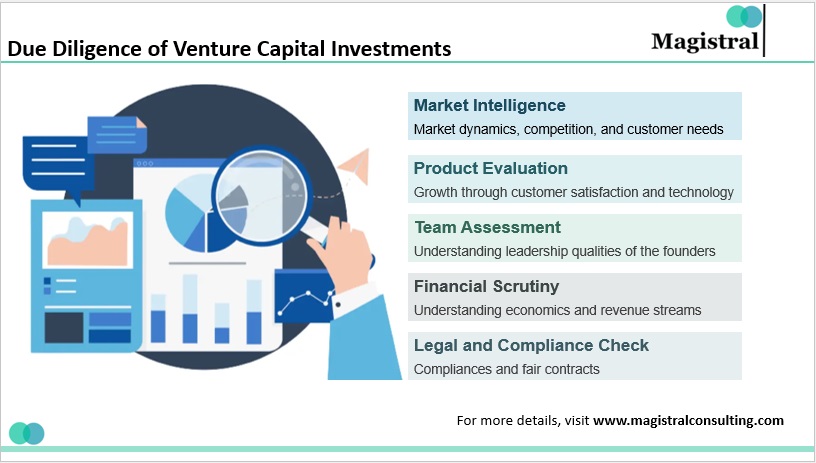

DDQs use a structured approach in the acquisition of the substantive information regarding the financial health, legal position, operational resiliency, cyber security, and ESG performance of a company. These have been found to be useful across organizations to assist risk assessment, offer a more uniform platform for disclosures, and finally arrive at fair judgments. Organizations find them useful for facilitating the risk assessment process, providing a more uniform method for disclosures, and ultimately making informed decisions. According to PwC’s M&A Outlook 2023 report, 76% of failed deals listed inadequate due diligence as a key reason for the failure. This signifies the due diligence questionnaire is a critical part of completing successfully.

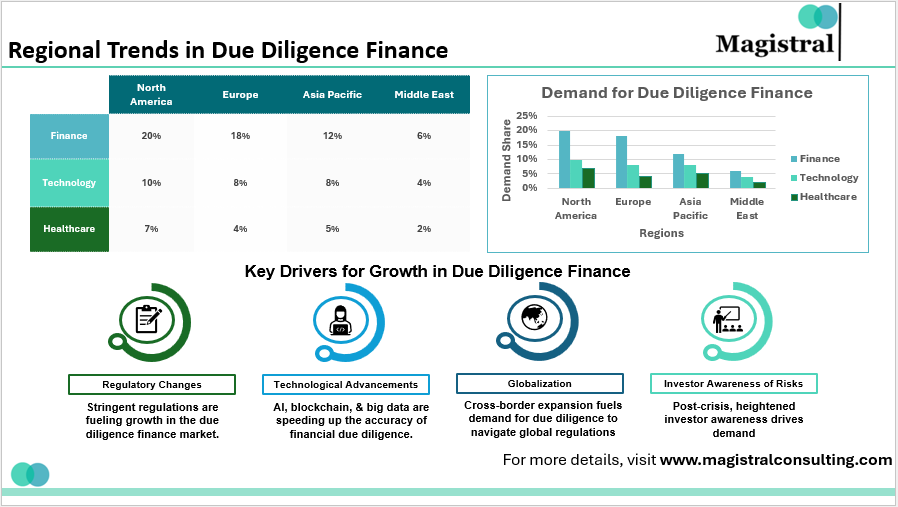

Current Market Trends and Data Insights in Due Diligence Questionnaire Usage

Recent market benchmarks indicate that global M&A deal openings increased by 12% year-on-year in 2024 with APAC seeing a 17% lift. The increase in volume increases the pressure, both for effective questionnaires, and fast turnaround from vendors. More organizations are turning to boutique ODD (operational due diligence) firms and technology consultants as partners to have additional capacity and resilience.

More organizations expect to see ‘digital completion’ and ‘automated review’ of their questionnaire, particularly with the context of regulated industries, cross-border transactions, and operational outsourcing.

Evolving Landscape: Why Modern Businesses Redefine the Due Diligence Questionnaire

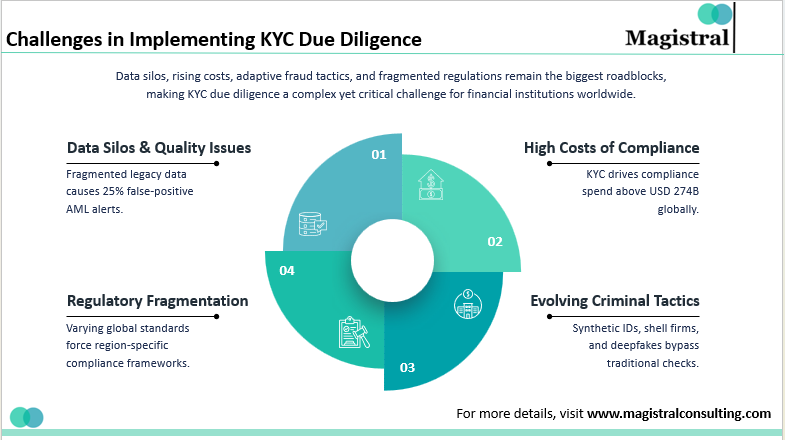

Transformative business dynamics and more stringent regulations have now positioned the due diligence questionnaire as a key process to maintain an operational license to operate and be strategic supported. The traditional bastion of due diligence – a straightforward questionnaire has in recent years, left organisations ill-equipped to identify nuanced risks, or adapt to the real-time changes in their supplier or partner environment. In response, companies have utilised digital transformation and data-driven improvements to remedy these shortcomings.

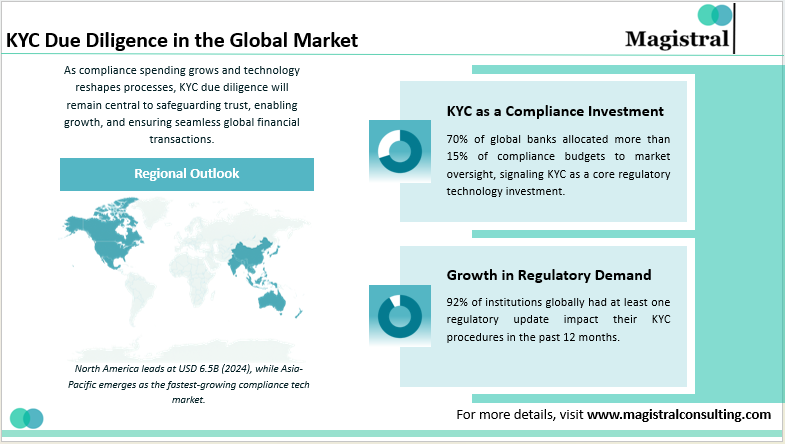

Rise of Regulatory Complexity

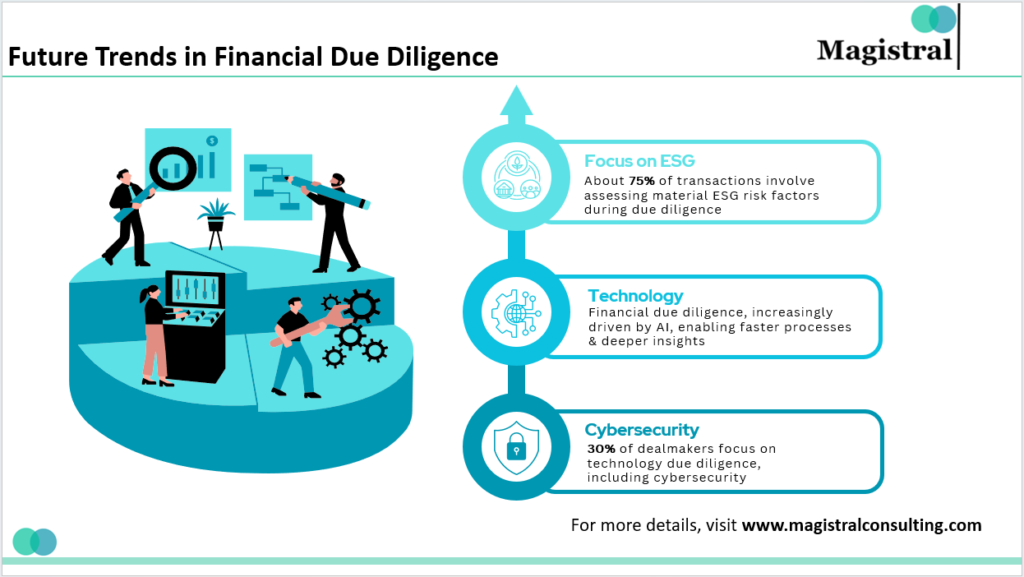

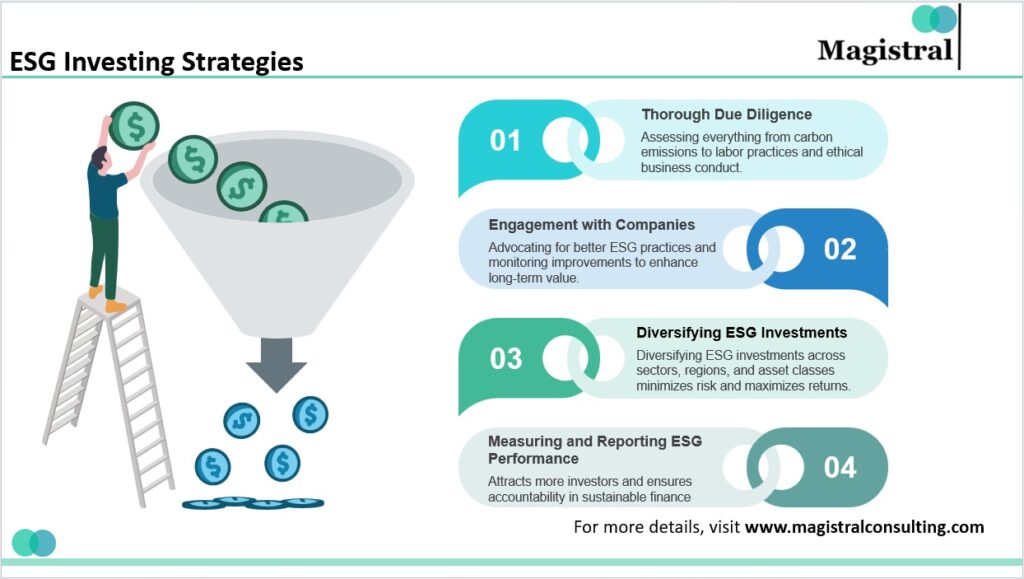

The regulatory landscape has quickly evolved resulting in changes to compliance related questions a company has as it relates to its due diligence questionnaire. Companies are being forced to include the varying updates of global data privacy legislations, anti-bribery legislation, and ESG (environmental, social, governance) requirements around the world into part of their due diligence assessment.

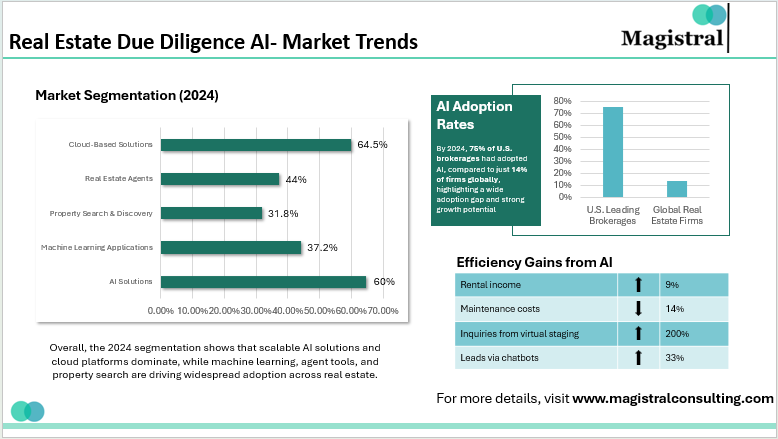

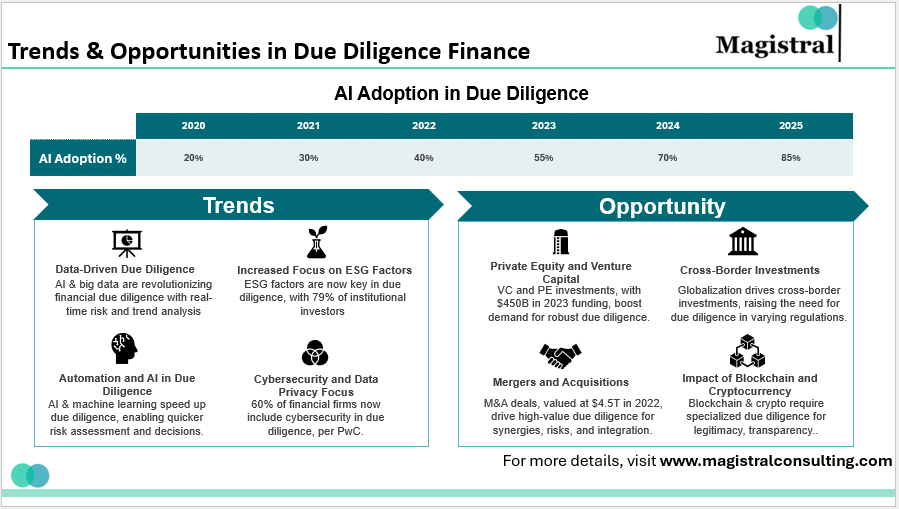

Dependence on Technology and Automation

Recent industry surveys show that using digital tools including artificial intelligence baseline standards and workflow automation have increased the speed and accuracy of prior response inquiries allowing for a more expedited questionnaire process. Platforms, such as Datasite, allow risk signals to be flagged in real time and now users can integrate outputs of analytics to their compliance, monitoring, and risk scoring engines.

Extended Timeframes and Greater Depth

Market information from Datasite shows due diligence timelines in APAC have increased. This is anywhere from 30-50 days for some markets in 2024. This shows the importance of being able to capture all required disclosures and emerging risks in a structured questionnaire. They then use the due diligence process as thorough validation.

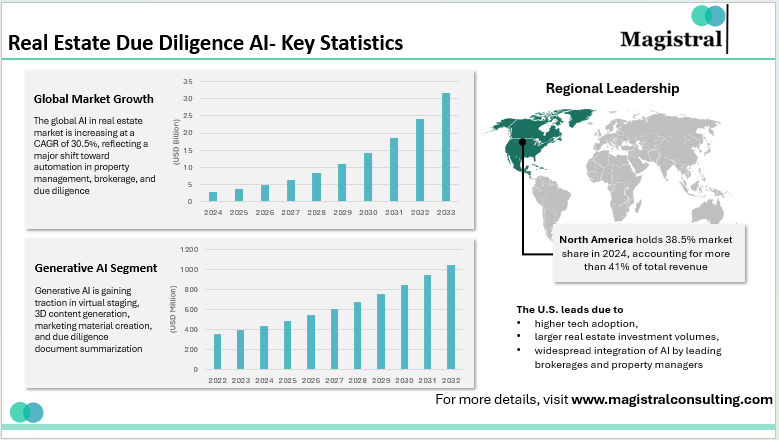

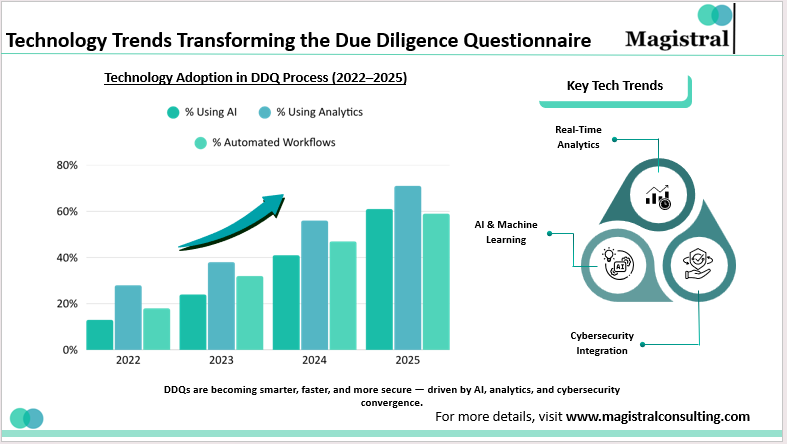

Technology Trends Transforming the Due Diligence Questionnaire

A major transformation in 2025 involves integration of analytics, artificial intelligence, and project management solutions within questionnaire administration.

Technology Trends Transforming the Due Diligence Questionnaire

Analytics for Real-Time Insights

Top organizations are employing analytics platforms to automate the review of questionnaires and the scoring of risk. These solutions help identify inconsistencies or overly optimistic information and provide clear signals for decision-making.

AI and Machine Learning

Artificial intelligence is increasingly improving questionnaires, such as identifying duplicate responses, suggesting follow-up questions, and placing documentary evidence into context. AI systems also help track all previous cycles of questionnaires, which increase the performance of future versions.

Cybersecurity Integration

As threat landscapes continue to broaden, DDQ platforms perform real-time monitoring of cyber risk. It also deals with threat intelligence feeds providing existing compliance levels and flagging risks.

Essential Components: Structuring a High-Impact Due Diligence Questionnaire

Organizations are increasingly depending on a standardized, risk-based model for their questionnaire, covering the core pillars of financials, operational health, cyber security, ESG responsibilities.

Financials and Operational Health

A well-structured questionnaire will provide transparency into financial statements, internal controls reports, audit history, and cash flows. Best practices favour transparency and documentation, including auditor reports, profit margins, and relevant insurance coverage.

Legal Compliance

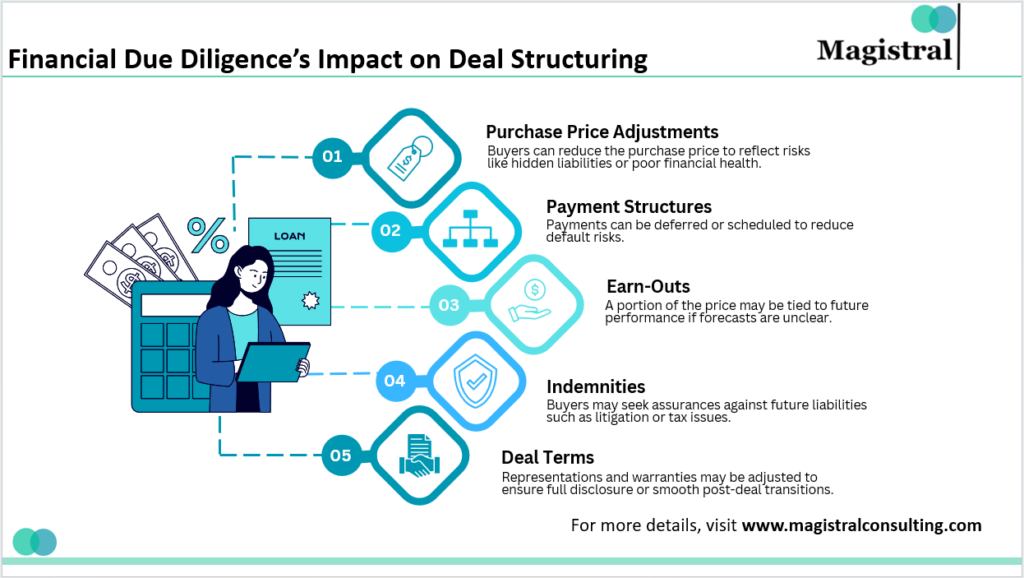

Legal questions focus on completed and pending litigation, contract validity, and intellectual property protections. For M&A or vendor scenarios, questions on anti-corruption and export controls should also be included. This ensures the company’s legal standing and meets the legal obligations of noting adherence to applicable laws.

Cybersecurity and Data Protection

Modern conceptualizations of questionnaires will dwell on IT governance, access management, encryption protocols, and breach notification processes. Adherence to globally recognized standards, such as ISO 27001, NIST, or SOC 2 compliance, is increasingly becoming a must. This is an opportunity to minimize the risk of cyber or data threats. It also helps in a position where the company could manage events to safeguard its information appropriately

ESG and Sustainability Criteria

In 2025, the best practice will include ESG as part of the questionnaire. It is in accordance with investor, regulator, and societal demands for transparency and accountability. Questions about environmental compliance, sustainability initiatives, and governance practices should be present. The purpose is to also ensure that the company complies with global standards and is also prepared for (regulatory) future changes.

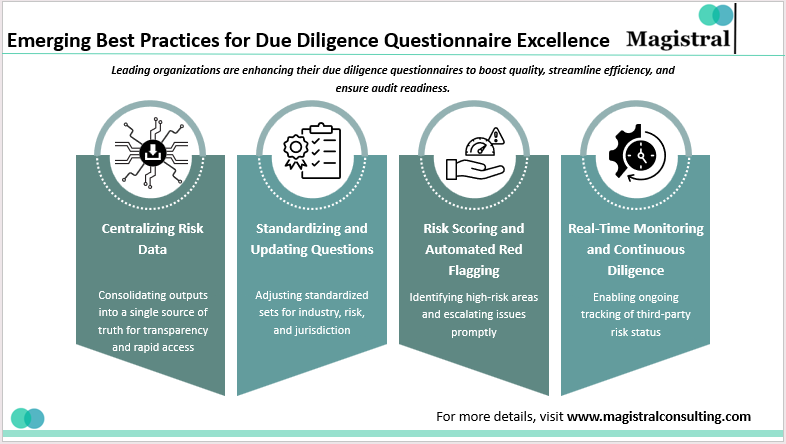

Emerging Best Practices for Due Diligence Questionnaire Excellence

Top organizations are refining their questionnaire processes to improve quality, efficiency, and auditability.

Emerging Best Practices for Due Diligence Questionnaire Excellence

Centralizing Risk Data

Consolidating all questionnaire outputs and supporting documentation into a centralized data repository or “single source of truth”. It improves transparency and offer the ability for rapid access to information across the organization, ensuring that it is done consistently.

Standardizing and Updating Questions

Firms can standardize template forms and question sets, taking into consideration industry, risk profile, and jurisdiction. Thereby eliminating redundancy and ensuring compliance with revisions to relevant regulations and/or internal policies.

Risk Scoring and Automated Red Flagging

Integrating risk matrices into the questionnaire process allows organizations to focus resources on the highest-risk areas and initiate immediate escalation for identified “red flags”.

Real-Time Monitoring and Continuous Diligence

DDQ frameworks are increasingly facilitating ongoing monitoring enabling organisations to receive timely alerts of any changes to the risk status of third-parties or market conditions.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

Akansha is a Stanford Seed alum with an MBA (Finance & Operations) and B.Com (Hons). She delivers business and financial research for PE/VC and investment banking clients. Experience spans fundraising, M&A support, deal sourcing, consolidation accounting, supply chain analysis, and CRM-led outreach. Known for meticulous detail and fast learning, she turns analysis into investor-ready decisions.