Introduction

After experiencing a turbulent time, the Merger and Acquisition sector is finally exposed to some light in the market. With the increasing diversification among businesses, investors, strategic acquirers, and alike interest holders they are utilizing more of their consciousness to understand the position of their business in order to strategically analyze and highlight the strengths and weaknesses related to the collaboration aspect of the businesses. A confidential information memo unfolds both the qualitative and quantitative aspects of any potential deal for an investor or potential buyer, the summary structure of the document allows the interested ones to measure the level of excitement for the opportunity. With a non-legally binding feature, the document answers the obvious and gives details about the investment’s growth potential.

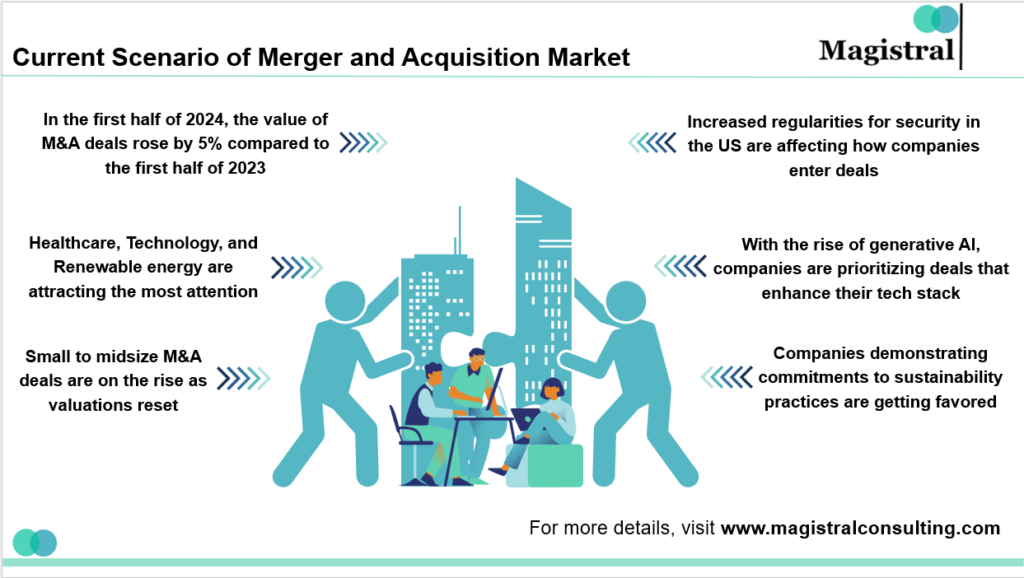

Current Scenario of Merger and Acquisition Market

Essential Components of Confidential Information Memo: Aspects that Prospects Should Evaluate

The document is typically a compilation of various components along with some additional components such as intellectual property rights details, legal regulatory details, industry, and market knowledge, and more. From details like the number of employees to the number of customers along with customer growth rate and customer concentration to financial details like financial statements and projections along with legal details which highlight elements such as ownership structure and leases. A prospective buyer focuses on the following key elements to assess the potential risk and value of the business on offer:

Overview of the company

This portion of the document contains basic information about the history of the company, its place of headquarters its structure, products, and services along with the market size of the company. Apart from this confidential information memos also contain required financial details like revenue, EBITA, and net income of the company as well as customer details and employee details.

Executive Summary

It consists of a detailed summary of the entire document with at least the following information:

Key business offerings of the company

Summarized financial detail

The nature of the transactions the company deals in

Finally an investment rationale explaining why an investment is worthy for an investor.

This snapshot of the business clearly outlines a compelling overview of why the business is a valuable opportunity for a buyer and investor along with the vision, mission, and core values of the business. For small businesses, this section sets the stage for comprehension which makes the businesses an attractive target for acquisition.

Market Analysis

Based on reliable data sources like the World Bank, IDC, and others confidential information memos contain a creditable market analysis. This helps the investor and acquirer understand the strategy of the company to deal with the various elements of the market. The major information in this section is related to the growth trends in the market with the factors driving them. Ranking the targets based on which mapping of the competitors is done. This helps the decision-makers to read, analyze, and interpret the future situation of the company in the market.

Financial Performance

Confidential information memo provides details based on detailed financial statements. This includes, cashflow statements, income statements, and balance sheets typically of 4 to 5 years. It measures the key metrics like amount and number of cash flows, the growth rate of revenue, the overall profitability of the company. This section allows the interest holders to understand the financial health as well as the financial potential (based on its growth prospects). This is done by drawing a trend analysis based on the past data of the company.

Operational Details

This section gives overall details of the operational functioning of the company which broadly includes production processes (if the company has in-house manufacturing), procurement details, procured technologies, supply chain details, logistics details, and other facilities of the company. By highlighting these operational details confidential information memo explains the real operational strengths and potential weaknesses of the company which helps the interest holders to take calculative risks post-acquisition in the market.

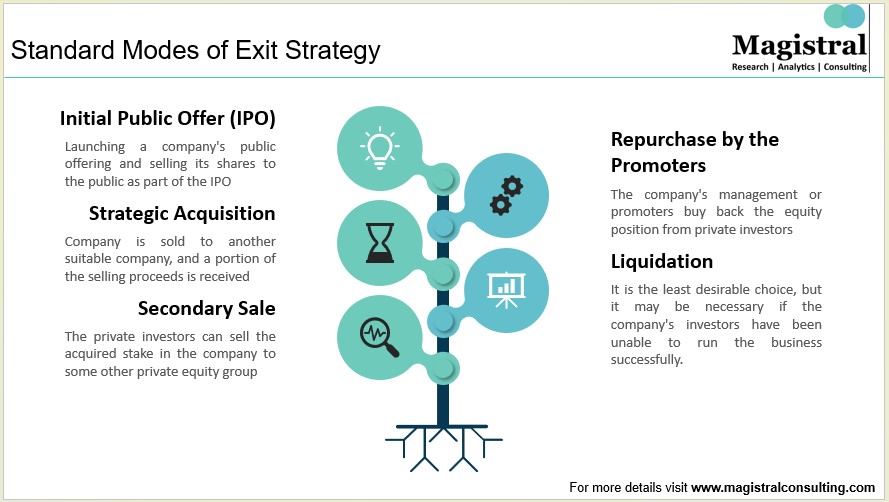

Opportunities of Growth

To give insights into the growth opportunities of the company, this section of the confidential information memo outlines the important roadmap of how the company can be scaled and grown in the future. Certainly, this section includes the plans for expanding (can be vertical or horizontal), strategies to capitalize on emerging trends in the industry, and plans for introducing new products or services in the market, this clears the vision of the company to the buyer which helps the buyer to gain confidence on the business and trust it with its investment.

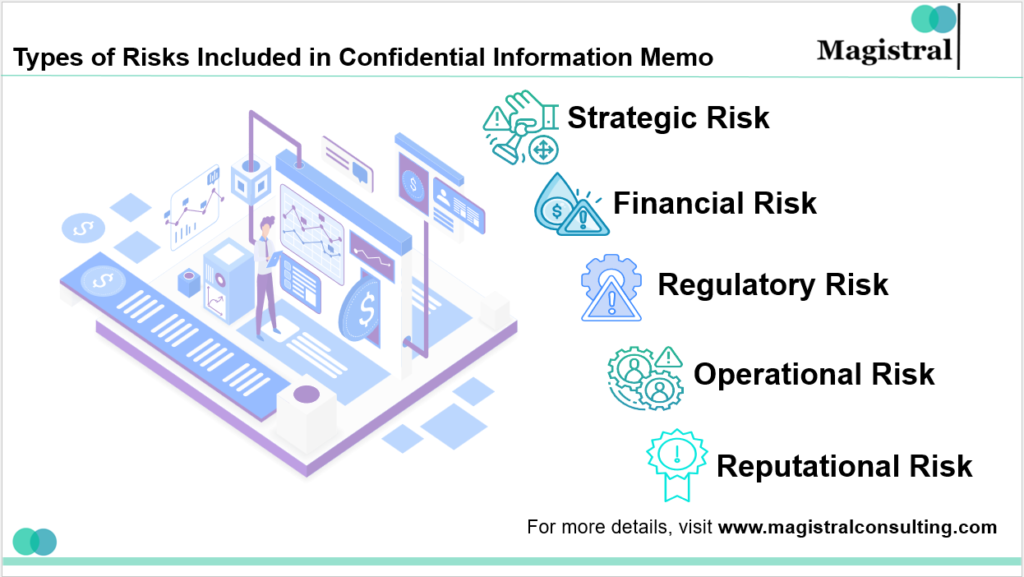

Risk Factors

There is no business without risk, which makes it one of the most important aspects for an investor to study. This section of the document provides a clear picture of the existing as well as the potential challenges of the business. Confidential information memo considers both the internal as well as external risks to measure factors like market volatility, legal challenges, operational inefficiencies, and more to inform interested stakeholders about essential possibilities for informed decision-making about acquisition.

Types of Risks Included in Confidential Information Memo

Legal Information

This legal information section explains the bottlenecks of legalities. This includes intellectual property rights, ongoing and expected litigations, compliance requirements, licenses, and permits related to business. The section holds more importance to small businesses than the large businesses in the market. This is due to more potential constructive legal structure. A study of all the risks in the confidential information memo allows the buyer to understand the crucial aspects of assessing the potential liabilities of the business.

Testimonials of Customers and Case Study

Towards the end, the document contains some relevant case studies and client testimonials as a sign of satisfied customers. Most of the confidential information memo contains this as it is evidence of growth for potential buyers and stakeholders. It also gives insights into the company’s value, effectiveness, and reputation. This is via the reviews shared by the clients themselves, it boosts confidence of the potential buyers in the market.

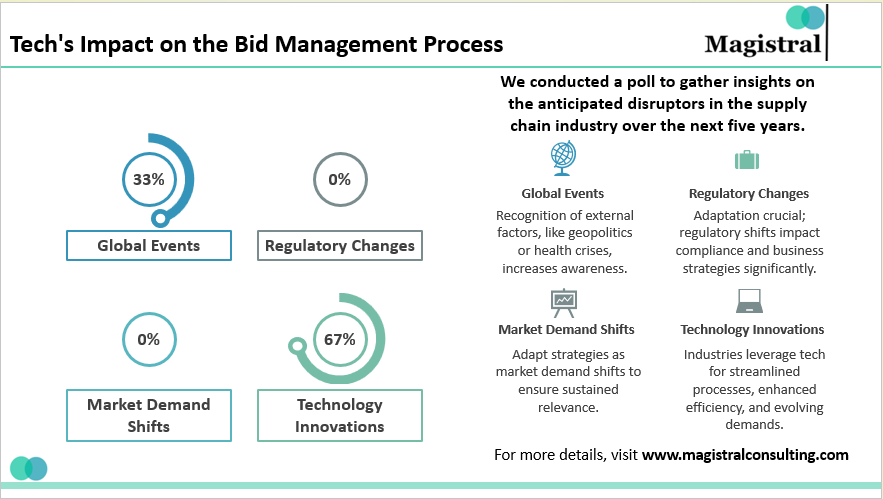

According to the report shared by PitchBook, Private Equity firms hold more than 27,000 portfolios of companies globally stating a sharp dip compared to the past years. With the evident steadiness in the market, one clear thing is the bounce back of Merger and Acquisition. Globally, corporates are moving towards Mergers and Acquisitions to accelerate growth and to reinvent their businesses to cope with AI. With the high demand for investments, AI is turning the way of the economy’s growth, and Mergers and Acquisitions are no exception. Confidential information memo allows investors to have a deeper look into the opportunities for investments.

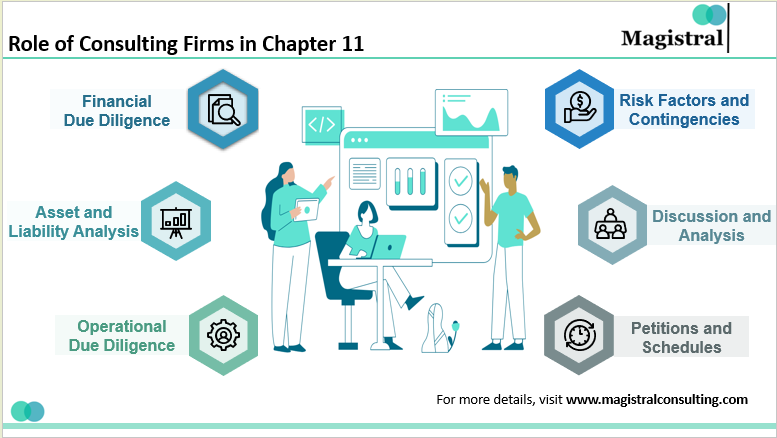

Magistral’s services for Merger and Acquisition

With the help of its expertise and specialized resources Magistral measures and covers various aspects of the transaction process. The following are the most important services of Magistral for merger and acquisition:

Valuation Services

The expert analysts of Magistral follow a detailed performance and industry analysis to determine the fair value of the business.

Deal Origination

Magistral helps businesses to identify and secure new investment opportunities and business deals to expand their business by investing meticulously.

Deal Execution

Magistral focuses on comprehensive management of the deal processing and precisely streamlines the operations to ensure a successful deal completion.

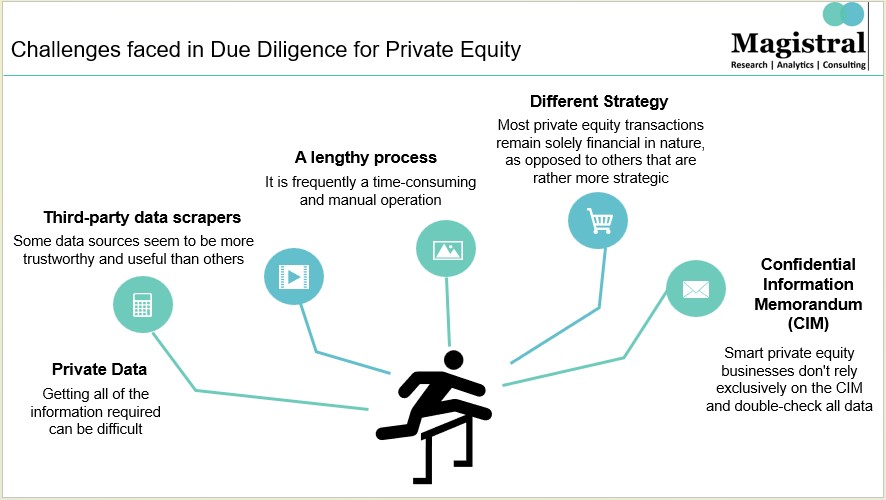

Due Diligence

Magistral conducts a detailed analysis of all financial, operational, and legal aspects. Through this we ensure clients about the valuation and potential of the collaboration.

Risk Management

Magistral identifies existing and potential risks related to merger and acquisition which majorly include financial, market, and operational risks.

Regulatory and Compliance

Magistral ensures that the collaboration meets all the necessary regulatory compliances and requirements including antitrust filings and other documentation.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

How does Magistral ensure confidentiality during Merger and Acquisition transactions?

Magistral follows typical stringent measures to maintain the confidentiality of the transactions. Some of the major measures include Non- non-disclosure agreements, restricted access to confidential data, and also conducts regular audits to ensure compliance with confidential agreements with clients.

What benefits does Magistral provide in cost management during Mergers and Acquisitions?

By offering scalable plans and solutions Magistral reduces the need for in-house infrastructure and resources which streamlines the processes, reduces the time and cost of management, and eliminates redundancies.

What steps does Magistral follow to manage operational risk post - Merger and Acquisition?

Magistral implements best practices for efficient operations and conducts risk assessments regularly to develop strategies for risk management.