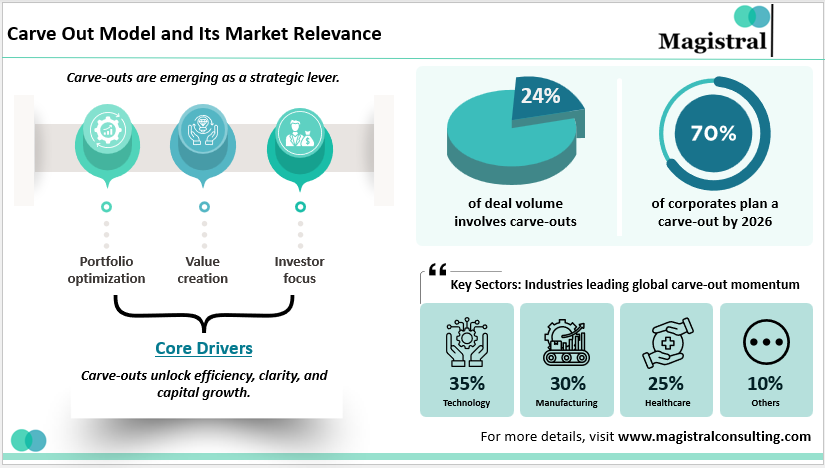

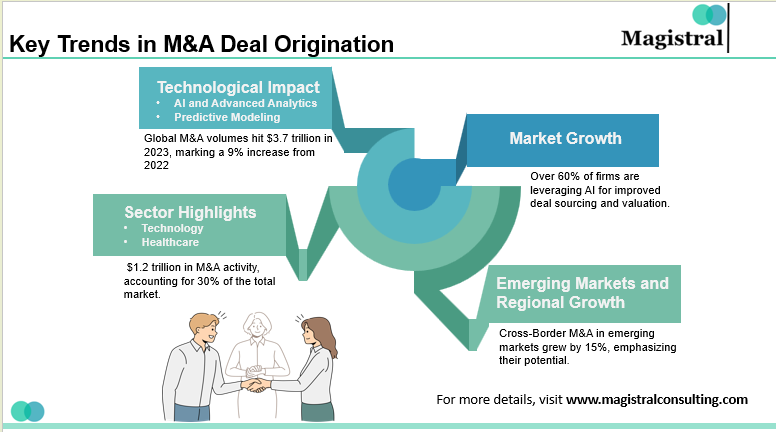

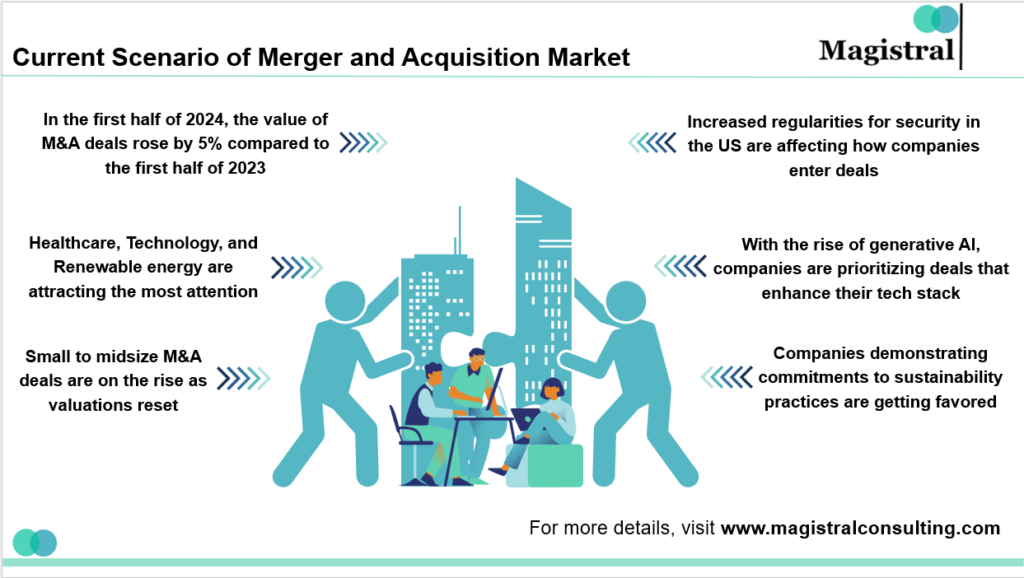

In today’s M&A landscape, the carve-out model is becoming increasingly relevant as companies seek to refine their portfolios and investors aim to achieve long-term value through a strategic investment process. In EY’s 2024 Global Divestment Study, roughly 70% of large companies are planning at least one carve-out by 2026, typically to help fund growth or improve strategic focus.

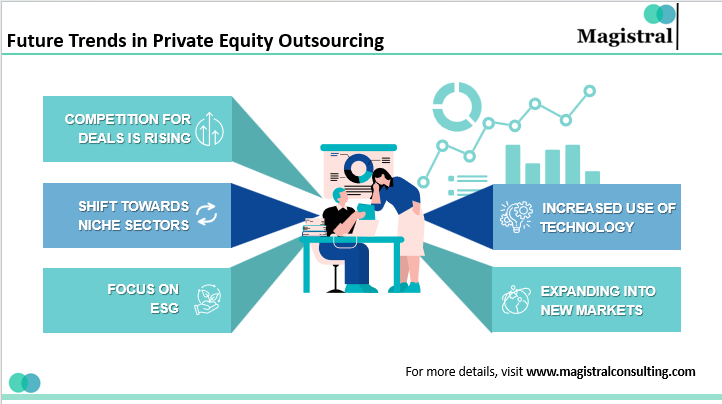

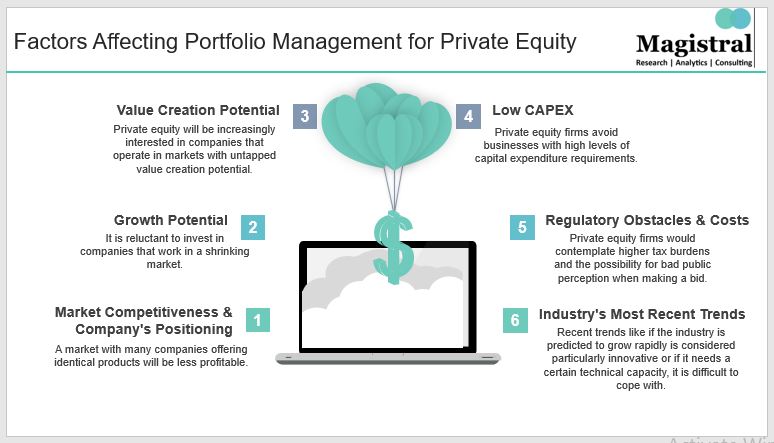

In addition to corporate restructuring, the carve-out process attracts private equity investors who are searching for lower-optimized assets that they can turn into more optimized and potentially desirable assets. So, the carve-out model could be considered a bridging model for corporate restructuring and growth investing to promote efficiencies, create value, and competitive standing in a market.

Carve Out Model and Its Market Relevance

Carve Out Model and Its Market Relevance

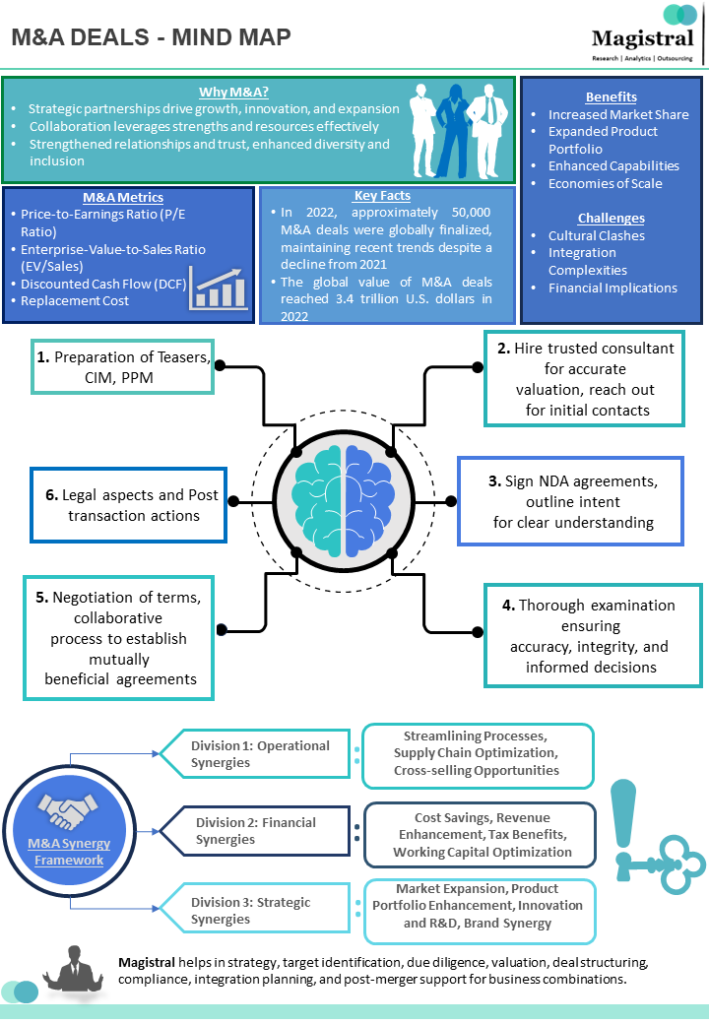

The carve-out model is the process by which a company’s unit or subsidiary is completely or partially separated from the parent company and allowed to operate as a separate entity. According to the PwC’s 2025 M&A Outlook, carve-outs accounted for almost 24% of worldwide transactions in 2024, the most vigorous activity being recorded in the areas of healthcare, manufacturing, and technology.

The model is becoming increasingly common as companies are trying to cope with the difficulties in the economy by concentrating on their main businesses. In addition, private equity firms and institutional investors are taking advantage of the carve-outs to buy good assets at low prices and, at the same time, reorganizing them to realize the synergies both operationally and financially.

Rise of Strategic Portfolio Optimization

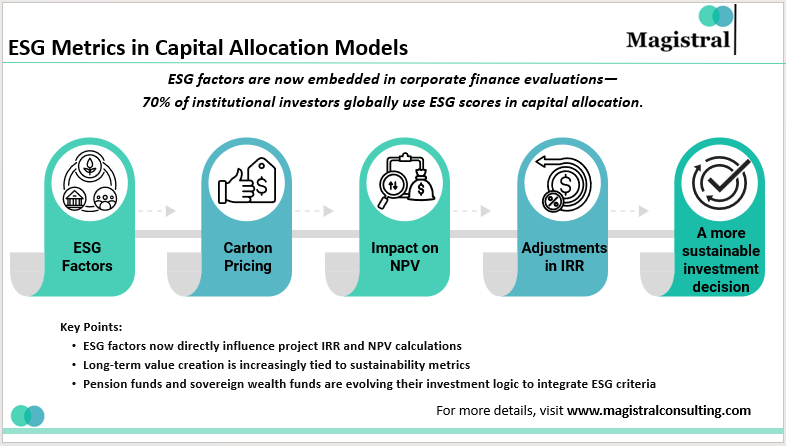

According to Deloitte’s Divestitures Report, 78% of global executives surveyed view carve-outs as the primary lever for strategic repositioning. Rising costs of capital, combined with investor pressures to focus on performance, have made such transactions commonplace on boardroom agendas.

Example: Siemens’ Energy Division Spin Out

When Siemens pursued a carve-out of its Energy division to form Siemens Energy AG, it created a focused business with a specialty in renewables, while also allowing both entities to articulate a more focused and clear strategic agenda. As the example shows, the carve-out model can create value clarity.

Financial and Operational Dimensions of the Carve Out Model

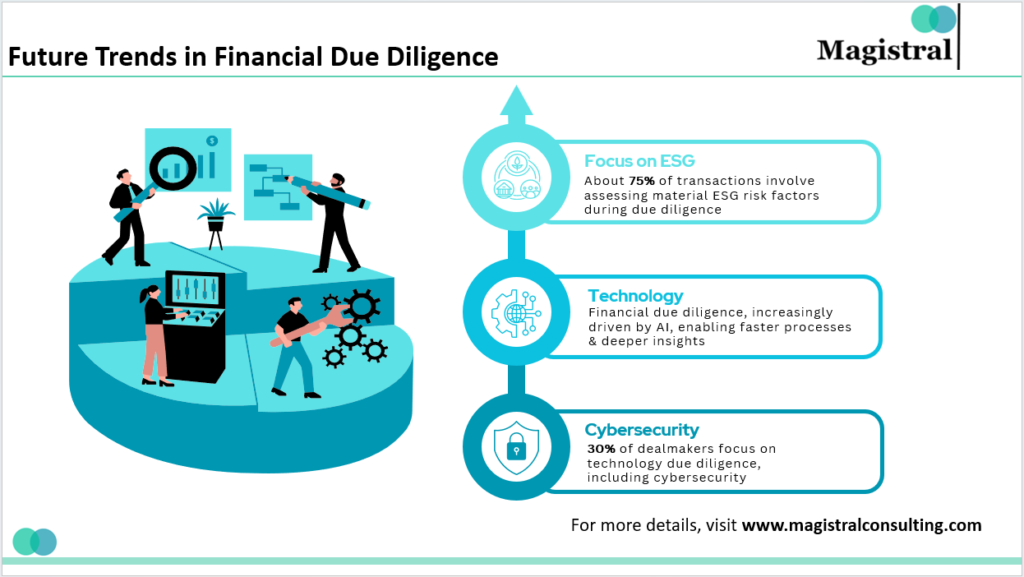

In addition to strategic decisions, there’s an important financial and operational aspect of successfully executing the carve-out model. According to McKinsey’s 2025 M&A Synergy report, the reason 40% of carve-outs fail to meet performance expectations is due to poor planning for the transition period.

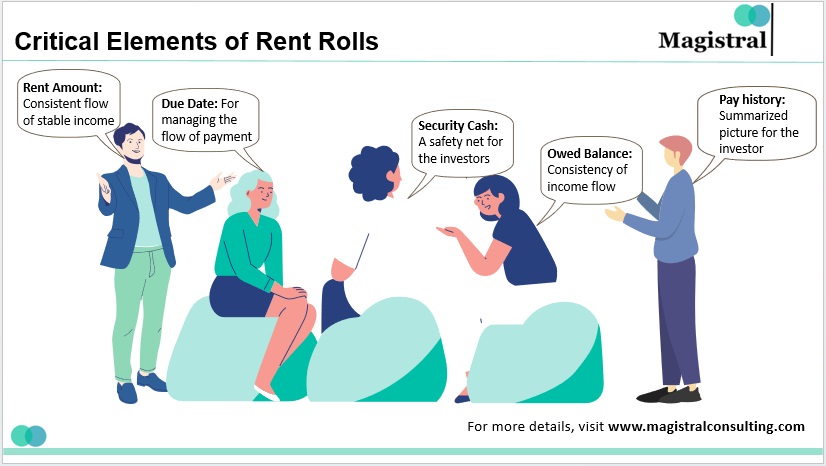

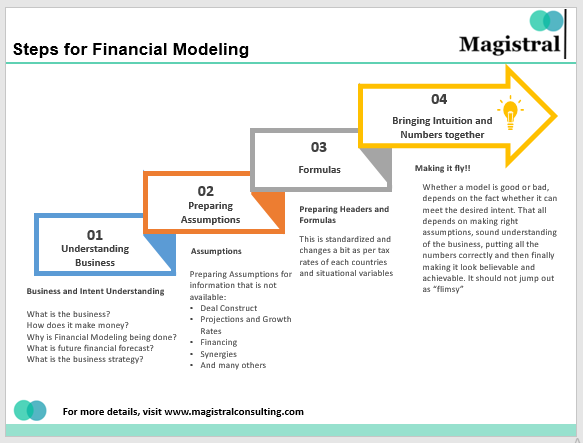

There needs to be careful financial modeling, clear Transition Service Agreements (TSAs), and thoughtful operational planning at all stages of the carve-out process. This is where the work of a real estate financial modeler and appraiser will be invaluable to understanding the financial implications of an operating standalone entity.

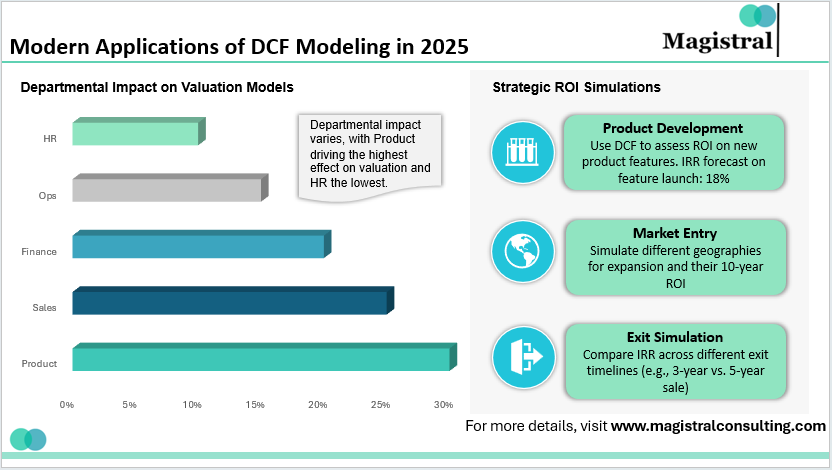

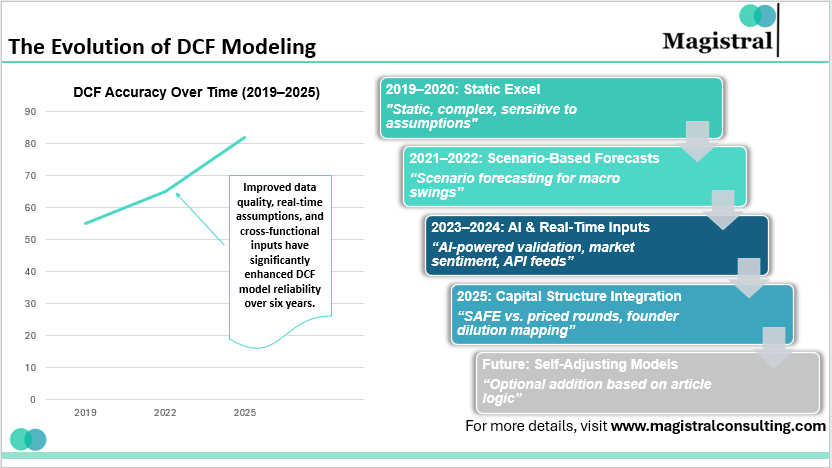

Financial Structuring and Valuation

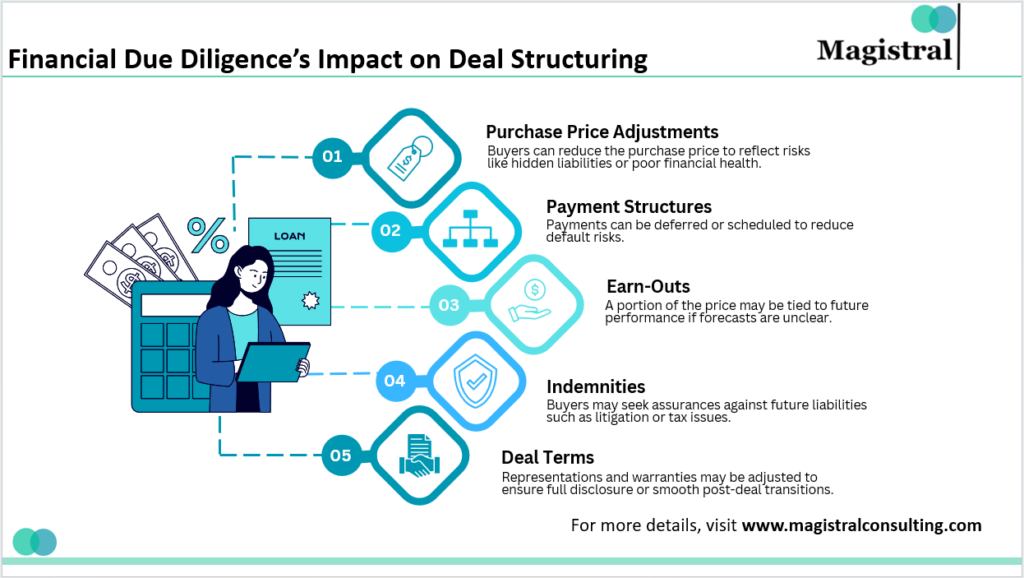

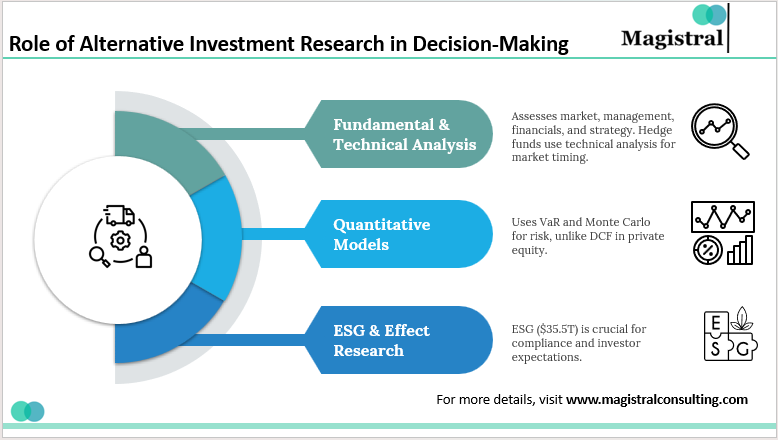

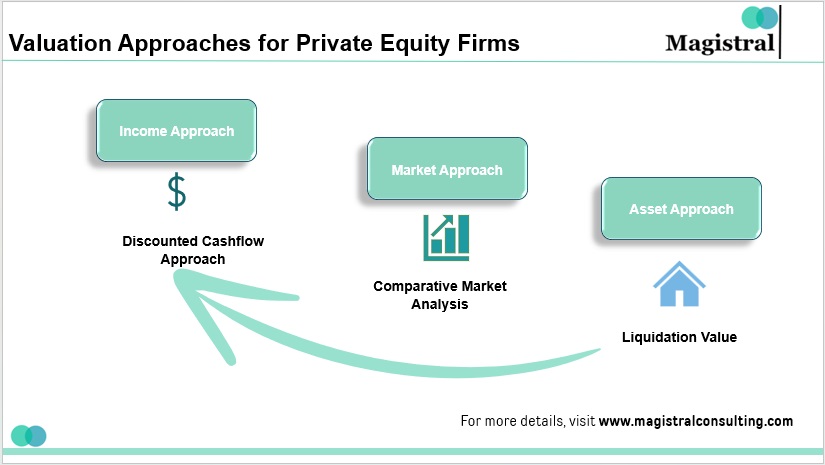

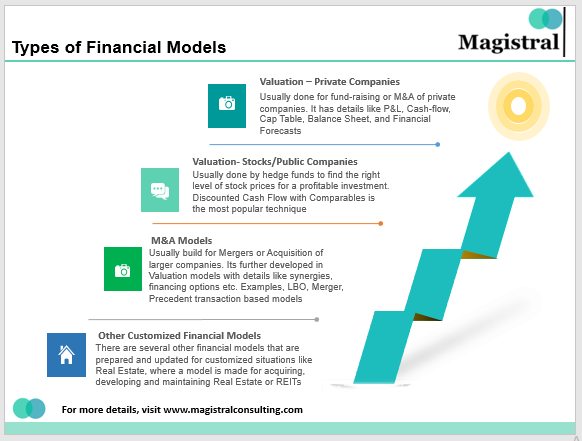

Valuation is the foundational component of the carve-out model. Firms typically will use some type of DCF modeling to capture the intrinsic value of the business and to assess the impact the separation will have on the entity’s capital structure, debt obligations, and tax implications.

Transitional Service Agreements (TSAs)

Transition Services describe the services that the parental organization will agree to provide to the carved-out organization through the transitional period. Having TSA poorly scoped generates reliance on operational continuity, cost overruns, and operational dis-optimization.

Operational Continuity and Talent Transition

Retaining key employees, establishing standalone HR and IT systems, and brand continuity are also critical. According to KPMG’s 2024 report, more than 60% of failed carve-outs cite workforce disruptions as a primary reason for underperformance.

The Role of Investors in the Carve Out Model

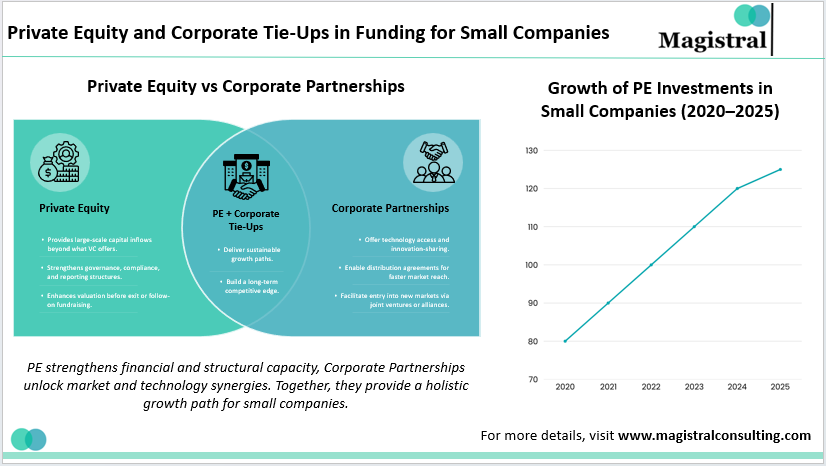

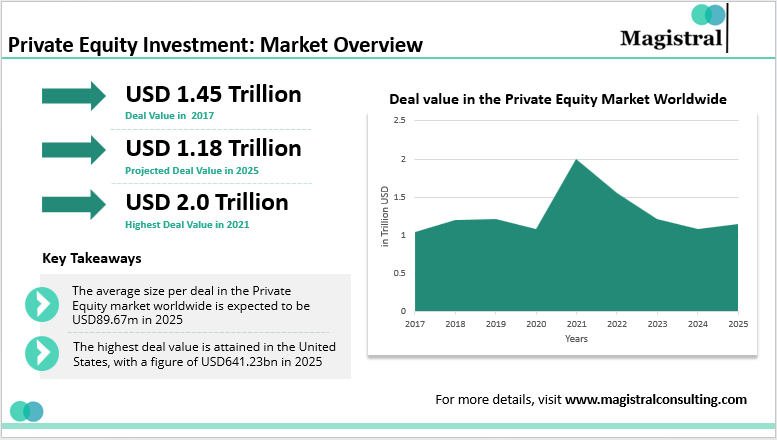

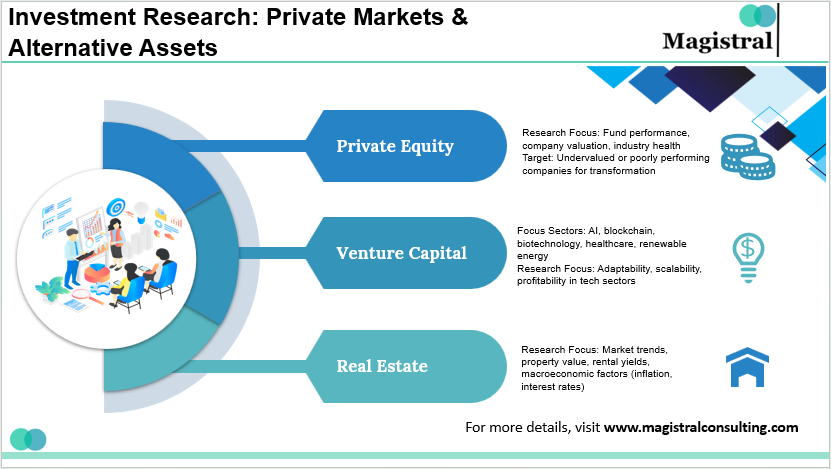

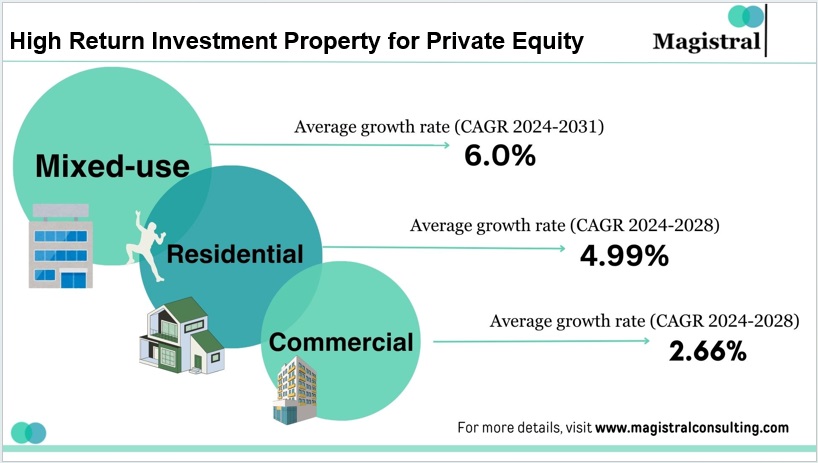

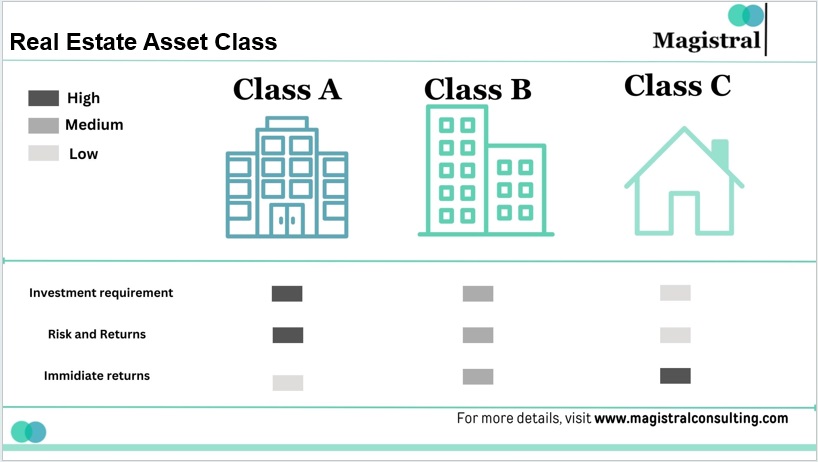

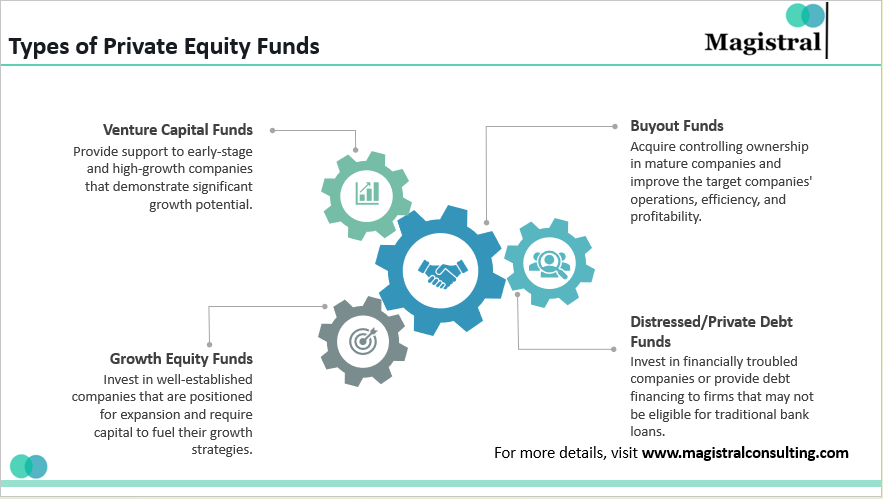

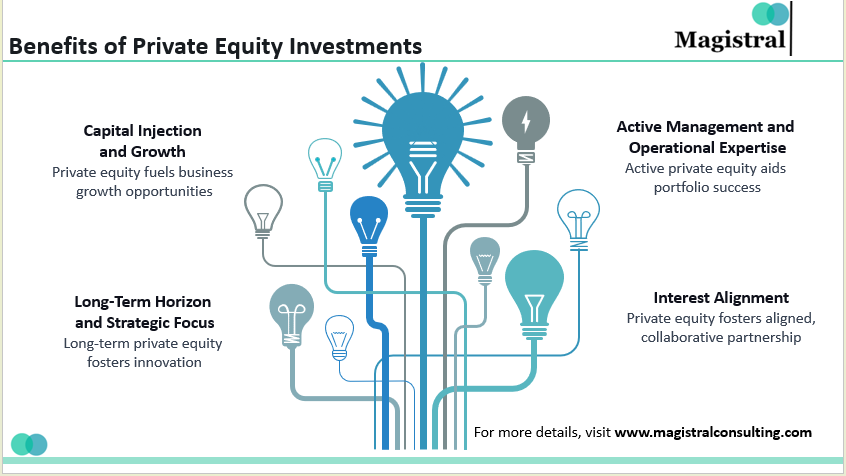

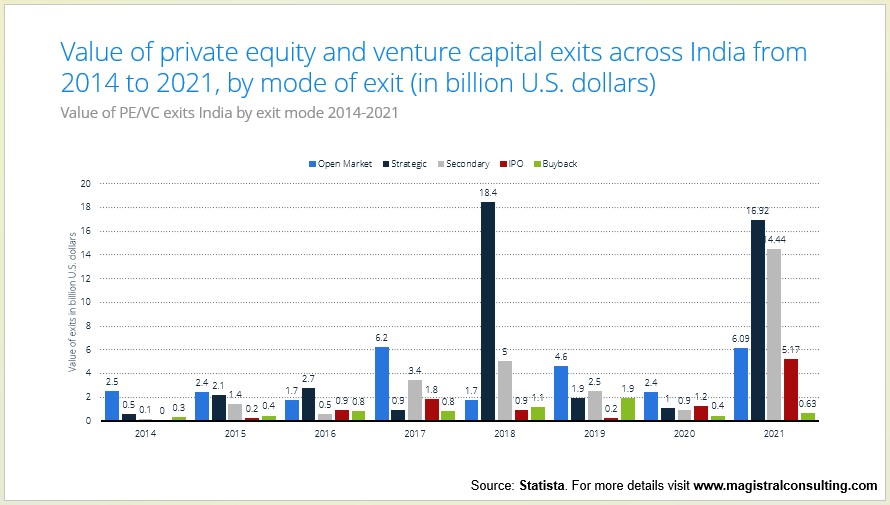

The carve out model offers private equity and venture capital investors the opportunity to buy stable and growing business units that are, quite simply, underperforming and transform them into high-value assets.

Private Equity Participation

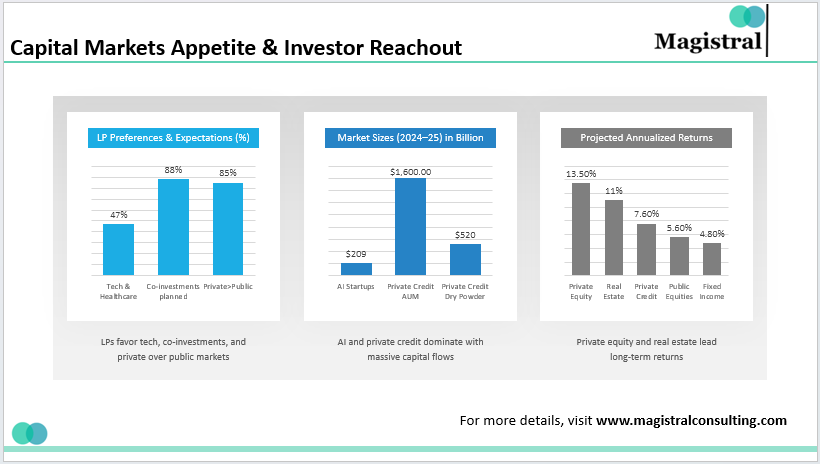

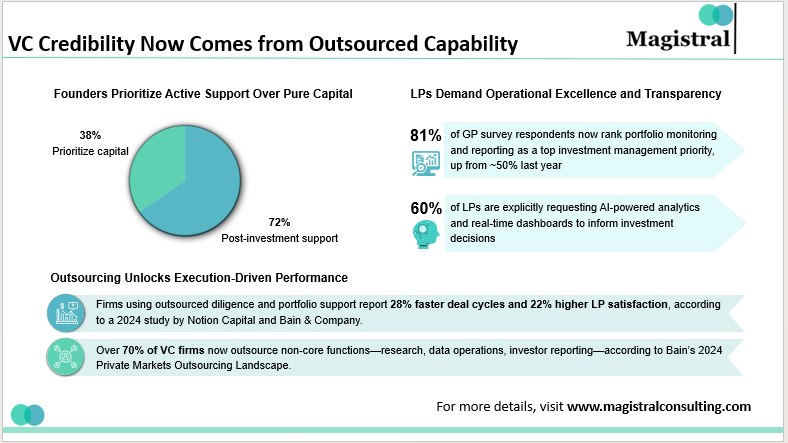

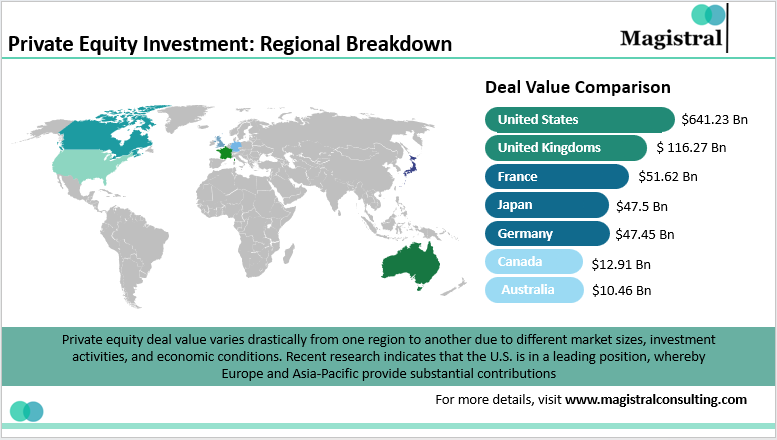

In Bain & Company’s 2025 Global Private Equity Report, it was noted that 45% of global PE deal value is derived from carved-out transactions. PE investors tend to be effective in increasing operational efficiency and growth by focusing on their invested capital and strategic capital restructuring.

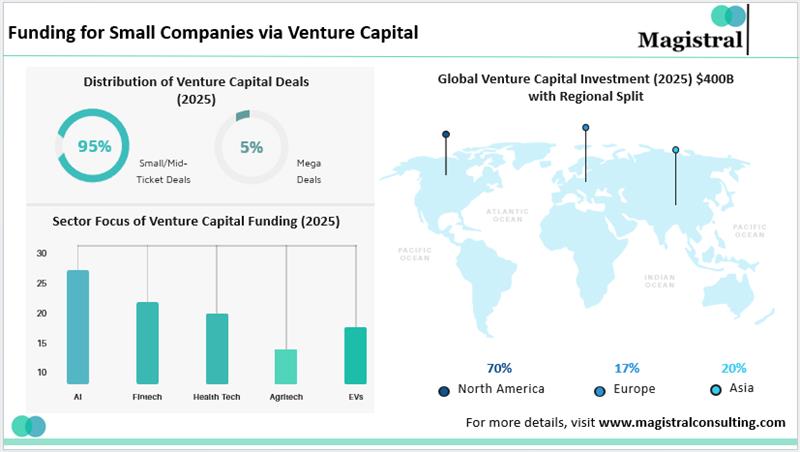

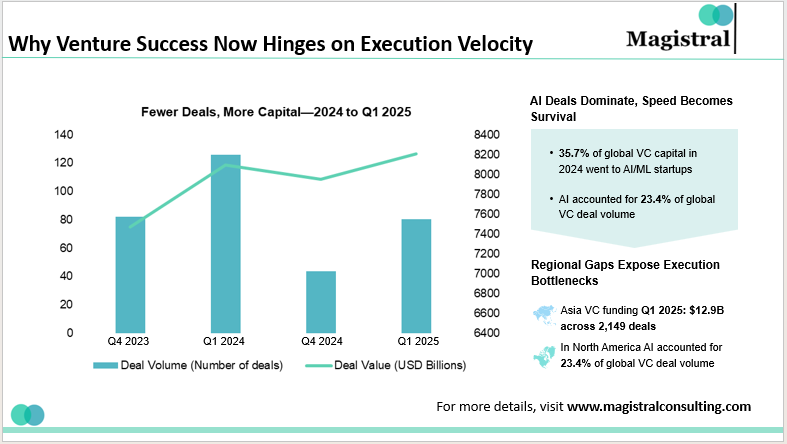

Venture Capital and Growth Investors

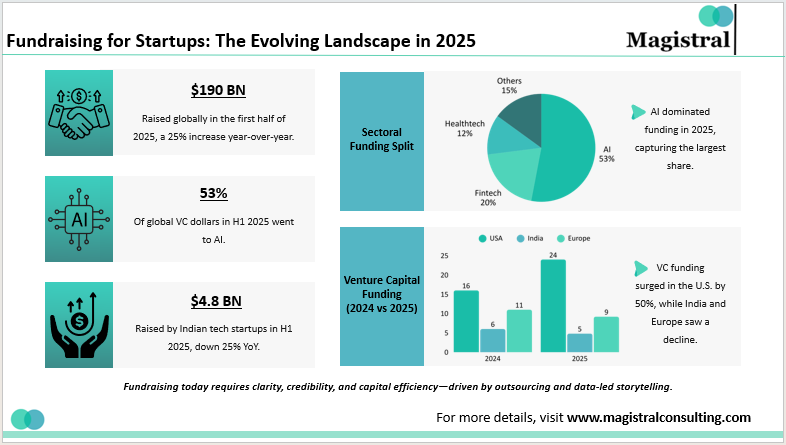

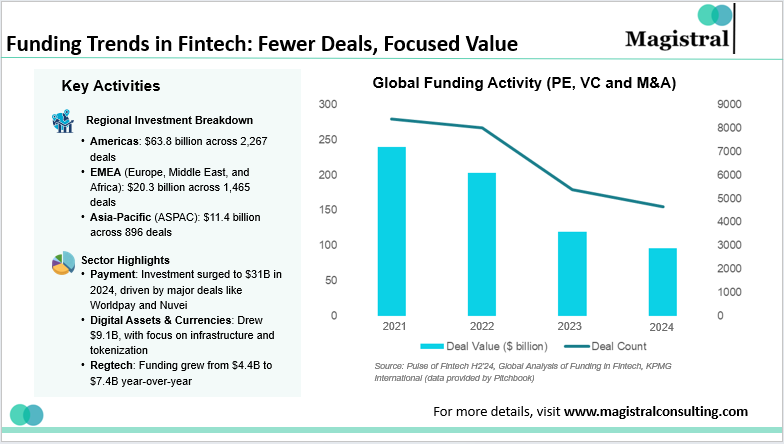

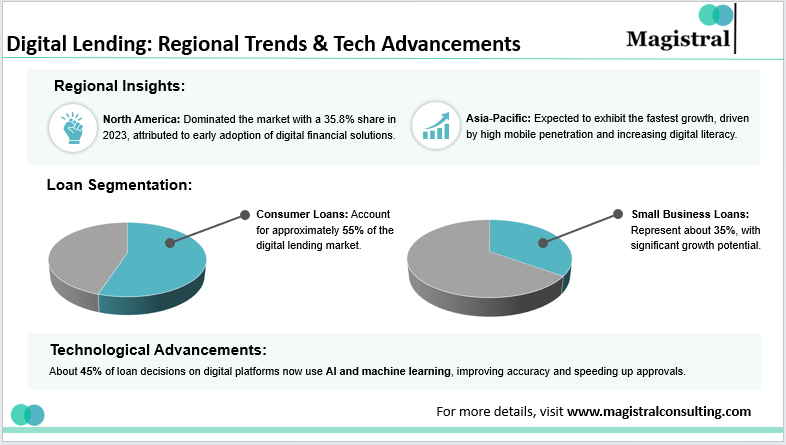

In technology-focused carve-outs, AI or fintech subsidiaries, for example, venture capital investor participation in carve-outs is often a catalyst for innovation and growth. The parent company retains some equity and an operational partnership connection, but the transaction is generally a capital infusion into the participants.

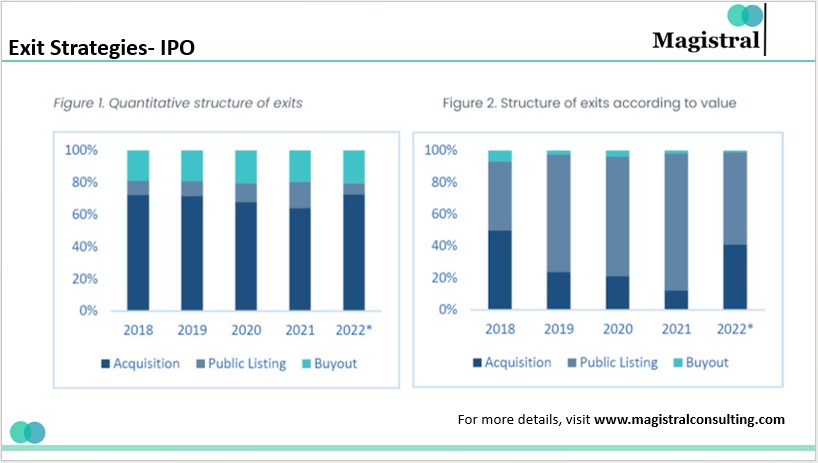

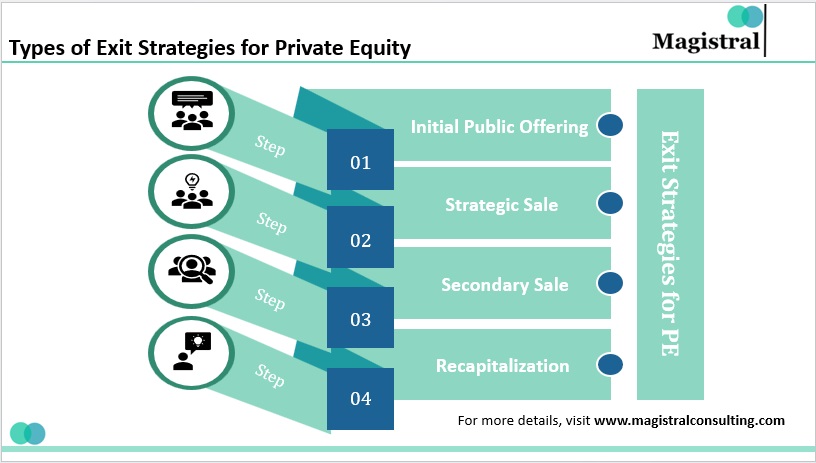

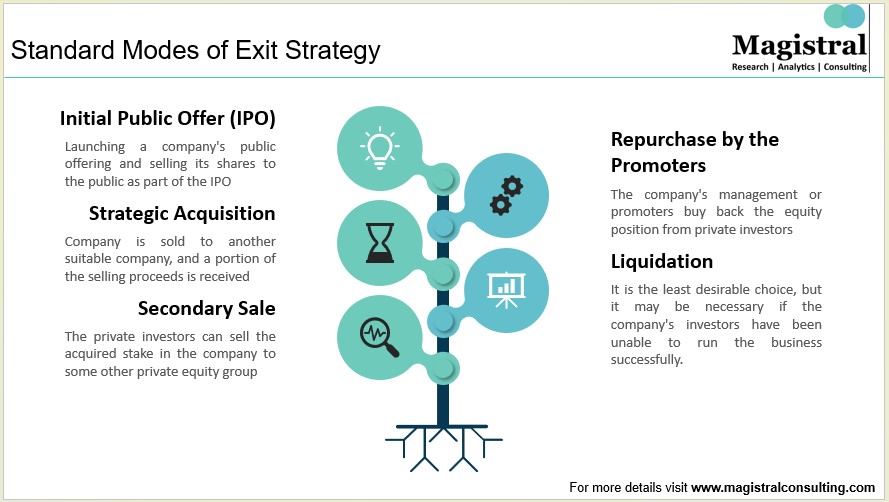

Exit Pathways and Performance

In MSCI’s 2024 study, spin-offs that took place after a carve-out were associated with spin-off IPO return across three years that were 18-22% better than standard corporate spin-offs. Many investors leverage the carve-out to facilitate digital transformation-enhanced business connections with the removed business line and other cost optimization techniques to facilitate a better valuation at exit.

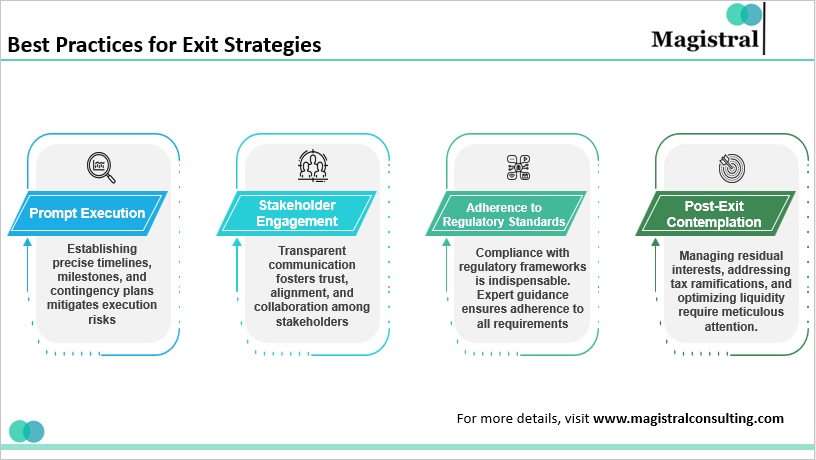

Strategic Execution of the Carve Out Model

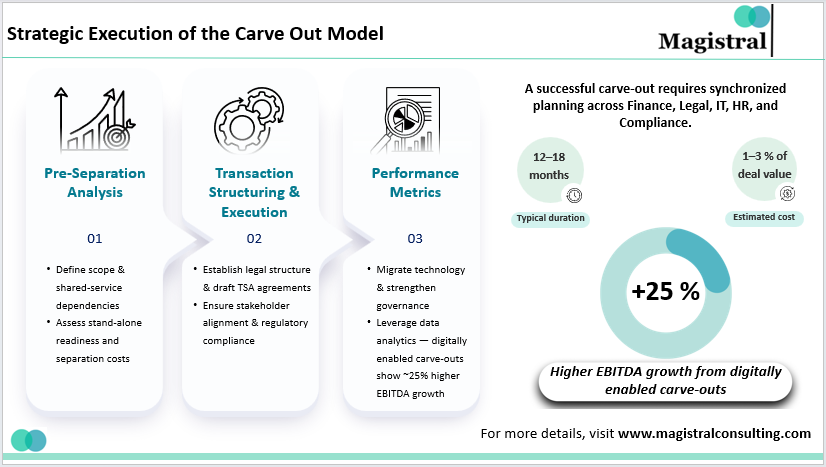

The execution of a carve-out model involves a well-coordinated and synchronized planning of the finance, legal, IT, HR, and compliance functions. The total time for an average carve-out is between 12 and 18 months, and the cost could be anywhere from 1% to 3% of the total deal value.

Strategic Execution of the Carve Out Model

Pre-Separation Analysis

This phase identifies the scope of divestiture, including dependencies and separation costs. It is a must for the management team to decide if the divested business unit would be self-sufficient without critical systems or shared services, as well as if it would do so by using them.

Transaction Structuring and Execution

The steps of establishing the legal structure, drafting term sheets and agreements, managing communication among stakeholders, and ensuring compliance with regulations are all very important. Furthermore, integration teams also investigate the possibility of buyer and investor compatibility.

Post-Carve-Out Optimization

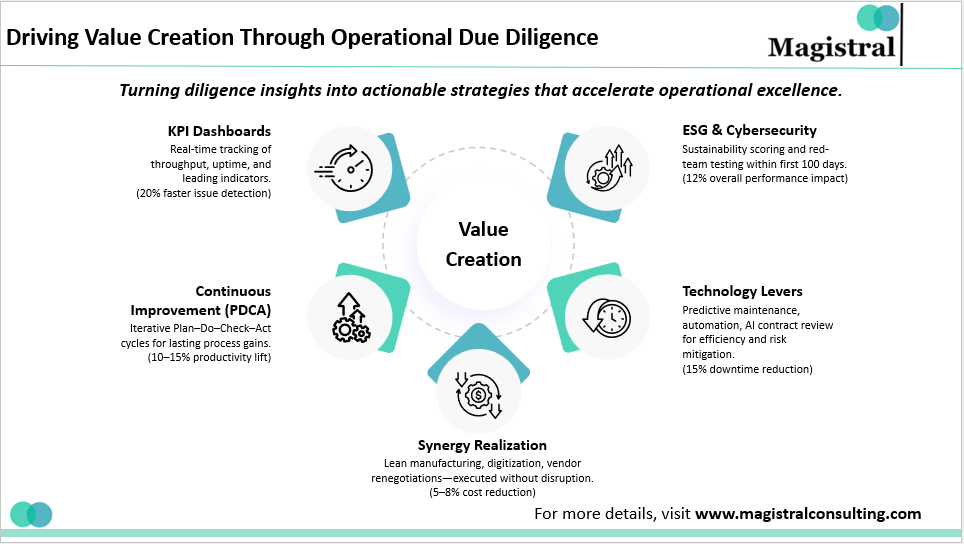

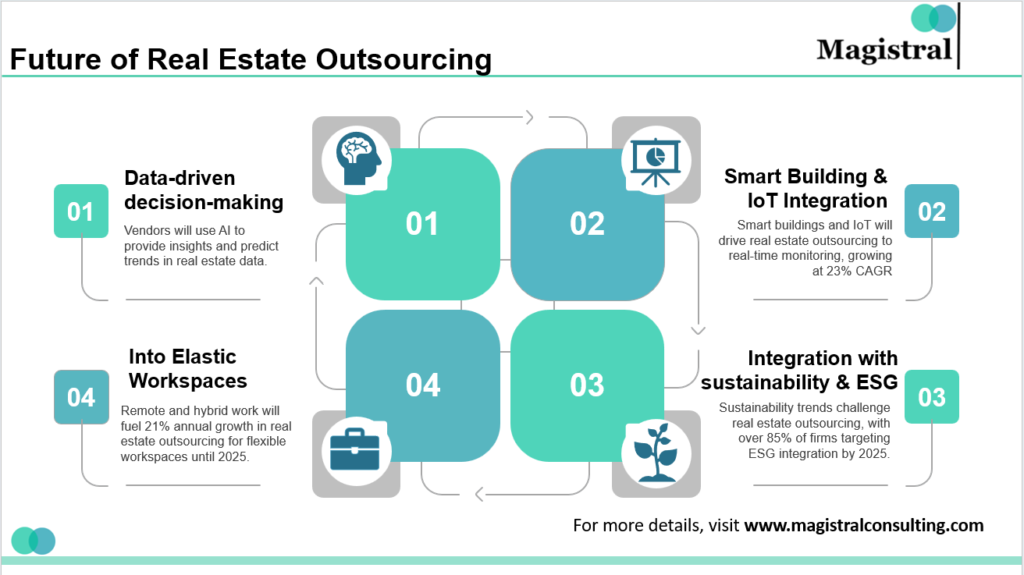

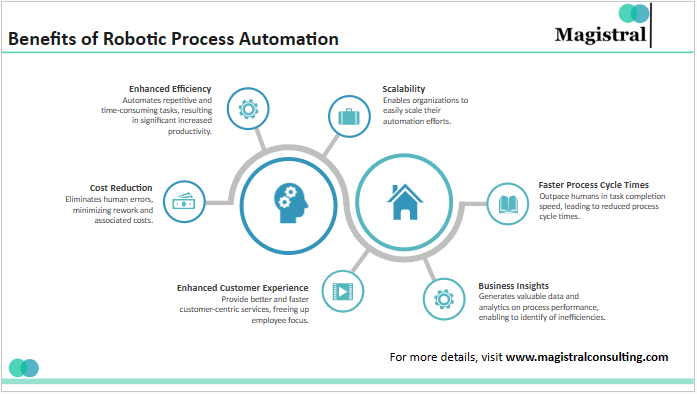

After the deal closing, the firms devote their attention to technology, process, and governance. To be specific, McKinsey (2025) claims that digitally enabled carve-out activities enjoy a 25% lead over their non-digital peers in EBITDA growth, which is driven by advanced data analytics and automation.

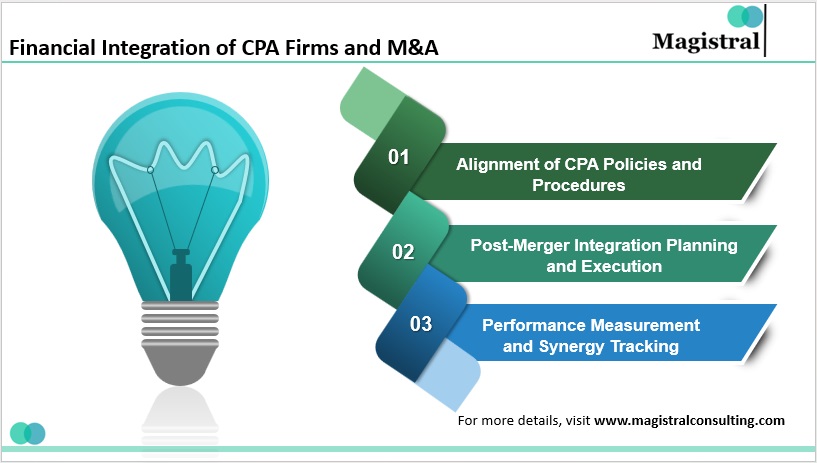

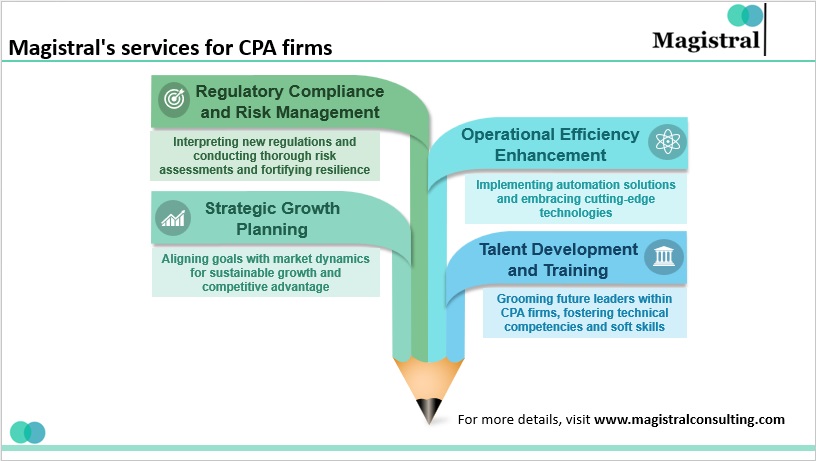

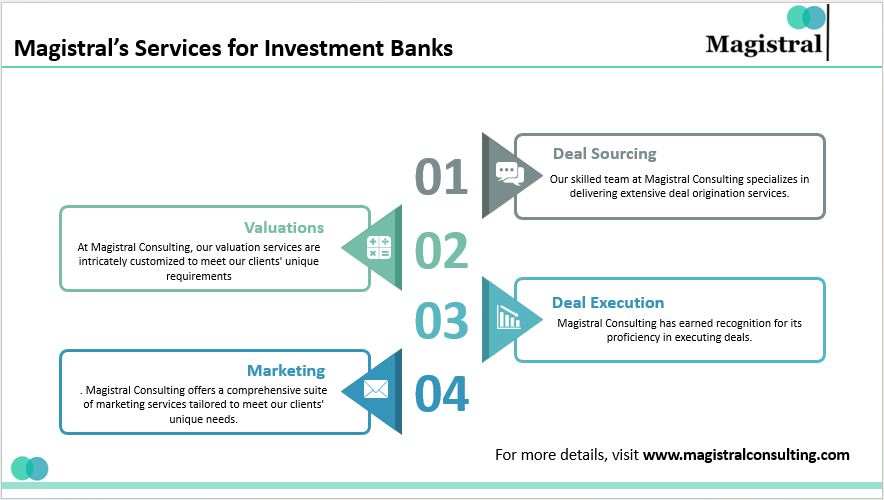

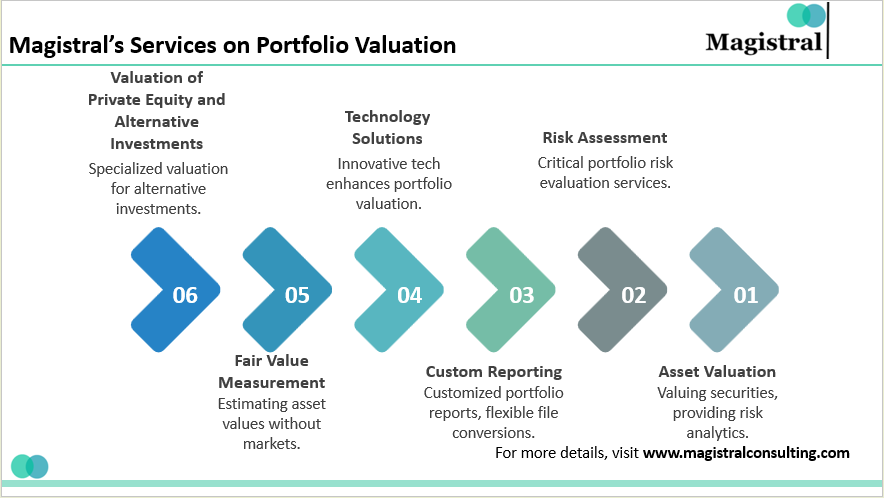

Magistral Consulting’s Support in the Carve Out Model

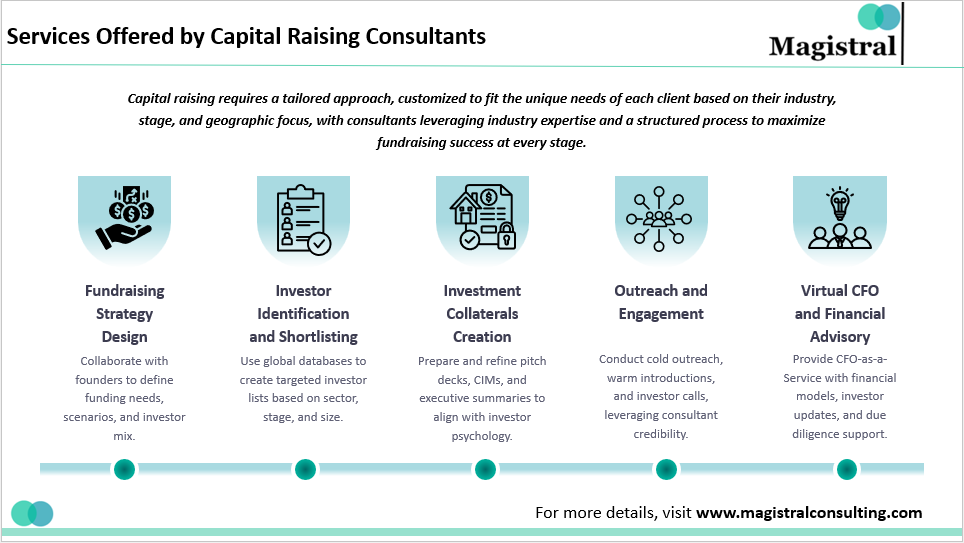

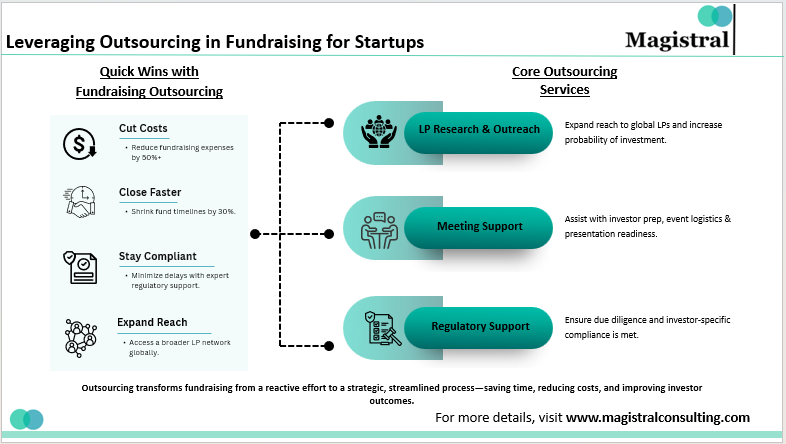

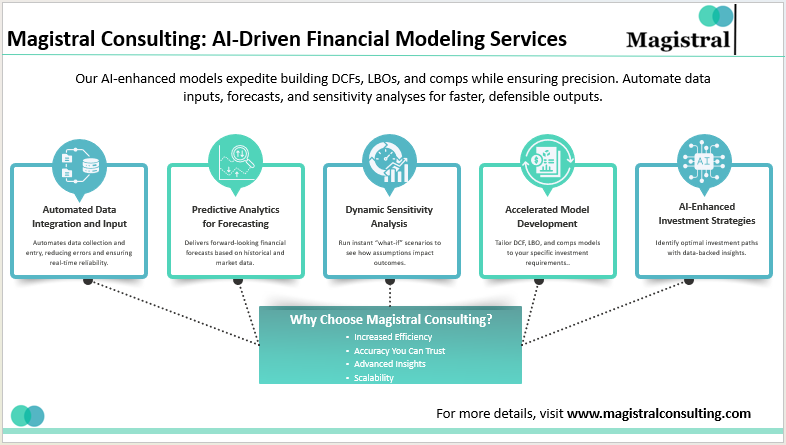

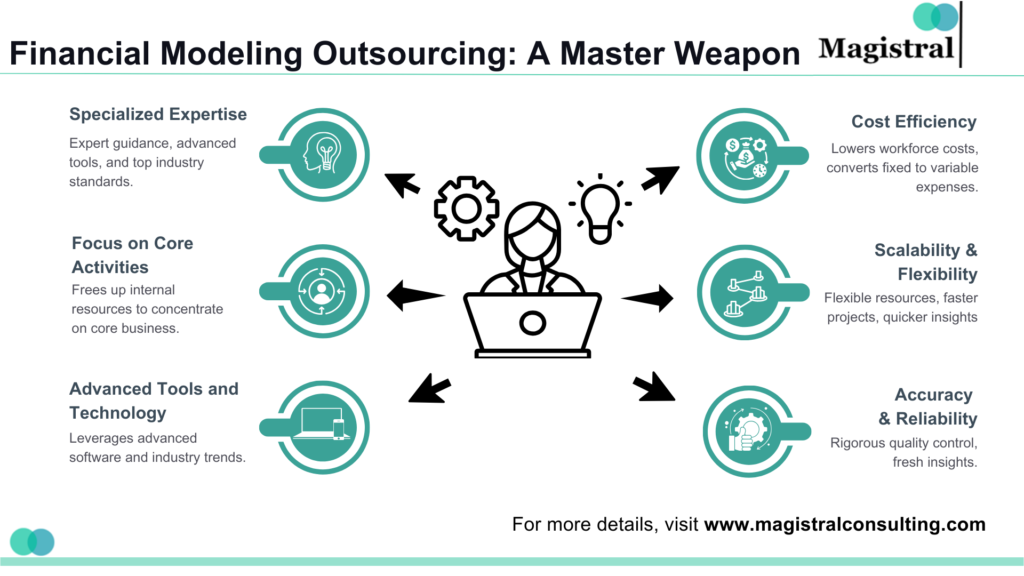

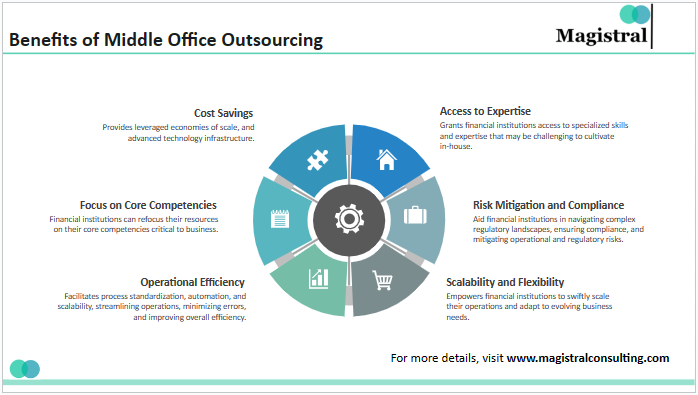

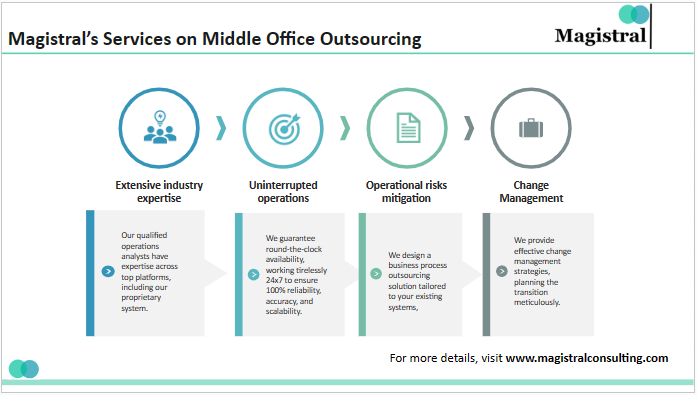

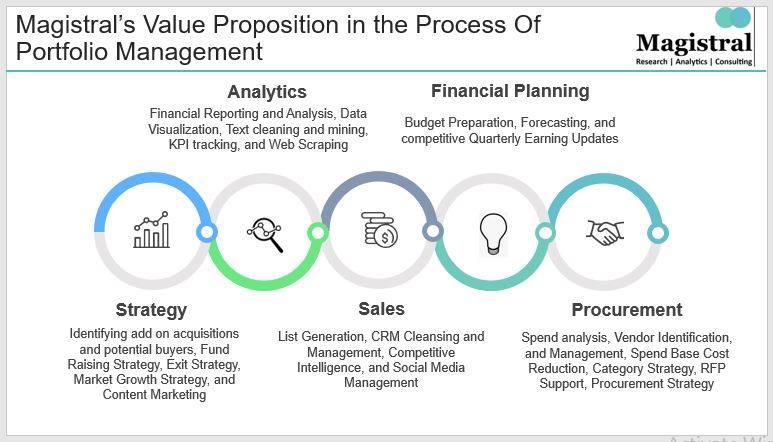

Magistral Consulting works with global corporate and investment firms to effectively execute the carve-out model – this is the integration of strategy, analytics, and operations.

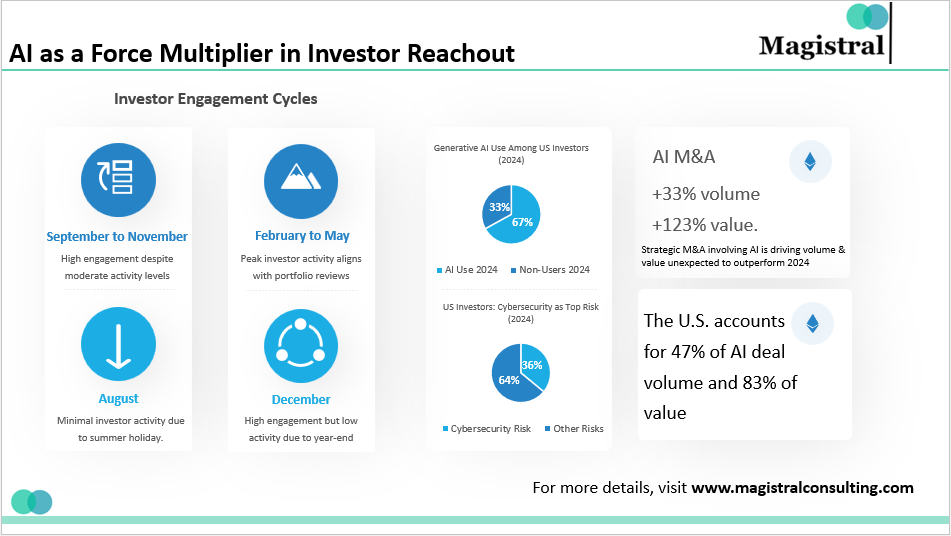

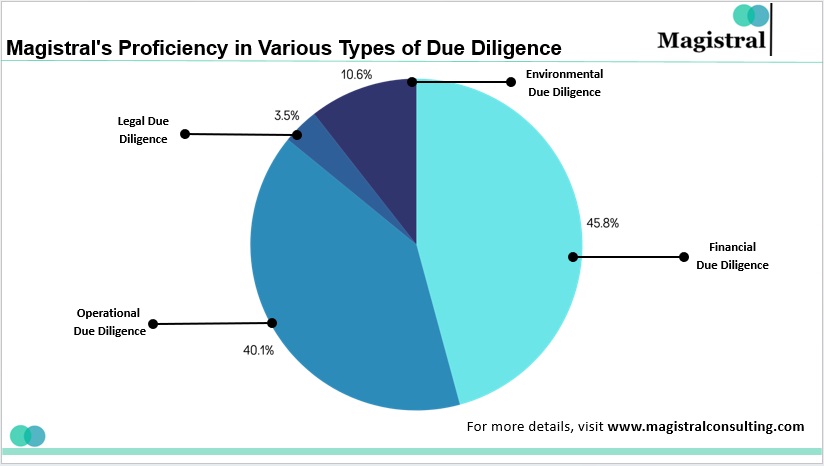

The firm specializes in deal support and operational due diligence, which empowers clients to deliver successful transitions. Utilizing a data-driven model, Magistral alleviates the risk of overestimating the potential of the carve-out and delivers sustainable value rather than just short-term value.

Financial and Strategic Advisory

Magistral can assist in valuation modeling, standalone forecasts, and transaction simulations. Providing decision-makers with evidence-based decision-making.

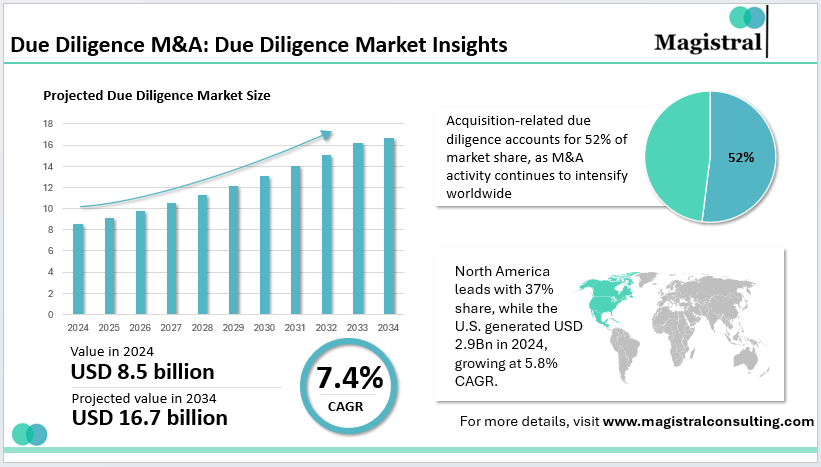

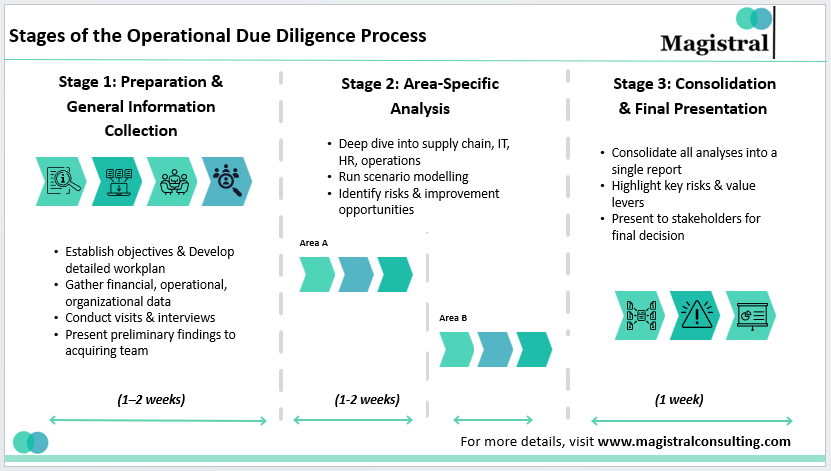

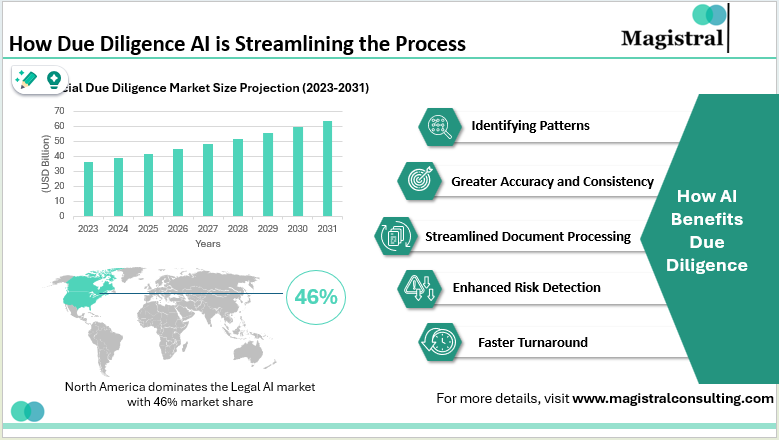

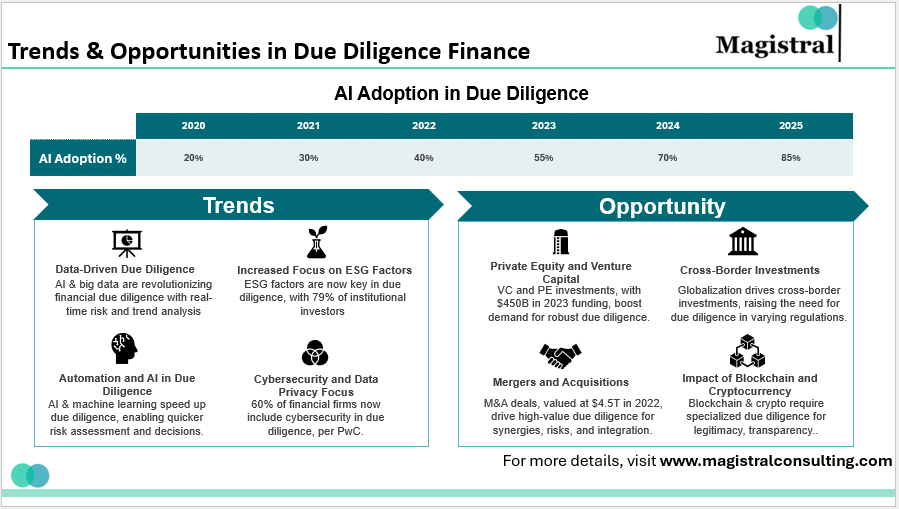

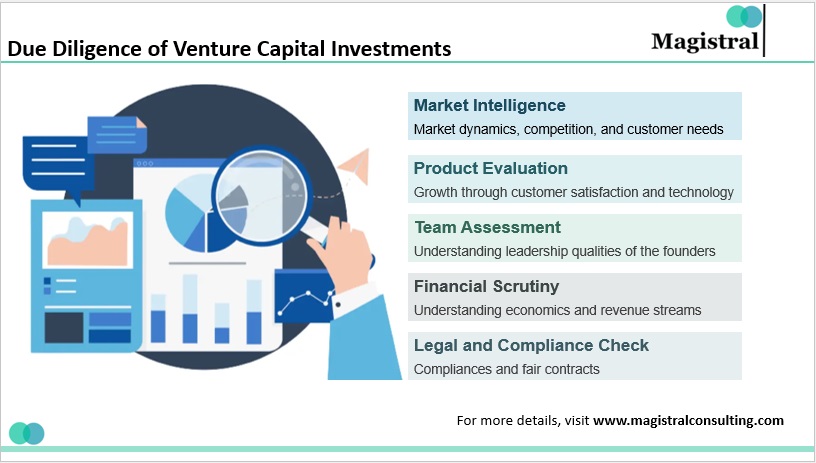

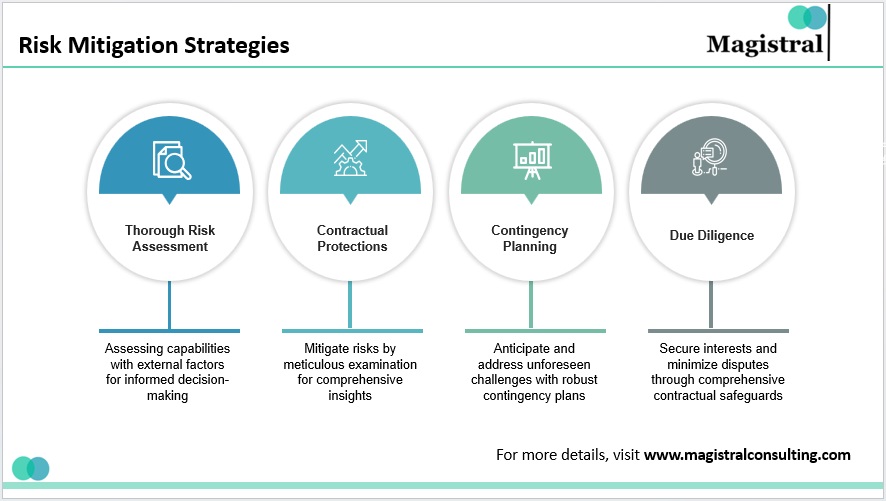

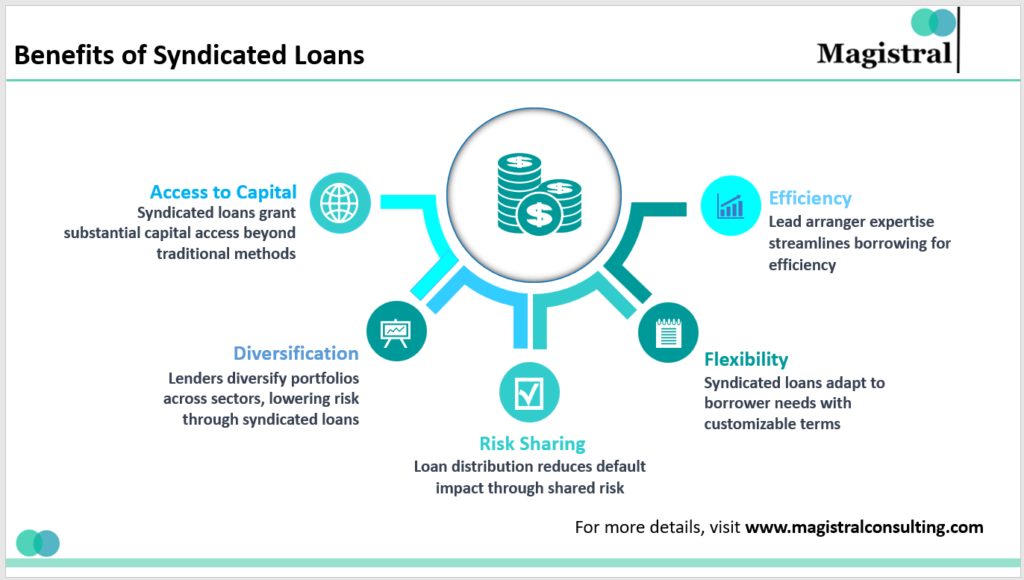

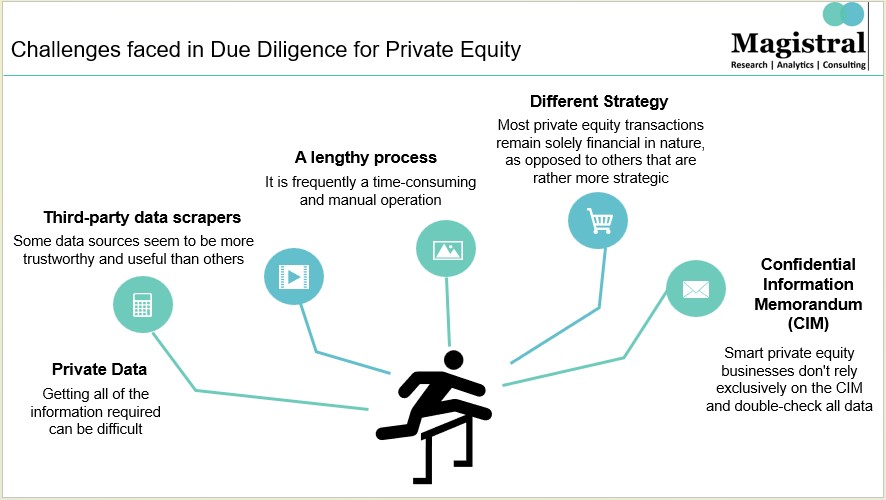

Due Diligence and TSA Structuring

Utilising its extensive network of experienced professionals, the firm can support firms with both operational and commercial due diligence to clearly document reasonable TSA structures to proactively manage transitions from both an operational and commercial perspective.

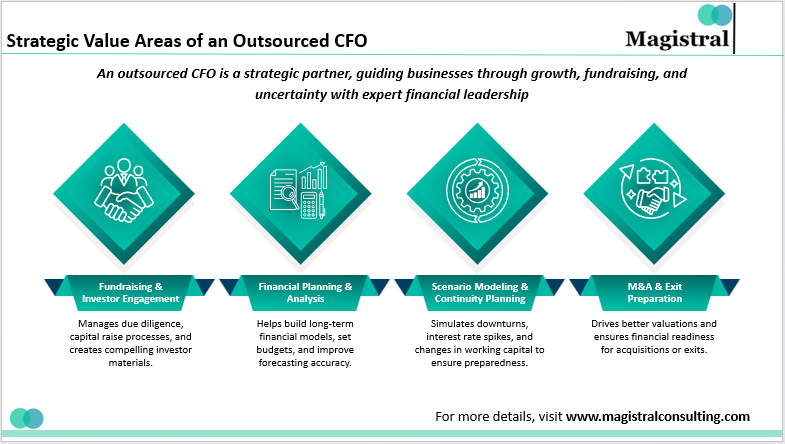

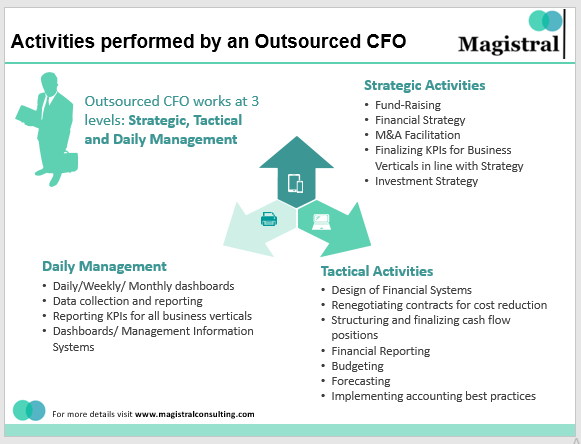

Post-Separation CFO and Operations Support

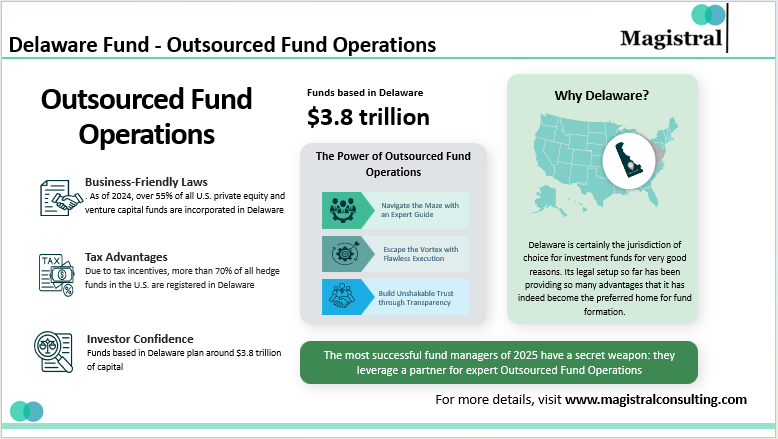

Magistral can also provide outsourced CFO support for independent firms as they begin their journey in an independent context to help with the establishment of key controls, liquidity management, and ongoing reporting processes that can be scalable to future growth.

Magistral leverages a combination of analytical rigour and industry experience to transform carve-outs from complicated divestments to replacements for engines of growth and transformation.

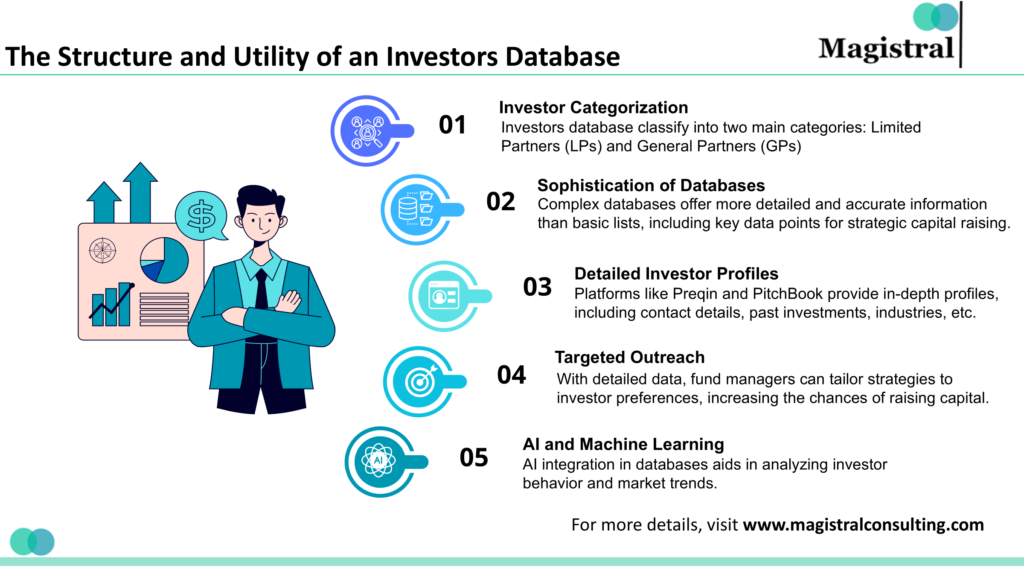

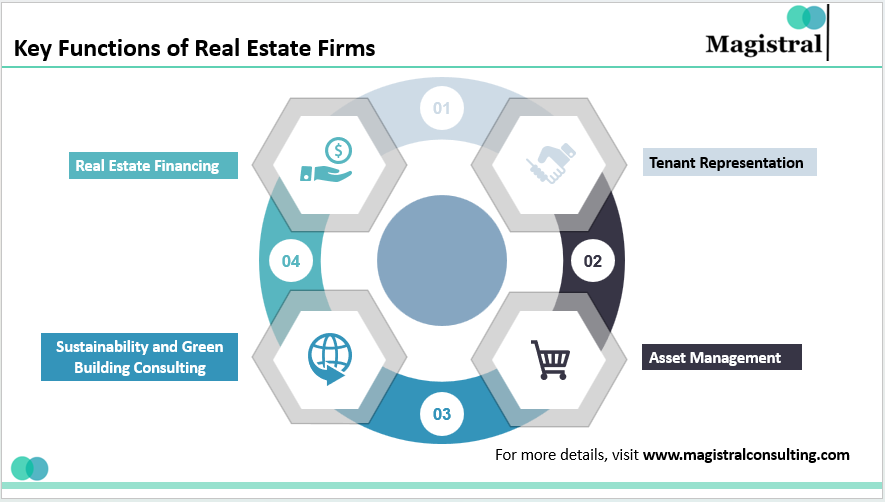

About Magistral Consulting

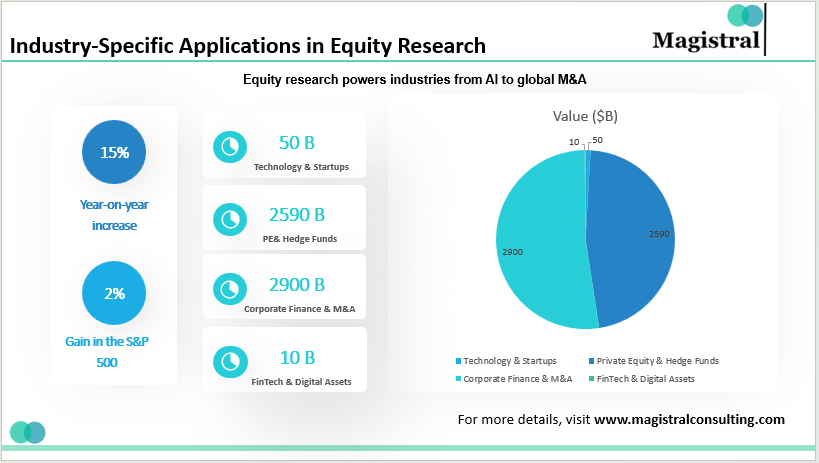

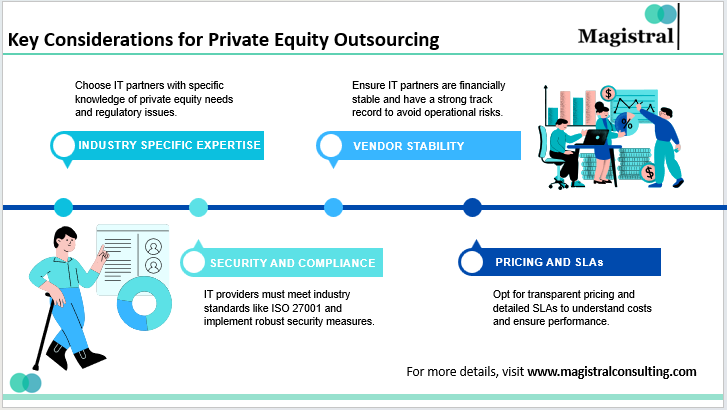

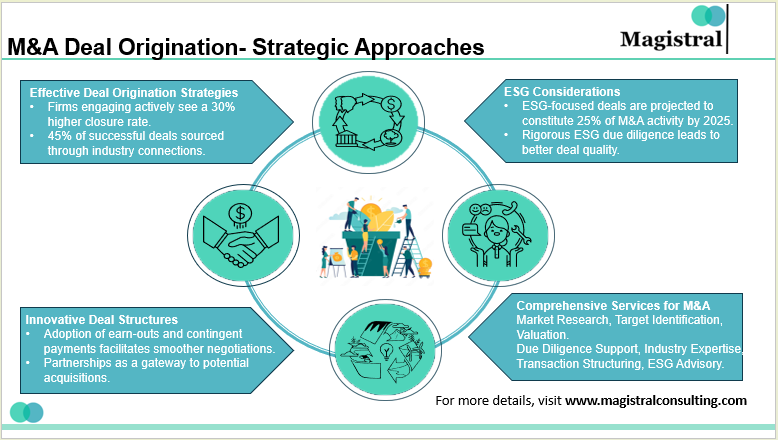

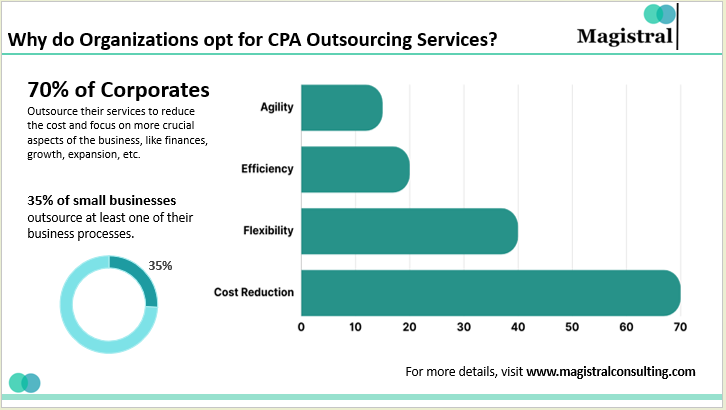

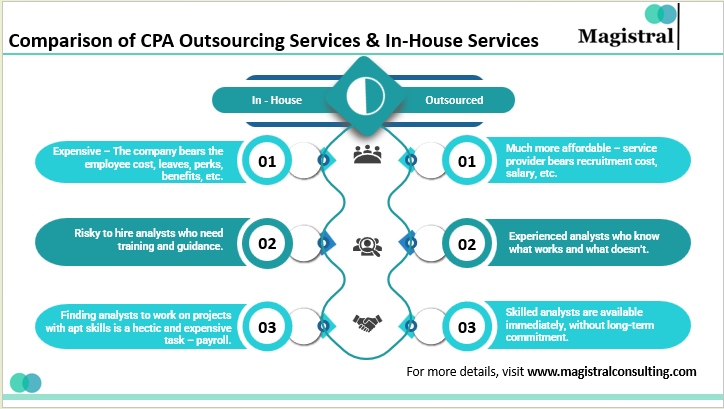

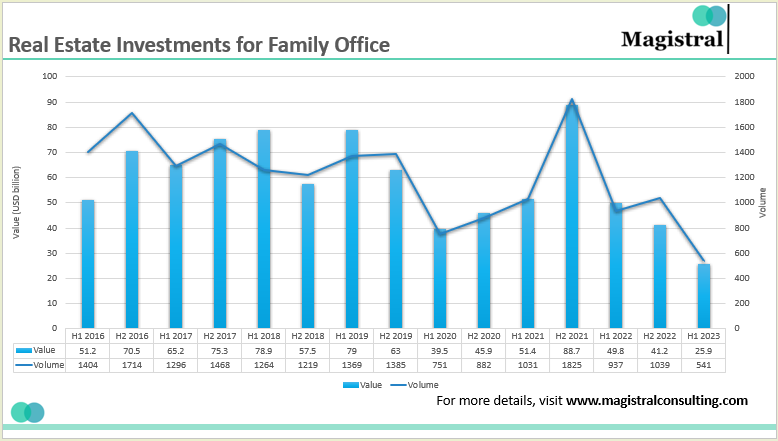

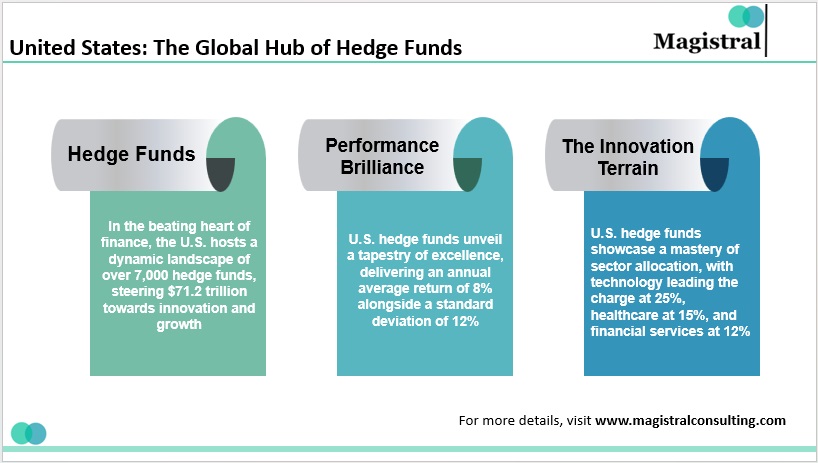

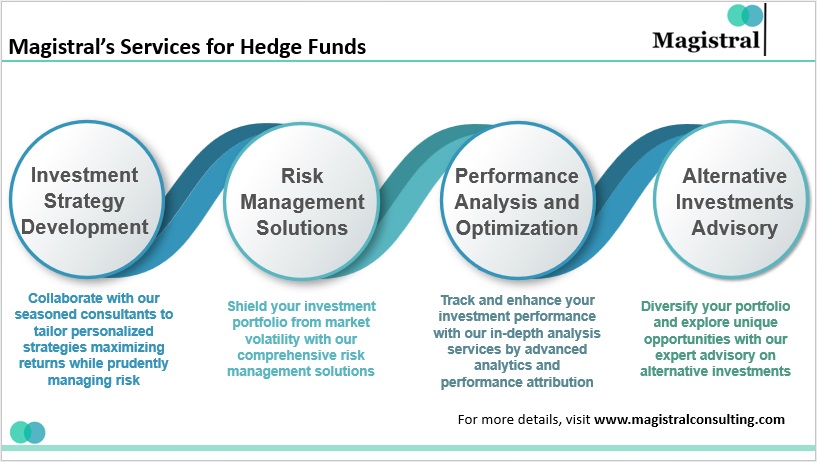

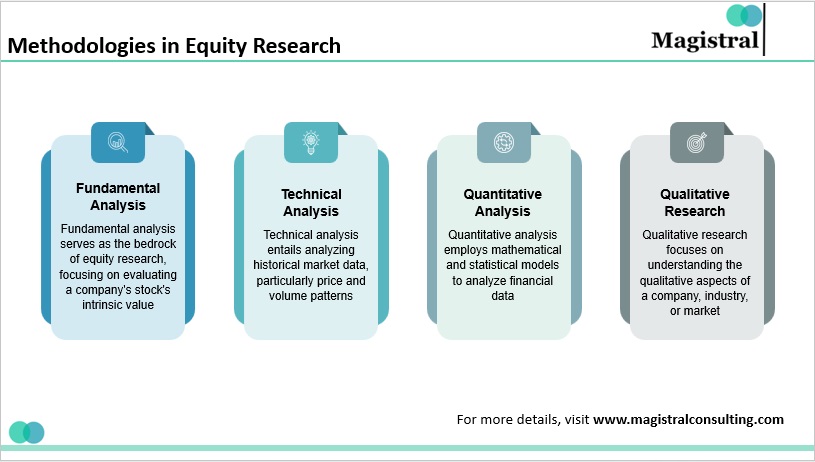

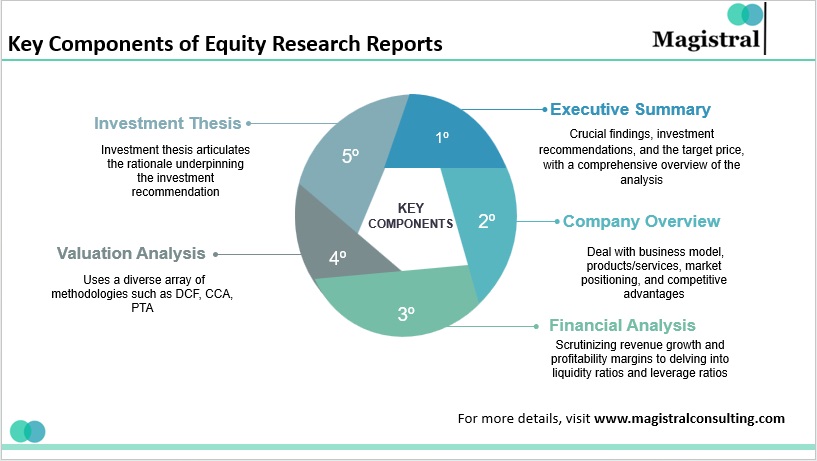

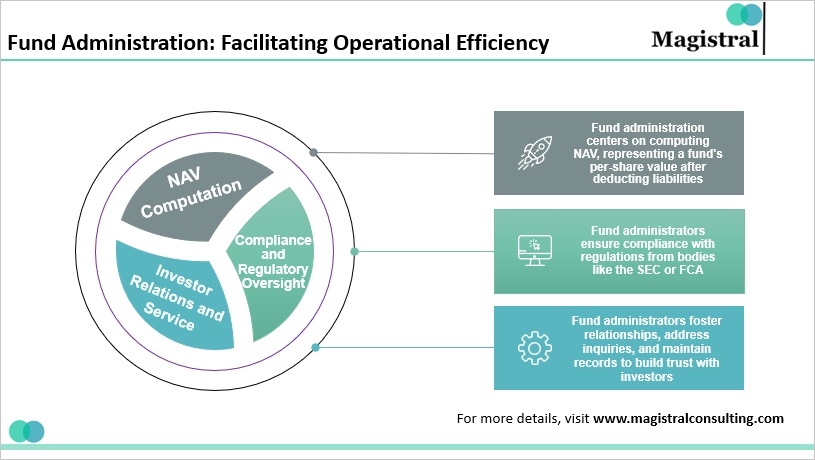

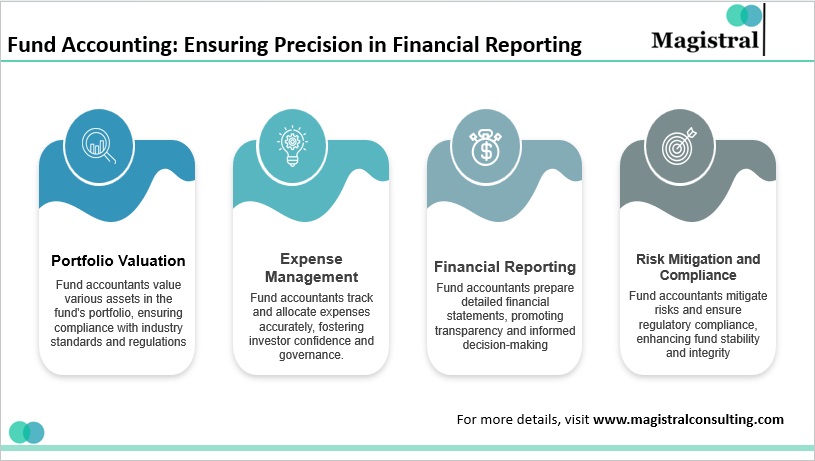

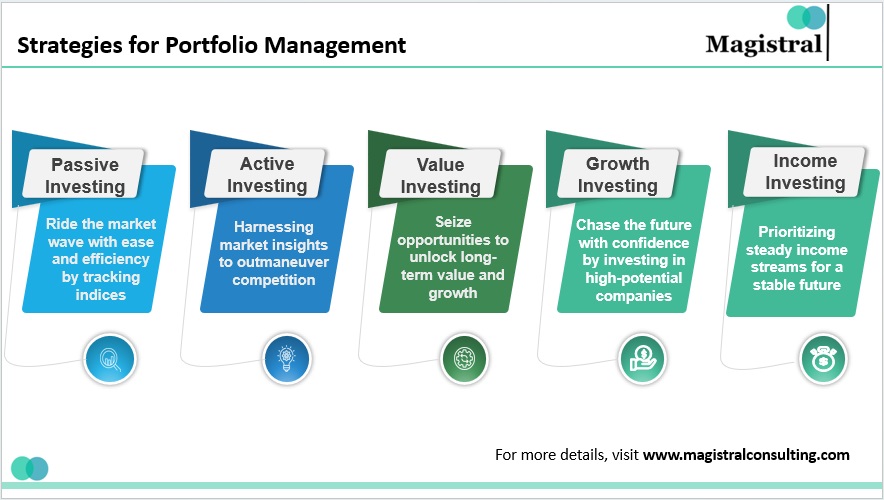

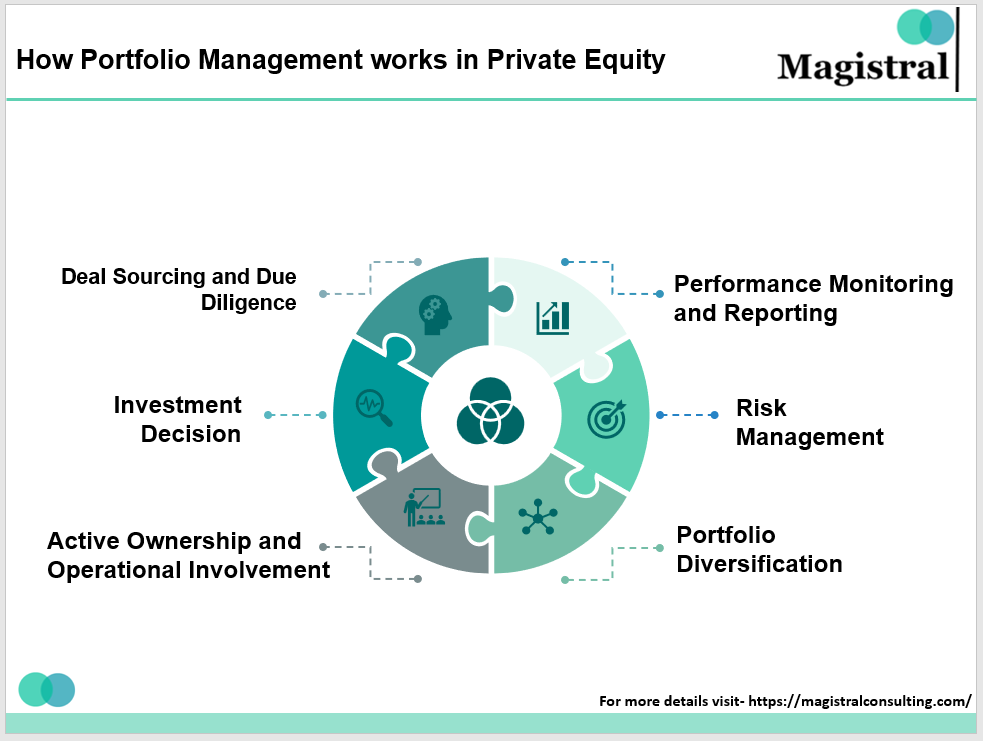

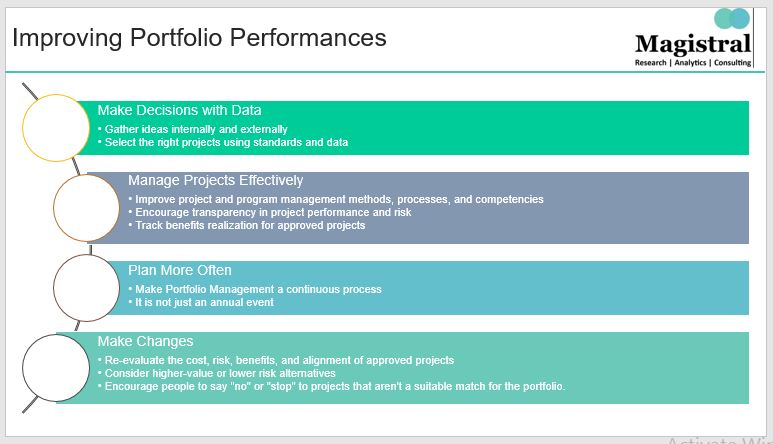

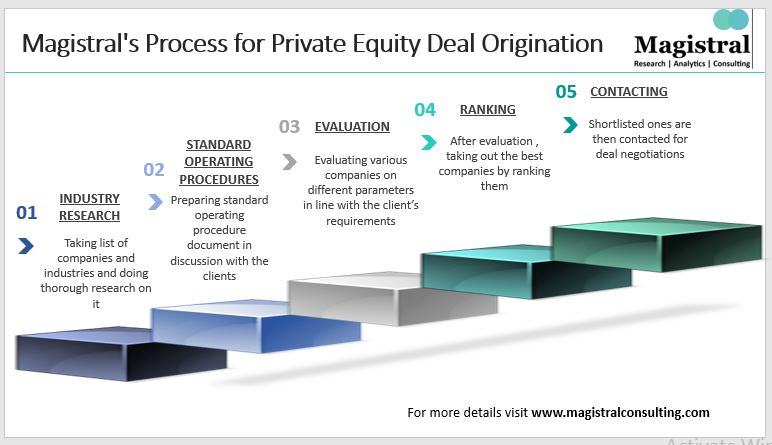

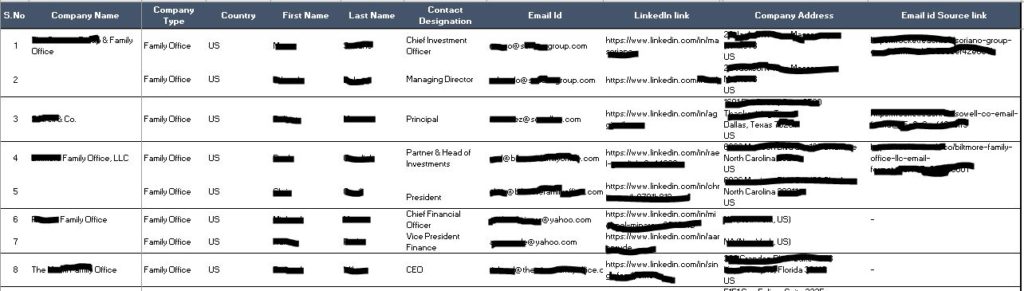

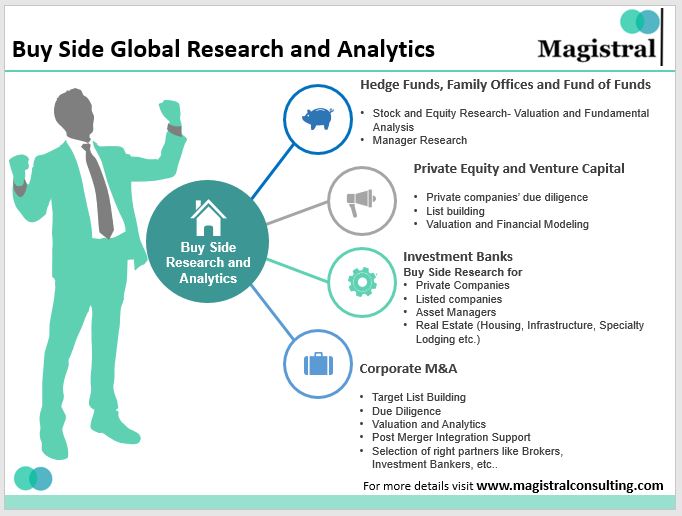

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

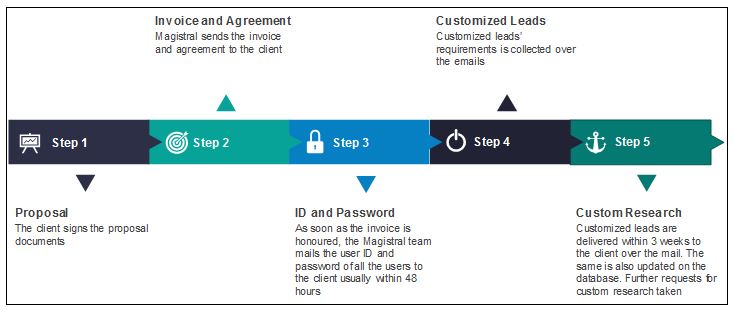

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

Utkarsh is a finance professional with expertise in investment research, M&A, and financial modeling. He has built and applied models including DCF, LBO, and comparable analysis, supporting investment banks, private equity, and venture capital firms across diverse sectors. Utkarsh holds an MBA in International Business & Finance from Symbiosis International University, a B.Com (Hons) from Delhi University, and has completed the Stanford Seed program at Stanford Graduate School of Business.

FAQ’s

What is the carve out model in M&A?

Why do companies prefer carve-outs over full divestitures?

How do private equity firms benefit from carve-outs?

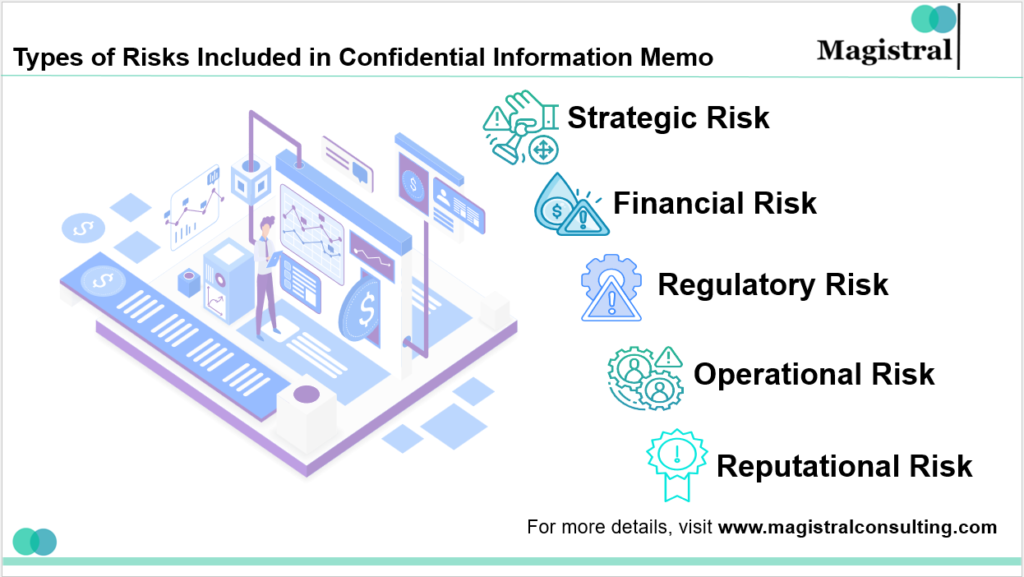

What are key risks in implementing a carve out model?

How does Magistral Consulting support carve-outs?

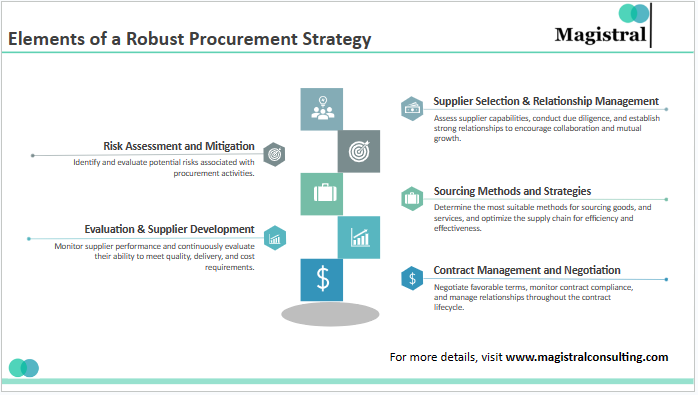

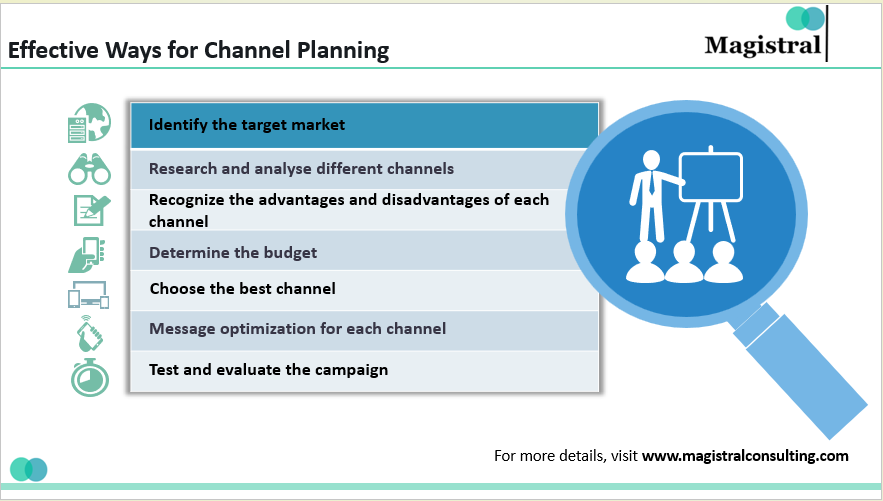

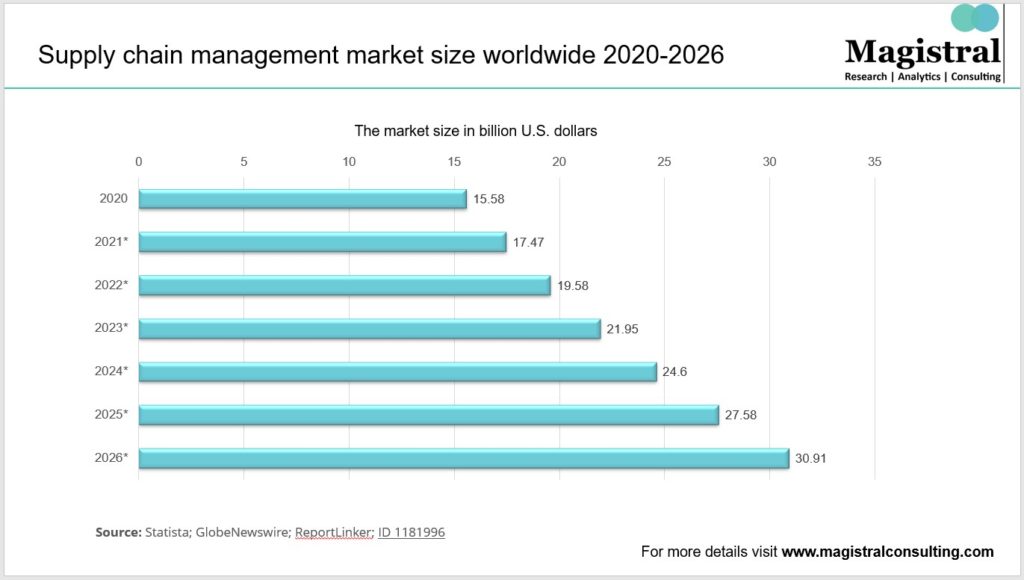

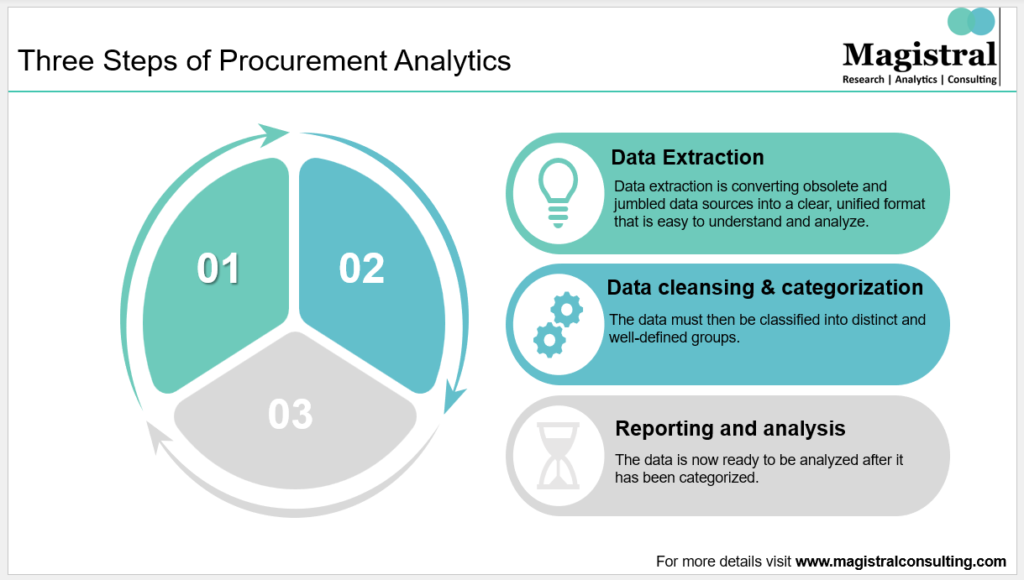

Procurement is an area where cost optimization strategies start to show an impact on bottom-line almost immediately. It’s one of the foremost areas, which is attacked by experienced turnaround professionals. Direct sourcing which almost decides the profit margins of the organization or even its competitive standing in the market hogs all the management attention. Indirect sourcing at the same time is complex and requires expertise that is usually not present in the organization.

Procurement is an area where cost optimization strategies start to show an impact on bottom-line almost immediately. It’s one of the foremost areas, which is attacked by experienced turnaround professionals. Direct sourcing which almost decides the profit margins of the organization or even its competitive standing in the market hogs all the management attention. Indirect sourcing at the same time is complex and requires expertise that is usually not present in the organization.